- Home

- »

- Pharmaceuticals

- »

-

U.S. Point-of-Care Molecular Diagnostics Market Report 2030GVR Report cover

![U.S. Point-of-Care Molecular Diagnostics Market Size, Share & Trends Report]()

U.S. Point-of-Care Molecular Diagnostics Market Size, Share & Trends Analysis Report Test Location, By Application (Infectious Diseases, Oncology, Prenatal Testing), By Technology (PCR, Sequencing), By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-203-1

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

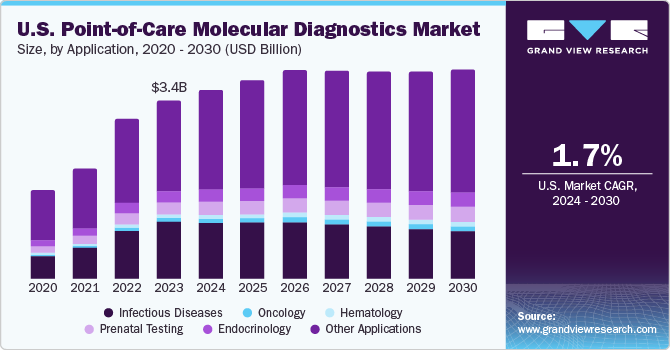

The U.S. point-of-care molecular diagnostics market size was estimated at USD 3.35 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 1.7% from 2024 to 2030. The growth of the market is driven by rise in end-user awareness, along with the increased efficiency of the testing methods and favorability for non-laboratory testing. For instance, in the U.S., approximately 1% infants are diagnosed with congenital heart diseases (CHDs) every year. However, advancements in prenatal testing have led to rapid detection of genetic biomarkers in embryos, thus leading to early diagnosis of CHDs and other genetic disorders.

The U.S. point-of-care molecular diagnostics market growth is positively impacted by the county’s patient-centric healthcare services. Thus, the demand for POC diagnostics has led to significant market growth. According to a study in the BioChip Journal in 2021, pathogen-specific treatment provided by multiplex POC tests is crucial in remote critical care, thus witnessing increased adoption in laboratory facilities. The applications of POC molecular testing range from glucose tests to complex coagulation testing. Due to the easy accessibility and reduced timeframe of diagnosis, many clinics are opting for POC testing, as opposed to conventional testing methods.

The increasing incidence of genetic disorders as well as infectious diseases, such as sexually transmitted diseases (STIs, namely HIV, HPV) and dengue, have led to fastened technological developments in molecular diagnostics. Moreover, the introduction of healthcare information systems, paired with the advent of teleconsultation services, has led to increased awareness and adoption of POC testing. The increase in

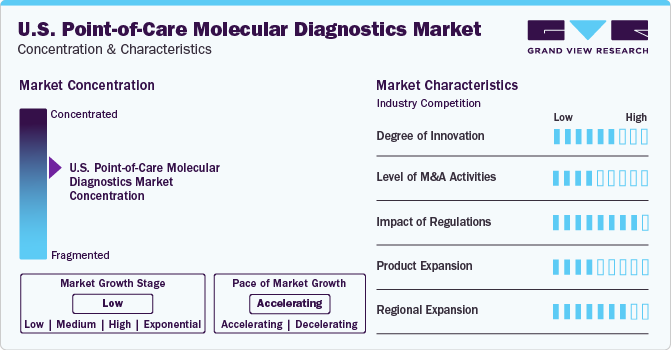

Market Concentration & Characteristics

Degree of Innovation: Market growth stage is low, and pace of market growth is accelerating. The U.S. point-of-care molecular diagnostics market is characterized by a moderate-to-high degree of innovation owing to the advancements in technology, including the introduction of next-generation sequencing (NGS)-friendly applications. Previously, POC testing has seen barriers in NGS testing, and market players as well as academic institutions have focused on relentless research and development efforts to overcome these.

Players in the point-of-care molecular diagnostics market leverage market strategies such as mergers, acquisitions, collaborations, and partnerships to promote reach of their offerings and increase their product capabilities in the region. For instance, in 2022, Bio-Rad Laboratories acquires Curiosity Diagnostics, integrating Curiosity’s rapid PCR system, PCR|ONE, to expand its presence in near-patient molecular diagnostics labs.

The point-of-care molecular diagnostics market is strongly driven by regulatory authorities. The regulatory framework for approvals acts as a restraining factor for market growth in the U.S. In addition to the complex regulatory framework in the country, the Food and Drug Administration (FDA) is increasingly cautious regarding the adoption of POC tests due to their role in critical care and serious medical decision-making. Furthermore, post-market investigations of IVD products are also limiting market growth. However, incidences of FDA approval in the market are a resultant of careful testing and methodologies by market participants. For example, in July 2023, Lumos Diagnostics received clearance from the FDA to market their rapid point-of-care test, FebriDx®, in the U.S.

Technological advancements in the point-of-care molecular diagnostics market are also focused on making essential testing cheaper, thus sourcing and manufacturing economically feasible diagnostic solutions. Moreover, increased investments by public and private organizations in the diagnostics sector have provided additional opportunities for emerging players to reinforce their market position through product development.

Test Location Insights

The OTC segment held a marginally higher share of 52.01% in the U.S, and is anticipated to register a significant growth rate from 2024 to 2030. Self-testing and over-the-counter testing kits are widely available on e-commerce platforms and facilitate early diagnosis, along with constant patient monitoring. The distinctive factor for OTC tests remains their availability without the need of a prescription, and are thus applicable for more common usage. Instances of product development in the segment are spurring market growth further.

The point-of-care test location segment is estimated to register the fastest CAGR over the forecast period. POC molecular testing identifies viruses and infectious agents using their genetic material, and is thus marketed as a POC test kit that can provide quick results and portability. POC tests for various cancers, including prostate, bladder, colorectal, cervical, HPV-causing head and neck, liver, breast, and lung cancer are also commercially available in the U.S. The growing interest in developing molecular diagnostic platforms is driving market participants to design assays & molecular diagnostic systems for near-patient testing. For instance, in October 2023, the National Institute of Biomedical Imaging and Bioengineering (NIBIB) at the National Institutes of Health (NIH) awarded the Atlanta Center for Microsystems Engineered Point-of-Care Technologies (ACME POCT) with USD 7.8 million over the next 5 years to support inventors across the U.S.

Application Type Insights

The infectious diseases segment registered a market share of 31.7% in 2023. In 2021, there were 36,136 new HIV diagnoses in the United States, with an estimated 1.2 million people living with HIV. Despite significant efforts in managing infectious diseases, there is a huge demand for low-cost, accurate, and sensitive POC products. Nanotechnology has found widespread applications in the healthcare industry.

The other applications segment held the largest market share of over 50% in 2023, owing to the rising awareness regarding the benefits associated with the adoption of POC molecular diagnostic solutions. This segment comprises POC solutions used in fertility & pregnancy testing, nephrology, autoimmune disease, and cardiac markers, among others. Due to the lack of medical intervention needed in these tests, significant growth is anticipated in the other applications segment over the forecast period.

The oncology segment is anticipated to witness the fastest growth over the forecast period. POC tests are being rapidly adopted for enabling mass screening & early detection for a broad range of cancer types. Furthermore, presence of a large number of government-funded testing programs, such as the National Breast and Cervical Cancer Early Detection Program, is expected to drive market growth.

Technology Insights

The PCR-based segment dominated the market with a revenue share of 65.60% in 2023. PCR is the foremost and simplest procedure performed before any molecular diagnostic investigation involving genetic material. This technology enables cancer detection in its early stages, often before clinical symptoms manifest. The increase in applications of POC molecular diagnostics in the fields of pharmacogenomics, drug discovery & development, acquired immunodeficiency syndrome, and cancer research directly boosts the demand for PCR technologies. PCR-based segment held a significant share due to the advantages and varied applications of multiplex PCR over conventional PCR methodologies.

The genetic sequencing-based POC molecular diagnostics segment is anticipated to register the fastest CAGR during the forecast period owing to the increasing demand for rapid and accurate testing and rising prevalence of infectious diseases. Furthermore, advancements in sequencing techniques have led to increased adoption in various medical settings, driving market expansion. Moreover, the growing demand for personalized medicine and expanding applications of genetic sequencing are driving the growth of this segment.

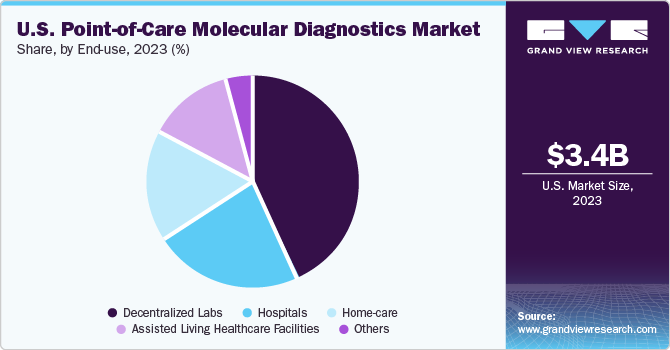

End-use Insights

The decentralized segment held the largest market share of 42.81% in 2023, owing to the wide applications of POC molecular diagnostics in decentralized labs. These tests have revolutionized the market by accelerating decision-making and reducing turnaround time for decentralized testing. Decentralized testing empowers healthcare providers by saving chain-lag time, saving costs, and reducing the length of delay in treatment. The usage of assays aids the rapid detection and automation of workflows in comprehensive tests, along with other advantages. In December 2023, Roche, a leading healthcare company in pharmaceuticals and diagnostics, announced a recent agreement to buy POC technology from LumiraDx for USD 350 million. With this movement, the company aims to use LumiraDx’s versatile platform in improving point-of-care testing in decentralized healthcare settings globally.

The home care segment is expected to grow at the fastest rate over the forecast period. A primary factor driving the home care segment is the improved patient care decision-making due to reduced diagnosis time. Moreover, it enables better patient care and provides faster access to treatment. The increase in geriatric population has led to a larger section of the population being vulnerable to chronic illnesses. Technological advancements have led to the introduction of novel devices for treatment that can be used in homecare settings. Thus, the increased access to medical care and focus on better technological solutions in home care testing is burgeoning the market growth.

Key U.S. Point-of-Care Molecular Diagnostics Company Insights

Some of the key players operating in the U.S. point-of-care molecular diagnostics market include Abbott Laboratories; QIAGEN; F. Hoffman-La Roche Ltd; bioMerieux; and BD. Numerous key players are undertaking strategic initiatives such as expansion, product introductions, mergers, and acquisitions, while also focusing on increasing product reach in the U.S. Several market participants are investing in research and development initiatives, making the market susceptible to further growth.

Key U.S. Point-of-Care Molecular Diagnostics Companies:

- QIAGEN

- Danaher

- Thermo Fisher Scientific, Inc.

- BD

- F. Hoffman-La Roche AG

- Charles River Laboratories

- Quest Diagnostics Incorporated

- Bio-Rad Laboratories, Inc.

- Hologic Inc.

- Agilent Technologies, Inc.

Recent Developments

-

In February 2024, BD, a U.S. based medical technology company, announced that they have begun clinical trials for a rapid Point-of Care Molecular Dx instrument and an assay to detect STIs.

-

In November 2023, binx health, a healthcare technology and diagnostics company, announced its agreement with Fisher Healthcare, a part of Thermo Fisher Scientific, to expand the nationwide distribution of their molecular POC platform, bimx io, in the U.S.

-

In March 2023, Lucira Health, a U.S.-based company that was acquired by Pfizer in April 2023, announced the launch of the first and only at-home COVID-19 and flu tests in the U.S., a test approved by the FDA under Emergency Use Authorization (EUA) for OTC usage at home and other nonlaboratory locations.

U.S. Point-of Care Molecular Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.54 billion

Revenue forecast in 2030

USD 3.92 billion

Growth Rate

CAGR of 1.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million, number of tests in million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Test location, application type, technology, end-use, states

Key companies profiled

Abbott Laboratories; QIAGEN; Danaher; Thermo Fisher Scientific, Inc.; BD; F. Hoffman-La Roche AG; Charles River Laboratories; Quest Diagnostics Incorporated; Bio-Rad Laboratories, Inc.; Hologic Inc.; Agilent Technologies, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Point-of-Care Molecular Diagnostics Market Report Segmentation

This report forecasts revenue growth at the country and state levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. point-of-care molecular diagnostics market report based on test location, application type, technology, end-use, and states.

-

Test Location Outlook (Revenue, USD Million, 2023 - 2030)

-

OTC

-

POC

-

-

Application Type Outlook (Revenue, USD Million, 2023 - 2030)

-

Infectious Diseases

-

HIV POC

-

Clostridium difficile POC

-

HBV POC

-

Pneumonia or Streptococcus associated infections

-

Respiratory syncytial virus (RSV) POC

-

HPV POC

-

Influenza/Flu POC

-

HCV POC

-

MRSA POC

-

TB and drug-resistant TB POC

-

HSV POC

-

Other Infectious Diseases

-

-

Oncology

-

Hematology

-

Prenatal Testing

-

Endocrinology

-

Other Applications

-

-

Technology Outlook (Revenue, USD Million, 2023 - 2030)

-

PCR-based

-

Genetic Sequencing-based

-

Hybridization-based

-

Microarray-based

-

-

End-use Outlook (Revenue, USD Million, 2023 - 2030)

-

Decentralized Labs

-

Hospitals

-

Home-care

-

Assisted Living Healthcare Facilities

-

Other uses

-

Frequently Asked Questions About This Report

b. The U.S. point-of-care molecular diagnostics market is estimated at USD 3.35 billion in 2023 and is expected to reach USD 3.54 billion in 2024.

b. The U.S. point-of-care molecular diagnostics market is expected to grow at a CAGR of 1.7% from 2024 to 2030 to reach USD 3.92 billion in 2030.

b. The OTC segment held a marginally higher share of 52.01% in the U.S. and is anticipated to register a significant growth rate from 2024 to 2030.

b. Some of the key players operating in the U.S. point-of-care molecular diagnostics market include Abbott Laboratories; QIAGEN; F. Hoffman-La Roche Ltd; bioMerieux; and BD.

b. The growth of this market is driven by a rise in end-user awareness, along with the increased efficiency of the testing methods and favorability for non-laboratory testing.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."