- Home

- »

- Clinical Diagnostics

- »

-

Point Of Care Molecular Diagnostics Market Report, 2033GVR Report cover

![Point Of Care Molecular Diagnostics Market Size, Share & Trends Report]()

Point Of Care Molecular Diagnostics Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Infectious Diseases, Oncology, Prenatal Testing, Endocrinology), By Technology, By Test Location, By End-use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-886-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Point-of-Care Molecular Diagnostics Market Summary

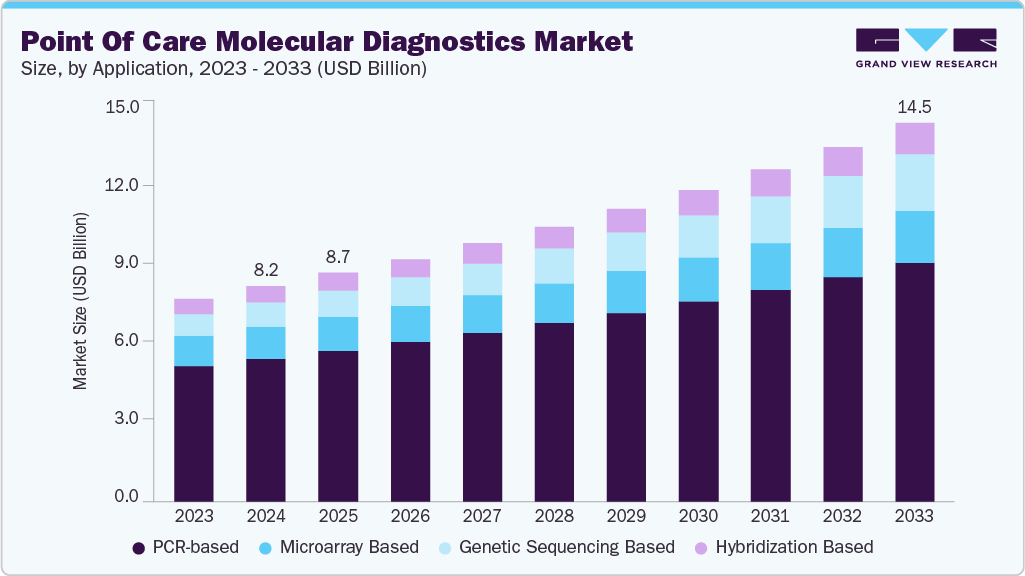

The global point of care molecular diagnostics market size was estimated at USD 8.22 billion in 2024 and is projected to reach USD 14.47 billion by 2033, growing at a CAGR of 6.52% from 2025 to 2033. This market focuses on rapid and accurate molecular testing conducted near the patient, enabling timely clinical decision-making. These platforms are used across various applications, particularly in infectious disease detection, respiratory illnesses, and sexually transmitted infections.

Key Market Trends & Insights

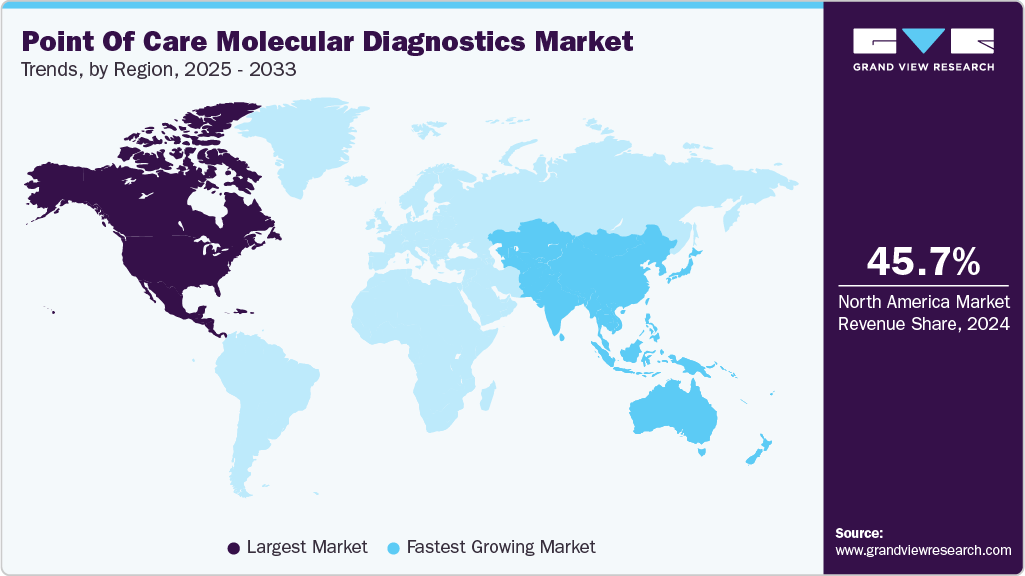

- The North America point of care molecular diagnostics market accounted for the largest revenue share of 45.70% in 2024.

- The U.S. led the North America market and held the largest revenue share in 2024

- Based on test location, the OTC segment dominated the global market with the largest revenue share of 52.60% in 2024.

- Based on application, the infectious disease segment held the largest revenue share of 47.95% in 2024.

- Based on technology, the PCR-based segment dominated the market with the largest revenue share of 66.37% in 2024.

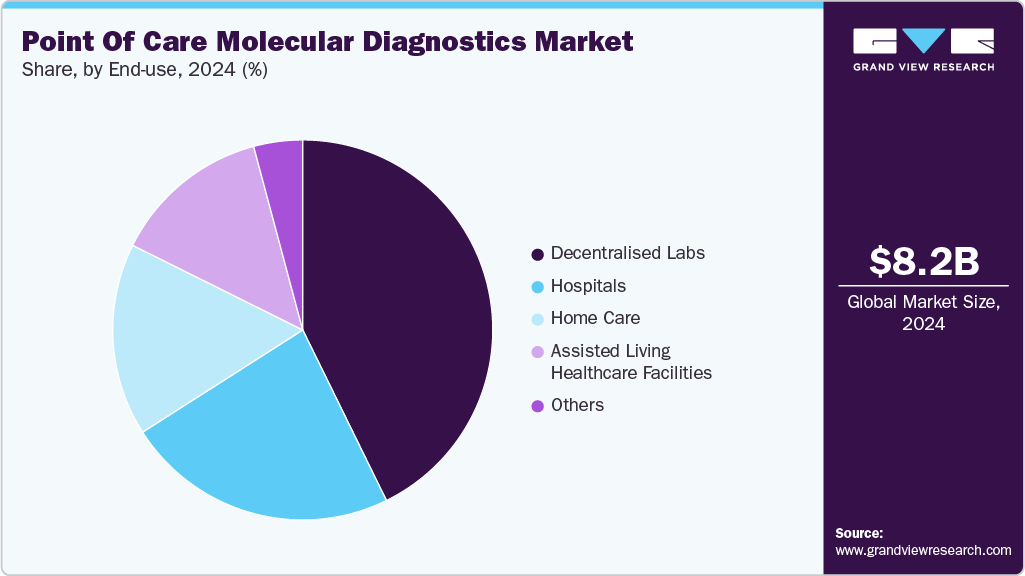

- Based on end use, the decentralized labs segment held the largest revenue share of 42.74% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.22 Billion

- 2033 Projected Market Size: USD 14.47 Billion

- CAGR (2025-2033): 6.52%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Market growth is driven by the rising demand for decentralized testing, especially in resource-limited settings and emergency care environments. The increasing burden of infectious diseases and the need for rapid turnaround time have expanded the adoption of point-of-care molecular technologies. Technological advances in microfluidics, isothermal amplification, and portable PCR systems are enhancing the accuracy and usability of these diagnostics. In addition, post-pandemic healthcare priorities emphasize rapid response testing, further supporting market expansion.

Moreover, POC molecular diagnostics in primary care settings range from simple glucose testing to complex coagulation testing. In several clinics, professionals are switching to POC testing from conventional lab testing, which helps shorten the time taken to decide whether further tests are required by avoiding delays during specimen preparation and transport. Other advantages of POC molecular diagnostics are rapid availability of results, lower costs, and better outcomes. The point of care molecular diagnostics industry has grown rapidly in the past few years, especially in the U.S. and European countries, owing to increased awareness regarding various issues such as medical & organizational concerns and economic advantages of POCT.

Aging is influenced by the interaction of several environmental and genetic factors and is characterized as the single most substantial risk factor for cancer development. Based on the U.S. National Cancer Institute’s Surveillance Epidemiology and End Results (SEER) Database, 38% of women and 43% of men are estimated to develop cancer during their lifetime. Nearly two-thirds of all new cancer cases are diagnosed in people aged 65 and above, which highlights that aging can make people more vulnerable to cancer. This is where molecular diagnostics play an important role, as it has a tremendous impact on the management of cancer, infectious diseases, and cardiovascular diseases. It is, therefore, vital for public health surveillance and detection. Thus, the growing geriatric population is expected to drive market growth.

Moreover, market players are continuously involved in the development of novel POC testing products to capitalize on market opportunities. For instance, in February 2023, Huwel Lifesciences designed a portable RT-PCR machine to test types of viruses. The company claimed that the test takes around 30 minutes and can be used to detect respiratory and other infections using blood and gastrointestinal samples. Moreover, in April 2023, Curative, Inc. announced the spin-off of Sensible Diagnostics, focusing on the commercialization of a novel POC PCR testing platform to provide results within 10 minutes with high accuracy.

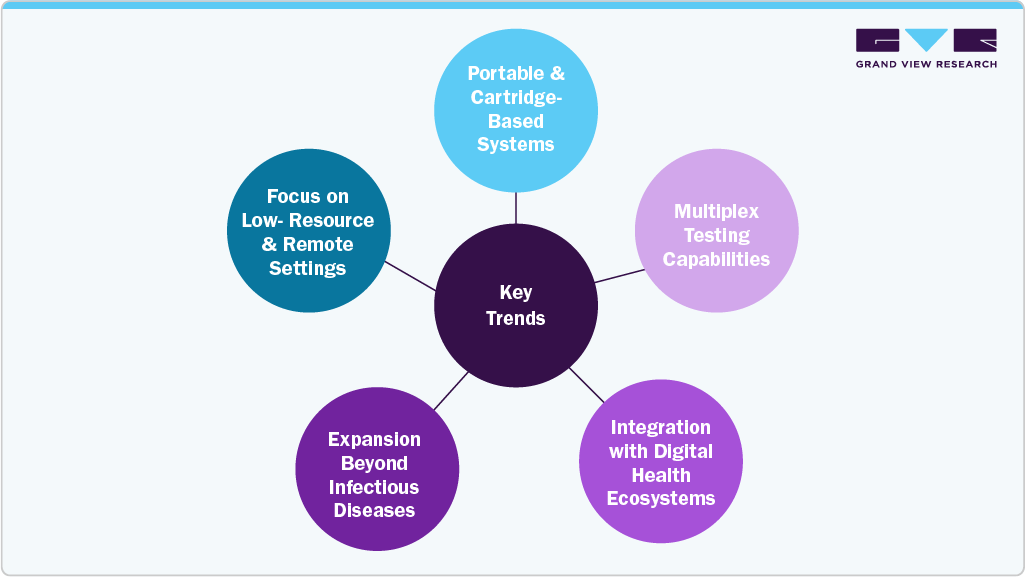

Key Trends Shaping the Point-of-Care Molecular Diagnostics Market

Portable and Cartridge-Based Systems:

Compact, all-in-one molecular testing platforms with self-contained cartridges are gaining popularity due to ease of use, minimal training requirements, and suitability for decentralized settings.

Multiplex Testing Capabilities:

There is growing adoption of POC devices capable of detecting multiple pathogens from a single sample. This supports faster differential diagnosis, particularly for respiratory infections with overlapping symptoms.

Integration with Digital Health Ecosystems:

POC molecular devices are increasingly being designed with wireless connectivity, enabling real-time data sharing with electronic health records and supporting telemedicine and remote monitoring initiatives.

Expansion Beyond Infectious Diseases:

While infectious disease testing dominates, companies are expanding into new areas such as oncology, genetic screening, and antimicrobial resistance, broadening the clinical utility of POC molecular platforms.

Focus on Low-Resource and Remote Settings:

The development of rugged, battery-powered devices with minimal infrastructure needs is addressing diagnostic gaps in rural, emergency, and mobile care environments, especially in developing countries.

These trends underscore the growing importance of rapid, decentralized diagnostics in clinical decision-making. With continued improvements in portability, connectivity, and test versatility, point-of-care molecular diagnostics are becoming more accessible across diverse healthcare environments. The expansion beyond infectious diseases further broadens their clinical relevance. As healthcare systems prioritize speed and accuracy, these technologies are expected to see sustained demand in developed and developing regions.

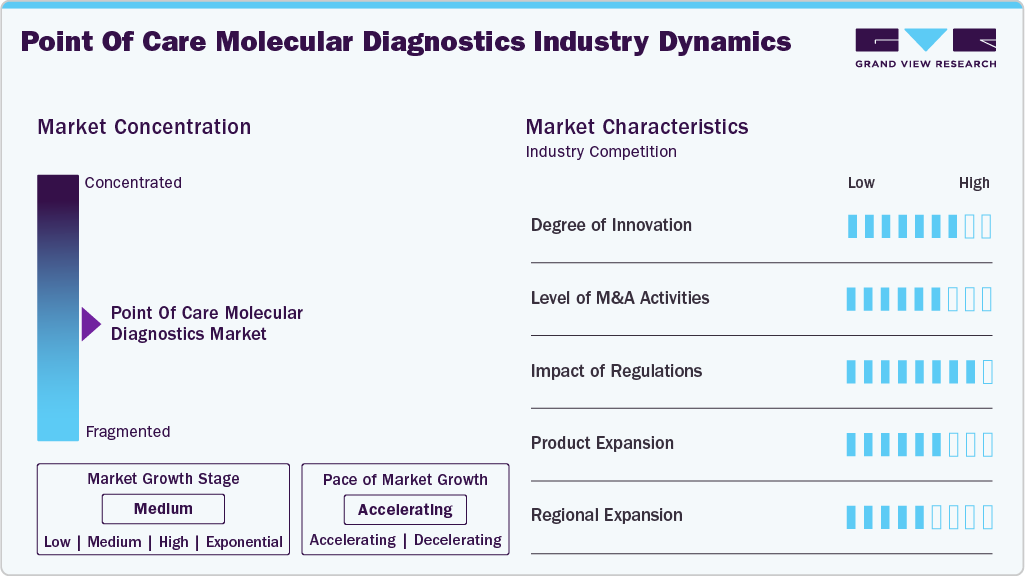

Market Concentration & Characteristics

Innovation is high in the point-of-care molecular diagnostics space, driven by the need for faster, more accurate, and portable testing solutions. Advancements such as microfluidic cartridges, smartphone-based readers, and isothermal amplification improve diagnostic speed and sensitivity. Many platforms now support multiplex testing and digital connectivity, aligning with trends in remote care and decentralized diagnostics. In February 2025, Aptitude secured Emergency Use Authorization (EUA) from the U.S. FDA for its Metrix COVID/Flu multiplex molecular test, which delivers PCR-grade accuracy at the point of care (POC) or even for over-the-counter (OTC) use and provides results in about 20 minutes. This device combines multiplex capability, speed, and portability, reinforcing the market’s focus on innovation for rapid and decentralized diagnostics.

Mergers and acquisitions are moderately active, with larger diagnostic firms acquiring startups to enhance molecular testing portfolios. These deals often focus on integrating novel technologies or expanding into underserved markets. Strategic collaborations between diagnostics and digital health firms are also rising, helping accelerate R&D and improve platform interoperability.

Regulatory bodies such as the U.S. FDA and the European Medicines Agency (EMA) are critical in shaping market access. Emergency use authorizations during the pandemic accelerated initial adoption, and now more stringent pathways are in place for long-term commercial use. Compliance with regional standards like CE marking and ISO certifications remains essential for product approval and adoption.

Companies are expanding their test menus to include a broader range of pathogens and clinical conditions. Platforms now offer assays for respiratory diseases, sexually transmitted infections, and antimicrobial resistance. The focus is on delivering compact, cartridge-based systems that enable rapid, multiplexed testing with minimal user input. Integration with cloud-based platforms also supports real-time data access. In January 2025, Roche received FDA clearance and CLIA waiver for its cobas Liat system, introducing a molecular point-of-care test for sexually transmitted infections such as Chlamydia and Gonorrhea. The test delivers PCR-grade accuracy with results in about 20 minutes, strengthening the market trend toward expanding menus beyond respiratory pathogens and supporting decentralized care models.

While North America and Europe lead in adoption, manufacturers are increasingly targeting Asia-Pacific, Latin America, and parts of Africa for market growth. These regions present strong potential due to expanding primary healthcare access, growing disease burden, and government initiatives to support decentralized diagnostics. Local manufacturing and distribution partnerships are helping lower costs and improve accessibility.

Application Insights

The infectious disease segment accounted for the largest market share of 47.9% in 2024, driven by the need for rapid and accurate diagnosis of conditions such as COVID-19, influenza, HIV, and respiratory infections. The segment’s dominance reflects the high demand for quick, on-site molecular testing to manage outbreaks and reduce transmission, particularly in emergency and outpatient settings. Point-of-care molecular platforms enable early detection using small samples with minimal lab infrastructure, supporting timely treatment decisions. According to UNAIDS, 40.8 million people were living with HIV in 2024, and there were 1.3 million new infections and 630,000 AIDS-related deaths in the same year. In addition, mobile and decentralized testing have improved linkage to antiretroviral therapy, with 31.6 million people receiving treatment by the end of 2024. These figures highlight the critical role of accessible POC molecular diagnostics in global infectious disease control. The focus on pandemic preparedness, antimicrobial resistance, and decentralized testing has further strengthened adoption. Moreover, these tests are increasingly used in remote areas, travel clinics, and resource-limited environments due to their speed, portability, and reliability.

The oncology segment is expected to be the most lucrative application area in the point of care molecular diagnostics industry, driven by the growing demand for rapid and precise cancer detection closer to the patient. With cancer rates rising globally, there is an increasing need for decentralized testing solutions that can identify genetic mutations and tumor markers without delay. Point-of-care molecular platforms offer the ability to detect oncogenic signatures through minimally invasive methods, supporting early diagnosis and guiding targeted therapies. Technological innovations such as portable PCR devices, microfluidic chips, and multiplex assays are making these tools more accessible in outpatient and resource-limited settings. As personalized medicine becomes a clinical priority, POC molecular diagnostics are emerging as valuable tools for delivering faster, data-driven oncology care.

Technology Insights

PCR-based technologies held the largest share of 66.37% in the global point of care molecular diagnostics market in 2024, due to their reliability, high sensitivity, and broad clinical utility. Recognized as the gold standard for DNA amplification, PCR remains the most trusted and widely used method in molecular diagnostics, especially for infectious diseases such as COVID-19, influenza, and HIV. Its role extends beyond infection control into drug discovery, cancer research, pharmacogenomics, and acquired immunodeficiency syndrome, supporting its continued dominance in POC. Technological advancements like multiplex PCR and portable thermal cyclers have enhanced usability, enabling faster and more comprehensive testing in decentralized environments. In February 2025, Visby Medical received FDA 510(k) clearance and a CLIA waiver for its handheld Respiratory Health Test. This compact PCR-based device detects Influenza A, Influenza B, and SARS-CoV-2 in under 30 minutes at the point of care. These advantages and the expanding scope of clinical applications continue to drive strong demand for PCR-based point-of-care diagnostic platforms.

The genetic sequencing-based point-of-care molecular diagnostics segment is expected to grow at the fastest CAGR during the forecast period. This technology allows real-time analysis of genetic material, helping doctors detect diseases early and choose treatments that are better suited to each patient. The segment’s growth is supported by the rising need for fast and accurate testing and the growing number of infectious disease cases. Improvements in sequencing methods have made these tools easier to use in clinics, hospitals, and mobile care units. In addition, the shift toward personalized medicine and the broader use of genetic testing across healthcare are helping this segment expand quickly.

Test Location Insights

In 2024, the over-the-counter (OTC) diagnostics segment led the global point-of-care molecular diagnostics market with the highest share of 52.60%. OTC diagnostic products support early detection and continuous patient monitoring while reducing the need for visits to healthcare facilities, helping to lower overall medical costs. As demand for point-of-care molecular testing rises, there is a growing need for user-friendly platforms that allow individuals to conduct tests without professional supervision. In response, several companies are introducing innovative home-based kits targeting various infectious diseases. For example, in March 2023, Lucira Health launched the first and only at-home combined COVID-19 and flu test in the U.S. Such developments are driving the growth of the OTC diagnostics segment, making self-testing more accessible and practical for everyday use.

The point-of-care test location segment is expected to grow at the fastest CAGR during the forecast period. These tests provide quick results and can be used outside traditional labs, making them convenient and portable. Molecular tests, which detect the genetic material of infectious agents, are a fast-growing part of this segment. Many of these tests are now being used in clinics, mobile units, and remote areas because they are fast, easy to use, and more affordable than lab-based testing. Several companies are focusing on developing systems specifically for near-patient use. For instance, in April 2023, Mobilo Diagnostics announced the launch of Truenat H3N2/H1N1, the first point-of-care real-time PCR test to help identify influenza infections quickly. These developments make POC molecular testing more available and practical across various healthcare settings.

End-use Insights

In 2024, the decentralized labs segment dominated the point-of-care molecular diagnostics industry with the highest share of 42.74%. Advancements in rapid assays have significantly boosted this segment by making it easier for healthcare practitioners to make quick decisions and receive results. Such tests are now standard in clinics, urgent care centers, and remote facilities, delivering reliable results at or near the point of patient care. Funding and government support continue to fuel this expansion. For instance, in October 2023, the National Institutes of Health (NIH)-through its National Institute of Biomedical Imaging and Bioengineering (NIBIB)-awarded USD 7.8 million to the Atlanta Center for Microsystems Engineered Point-of-Care Technologies (ACME POCT) to support developers of new POC molecular diagnostic platforms. This investment aims to accelerate the development of rapid, near-patient testing tools, especially valuable in emergency rooms and decentralized lab settings.

The home care segment is expected to grow at the fastest CAGR over the forecast period, supported by the convenience and cost-effectiveness of point-of-care molecular diagnostics at home. These tests allow patients to monitor their health, get quick results, and make timely decisions without visiting a clinic or hospital. Most POC devices are user-friendly and do not require advanced lab setups, making them ideal for home use. This is especially helpful for testing conditions that may carry stigma, such as sexually transmitted infections. With healthcare shifting toward prevention and early detection, home-based POC diagnostics are expected to grow strongly, offering patients more control and privacy in managing their health.

Regional Insights

North America dominates the global point of care molecular diagnostics market, supported by strong healthcare infrastructure, widespread adoption of rapid testing technologies, and growing demand for decentralized diagnostics. The region benefits from well-established regulatory frameworks and increased investment in portable molecular testing platforms across various care settings. Advances in PCR, isothermal amplification, and genetic sequencing are further driving growth. Integration with digital health systems and expanding use of at-home diagnostics continue to support the region’s leadership in both market size and innovation.

U.S. Point of Care Molecular Diagnostics Market Trends

The U.S. leads the global point of care molecular diagnostics industry, driven by growing demand for rapid testing across emergency care, outpatient services, and home-based settings. The focus on early detection of infectious diseases, strong public health initiatives, and widespread availability of portable molecular platforms have accelerated adoption. High patient throughput in clinical environments and the shift toward decentralized care continue to fuel the need for fast and reliable diagnostics. In November 2023, binx health entered into a distribution agreement with Fisher Healthcare to expand the reach of its molecular point-of-care platform, binx io, across the U.S. The platform enables rapid, on-site testing for sexually transmitted infections, supporting broader access to molecular diagnostics in near-patient settings. In addition, the growing use of self-testing kits, digital connectivity, and compact analyzers continues to drive market growth across diverse healthcare applications.

Europe Point of Care Molecular Diagnostics Market Trends

The Europe point of care molecular diagnostics industry is experiencing steady growth, driven by rising demand for rapid and decentralized testing across clinical and outpatient settings. Countries such as Germany, France, and the UK are leading adoption, supported by strong healthcare infrastructure and national efforts to expand early disease detection. Growing use of molecular platforms for infectious disease testing, along with wider acceptance of self-testing and home-based diagnostics, is contributing to market expansion. The region is also seeing increased integration of POC systems with digital health tools, improving data sharing and patient management, which further supports broader adoption across primary care and remote settings.

The UK point of care molecular diagnostics market is growing steadily, supported by the healthcare system’s focus on early detection, decentralized testing, and faster clinical decision-making. The adoption of molecular POC platforms is increasing across outpatient clinics, pharmacies, and home care due to rising demand for quick and accurate diagnosis, particularly for infectious diseases. Government efforts to expand digital health services and improve diagnostic access in community settings are further supporting this trend. The growing use of portable PCR and isothermal testing systems, combined with interest in self-testing options, positions the UK as a key contributor to regional market growth.

The point of care molecular diagnostics market in Germany is showing strong growth, supported by a well-established healthcare system and rising demand for rapid testing in outpatient and decentralized care settings. The country is seeing increased use of molecular POC platforms for infectious disease detection, particularly in community clinics and emergency departments. Broader adoption is driven by the need for fast, accurate results and reduced reliance on central laboratories. Ongoing innovation in portable PCR and multiplex testing devices is making near-patient diagnostics more practical, while government support for healthcare digitization is helping integrate these tools across various care levels.

Asia Pacific Point of Care Molecular Diagnostics Market Trends

The Asia Pacific point of care molecular diagnostics industry is the fastest-growing regional segment, driven by the rising awareness of early disease detection, expanding access to healthcare services, and growing demand for rapid diagnostic solutions. Countries such as China, India, and Japan are increasing investments in community health programs and decentralized care to support timely diagnosis, especially in rural and underserved areas. The availability of cost-effective molecular POC platforms, along with government-backed initiatives to improve diagnostic infrastructure, is boosting adoption across the region. In addition, advancements in mobile health technologies and portable testing devices are making POC molecular diagnostics more accessible in both clinical and home settings.

The Japan point of care molecular diagnostics market is expanding gradually, driven by the country's focus on early disease detection, aging population, and growing need for rapid diagnostics in outpatient and home care settings. Molecular POC testing is gaining traction in areas such as respiratory infections and chronic disease monitoring, where quick and accurate results are critical. Although regulatory processes remain rigorous, the demand for compact, easy-to-use testing platforms is rising across clinics, pharmacies, and mobile care units. The growing interest in self-testing, along with the integration of digital tools for result tracking and reporting, is supporting broader adoption of molecular diagnostics at the point-of-care.

The point of care molecular diagnostics in China represents a major growth opportunity, supported by increasing demand for rapid testing, expanding healthcare infrastructure, and strong government focus on public health. The use of molecular POC platforms is rising in community clinics, hospitals, and mobile health units, particularly for infectious disease detection and chronic condition monitoring. National efforts to promote healthcare digitization and improve rural health services are further accelerating market adoption. In addition, the need for cost-effective, portable, and easy-to-use diagnostic tools is encouraging local innovation and attracting international players to the growing market.

Latin America Point of Care Molecular Diagnostics Market Trends

Latin America is experiencing steady growth in the point of care molecular diagnostics industry, supported by expanding access to healthcare services, rising awareness of early disease detection, and a push toward decentralized testing. Countries such as Brazil and Mexico are investing in rapid diagnostic solutions to strengthen primary care, manage infectious disease outbreaks, and reach underserved populations. The availability of affordable and portable molecular platforms is enabling broader use in rural clinics, community health programs, and mobile units. Continued focus on public health improvement and the growing role of near-patient testing are expected to drive further market expansion across the region.

The Brazil point of care molecular diagnostics market is expanding steadily, driven by the need for rapid and accessible testing across public and private healthcare sectors. Rising demand for early detection of infectious diseases, combined with efforts to improve diagnostic access in underserved areas, is supporting market growth. Government health programs and mobile care initiatives are promoting the use of molecular POC platforms in community clinics and rural regions. In addition, increasing interest in self-testing and the integration of digital health tools are encouraging the adoption of portable diagnostic systems, positioning Brazil as a key market for point-of-care molecular diagnostics in Latin America.

Middle East and Africa Point Of Care Molecular Diagnostics Market Trends

The Middle East & Africa region shows emerging growth in the point of care molecular diagnostics industry, supported by rising awareness of early disease detection, expanding healthcare access, and public health efforts. Countries such as South Africa, the UAE, and Saudi Arabia are increasingly adopting molecular POC testing in primary care, emergency settings, and remote areas to improve diagnostic turnaround times. While healthcare infrastructure varies across the region, the demand for affordable, portable, and easy-to-use testing solutions continues to rise. Mobile health units, government-led outreach programs, and international collaborations are playing a key role in bringing molecular diagnostics to underserved populations.

Key Point Of Care Molecular Diagnostics Company Insights

Key players in the point of care molecular diagnostics industry are actively focusing on new product development and securing regulatory approvals to expand their offerings. In addition, companies are pursuing strategic initiatives such as partnerships, collaborations, mergers, and acquisitions to strengthen their market presence. These efforts aim to enhance technology portfolios, increase geographic reach, and improve access to rapid diagnostic solutions across diverse healthcare settings.

Key Point Of Care Molecular Diagnostics Companies:

The following are the leading companies in the point of care molecular diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- Bayer AG

- F. Hoffmann-La Roche AG

- Nova Biomedical

- QIAGEN

- Nipro Diagnostics

- Danaher

- Bio-Rad Laboratories, Inc.

- bioMérieux

- Agilent Technologies, Inc.

- Abaxis

- OraSure Technologies

Recent Developments

-

In July 2025, Waters Corporation announced a USD 17.5 billion Reverse Morris Trust merger with Becton Dickinson’s Biosciences and Diagnostic Solutions business. The integration is set to double Waters’ addressable market to approximately USD 40 billion, creating a stronger presence in clinical diagnostics with expanded molecular capabilities. The addition of BD’s molecular technologies and multiplex testing portfolio enhances opportunities for decentralized and near-patient applications, supporting growth in molecular testing for infectious diseases and oncology within the point-of-care segment.

-

In January 2025, Aptitude Medical Systems secured USD 10 million in funding to accelerate the development of a point-of-care and over-the-counter molecular test for Chlamydia trachomatis (CT), Neisseria gonorrhoeae (NG), and Trichomonas vaginalis (TV) on its Metrix platform. This funding aims to extend the platform’s scope beyond respiratory diagnostics to sexual health applications, supporting broader adoption of decentralized and self-testing solutions in molecular diagnostics.

-

In February 2024, Becton Dickinson announced the commencement of clinical trials for a rapid point-of-care molecular diagnostics platform and an associated assay designed to detect Chlamydia trachomatis (CT) and Neisseria gonorrhoeae (GC).

Point Of Care Molecular Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.73 billion

Revenue forecast in 2033

USD 14.47 billion

Growth rate

CAGR of 6.52% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, technology, test location, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Sweden; Denmark; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Abbott; Bayer AG; F. Hoffmann-La Roche AG; Nova Biomedical; QIAGEN; Nipro Diagnostics; Danaher; Bio-Rad Laboratories, Inc.; bioMérieux; Agilent Technologies, Inc.; Abaxis; OraSure Technologies

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Point Of Care Molecular Diagnostics Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global point of care molecular diagnostics market report based on application, technology, test location, end-use, and region:

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

PCR-based

-

Genetic Sequencing-based

-

Hybridization-based

-

Microarray-based

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Infectious Diseases

-

HIV POC

-

Clostridium difficile POC

-

HBV POC

-

Pneumonia or Streptococcus associated infections

-

Respiratory syncytial virus (RSV) POC

-

HPV POC

-

Influenza/Flu POC

-

HCV POC

-

MRSA POC

-

TB and drug-resistant TB POC

-

HSV POC

-

Other Infectious Diseases

-

-

Oncology

-

Hematology

-

Prenatal Testing

-

Endocrinology

-

Other Applications

-

-

Test Location Outlook (Revenue, USD Million, 2021 - 2033)

-

OTC

-

POC

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Decentralized Labs

-

Hospitals

-

Home-care

-

Assisted Living Healthcare Facilities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global point of care molecular diagnostics market size was estimated at USD 8.22 billion in 2024 and is expected to reach USD 8.73 billion in 2025.

b. The global point of care molecular diagnostics market is expected to grow at a compound annual growth rate of 6.52% from 2025 to 2033 to reach USD 14.47 billion by 2033.

b. On the basis of application, the infectious disease segment accounted for the largest market share of 47.9% in 2024, driven by the need for rapid and accurate diagnosis of conditions such as COVID-19, influenza, HIV, and respiratory infections. The segment’s dominance reflects the high demand for quick, on-site molecular testing to manage outbreaks and reduce transmission, particularly in emergency and outpatient settings.

b. Some key players operating in the point of care molecular diagnostics market include Abbott Laboratories, Bayer Healthcare; F. Hoffmann-La Roche AG; Becton, Dickinson and Company; BioMerieux; Bio-Rad Laboratories, Inc.; Cepheid, Inc.; Danaher Corporation; and Johnson & Johnson Services, Inc.

b. Key factors that are driving the market growth include high quality of test results in very short time, development of accurate & faster testing methods, and offering convenient diagnostic approach for physicians.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.