- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Polyvinyl Butyral Market Size, Industry Report, 2033GVR Report cover

![U.S. Polyvinyl Butyral Market Size, Share & Trends Report]()

U.S. Polyvinyl Butyral Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Films & Sheets, Resins, Solutions), By Application (Laminated Safety Glass, Adhesives), By End Use (Automotive, Photovoltaics), And Segment Forecasts

- Report ID: GVR-4-68040-696-5

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Polyvinyl Butyral Market Summary

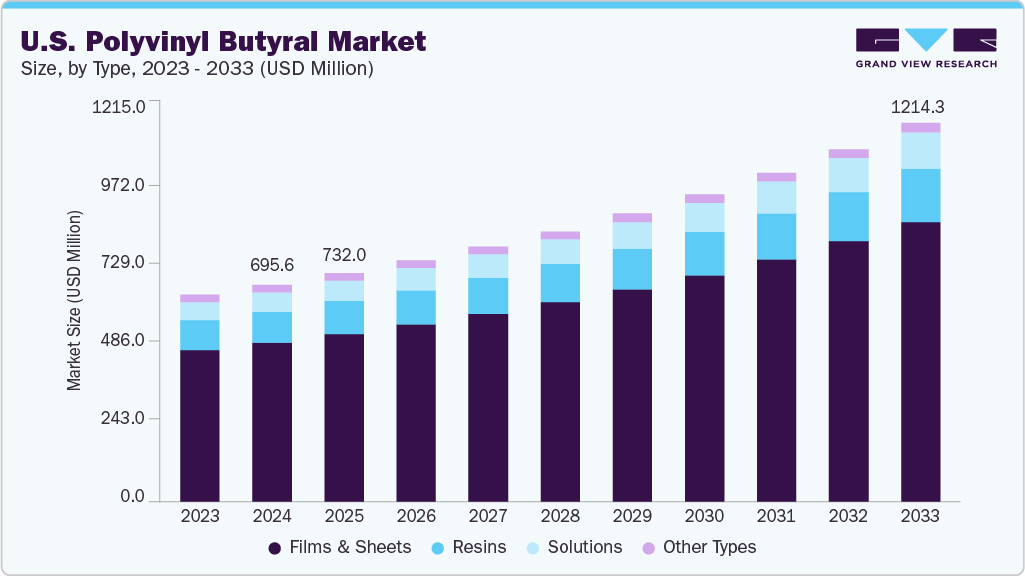

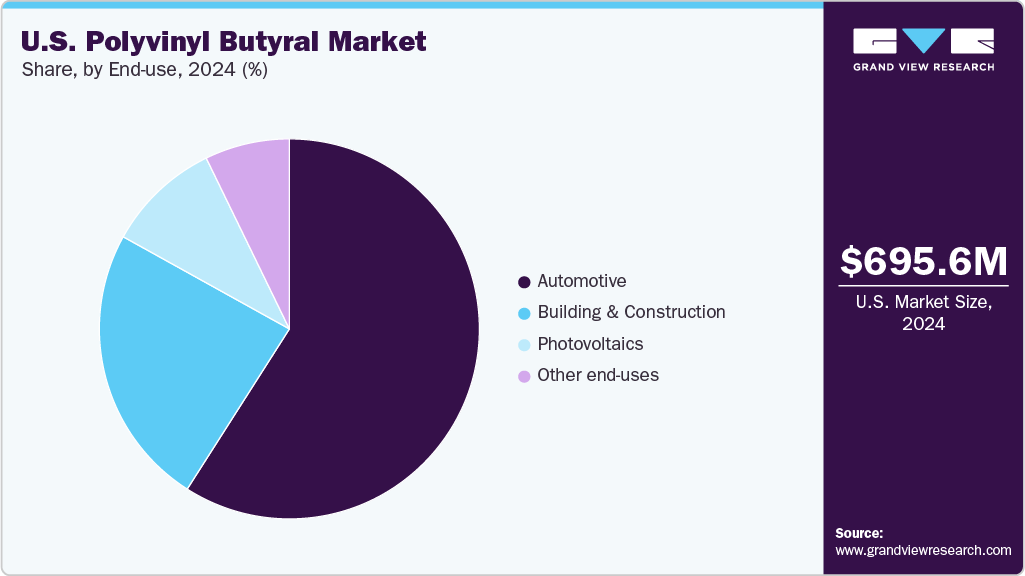

The U.S. polyvinyl butyral market size was estimated at USD 695.6 million in 2024 and is projected to reach USD 1,214.3 million by 2033, growing at a CAGR of 6.5% from 2025 to 2033. The expansion of solar energy installations is boosting polyvinyl butyral (PVB) demand as the resin serves as a critical interlayer in laminated photovoltaic modules, enhancing durability against weather and mechanical stress.

Key Market Trends & Insights

- By type, the solutions segment is expected to grow at a considerable CAGR of 7.8% from 2025 to 2033 in terms of revenue.

- By application, the paints & coatings segment is expected to grow at fastest CAGR of 6.8% from 2025 to 2033 in terms of revenue.

- By end use, the photovoltaics segment is expected to grow at a considerable CAGR of 7.5% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 695.6 Million

- 2033 Projected Market Size: USD 1,214.3 Million

- CAGR (2025 - 2033): 6.5%

At the same time, rising interest in green building certifications is prompting architects to specify laminated glass with PVB interlayers for facades, driving steady consumption beyond traditional automotive uses.

The U.S. Polyvinyl Butyral market has been shaped by its expanding role in automotive safety glass applications. Increasing adoption of laminated windshield systems in mid‑ and high‑end vehicle segments has driven steady volume growth. Meanwhile, evolving consumer preferences for premium cabin aesthetics are pushing OEMs to favor clear, distortion‑free interlayers. This trend is reinforced by stringent federal and state safety mandates that require enhanced impact resistance. As a result, manufacturers are investing in capacity expansions and process improvements to meet both performance and aesthetic demands.

Drivers, Opportunities & Restraints

Rising automotive production and refurbishment activities stand as the primary catalyst for Polyvinyl Butyral consumption in the United States. As vehicle ownership rates climb and fleet renewal accelerates, demand for windshield replacement and OEM fit‑outs grows accordingly. In addition, the push towards electric and autonomous vehicles has led automakers to integrate larger glass roofs and panoramic windshields, which rely on PVB for structural integrity and acoustic comfort. This dynamic underpins consistent raw material off‑take and encourages suppliers to optimize resin formulations for enhanced durability.

The growing architectural glazing sector presents a significant opportunity for Polyvinyl Butyral producers. Developers and designers increasingly specify laminated safety glass for high‑rise façades and commercial interiors, driven by concerns over hurricane resistance, blast mitigation, and noise control. Integrating PVB interlayers into curtain walls and storefronts can deliver superior strength and sound attenuation without compromising transparency. Capitalizing on this trend, resin manufacturers can collaborate with glass fabricators to develop specialty grades tailored to architectural performance criteria, thereby unlocking new revenue streams beyond the automotive domain.

Despite robust demand drivers, the Polyvinyl Butyral market faces constraints related to raw material volatility and regulatory scrutiny. The primary feedstocks for PVB production, including butyraldehyde and polyvinyl alcohol, are subject to price fluctuations driven by petrochemical market cycles.

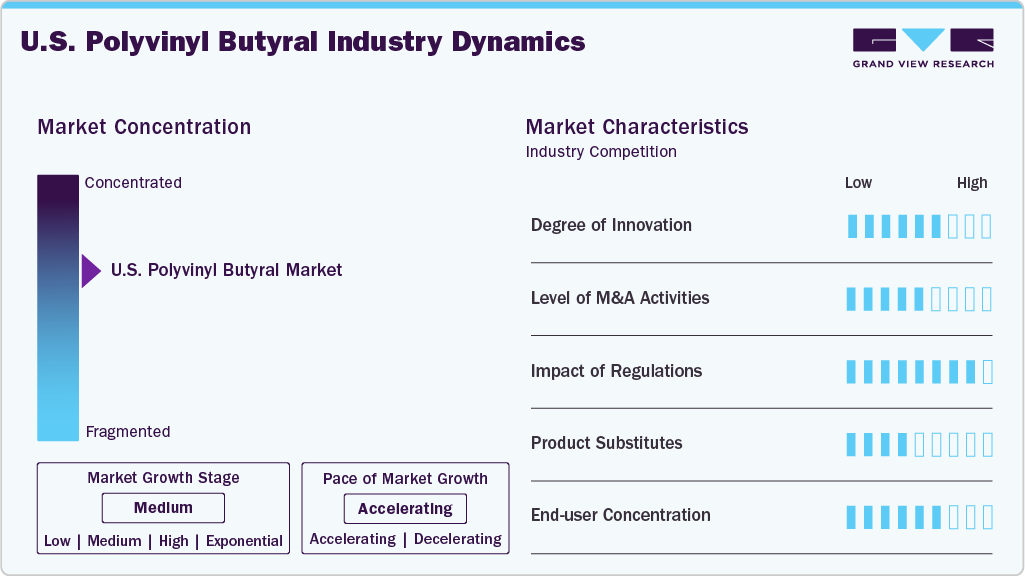

Market Concentration & Characteristics

The market growth stage of the U.S. polyvinyl butyral market is medium, and the pace is accelerating. The market exhibits fragmentation, with key players dominating the industry landscape. Major companies such as Eastman Chemical Company, Kuraray America, Inc., Sekisui Specialty Chemicals America, LLC, Everlam USA, Huakai Plastic (Chongqing) Co., Ltd., Chang Chun Plastic (USA), Inc., and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet evolving industry demands.

Polyvinyl butyral faces competition from ionoplast interlayers such as SentryGlas Plus, which deliver superior stiffness and weatherability for demanding exterior applications; ethylene‑vinyl acetate is also displacing PVB in solar encapsulation owing to its cross‑linked durability and moisture resistance. In addition, thermoplastic polyurethane films are emerging in specialty safety glazing where enhanced tear resistance and recyclability are prized.

Federal Motor Vehicle Safety Standard No 205 requires all windshields to meet rigorous glazing performance criteria, effectively mandating PVB or equivalent interlayers in automotive applications. Concurrently, EPA’s New Source Performance Standards for the polymer manufacturing industry set strict limits on volatile organic compound emissions, compelling PVB producers to invest heavily in solvent recovery and abatement systems, which increases production costs and can constrain capacity expansion.

Type Insights

Films & sheets dominated the U.S. polyvinyl butyral market across the type segmentation in terms of revenue, accounting for a market share of 73.49% in 2024 and is forecasted to grow at 6.6% CAGR from 2025 to 2033. Manufacturers are responding to rising demand for sound‑attenuating interlayers in office towers and premium residences, where occupants expect both safety and acoustic comfort. At the same time, enhanced UV‑blocking formulations are gaining traction among glass processors seeking to protect interior furnishings. This confluence of aesthetic, safety, and performance requirements is sustaining the segment’s leadership in the PVB portfolio.

Solutionssegment is anticipated to grow at the fastest CAGR of 7.8% through the forecast period. End users value the resin’s ability to impart improved adhesion on metal and plastic substrates without compromising transparency. In particular, demand is surging for spray‑applied acoustic coatings in mass transit interiors and high‑end furniture manufacturing. As equipment makers optimize inline processing, PVB solutions are capturing share from solvent‑borne alternatives.

Application Insights

Laminated safety glass dominated the U.S. polyvinyl butyral market across the application segmentation in terms of revenue, accounting for a market share of 71.30% in 2024 and is anticipated to grow at 6.6% CAGR over the forecast period. It is driven by stringent occupant‑protection regulations across vehicle and building codes. Glass assemblers are under growing pressure to meet federal crash test requirements and evolving state‑level façade standards aimed at blast mitigation. Beyond impact resistance, architects increasingly specify laminated units for hurricane‑prone regions, valuing PVB’s energy‑absorption performance. This regulatory and environmental nexus ensures that laminated safety glass will continue to anchor PVB consumption.

The paints & coatings segment is anticipated to grow at a significant CAGR of 6.8% through the forecast period. PVB is gaining a foothold in paints and coatings as formulators seek transparent binders that deliver excellent flow and weather resistance. The resin’s compatibility with waterborne systems is unlocking low‑VOC refinishing solutions for the automotive aftermarket and marine sectors. In addition, PVB‑based coatings are being explored for graffiti‑resistant wall finishes in urban developments. This convergence of environmental compliance and performance innovation is propelling rapid growth in PVB coatings applications.

End Use Insights

Automotive led the U.S. polyvinyl butyral market across the end use segmentation in terms of revenue, accounting for a market share of 59.04% in 2024 and is expected to grow at a CAGR of 6.6% through the forecast period. Vehicle manufacturers drive PVB demand through the integration of advanced glazing technologies in new model launches. The shift toward electric vehicles has catalyzed broader adoption of expansive glass roofs and frameless door designs, both of which rely on PVB for structural bonding and noise dampening. As OEMs compete on cabin refinement, laminated glass with PVB interlayers has become a key differentiator in ride quality. Continuous platform upgrades ensure that the automotive sector will remain the primary growth engine for PVB.

The photovoltaics segment is expected to expand at a substantial CAGR of 7.5% through the forecast period. Surging utility‑scale and distributed solar installations are fueling demand for PVB as an advanced encapsulant in laminated photovoltaic modules, where its adhesion properties and UV resistance extend module lifespan. State renewable portfolio standards and federal incentives under the Inflation Reduction Act are accelerating project pipelines, prompting glass laminators to optimize PVB formulations for improved moisture barrier performance.

U.S. Polyvinyl Butyral Company Insights

The U.S. Polyvinyl Butyral Market is highly competitive, with several key players dominating the landscape. Major companies include Eastman Chemical Company, Kuraray America, Inc., Sekisui Specialty Chemicals America, LLC, Everlam USA, Huakai Plastic (Chongqing) Co., Ltd., and Chang Chun Plastic (USA), Inc. The U.S. polyvinyl butyral market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key U.S. Polyvinyl Butyral Companies:

- Eastman Chemical Company

- Kuraray America, Inc.

- Sekisui Specialty Chemicals America, LLC

- Everlam USA

- Huakai Plastic (Chongqing) Co., Ltd.

- Chang Chun Plastic (USA), Inc.

Recent Developments

-

In June 2024, Shark Solutions announced the launch of SharkDispersionTD, a newly developed sustainable dispersion made from post-consumer recycled polyvinyl butyral (PVB). This product was designed to enhance foaming performance and foam formation speed, outperforming their previous SharkDispersionMW1. SharkDispersionTD is intended as a replacement for traditional virgin, oil based SBR or VAE latex binders in carpet adhesives.

U.S. Polyvinyl Butyral Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 732.0 million

Revenue forecast in 2033

USD 1,214.3 million

Growth rate

CAGR of 6.5% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Report segmentation

Type, application, end use

Country scope

U.S.

Key companies profiled

Eastman Chemical Company; Kuraray America, Inc.; Sekisui Specialty Chemicals America, LLC; Everlam USA; Huakai Plastic (Chongqing) Co., Ltd.; Chang Chun Plastic (USA), Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Polyvinyl Butyral Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the U.S. polyvinyl butyral market report on the basis of type, application, and end use:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Films & Sheets

-

Resins

-

Solutions

-

Other types

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Laminated Safety Glass

-

Paints & Coatings

-

Adhesives

-

Other applications

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Automotive

-

Building & Construction

-

Photovoltaics

-

Other end use

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.