- Home

- »

- Advanced Interior Materials

- »

-

U.S. Portable Air Compressor Market, Industry Report, 2033GVR Report cover

![U.S. Portable Air Compressor Market Size, Share & Trends Report]()

U.S. Portable Air Compressor Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Reciprocating, Rotary), By Operating Mode (Electric, Internal Combustion Engine), By Lubrication (Oil Free), By Power Range, By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-615-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Portable Air Compressor Market Trends

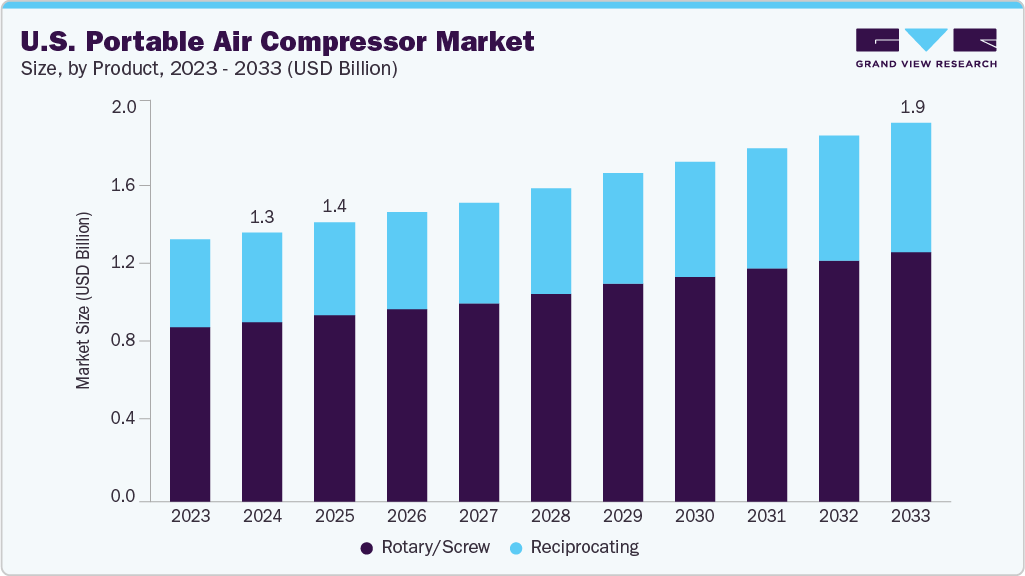

The U.S. portable air compressor market size was estimated at USD 1,347.1 million in 2024 and is projected to reach USD 1,892.9 million by 2033, growing at a CAGR of 3.9% from 2025 to 2033. The U.S. portable air compressor market is primarily driven by the expanding construction and automotive sectors, where demand for reliable and mobile compressed air solutions is high.

Key Market Trends & Insights

- The portable air compressor market in the U.S. is expected to grow at a substantial CAGR of 3.9% from 2025 to 2033.

- By product, the reciprocating segment is expected to grow at a considerable CAGR of 4.2% from 2025 to 2033 in terms of revenue.

- By operation mode, the internal combustion engine segment is expected to grow at a considerable CAGR of 4.0% from 2025 to 2033 in terms of revenue.

- By lubrication, the oil-free compressor segment is expected to grow at a considerable CAGR of 5.4% from 2025 to 2033 in terms of revenue.

- By power range, the 51-250 kW segment is expected to grow at a considerable CAGR of 4.4% from 2025 to 2033 in terms of revenue.

- By end use, the mining segment is expected to grow at a considerable CAGR of 5.1% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 1,347.1 Million

- 2033 Projected Market Size: USD 1,892.9 Million

- CAGR (2025-2033): 3.9%

Moreover, the growing emphasis on sustainability and environmental compliance is pushing manufacturers to innovate eco-friendly portable air compressors. The versatility of portable compressors in various industries, including mining, agriculture, and manufacturing, is broadening their application scope.

Increasing demand for portable and compact equipment due to space constraints at job sites is another key factor. The rise in rental services for portable compressors is making these products more accessible to small and medium enterprises. Lastly, continuous improvements in compressor durability and performance are enhancing user experience, driving market adoption.

Market Concentration & Characteristics

The U.S. portable air compressor market is moderately concentrated, led by major players like Ingersoll Rand, Atlas Copco, and Gardner Denver. These companies hold significant market shares due to strong brand presence and extensive distribution networks. Smaller regional manufacturers also compete by offering specialized and cost-effective solutions. This mix ensures a competitive landscape with continuous innovation and diverse product offerings.

The U.S. portable air compressor industry experiences steady innovation focused on improving energy efficiency, noise reduction, and portability. Advances in oil-free technology and smart controls are enhancing product performance and user convenience. Manufacturers invest heavily in R&D to meet evolving customer needs and environmental standards. This continuous innovation drives product differentiation and market growth.

M&A activity in the U.S. portable air compressor market is moderate, with larger firms acquiring niche players to expand their technology base and geographic reach. These acquisitions help companies diversify product lines and strengthen market positioning. Smaller companies often merge to pool resources and improve competitiveness. Overall, M&A acts as a strategic tool to accelerate growth and innovation.

Regulatory standards related to emissions, noise levels, and workplace safety significantly influence the U.S. portable air compressor market. Compliance with EPA guidelines and OSHA regulations pushes manufacturers to develop cleaner, quieter, and safer equipment. Stricter environmental policies are driving the adoption of energy-efficient and oil-free compressors. Regulations ensure sustainable industry growth while protecting users and the environment.

Drivers, Opportunities & Restraints

The U.S. portable air compressor market is driven by growing demand from construction, automotive, and manufacturing sectors requiring flexible and efficient compressed air solutions. Technological advancements like oil-free compressors and enhanced energy efficiency boost adoption. Increasing infrastructure projects and maintenance activities further fuel market growth. Rising rental services make compressors accessible to smaller businesses. Additionally, stringent environmental regulations push innovation toward cleaner, quieter models.

There are significant opportunities in developing smart, connected compressors with IoT capabilities for predictive maintenance and remote monitoring. Expansion in the renewable energy and electric vehicle industries creates new applications for portable compressors. Growing awareness of eco-friendly equipment drives demand for sustainable product lines. Untapped markets in small-scale manufacturing and agriculture offer potential growth areas. Collaborations and partnerships can accelerate technological advancements and market penetration.

High initial investment and maintenance costs limit adoption among small and medium enterprises. Fluctuating raw material prices impact manufacturing expenses and final product pricing. Competition from alternative technologies and stationary compressors may reduce demand. Noise and emission concerns in urban areas restrict usage in certain regions. Lastly, supply chain disruptions can delay product availability, affecting market growth.

Product Type Insights

The rotary/screw compressor segment dominated the market and accounted for a revenue share of 66.7% in 2024, due to its continuous airflow and higher efficiency for heavy-duty applications. It is widely preferred in industrial settings requiring consistent and large volumes of compressed air. The segment benefits from innovations such as oil-free models and variable speed drives. This dominance is expected to continue as industries prioritize energy-efficient and reliable compressor solutions.

However, reciprocating compressors are the fastest-growing segment, due to their robustness and suitability for low to medium pressure applications. Its simple design and ease of maintenance make it popular among small and medium-sized enterprises. Increasing demand in sectors like automotive repair and construction is fueling this growth. Additionally, technological improvements are enhancing its efficiency and durability.

Operation Mode Insights

The internal combustion engine compressor segment accounted for a revenue share of 65.0% in 2024, owing to its portability and ability to operate in remote locations without access to electricity. ICE compressors provide high power output and reliability for heavy-duty applications in construction, mining, and agriculture. Their robustness and ease of refueling make them indispensable in off-grid environments. Despite growing electric alternatives, ICE compressors remain essential where the power supply is limited.

The electric operation mode segment is growing significantly in the U.S. portable air compressor market due to increasing environmental regulations and the push for cleaner energy solutions. Electric compressors offer quieter operation and lower emissions, making them ideal for urban and indoor applications. Advances in battery technology and energy efficiency are further driving their adoption. This growth is supported by rising demand from sectors focused on sustainability.

Lubrication Insights

Oil-filled compressor segment accounted for a revenue share of 75.8% in 2024 due to its proven reliability and superior cooling and lubrication properties. These compressors are widely used in heavy industrial applications requiring continuous and high-pressure air delivery. The robust design ensures longer service life and reduced downtime. Moreover, established infrastructure and widespread availability contribute to its market dominance. Despite rising oil-free alternatives, oil-filled compressors remain essential for demanding operations.

Oil-free compressors are the fastest-growing segment, driven by increasing demand for environmentally friendly and low-maintenance equipment. These compressors are preferred in industries like pharmaceuticals, food & beverage, and electronics, where oil contamination must be avoided. Advances in materials and technology have improved their durability and efficiency. Additionally, stringent regulations on emissions and contamination are driving adoption. The growing need for clean and reliable compressed air supports this market expansion.

Power Range Insights

51-250 kW segment accounted for a revenue share of 37.6% in 2024,owing to its versatility and wide application across various sectors like automotive repair, small-scale manufacturing, and service industries. Its moderate power output meets the needs of many end-users seeking compact yet efficient compressors. Additionally, competitive pricing and easier maneuverability contribute to its strong market presence. Ongoing innovations in energy-saving features and noise reduction help maintain its leading position in the U.S. market.

The 251-500 kW power range is a significant growing segment, driven by increasing demand from heavy industries such as mining, construction, and manufacturing. This power range offers a balance between high performance and portability, making it ideal for large-scale operations requiring reliable and efficient compressed air solutions. Technological advancements improving fuel efficiency and reducing emissions further boost its adoption. The segment’s growth is supported by expanding infrastructure projects and stricter environmental regulations.

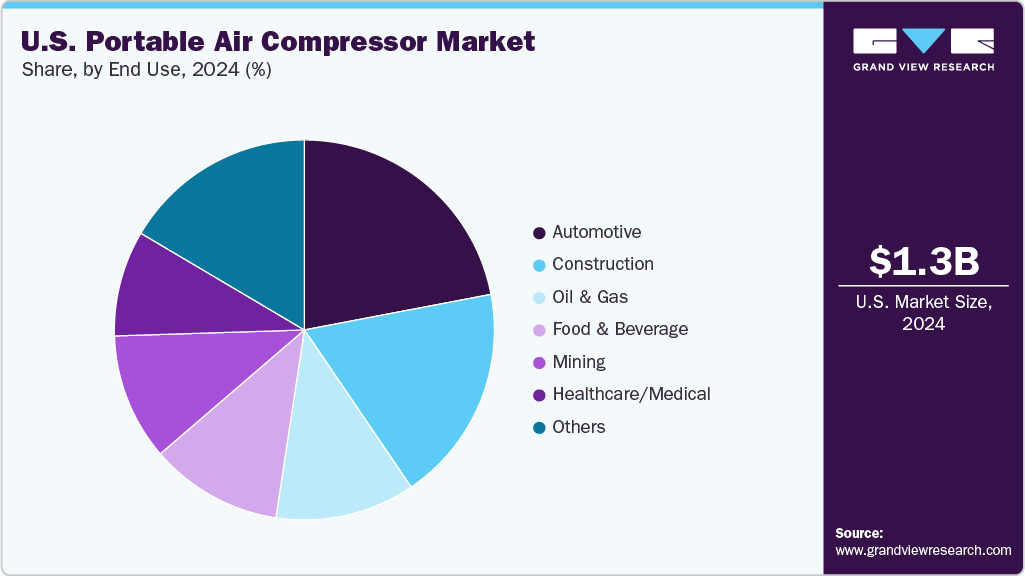

End Use Insights

The automotive segment accounted for a revenue share of 22.0% in 2024 due to portable air compressors for assembly lines, painting, tire inflation, and maintenance operations. The expanding automotive manufacturing base and aftermarket services drive consistent compressor demand. The sector benefits from innovations like oil-free and quieter compressors, improving operational efficiency. Strong OEM and service network support further solidifies its market leadership. Overall, automotive remains a key end-user with steady growth prospects.

The mining industry is witnessing the fastest growth due to increasing mineral exploration and extraction activities. Portable compressors provide essential power for drilling, blasting, and material handling in remote mining sites. Growing investments in mining infrastructure and technological upgrades are fueling demand. Additionally, stringent safety and environmental regulations are encouraging the use of advanced, efficient compressors. This rapid growth reflects mining’s critical role in the country’s industrial landscape.

Key U.S. Portable Air Compressor Company Insights

Some key players operating in the market include Ingersoll Rand, Atlas Copco, and Husky Cooperation.

-

Atlas Copco is a U.S. leader in the manufacturing of industrial equipment, including portable air compressors. Known for its innovation and commitment to sustainability, the company offers a wide range of energy-efficient and reliable compressor solutions tailored to various industries such as construction, mining, and manufacturing. Atlas Copco emphasizes advanced technology, durability, and user-friendly designs, making it a preferred choice worldwide. Their strong focus on customer service and after-sales support strengthens their market presence.

-

Ingersoll Rand is a prominent player in the portable air compressor market, recognized for its high-quality and durable products designed for industrial and commercial use. The company delivers innovative compressor technologies that prioritize efficiency, low maintenance, and environmental compliance. Serving diverse sectors such as automotive, construction, and oil & gas, Ingersoll Rand continually invests in research and development to enhance product performance and sustainability. Their extensive U.S. distribution network ensures wide accessibility and reliable customer support.

Key U.S. Portable Air Compressor Companies:

- Ingersoll Rand

- Atlas Copco

- Husky Cooperation

- Doosan Portable Power

- Stanley Black & Decker, Inc.

- Gardner Denver, Inc.

- Kaeser Kompressoren SE

- TEWATT

- Elgi Compressors USA, Inc.

- Hitachi

Recent Developments

-

In March 2025, TEWATT has introduced its Stage V Dual-Mode Air Compressor, designed to meet the stringent EU Stage V emission standards. This portable diesel-driven compressor offers a versatile pressure range of up to 21 bar, making it suitable for various applications such as water well drilling, geothermal drilling, and oil & gas exploration. Powered by a Volvo TAD883VE engine, it ensures stable performance even in extreme temperatures and challenging environments.

-

In April 2025, Mann+Hummel has significantly enhanced operational efficiency at its U.S. plant by upgrading its compressed air system with ELGi's technology. This overhaul, carried out in collaboration with Pattons Inc., has resulted in annual savings exceeding $160,000 and a reduction of over 2 million kWh in energy consumption. The installation of five ELGi EG-160 rotary screw air compressors, three AR-2350 dryers, and an Airmatics smart control system has eliminated over 20 daily air-related downtimes, leading to improved product quality and reduced resource wastage.

U.S. Portable Air Compressor Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,395.8 million

Revenue forecast in 2033

USD 1,892.9 million

Growth rate

CAGR of 3.9% from 2025 to 2033

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, operation mode, lubrication, power range, end use.

Country scope

U.S.

Key companies profiled

Ingersoll Rand; Atlas Copco; Husky Cooperation; Doosan Portable Power; Stanley Black & Decker, Inc.; Gardner Denver, Inc.; Kaeser Kompressoren SE; TEWATT; Elgi Compressors USA, Inc.; Hitachi.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Portable Air Compressor Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. portable air compressor market report based on product, operation mode, lubrication, power range, and end use

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Reciprocating

-

Rotary/Screw

-

-

Operation Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

Electric

-

Internal Combustion Engine

-

-

Lubrication Outlook (Revenue, USD Million, 2021 - 2033)

-

Oil Free

-

Ool Filled

-

-

Power Range Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Up to 20 kW

-

21-50 kW

-

51-250 kW

-

251-500 kW

-

Over 500 kW

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Construction

-

Oil & Gas

-

Minning

-

Automotive

-

Healthcare/Medical

-

Food & Beverage

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. portable air compressor market size was estimated at USD 1,347.1 million in 2024 and is expected to be USD 1,395.8 million in 2025.

b. The U.S. portable air compressor market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.9% from 2025 to 2033 to reach USD 1,892.9 million by 2033.

b. The oil-filled compressor segment held a 75.8% share in 2024, driven by its reliability, superior cooling, and suitability for heavy-duty, high-pressure applications. Its robust design, long service life, and established infrastructure continue to support its dominance despite growing interest in oil-free alternatives.

b. Some of the key players operating in the U.S. portable air compressor market include Ingersoll Rand; Atlas Copco; Husky Cooperation; Doosan Portable Power; Stanley Black & Decker, Inc.; Gardner Denver, Inc.; Kaeser Kompressoren SE; TEWATT; Elgi Compressors USA, Inc.; Hitachi.

b. The U.S. portable air compressor market is driven by the expansion of construction and infrastructure projects, increasing demand for energy-efficient and compact equipment, and technological advancements such as smart monitoring systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.