- Home

- »

- Clinical Diagnostics

- »

-

U.S. Point-of-Care Glucose Testing Market, Industry Report, 2030GVR Report cover

![U.S. Point-of-Care Glucose Testing Market Size, Share & Trends Report]()

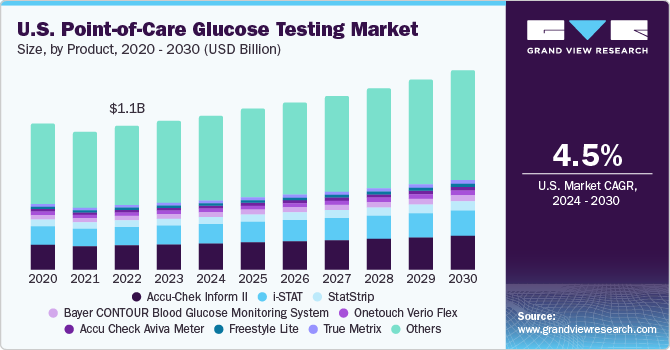

U.S. Point-of-Care Glucose Testing Market Size, Share & Trends Analysis Report By Product (Accu-Chek Inform II, Freestyle Lite, True Metrix, i-STAT, StatStrip, Onetouch Verio Flex, Bayer CONTOUR Blood Glucose Monitoring System), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-229-8

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

The U.S. point-of-care glucose testing market size was valued at USD 1.15 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 4.5% from 2024 to 2030. The rapid surge in geriatric population, improved accuracy of these point of care devices, and rapid advancements in mobile glucose monitoring apps are significantly driving the market growth.

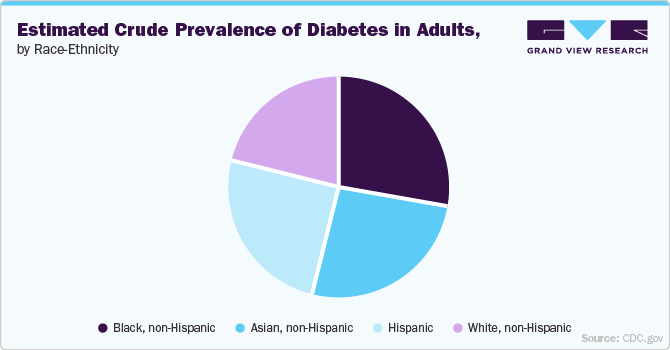

In 2023, U.S. accounted for a market share of over 34% in the global point-of-care glucose testing market. Large population at high risk of diabetes in the U.S. is a key factor contributing to growth in product demand. As per the CDC, diabetes is the 7th most common cause of death in the U.S. with over 38.4 million (i.e. 11.6% of the population) Americans had diabetes in 2021,. The presence of government organizations focusing on creating awareness regarding diabetes and glucose testing products available in the market has propelled the growth in the country. For instance, the American Heart Association, American Diabetes Association, and Pan American Health Organization are especially involved in such initiatives.

Rising healthcare expenditure for diabetes and increasing cost per person on diabetes are boosting the demand. Manufacturers in the U.S. are creating advanced diabetes management platforms, which is boosting the demand for POC glucose diagnostic products. For instance, One Drop is a diabetes management company that integrates data science with mobile computing.

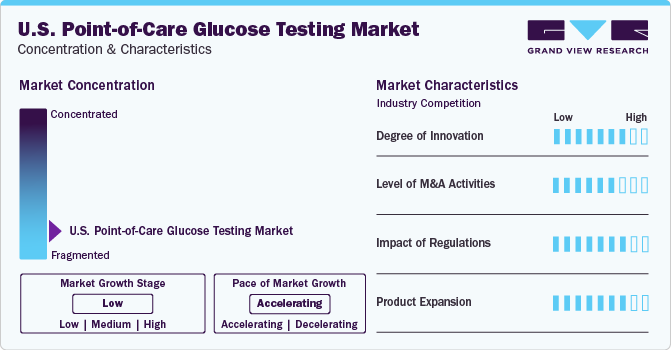

Market Characteristics & Concentration

The industry is expected to continue its growth trajectory for the coming 5-6 years as a huge percentage of the U.S. population is currently at danger of developing diabetes, which is a result of sedentary lifestyle, high blood pressure, obesity, smoking, and excessive alcohol consumption. This is projected to spur the demand for point-of-care glucose testing solutions.

Technological advancements such as the improvements in connectivity, design and accuracy aimed at improving functionality and efficacy are the key areas market players focusing on. The country is focusing on the digitalization of healthcare by leveraging innovative technologies, such as AI, big data, and cloud computing. Several players are launching various products to strengthen their product portfolio. This strategy enables companies to increase their customer reach, expand their product portfolios, and improve their offerings. For instance, in January 2022, Roche unveiled the launch of the Cobas pulse, a point-of-care blood glucose monitoring device designed for hospital personnel. The device comes with an add-on gadget developed like a touchscreen smartphone, which runs its own apps.

The U.S. point-of-care glucose testing industry is characterized by a high level of M&A and collaboration activities undertaken by leading players to increase their product portfolio and customer base. For instance, in June 2020, Tandem Diabetes Care and Abbott finalized an agreement to commercialize and develop an integrated diabetes solution that combines Tandem’s insulin delivery system and Abbott’s CGM technology.

The introduction of favorable regulatory policies aimed at promoting POC glucose diagnostics is expected to drive product demand. For instance, the implementation of Clinical Laboratory Improvement Amendments (CLIA) is expected to boost usage rates. CLIA-waived tests are approved for use by healthcare providers operating in nontraditional laboratory sites such as emergency rooms, physician offices, pharmacy clinics, health department clinics, and other healthcare facilities. CLIA-waived tests are associated with a smaller number of inaccurate results as they are simple laboratory examinations approved by the FDA for home use.

Product Insights

Accu-Chek Inform II accounted for the largest market share of 18.0% in 2023. This product is designed for in-vitro diagnostic procedures that help in monitoring blood glucose level. This glucose meter determines the level of blood glucose in venous, capillary, whole blood, and neonatal & arterial samples. Several healthcare professionals use Accu-Check Inform II, as it acts as a bedside monitoring solution aiding in determination of glucose and automates management of data generated by blood glucose tests. This helps healthcare professionals offer quality patient care.

Freestyle lite is expected to witness the fastest growth over the forecast period. FreeStyle Lite by Abbott is offered in discreet size with embedded backlight and port light, making it user-friendly for patients with a busy lifestyle. This device is used for determining blood glucose levels from blood samples collected from fingers, upper arm, forearm, hand, and thigh.

Key U.S. Point-of-Care Glucose Testing Company Insights

Some of the key U.S. point-of-care glucose testing players in are F. Hoffmann-La Roche Ltd., Abbott, LifeScan, Inc., and Bayer AG/Ascensia Diabetes Care Holdings AG among others. The industry is highly fragmented with the presence of many large, small, and medium-scale manufacturers. Key players are focusing on various business growth strategies, including new product launches, collaborations, expansion, partnerships, and acquisitions.

Key U.S. Point-of-Care Glucose Testing Companies:

- F. Hoffmann-La Roche Ltd.

- Abbott

- Nipro

- Platinum Equity Advisors, LLC (Lifescan, Inc.)

- Nova Biomedical

- ACON Laboratories

- Trividia Health, Inc.

- Prodigy Diabetes Care, LLC

- Bayer AG/Ascensia Diabetes Care Holdings AG

- EKF Diagnostics

Recent Developments

-

In January 2024, Roche announced the acquisition of LumiraDx’s point of care technology in a deal valuing over USD 350 million. This deal offered Roche a diverse range of clinical chemistry and immunoassay tests, having the potential for added high-medical value tests in the upcoming years.

-

In February 2023, Insulet Corporation acquired the assets of Automated Glucose Control LLC (AGC). AGC specializes in automated insulin delivery technology. With the help of this transaction, Insulet planned to make prominent innovations in developing automated insulin delivery technology.

U.S. Point-of-Care Glucose Testing Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1.56 billion

Growth rate

CAGR of 4.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product

Country scope

U.S.

Key companies profiled

F. Hoffmann-La Roche Ltd.; Abbott; Nipro; Platinum Equity Advisors, LLC (Lifescan, Inc.); Nova Biomedical; ACON Laboratories; Trividia Health, Inc.; Prodigy Diabetes Care, LLC; Bayer AG/Ascensia Diabetes Care Holdings AG; EKF Diagnostics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Point-of-Care Glucose Testing Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. point-of-care glucose testing market report based on product:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Accu Check Aviva Meter

-

Onetouch Verio Flex

-

i-STAT

-

Freestyle Lite

-

Bayer CONTOUR Blood Glucose Monitoring System

-

True Metrix

-

Accu-Chek Inform II

-

StatStrip

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. point-of-care glucose testing market size was estimated at USD 1.15 billion in 2023 and is expected to reach USD 1.19 billion in 2024.

b. The U.S. point-of-care glucose testing market is expected to grow at a compound annual growth rate of 4.5% from 2024 to 2030 to reach USD 1.56 billion by 2030.

b. Others segment has captured highest share of over 55.0% in 2023 in the U.S. point-of-care glucose testing market.

b. Some key players operating in the U.S. point-of-care glucose testing market include F. Hoffmann-La Roche Ltd.; Abbott; Nipro; PlatInium Equity Advisors, LLC (Lifescan, Inc.); Nova Biomedical; ACON Laboratories; Trividia Health, Inc.; Prodigy Diabetes Care, LLC; Bayer AG/Ascensia Diabetes Care Holdings AG; EKF Diagnostics.

b. Key factors that are driving the market growth include growing geriatric population, the ability of point-of-care (POC) diagnostic tests to deliver immediate results, thus providing improved patient care, and rising market penetration of electronic medical records (EMRs) are among the high-impact rendering drivers of this market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."