- Home

- »

- Homecare & Decor

- »

-

U.S. Pressure Washer Market Size, Industry Report, 2030GVR Report cover

![U.S. Pressure Washer Market Size, Share & Trends Report]()

U.S. Pressure Washer Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Electric Pressure Washer, Gas-Powered Pressure Washer), By Performance (Light Duty, Medium Duty), By Application, By Distribution Channel (Offline, Online), And Segment Forecasts

- Report ID: GVR-4-68040-551-2

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Pressure Washer Market Size & Trends

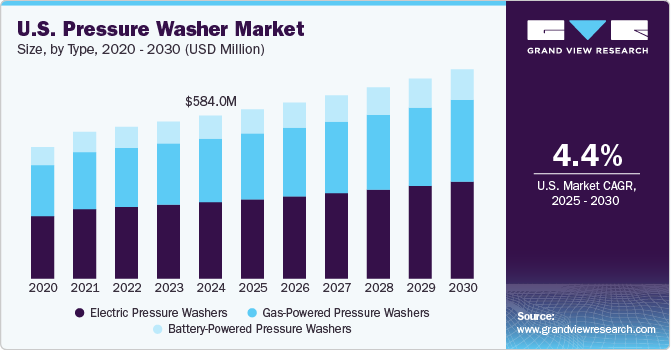

The U.S. pressure washer market size was estimated at USD 584.0 million in 2024 and is projected to grow at a CAGR of 4.4% from 2025 to 2030. This market growth is attributed to the increasing demand for high-efficiency cleaning solutions across residential, commercial, and industrial sectors. Pressure washers are becoming indispensable for tasks such as cleaning vehicles, home exteriors, and industrial equipment, offering convenience and time-saving benefits.

This growing adoption is further fueled by the rise in home improvement projects and the need for regular maintenance in industries such as automotive, construction, and manufacturing.

There is a growing cultural and economic emphasis on property aesthetics and maintenance, particularly in suburban and semi-urban regions. Homeowners are increasingly investing in outdoor cleaning solutions to preserve property value and curb appeal. Pressure washers are now considered essential tools for cleaning driveways, decks, siding, and fences. For example, the National Association of Realtors (NAR) has noted that pressure-washed exteriors can improve home resale value and visual appeal, prompting higher usage in pre-sale property preparations.

The rising popularity of the do-it-yourself (DIY) trend has significantly contributed to pressure washer sales, particularly in the residential segment. Consumers are opting to handle routine maintenance independently to reduce long-term service costs. Retailers such as The Home Depot and Lowe’s have reported consistent year-over-year growth in pressure washer sales, especially in compact and electric-powered models tailored to DIY consumers.

In commercial settings, stringent hygiene and cleanliness standards-particularly in sectors such as hospitality, food services, and healthcare-are bolstering the demand for high-powered, industrial-grade pressure washers. For instance, facilities management firms and contract cleaning service providers are increasingly integrating pressure washers into their standard operating procedures to achieve operational efficiency and meet regulatory standards.

The resurgence of construction and infrastructure development projects across the U.S.-particularly following federal stimulus packages under the Infrastructure Investment and Jobs Act-has driven demand for heavy-duty pressure washers. These machines are extensively used for site preparation, equipment cleaning, and concrete surface treatment. Contractors and rental agencies are expanding their fleets to meet short-term and project-based demand spikes.

The growing awareness of the benefits of pressure washer equipment in maintaining cleanliness and hygiene, especially in urban areas where the need for efficient cleaning solutions is higher.Moreover, advancements in pressure washer technology are contributing to market expansion. For instance, in July 2024, Yard Force unveiled its new premium pressure washer line that featured the high-performance YF3600-H and YF3200-H models, both powered by reliable Honda GX200 engines. The YF3600-H delivers an impressive 3600 PSI, equipped with a 25-foot polyurethane hose and heavy-duty brass pump head. The YF3200-H offers 3200 PSI, complemented by a 30-foot rubber hose and stainless wand. Both models boast rugged 12-inch wheels for mobility. This launch reaffirms Yard Force's commitment to quality and innovation in outdoor power equipment.

Moreover, manufacturers focus on developing eco-friendly and energy-efficient models to cater to environmentally conscious consumers. Innovations such as electric pressure washers with reduced noise and emissions are becoming increasingly popular, boosting adoption rates across diverse user segments. In April 2024, DiBO introduced three fully battery-powered, zero-emission high-pressure cleaners -CPU-SB open, ECN-MB, and ECN-MB skid -emphasizing sustainability. Featuring quiet motors, powerful lithium batteries, dual cleaning modes, and fast charging, these models redefine efficiency and environmental responsibility in cleaning solutions.

The construction and automotive industries also play a significant role in driving market growth. The construction sector's demand for high-pressure cleaning equipment to prepare surfaces and remove debris aligns with the growing number of infrastructure projects in the U.S. Similarly, the automotive industry relies heavily on pressure washers for cleaning vehicles, as they offer efficient and time-saving solutions compared to traditional methods. Furthermore, government regulations and policies promoting environmental sustainability push businesses and consumers toward pressure washers that consume less water while delivering high-performance cleaning.

Type Insights

Gas-powered pressure washers held a revenue share of 47.0% in the overall U.S. pressure industry in 2024, driven by their high power, durability, versatility, and efficiency, making them ideal for heavy-duty cleaning tasks in residential and commercial settings. In addition, the growing trend of DIY home improvement projects has increased the demand for efficient and powerful cleaning solutions. At the same time, the surge in residential and non-residential construction activities has further contributed to their popularity.

Battery-powered pressure washers are expected to grow at a CAGR of 5.0% from 2025 to 2030, driven by their convenience, portability, and eco-friendly nature. These devices cater to the increasing demand for cordless solutions, particularly among DIY enthusiasts and small-business owners who value flexibility and mobility. In addition, advancements in battery technology, such as longer runtimes and faster charging, have enhanced their appeal. The growing emphasis on sustainable and energy-efficient products further supports their adoption alongside the rising home improvement trend and outdoor cleaning projects.

Performance Insights

Professional-grade pressure washer equipment held a revenue share of 30.3% in the U.S. pressure washer industry in 2024. Industrial and commercial sectors, such as construction, manufacturing, and automotive, increasingly rely on high-pressure cleaning solutions for maintenance. Urbanization and large-scale infrastructure development projects are boosting demand for cleaning equipment, including pressure washer equipment, to maintain roads, public spaces, and buildings. Technological advancements, including eco-friendly and energy-efficient models, are attracting more customers. The post-pandemic emphasis on hygiene and sanitation has heightened awareness of cleanliness standards, driving demand for powerful cleaning equipment. Furthermore, the growth of service industries providing pressure washing for residential and commercial properties adds to this trend.

The use of pressure washers in heavy-duty is expected to grow at a CAGR of 4.6% from 2025 to 2030. Advancements in pressure washer equipment, including the development of high-pressure and durable models specifically designed for industrial applications, are further fueling this growth. In addition, the focus on environmental sustainability has led to innovations in pressure washers that minimize water and energy consumption while maximizing effectiveness. With industries prioritizing cleanliness for operational efficiency, safety, and compliance with regulatory standards, the demand for heavy-duty pressure washers is set to rise steadily.

Application Insights

The use of pressure washers in the commercial sector held a share of 69% in 2024. Commercial entities, such as cleaning services, hospitality businesses, and retail establishments, have a strong and ongoing need for high-efficiency cleaning solutions to maintain hygiene, aesthetics, and compliance with cleanliness standards. Pressure washers are essential for tasks such as cleaning driveways, sidewalks, parking lots, and building exteriors, offering time-saving and cost-effective benefits.

Furthermore, food processing, healthcare, and manufacturing industries require specialized pressure washer equipment to meet rigorous sanitation protocols and ensure operational efficiency. Technological advancements, such as the availability of versatile, portable, and energy-efficient models, have further facilitated adoption in these commercial settings. In addition, the rising trend of outsourcing cleaning services has amplified the demand for heavy-duty and reliable equipment among professional cleaning companies.

The use of pressure washer equipment in the residential/household setting is set to grow at a CAGR of 4.7% from 2025 to 2030. Homeowners are increasingly seeking efficient and time-saving tools for outdoor cleaning tasks, such as washing driveways, patios, decks, and vehicles. This trend is amplified by the rising popularity of DIY cleaning projects, where pressure washers are seen as indispensable for achieving professional-level results at home. Furthermore, growing awareness about hygiene and cleanliness, particularly after the pandemic era, has boosted the adoption of pressure washers for maintaining household environments.

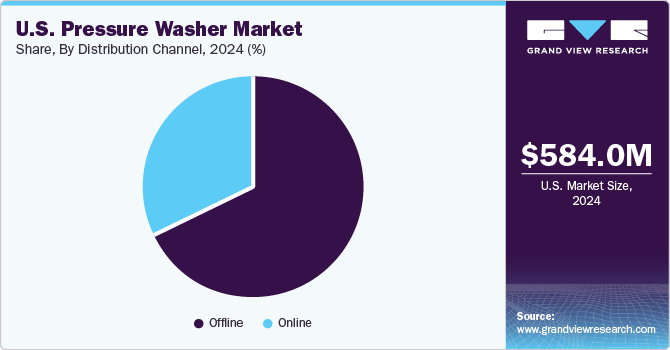

Distribution Channel Insights

Sales of pressure washers through offline channels accounted for a revenue share of 68.4% in 2024. Offline channels have traditionally been a stronghold for pressure washer sales, allowing customers to physically inspect and compare products before purchasing. This tactile experience and the ability to seek in-person advice from sales representatives have contributed to their popularity. In addition, offline stores often provide immediate availability of products, which appeals to customers who prefer not to wait for shipping. The presence of dedicated retail outlets and hardware stores across the U.S. further supports the dominance of offline channels in the market.

The online channel is expected to grow at a CAGR of 5.5% from 2025 to 2030, driven by the increasing preference for e-commerce platforms. Consumers are drawn to the convenience of online shopping, which offers a wide range of products, competitive pricing, and the ability to compare features and reviews. In addition, the growing penetration of smartphones and internet access, coupled with advancements in digital payment systems, has made online shopping more accessible. The rise of exclusive online discounts and promotions further fuels this trend, making e-commerce a preferred choice for many buyers in the U.S. market.

Key U.S. Pressure Washer Company Insights

The U.S. pressure washer industry is fragmented primarily due to the presence of several globally recognized players as well as regional players. Some key companies in the U.S. pressure washer industry include Alfred Kärcher SE & Co. KG, AR North America, Simpson & Company Limited, DEWALT, and others.

-

Alfred Kärcher SE & Co. KG is a global leader in cleaning technology, offering a wide range of pressure washers tailored for both residential and professional use. The company is known for its innovative and resource-efficient cleaning systems, which include high-performance pressure washers designed for applications such as cleaning vehicles, outdoor furniture, house exteriors, and industrial equipment.

-

AR North America specializes in manufacturing high-quality pressure washer pumps and accessories, serving both residential and commercial markets. The company is recognized for its robust and reliable products, which are widely used in various cleaning applications, including car washing, home maintenance, and industrial cleaning. AR North America's commitment to innovation and customer satisfaction has solidified its position as a key contributor to the U.S. pressure washer industry.

Key U.S. Pressure Washer Companies:

- Alfred Kärcher SE & Co. KG,

- AR North America

- Simpson & Company LimitedDEWALT

- DEWALT

- Stanley Black & Decker, Inc.

- CRAFTSMAN

- RYOBI Limited

- Sun Joe (Shop Joe/Joe Brands)

- Greenworks North America LLC

- Deere & Company

Recent Developments

-

In March 2024, Kärcher introduced the K 2 Horizontal, K 2 Premium Horizontal, and K 3 Horizontal pressure washers, combining high-quality performance with compact design. Designed for home and garden use, these models deliver up to 120 bar of working pressure and are ideal for cleaning vehicles, outdoor furniture, and small areas. The lightweight, universal motor ensures ease of use, while the suction hose allows for detergent integration.

-

In April 2024, Makita U.S.A., Inc. launched the 40V max XGT 1300 PSI 1.5 GPM Pressure Washer (GWH01), delivering portable, high-performance cleaning ideal for tasks such as patio furniture, gardening tools, and automotive detailing; it ensures versatile usage. Powered by 40V max batteries compatible with over 125 XGT tools, the GWH01 enhances efficiency. Tyler Brown of Makita emphasized its innovative design, aiming to revolutionize home and workspace maintenance with user-friendly functionality.

U.S. Pressure Washer Market Report Scope

Report Attribute

Details

Market revenue in 2025

USD 606.5 million

Revenue forecast in 2030

USD 750.5 million

Growth Rate (Revenue)

CAGR of 4.4% from 2025 to 2030

Actuals

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, performance, application, distribution channel

Country scope

U.S.

Key companies profiled

Alfred Kärcher SE & Co. KG; AR North America; Simpson & Company Limited; DEWALT; Stanley Black & Decker, Inc.; CRAFTSMAN; RYOBI Limited; Sun Joe (Shop Joe/Joe Brands); Greenworks North America LLC; Deere & Company

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Pressure Washer Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. pressure washer market report based on type, performance, application, and distribution channel:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Electric Pressure Washers

-

Gas-Powered Pressure Washers

-

Battery-Powered Pressure Washers

-

-

Performance Outlook (Revenue, USD Million, 2018 - 2030)

-

Light Duty

-

Medium Duty

-

Heavy Duty

-

Professional-Grade

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential/Household

-

Commercial

-

-

Distribution Channel (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

Frequently Asked Questions About This Report

b. The U.S. pressure washer market was estimated at USD 584 million in 2024 and is expected to reach USD 606.49 million in 2025.

b. The U.S. pressure washer market is expected to grow at a compound annual growth rate of 4.4% from 2025 to 2030, reaching USD 750.52 billion by 2030.

b. The U.S. pressure washer market dominated the overall pressure washer market in 2024. This is due to The growing awareness of the benefits of pressure washer equipment in maintaining cleanliness and hygiene, especially in urban areas where the need for efficient cleaning solutions is higher.

b. Some of the key players operating in the U.S. pressure washer market include Alfred Kärcher SE & Co. KG; AR North America; Simpson & Company Limited; DEWALT; Stanley Black & Decker, Inc.; CRAFTSMAN; RYOBI Limited; Sun Joe (Shop Joe/Joe Brands); Greenworks North America LLC; and Deere & Company.

b. The growth of the U.S. pressure washer market is primarily driven by the increasing demand for high-efficiency cleaning solutions across residential, commercial, and industrial sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.