- Home

- »

- Green Building Materials

- »

-

U.S. PC Wire And Strand Market Size & Share Report, 2030GVR Report cover

![U.S. PC Wire And Strand Market Size, Share & Trends Report]()

U.S. PC Wire And Strand Market (2023 - 2030 ) Size, Share & Trends Analysis Report By Surface Coatings (Uncoated, Galvanized, Epoxy, Others), By Application (Bridges, Buildings, Others), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-962-3

- Number of Report Pages: 72

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

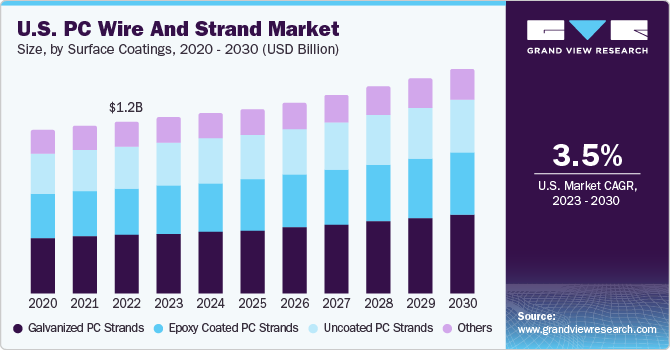

The U.S. PC wire and strand market size was valued at USD 1.2 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 3.5% from 2023 to 2030. The growth is largely supported by the rising construction activities and the popularity of prefab or offsite construction in the country. Prefab construction involves the molding of a structure in a controlled environment, followed by the process of curing. The finished product is then transported to the construction site for erection. Prestressed Concrete (PC) wires and strands are used to provide strength to concrete structures as well as to prefab structures.

Construction spending in the U.S. is anticipated to ascend at a significant rate over the forecast period. According to Oxford Economics, the volume of global construction output is predicted to grow by 85% and reach USD 17.5 trillion by 2030 with U.S., China, and India being the major economies boosting the growth. They are expected to account for 57% of the global growth until 2030. Such a positive outlook is projected to provide a suitable platform for the prestressed concrete (PC) wire and strand market growth.

The U.S. PC wire and strand industry is significantly influenced by China. China is a major exporter of the product to U.S. While, the majority of uncoated PC strand shipments for pre-tension application are supplied by domestic producers, coated PC strand shipments for post-tension application in the U.S. are mainly supplied by exporters from China.

The growth of the construction industry is anticipated to propel the demand for prestressed concrete (PC) wire and strand. Further, the positive outlook of upcoming projects in the U.S. construction industry and favorable government policies for infrastructure is expected to provide a lucrative opportunity for the market player. For instance, in August 2021, the U.S. government announced an infrastructure bill of USD 1 trillion. The investment from this bill is likely to support the construction of bridges, roads, water infrastructure, and high-speed internet among others.

Prefab or offsite is a method of construction, which involves the assembling of components of civil structures at a production or manufacturing facility and then transporting the complete assembly to the construction site. Precast structures are cast and hardened before being used for construction purposes. PC wires and strands are major components of prefab construction. These strands are basically used to attain compression or tension in the concrete structures.

Offsite construction is gaining importance in the U.S. construction sector as the method aids in avoiding material wastage and saving time. This type of construction can be done in any weather conditions. For example, flyovers and bridges can be constructed using prefab construction, wherein PC strands and girders are also used. Thus, growing demand for offsite or prefab construction is likely to drive the demand for PC wire and strand products over the coming years.

The major raw material used in the production of PC wire and strand is hot rolled, high carbon steel wire rod. Most of the manufacturers in the U.S. manufacture steel wire rods by recycling scrap. The manufacturers use steel scrap as a basic raw material. The steel scrap is melted at a steel shop, made up of an electric furnace. After the smelting process, a semi-product steel called as billet is obtained.

The billet is then transformed into different varieties of rod coils in a rolling mill. The rod coils are then utilized to manufacture different products such as steel wire rods, meshes, cables, cords, cold-pressed nuts and bolts, and springs. As a result, the prices of steel scrap are significantly correlated with the price of hot-rolled steel wire rods. Steel scrap, especially busheling scrap is strongly associated with high-carbon steel wire rod used to manufacture PC strand.

The uncoated segment of the market is likely to witness stagnant growth over the coming years. China is the largest exporter of steel-related products such as PC wires & strands and steel ropes & cables to the U.S. Any fluctuation in the market in China has an effect on the dynamics of the U.S. steel market and its related products. However, the recent imposition of import tariffs by the U.S. government is likely to reduce the impact of China on the U.S. steel market.

Surface Coatings Insights

The galvanized PC strands segment accounted for the largest revenue share of 34.1% in 2022 and is expected to grow at the fastest CAGR of 4.0% during the forecast period. This segment is anticipated to maintain its dominance over the forecast period. Galvanized PC wire and strand are coated in zinc before stranding, which makes it significantly resistant to corrosion. Proliferation in the development of multiple high-rise buildings and commercial buildings is the key factor for the dominance of this segment in the U.S.

In terms of volume, epoxy coated PC strands are expected to expand at a CAGR of 3.8% over the forecast period. Epoxy coated PC strands have perfect anti-corrosion performance and high fatigue resistance capability. Epoxy coated PC wire and strand is an ideal choice as a cost-effective and corrosion-resistant reinforcing solution for pre-tensioned concrete applications that are exposed to deicing salts or marine water conditions such as road deck panels and girders, and piling.

The uncoated PC strands segment is likely to observe slow growth as compared to its counterparts. The use of this product is largely concentrated on the inner application in precast structures. To avoid corrosion or rusting, this product is kept at minimum exposure to air.

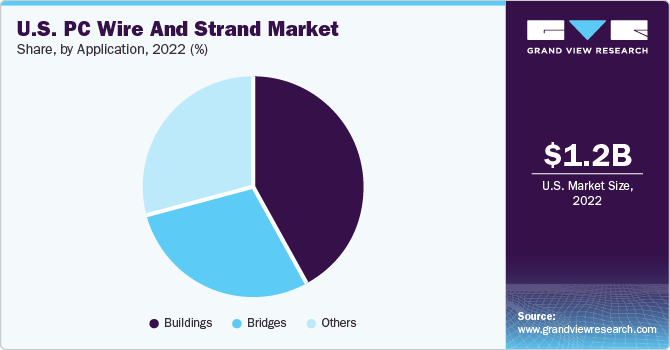

Application Insights

The buildings segment held the largest revenue share of 42.2% in 2022 and is expected to grow at the fastest CAGR of 3.8% over the forecast period. Significant investment in residential and commercial buildings is the major factor for its dominance. According to the U.S. Census Bureau, residential spending was valued at USD 366,660 million in 2008 and registered a CAGR of 7.9% to reach USD 546,173 million in 2018.

In terms of volume, the bridges segment is predicted to ascend at a CAGR of 3.1% over the forecast period. The segment is expected to witness steady growth over the forecast period owing to the increasing prominence of PC wires and strands for the restoration of bridges. According to an infrastructure report from the American Society of Civil Engineers (ASCE) in 2017, the U.S. had 614,387 bridges and roughly 9.1% of the nation’s bridges were found structurally deficient in 2016.

Regional Insights

West U.S. dominated the U.S. PC wire and strand market and accounted for the largest revenue share of 22.9% in 2022 and is expected to grow at the fastest CAGR of 4.4% during the forecast period. The construction boom in states such as Nevada, Washington, California, and Colorado is also expected to foster the market growth in the region. For instance, the massive projects in the pipeline in Nevada such as the Las Vegas stadium or Resorts World Las Vegas on the Strip are expected to provide lucrative opportunities for the PC strand and wire market in the region. Moreover, the Nevada Department of Correction has identified 225 projects, most of them consisting of maintenance and restoration projects and costing an estimated USD 486.6 million.

The Southwest U.S. is expected to grow at the second fastest CAGR of 4.0% during the forecast period The Southwest U.S. states, such as Arizona, Oklahoma, and New Mexico are the major contributors to the regional PC wire and strand market. High economic growth and favorable demographic trends are the major factors driving the growth of real estate development in the region. There is moderate growth in housing infrastructure owing to the rising relocation of people into the region.

In southwestern U.S. states such as Arizona, the rising construction of commercial buildings is the major factor driving the growth of the PC wire and strand market. Arizona is the second fastest growing state, in terms of real GDP growth. In addition, Arizona and Texas are among the states with very high population growth rate. As a result, there is significant demand for residential buildings, which is expected to drive the PC strand and wire market in the region.

New York City and Boston are some of the largest markets in the Southeast U.S. However, these cities have witnessed a slowdown in the construction sector in the last few years. Multi-family buildings have witnessed a slowdown in the recent past. However good growth is expected in industrial buildings and high-rise towers, which is estimated to be the primary factor supporting the PC strand and wire market growth in the region.

Key Companies & Market Share Insights

Major industry players are implementing the growth-through-acquisition strategy to increase their regional presence. For instance, some key mergers of the PC wire and strand industry include the advanced cord manufacturing agreement between Bekaert and Ontario Teachers’ as well as the takeover of American Spring Wire’s wire and strand segment by Insteel Industries in 2015 and 2014 respectively. The following are some of the key regional players in the U.S. PC wire and strand market:

-

Insteel

-

Sumiden Wire

-

LIBERTY Steel Group

-

Wire Mesh Company

-

DEACERO

-

ArcelorMittal

-

Usha Martin Limited

-

Bekaert

Recent Developments

-

In March 2020, Insteel Wire Products Company successfully purchased the assets of Strand-Tech Manufacturing Inc., for a total of USD 22.5 million. This acquisition allowed Insteel to increase its production capacity, streamline operational costs, and gain a competitive edge in the market.

-

In March 2019, Bekaert announced plans to restructure its operations in Belgium. The company has recently developed innovative concrete reinforcement solutions called Dramix steel fibers and aims to showcase its strengths at the TurkeyBuild2020 event. These strategic moves reflect Bekaert's commitment towards improving its product offerings and establishing a stronger presence in the construction industry.

U.S. PC Wire And Strand Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1.58 billion

Growth Rate

CAGR of 3.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilo tons, revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Surface coatings, application, region

Country scope

U.S.

Key companies profiled

Insteel; Sumiden Wire; LIBERTY Steel Group; Wire Mesh Company; DEACERO; ArcelorMittal; Usha Martin Limited; Bekaert

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. PC Wire And Strand Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. PC wire and strand market on the basis of surface coatings, application, and region:

-

Surface Coatings Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Uncoated PC strands

-

Galvanized PC strands

-

Epoxy coated PC strands

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Buildings

-

Bridges

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

U.S.

-

West U.S.

-

Midwest U.S.

-

Southwest U.S.

-

Southeast U.S.

-

Northeast U.S.

-

-

Frequently Asked Questions About This Report

b. The U.S. PC wire and strand market size was estimated at USD 1.2 billion in 2022 and is expected to reach USD 1.24 billion in 2023.

b. The U.S. PC wire and strand market is expected to grow at a compounded annual growth rate of 3.5% from 2023 to 2030 to reach USD 1.58 billion in 2030.

b. The galvanized segment dominated the U.S. PC wire and strand market with a share of 34.0% in 2022. This can be attributed to the proliferation in the development of multiple high-rise buildings and commercial buildings.

b. Some key players operating in the U.S. PC wire and strand market include Insteel; Sumiden Wire Products Corporation; Keystone Consolidated Industries, Inc. (Strand Tech Manufacturing); and Wire Mesh Corporation (WMC).

b. Key factors driving the U.S. PC wire and strand market growth include the rising construction activities and popularity of prefab or offsite construction in the country.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.