- Home

- »

- Organic Chemicals

- »

-

U.S. Potassium Hydroxide Market Size, Industry Report, 2033GVR Report cover

![U.S. Potassium Hydroxide Market Size, Share & Trends Report]()

U.S. Potassium Hydroxide Market (2025 - 2033) Size, Share & Trends Analysis Report By Form (Liquid, Pellets, Flakes, Powder), By Grade (Industrial Grade, Food Grade, Pharmaceutical Grade), By Application (Soap & Detergent Manufacturing, Fertilizer Production), And Segment Forecasts

- Report ID: GVR-4-68040-656-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S Potassium Hydroxide Market Summary

The U.S. potassium hydroxide market size was estimated at USD 766.0 million in 2024, and is projected to reach USD 1,073.0 million by 2033, growing at a CAGR of 3.6% from 2025 to 2033. The growth is attributed to biodiesel production applications due to their vital role in the production of biodiesel, serving as a key catalyst in the transesterification process that converts vegetable oils and animal fats into biodiesel and glycerin.

Key Market Trends & Insights

- The U.S. Potassium Hydroxide market is projected to grow at a CAGR of 3.6% from 2025 to 2033.

- The pellets form potassium hydroxide market is expected to witness the fastest growth of 4.2% from 2025 to 2033.

- By application, fertilizer production dominated the market with a revenue share of 34.6% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 766.0 Million

- 2033 Projected Market Size: USD 1,073.0 Million

- CAGR (2025-2033): 3.6%

When mixed with methanol, it creates a reactive medium that efficiently breaks down triglycerides in oils, yielding high-purity biodiesel with fewer impurities than alternative catalysts. Its ability to accelerate reaction times also leads to lower energy consumption and reduced production costs, making it a preferred choice in industrial-scale biofuel manufacturing. Potassium hydroxide contributes significantly to the environmental sustainability of biodiesel, a clean-burning alternative to conventional fossil fuels. Its use supports reduced carbon emissions, aiding the transition to renewable energy sources. Research has further optimized KOH usage, identifying a 1.5% concentration as ideal, yielding up to 93% methyl esters under certain conditions, an efficiency benchmark consistent with other biodiesel feedstocks such as chlorella and argemone oils. Additionally, combining the product with cost-effective materials like alum in hybrid catalytic systems offers new pathways for utilizing waste products such as palm oil sludge, helping address sustainability challenges in the palm oil industry. While fuel properties like kinematic viscosity improvements are still needed to meet all quality standards, integrating the product into these innovative processes demonstrates its critical role in advancing biofuel technologies and circular waste-to-energy solutions.

Potassium hydroxide is essential in the pharmaceutical industry for maintaining the appropriate pH levels required for many formulations' stability, safety, and effectiveness. By regulating pH, these products help ensure that medications remain stable and therapeutically active throughout their intended shelf life. Maintaining the correct pH also enhances the solubility and dispersion of active ingredients, leading to more consistent and predictable therapeutic outcomes. Additionally, potassium hydroxide is also directly involved in various pharmaceutical preparations. They are commonly used in the formulation of ointments and creams, contributing to the emulsification process and aiding in softening keratin-rich skin cells. This makes them particularly valuable in treating dermatological conditions such as warts, calluses, and other skin disorders, where removing dead skin and stimulating cell renewal is necessary. Their multifunctional role highlights their importance in pharmaceutical products' formulation and therapeutic performance.

The demand for powder-based potassium hydroxide is growing steadily, as it is a highly versatile and reactive alkaline compound crucial in the cosmetics and skincare industry. Its strong basic nature makes it essential in various formulation processes, particularly producing soaps, creams, and lotions. Potassium hydroxide powder is used to saponify fats and oils, creating mild, effective cleansing agents on the skin. Additionally, it serves as a pH adjuster, helping to maintain the stability and performance of skincare formulations. Due to its multifunctional properties, potassium hydroxide powder is a key ingredient in developing safe, high-quality cosmetic and personal care products.

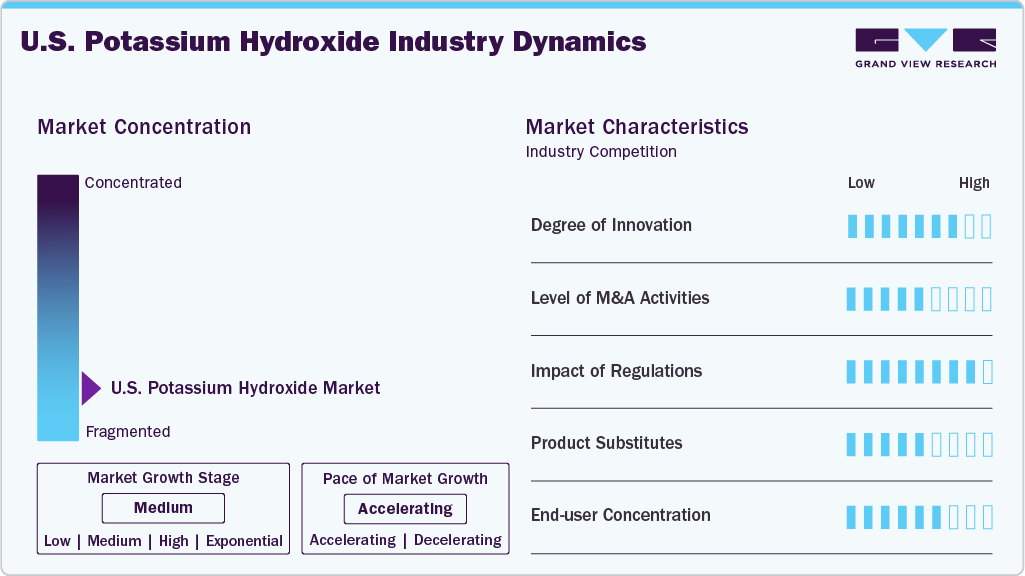

Market Concentration & Characteristics

The industry is highly fragmented, with a few dominant multinational corporations controlling a significant portion of raw material sourcing and downstream manufacturing. These industry leaders benefit from vertical integration, managing operations from chlor-alkali production to the formulation of high-value chemical derivatives and coatings. Their use of proprietary technologies, including advanced fluoropolymer systems, combined with robust regional manufacturing infrastructure, enables them to achieve economies of scale, maintain consistent product quality, and ensure supply chain reliability. Strict adherence to regulatory standards such as FDA and EPA compliance is essential, especially when serving critical sectors like electronics, pharmaceuticals, medical devices, food processing, and agriculture, where product purity, safety, and performance are paramount.

The market is also characterized by stable demand across diverse applications, including water treatment, biodiesel production, and personal care. With well-established access to key feedstocks and a growing focus on sustainability, U.S. manufacturers are increasingly investing in green chemistry, renewable energy integration, and waste reduction practices. Despite occasional price volatility driven by energy costs and supply chain disruptions, the U.S. KOH market remains mature, technologically advanced, and innovation-driven, particularly in high-purity applications like semiconductors, advanced batteries, and biobased materials.

The market is also characterized by stable demand across diverse applications, including water treatment, biodiesel production, and personal care. With well-established access to key feedstocks and a growing focus on sustainability, U.S. manufacturers are increasingly investing in green chemistry, renewable energy integration, and waste reduction practices. Despite occasional price volatility driven by energy costs and supply chain disruptions, the U.S. potassium hydroxide market remains mature, technologically advanced, and innovation-driven, particularly in high-purity applications like semiconductors, advanced batteries, and biobased materials.

Technological advancements are transforming the market, driving a shift from commodity-based supply models to performance-oriented, value-driven partnerships. Adopting digital tools such as predictive modeling, simulation-based formulation, and real-time performance monitoring is significantly accelerating product development cycles and enhancing the efficiency of application processes. These technologies enable manufacturers to design more precise and reliable KOH-based solutions tailored to the specific needs of end-use industries, from pharmaceuticals and electronics to energy and food processing.

In parallel, the rise of on-demand manufacturing models and custom batch production reshapes how value is created and delivered across the KOH value chain. These flexible production approaches allow companies to respond more quickly to evolving customer demands, reduce inventory costs, and serve specialized or small-batch markets with greater agility. These innovations highlight a broader industry shift-away from traditional bulk supply models and toward collaborative, technology-enabled ecosystems that prioritize customization, regulatory compliance, and high-performance outcomes.

Form Insights

Liquid form-based potassium hydroxide dominated the market, with a share of 56.5% in 2024, due to its essential chemical used across various industries. Its strong alkaline nature, high solubility, and low salt index make it particularly valuable in applications requiring neutralization, saponification, or enhanced solubility. In agriculture, the KOH solution is widely used to produce liquid fertilizers, improving nutrient absorption, enhancing crop yield, and increasing drought resistance. In the energy sector, it is an effective electrolyte in alkaline batteries and plays a crucial role in biodiesel production by transesterifying fats and oils. It is commonly used to manufacture personal care products such as soaps, shampoos, and lotions, where its basic properties aid in emulsification and product stability. Its ability to break down grease and organic matter in the cleaning industry makes it an active ingredient in drain cleaners, oven cleaners, and non-phosphate detergents. It is also a deicing agent for airport runways and glass manufacturing processes.

Pellets form-based potassium hydroxide is expected to grow at the fastest CAGR of 4.2% from 2025 to 2033 during the forecast period, owing to its crucial role in the soap and detergent industry, primarily due to its strong alkaline properties and effectiveness as a saponification agent. In soap manufacturing, these pellets are used to react with fats and oils in a process called saponification, resulting in the production of liquid soaps and soft soaps. Using the product pellets enables the formation of soaps that are more soluble, gentler on the skin, and offer superior cleansing performance. In detergent production, potassium hydroxide pellets are valued for emulsifying and breaking down fats and oils, making them highly effective in formulating powerful cleaning agents. Their strong alkalinity allows for the development of detergents capable of removing tough grease and grime, making them ideal for household cleaning products and industrial-grade formulations.

Grade Insights

Industrial-grade potassium hydroxide dominated the market, with a share of 67.9% in 2024. It is a key catalyst in transesterification, converting vegetable oils and animal fats into biodiesel and glycerin. Mixed with methanol, KOH accelerates the breakdown of triglycerides, enabling faster reactions and reducing energy costs. It is preferred over other catalysts for producing high-purity biodiesel with minimal impurities. Beyond its efficiency, using KOH supports sustainable energy goals by facilitating the production of cleaner-burning fuels, thereby contributing to reduced carbon emissions and environmental impact.

Food-grade potassium hydroxide is expected to grow at the fastest CAGR of 4.0% from 2025 to 2033 during the forecast period, due to its use in the food industry for its roles in pH regulation, stabilization, and preservation. It helps adjust the acidity in products like sauces, pickles, and canned vegetables, ensuring proper taste and texture. KOH is also a thickener and stabilizer in soups, dressings, and emulsified foods. It serves as a cleaning and antimicrobial agent, maintaining hygiene in food processing equipment. In fruit and vegetable processing, KOH aids in peel removal, while its derivatives support food preservation by inhibiting microbial growth.

Application Insights

Fertilizer production-based potassium hydroxide dominated the market, with a share of 34.6% in 2024, due to a significant role in agriculture, particularly in fertilizer production, where they serve as a key source of potassium, an essential nutrient for plant growth, root development, and improved water uptake. Using KOH-based fertilizers enhances soil fertility, supports sustainable farming practices, and yields higher crop yields by replenishing vital nutrients. In manure management, potassium hydroxide enhances the potassium content and nutrient availability of manure, particularly in its liquid form. Since potassium is highly soluble, it is most concentrated in the fluid portion of manure. The effectiveness of manure as a potassium source can also be influenced by the animal's diet, with higher potassium levels found in manure from animals consuming potassium-rich feed, such as poultry and sheep. Using KOH can thus support better nutrient recovery and application efficiency in organic fertilization practices.

Biodiesel production based on potassium hydroxide is expected to grow at the fastest CAGR of 5.3% from 2025 to 2033 during the forecast period, driven by its renewable nature, clean-burning properties, and compatibility with existing diesel engines. However, ensuring high-quality production is essential to fully realizing its environmental and performance benefits. Potassium hydroxide plays a crucial role in this process as a catalyst for biodiesel production. It facilitates the transesterification of vegetable oils, including rapeseed, sunflower, soybean, used cooking oils, and animal fats into biodiesel. This renewable fuel is widely used in the transport sector, blended with fossil diesel or in pure form. Compared to traditional diesel, biodiesel with KOH offers notable environmental advantages by significantly reducing CO₂ emissions and harmful particulates. Additionally, high-quality biodiesel production often relies on potassium hydroxide as an effective caustic catalyst due to its excellent reactivity and ease of mixing with methanol.

Key U.S. Potassium Hydroxide Companies Insights

Key players operating in the U.S. potassium hydroxide market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key U.S. Potassium Hydroxide Companies:

- Occidental Petroleum Corporation

- Tessenderlo Group

- ICC Chemical Corporation

- Evonik

- Hawkins

- Olin Corporation

- ERCO Worldwide

- INEOS KOH

- Kuehne Company

- Veolia (American Industrial Partners)

- California Chemical

Recent Developments

-

In July 2024, American Industrial Partners (AIP) acquired Veolia North America’s Sulfuric Acid Regeneration Business, now rebranded as Nexpera. This business includes potassium hydroxide (KOH) regeneration operations. This strategic move strengthens Nexpera’s position as a key circular economy player offering mission-critical environmental services to refineries and industrial clients.

-

In February 2024, INEOS Inovyn introduced a new Ultra Low Carbon (ULC) Chlor-Alkali product range, which includes caustic potash (potassium hydroxide/KOH), delivering up to a 70% reduction in carbon footprint compared to industry averages. This innovation is powered by renewable energy, notably hydroelectric power in Rafnes (Norway) and offshore wind energy in Antwerp (Belgium).

U.S. Potassium Hydroxide Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 789.6 million

Revenue forecast in 2033

USD 1,073.0 million

Growth rate

CAGR of 3.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, grade, and application

Key companies profiled

Occidental Petroleum Corporation; Tessenderlo Group; ICC Chemical Corporation; Evonik; Hawkins; Olin Corporation; ERCO Worldwide; INEOS KOH; Kuehne Company; Veolia (American Industrial Partners); California Chemical

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Potassium Hydroxide Market Report Segmentation

This report forecasts revenue growth at the country level and analyzes the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the U.S. potassium hydroxide market report based on form, grade, and application.

-

Form Outlook (Revenue, USD Million, 2018 - 2033)

-

Liquid

-

Pellets

-

Flakes

-

Powder

-

-

Grade Outlook (Revenue, USD Million, 2018 - 2033)

-

Industrial Grade

-

Food Grade

-

Pharmaceutical Grade

-

-

Application Outlook (Revenue, USD Million, 2018 - 2033)

-

Soap & Detergent Manufacturing

-

Fertilizer Production

-

Biodiesel Production

-

Chemical Manufacturing

-

Water Treatment

-

Textile Processing

-

Food Processing

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. potassium hydroxide market size was estimated at USD 766.0 million in 2024 and is expected to reach USD 789.6 million in 2025.

b. The U.S. potassium hydroxide market is expected to grow at a compound annual growth rate of 3.6% from 2025 to 2033 to reach USD 1,073.0 million by 2033.

b. The industrial-grade segment led the market and accounted for the largest revenue share of 67.9% in 2024, driven by its use in the pharmaceutical sector, particularly in advanced wound care products like bandages.

b. Some of the key players operating in the U.S. Potassium Hydroxide market include Occidental Petroleum Corporation, Tessenderlo Group, ICC Chemical Corporation, Evonik, Hawkins, Olin Corporation, ERCO Worldwide, INEOS KOH, Kuehne Company, Veolia (American Industrial Partners) and California Chemical

b. The growth of U.S. potassium hydroxide market is attributed to biodiesel production applications due to their vital role in the production of biodiesel, serving as a key catalyst in the transesterification process that converts vegetable oils and animal fats into biodiesel and glycerin.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.