- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Polyvinylidene Chloride Coated Films Market Report 2033GVR Report cover

![U.S. Polyvinylidene Chloride Coated Films Market Size, Share & Trends Report]()

U.S. Polyvinylidene Chloride Coated Films Market (2025 - 2033) Size, Share & Trends Analysis Report By Material Type (PE, PP), By Application (Lidding Films, Pouches & Bags), By End Use (Food & Beverage, Healthcare & Pharmaceuticals), And Segment Forecasts

- Report ID: GVR-4-68040-642-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Polyvinylidene Chloride Coated Films Market Summary

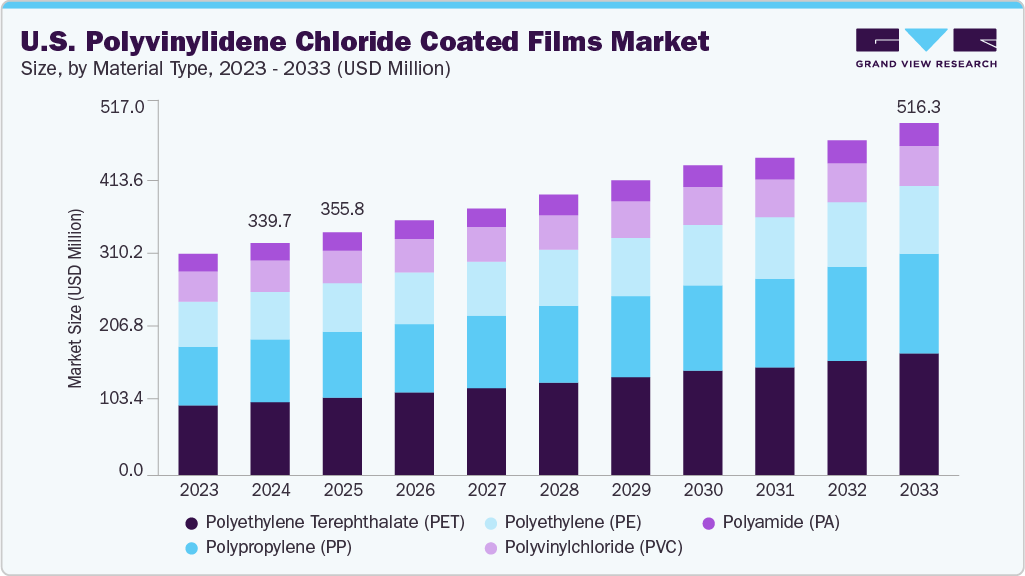

The U.S. polyvinylidene chloride coated films market size was estimated at USD 339.7 million in 2024 and is projected to reach USD 516.25 million by 2033, growing at a CAGR of 4.76% from 2025 to 2033. PVDC-coated films are used extensively in multilayer structures, including blister packaging, meat and cheese wraps, and peelable lidding films.

Key Market Trends & Insights

- By material type, the polyethylene terephthalate (PET) is expected to grow at the fastest CAGR of 5.74% from 2025 to 2033 in terms of revenue.

- By application, the laminates segment is expected to grow at the fastest CAGR of 5.46% from 2025 to 2033 in terms of revenue.

- By end use, the healthcare & pharmaceuticals segment is expected to grow in revenue at the fastest CAGR of 5.76% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 339.7 million

- 2033 Projected Market Size: USD 516.3 million

- CAGR (2025-2033): 4.76%

The country’s robust packaging infrastructure and emphasis on product safety and hygiene, especially post-COVID-19, have maintained steady demand for these materials. Moreover, a high prevalence of over-the-counter and prescription medication usage in the U.S. sustains consistent demand from pharmaceutical converters and contract packaging organizations.

The U.S. also leads in terms of technological innovation and regulatory compliance, encouraging the adoption of PVDC-coated films that meet FDA, USP, and cGMP standards. With major producers such as Tekni‑Plex, Inc., Solvay SA, and Mondi Group operating production and R&D facilities domestically, the market benefits from close supply chain coordination, fast lead times, and customization options.

Drivers, Opportunities & Restraints

One of the primary drivers in the U.S. PVDC coated films market is the demand for extended shelf-life packaging, especially in processed foods and sensitive pharmaceuticals. Additionally, the rise in e-commerce pharmaceutical sales, cold chain logistics, and ready-to-eat meals also amplifies the need for packaging that preserves product efficacy and safety over extended distribution cycles.

Emerging opportunities are centered around sustainable innovation and next-generation PVDC formulations. Companies are investing in aqueous PVDC dispersions, downgauged coatings, and recyclable barrier structures, which can meet evolving environmental standards. With increasing demand for clean-label packaging and mono-material solutions, there is an opportunity to engineer PVDC-coated films that are more compatible with mechanical recycling streams, especially in healthcare and dairy packaging formats.

However, key restraints include environmental concerns over halogenated materials. Growing pressure from NGOs and regulatory bodies could potentially lead to phasedown scenarios or stricter labelling for PVDC films. Moreover, volatile raw material costs, particularly for specialty polymers, along with capital intensity in coating and laminating equipment, pose additional barriers for small and mid-sized industry players.

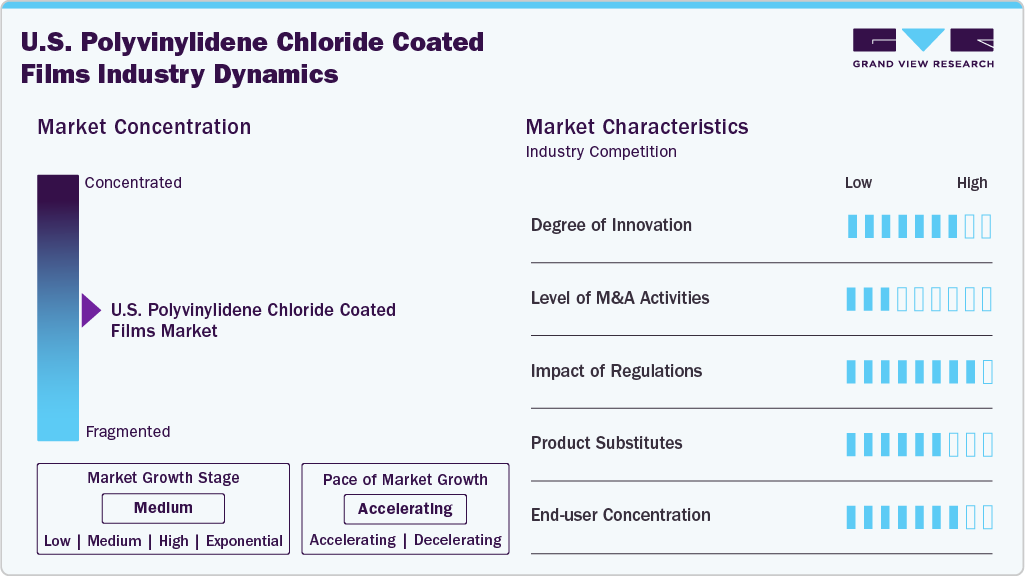

Market Concentration & Characteristics

The U.S. PVDC-coated films market is moderately consolidated, dominated by a handful of vertically integrated players such as Tekni‑Plex, Inc., Chemours, Solvay SA, SKC, Inc., and Mondi Group. These companies possess both coating expertise and downstream converting capabilities, giving them control over the entire value chain—from resin formulation to final film production.

In the U.S., PVDC-coated film usage is tightly governed by agencies like the Food and Drug Administration (FDA) and Environmental Protection Agency (EPA). These agencies define specific extractable and leachable limits, residual monomer thresholds, and moisture ingress standards. PVDC is under increasing scrutiny due to its chlorine content and potential incompatibility with curbside recycling infrastructure. Companies operating in the U.S. are now under pressure to redesign or reformulate PVDC applications for more circular compatibility.

Alternatives to PVDC-coated films in the U.S. include EVOH-based multilayer films, aluminum foil laminates, and newer bio-based coatings, such as EVOH has gained traction in applications where oxygen barrier performance is crucial but recyclability or chlorine-free content is prioritized.

End-user concentration in the U.S. PVDC-coated films market is strongly skewed toward the pharmaceutical and processed food sectors. Major pharma firms as well as packaging contract manufacturers, rely on PVDC-coated blister packs for moisture-sensitive and unit-dose drugs. The aging population and rise in chronic diseases further reinforce steady pharmaceutical demand for high-barrier films.

Material Type Insights & Trends

Polyethylene terephthalate (PET) dominated the market across the material type in terms of revenue, accounting for a market share of 31.73% in 2024. PET is preferred in pharmaceutical and medical packaging due to its strength, stiffness, and clarity. The coating imparts high moisture and oxygen resistance, enabling use in blister packs, lidding films, and diagnostics packaging, where drug stability and sterility are crucial.

Polyethylene (PE) PVDC-coated films are anticipated to grow at a significant CAGR of 4.13% through the forecast period. It is widely used for its flexibility and cost-effectiveness in food and personal care packaging. The addition of PVDC coating significantly enhances PE’s oxygen and moisture barrier, making it ideal for sensitive dry foods, hygiene products, and semi-rigid pouches. Low-density variants maintain seal integrity at low temperatures, suiting high-speed packaging operations.

Polyvinylchloride (PVC) serves as a traditional substrate for PVDC coating in blister packaging, particularly in pharmaceuticals. The combination provides exceptional thermoformability and superior barrier against water vapor, ensuring product efficacy. However, rising regulatory and environmental concerns over PVC may drive a gradual shift toward alternatives in the long term.

Application Insights & Trends

Laminates led the market across the application segmentation in terms of revenue, accounting for a market share of 31.96% in 2024. PVDC coated films used in laminates create high-performance multi-layer structures that offer enhanced shelf life and mechanical strength. These are especially critical in retort packaging and vacuum pouches, where barrier performance must be retained under high temperature and pressure.

The wraps segment is expected to expand at a substantial CAGR of 5.21% through the forecast period. For cheese, meats, and bakery goods, PVDC coated wraps ensure aroma retention, prevent moisture loss, and extend freshness. Their clarity and printability also support branding and product visibility at the point of sale, making them ideal for retail-ready applications.

PVDC-coated lidding films are essential for sealing thermoformed trays, particularly in dairy, ready meals, and pharmaceutical blisters. The coating ensures hermetic sealing and controlled permeability, improving both safety and shelf appeal.

Additionally, PVDC films are used in flexible pouches and sachets for snacks, pet food, and medical products. These coatings help maintain gas barrier properties while allowing the pouch to remain lightweight, puncture-resistant, and easy to seal.

End Use Insights & Trends

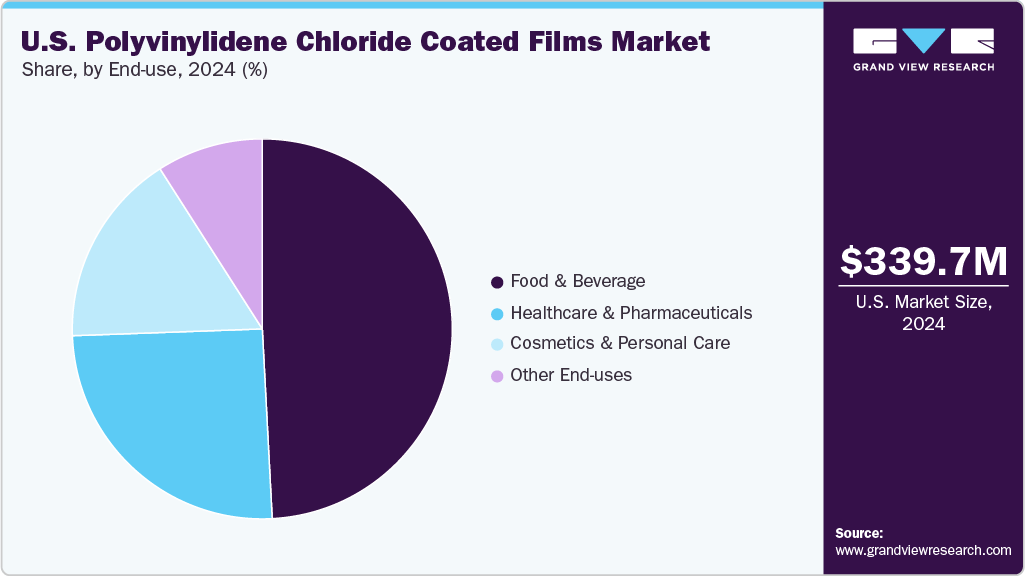

Food & beverage dominated the U.S. Polyvinylidene Chloride Coated Films market across end-use in terms of revenue, accounting for a market share of 49.17% in 2024. The product is extensively used in the food sector for MAP trays, snack packs, meat wraps, and confectionery overwraps. Their ability to inhibit moisture ingress and oxygen exposure plays a critical role in preserving taste, texture, and shelf life.

The healthcare & pharmaceuticals segment is projected to witness the fastest CAGR of 5.76% over the forecast period. The pharmaceutical sector relies heavily on PVDC-coated films for blister packs, sachets, and medical diagnostics packaging. Their superior moisture and oxygen barrier characteristics ensure drug stability and compliance with stringent regulatory standards such as those set by the FDA and USP.

In the cosmetics & personal care segment, PVDC-coated films are used for sachets, sample pouches, and multipack wraps. They help maintain product integrity by protecting sensitive formulations like creams, serums, and gels from air and UV exposure, thereby enhancing shelf life and consumer confidence.

U.S. Polyvinylidene Chloride Coated Films Companies Insights

Key players operating in the U.S. polyvinylidene chloride coated films market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key U.S. Polyvinylidene Chloride Coated Films Companies:

- Tekni‑Plex, Inc.

- Chemours

- Solvay SA

- SKC, Inc.

- Mondi Group

- Cosmo Films Ltd.

- Bilcare Ltd.

- Klöckner Pentaplast

- Innovia Films

Recent Developments

- In February 2024, Tekni‑Plex, Inc. announced the expansion of its production capacity for injection blow-molded bottles and five-layer blown films at Pharmapack Europe. This strategic move aims to meet growing demand in the pharmaceutical and healthcare sectors for high-barrier packaging solutions. The expansion includes new advanced manufacturing lines to enhance the efficiency, quality, and scalability of both rigid and flexible packaging formats, particularly for moisture-sensitive and oxygen-sensitive drug products.

U.S. Polyvinylidene Chloride Coated Films Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 355.8 million

Revenue forecast in 2033

USD 516.3 million

Growth rate

CAGR of 4.76% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material type, application, end use, and region

U.S.

Key companies profiled

Tekni‑Plex, Inc.; Chemours; Solvay SA; SKC, Inc.; Mondi Group; Cosmo Films Ltd.; Bilcare Ltd.; Klöckner Pentaplast; Innovia Films

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Polyvinylidene Chloride Coated Films Market Report Segmentation

This report forecasts volume & revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. polyvinylidene chloride coated films market report on the basis of material type, application, end use, and region:

Material Type Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Polyethylene Terephthalate (PET)

-

Polyvinylchloride (PVC)

-

Polyamide (PA)

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Laminates

-

Wraps

-

Lidding Films

-

Pouches & Bags

-

Blisters

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Food & Beverage

-

Healthcare & Pharmaceuticals

-

Cosmetics & Personal Care

-

Other End Uses

Frequently Asked Questions About This Report

b. The U.S. polyvinylidene chloride coated films market size was estimated at USD 339.68 million in 2024 and is expected to reach USD 355.79 million in 2025.

b. The U.S. polyvinylidene chloride coated films market is expected to grow at a compound annual growth rate of 4.76% from 2025 to 2033 to reach USD 516.25 million by 2033.

b. Polyethylene terephthalate (PET) dominated the U.S. polyvinylidene chloride coated films market with a share of 31.73% in 2024, as it serves as a base film for PVDC coatings owing to its dimensional stability, strength, and high clarity.

b. Some key players operating in the U.S. polyvinylidene chloride coated films market include Tekni‑Plex, Inc., Chemours, Solvay SA, SKC, Inc., Mondi Group, Cosmo Films Ltd., Bilcare Ltd., Klöckner Pentaplast, and Innovia Films.

b. Key factors that are driving the U.S. polyvinylidene chloride coated films market growth include increasing demand for high-performance packaging materials in the food and pharmaceutical industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.