- Home

- »

- Medical Devices

- »

-

U.S. Product Design And Development Services Market, Industry Report, 2030GVR Report cover

![U.S. Product Design And Development Services Market Size, Share & Trends Report]()

U.S. Product Design And Development Services Market (2024 - 2030) Size, Share & Trends Analysis Report By Service (Research, Strategy & Concept Generation, Concept & Requirements Development), By Application, By End-user, And Segment Forecasts

- Report ID: GVR-4-68040-223-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

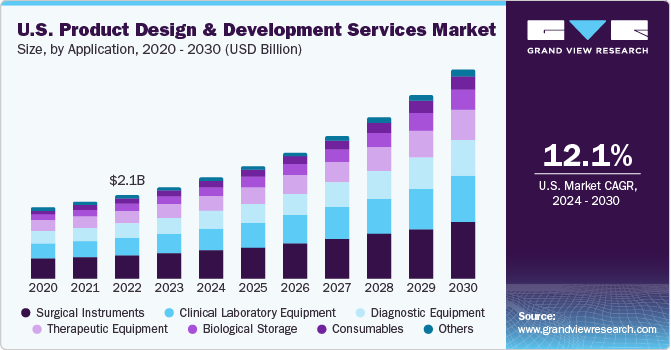

The U.S. product design and development services market size was valued at USD 2.34 billion in 2023 and is projected to grow at a CAGR of 12.1% from 2024 to 2030. Rapid growth in manufacturing of medical devices to meet the increasing demand for efficient healthcare is one of the high impact rendering drivers for the market growth.

The U.S. market accounted for over 23% of the global product design and development services market in 2023. Large medical device companies are outsourcing part of their functions such as report writing & publishing, clinical trial application services, product design, and product maintenance to regulatory service providers, thereby contributing to the overall growth of medical device outsourcing market. In addition, the rapid development of cost-effective medical equipment is likely to positively impact the market during the forecast period.

Key companies are also increasingly inclined toward medical device product design and development due to the need for high maintenance and efficient systems for the management of raw materials. This helps in minimizing the overall setup costs and regulatory requirements. Moreover, medical device product design and development services outsourcing enable the company to focus on core capabilities, sharing of associated risks, and improved service delivery, which are pertinent to gaining competitive advantages.

The U.S. FDA is actively involved in improving R&D funding in healthcare. For instance, in March 2022, U.S. FDA requested the government to increase healthcare funding by 34%. It requested the U.S. government to increase funding by USD 5 million to improve the safety and security of medical devices.

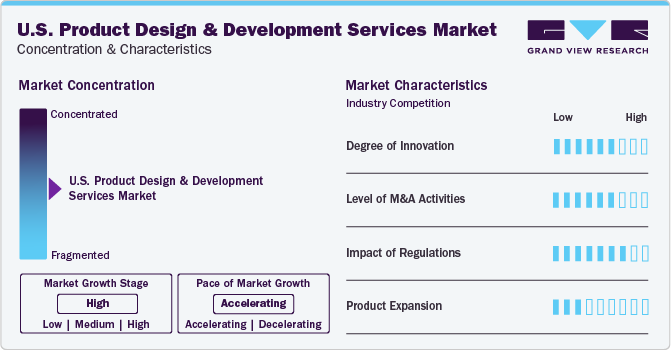

Market Characteristics & Concentration

The market is witnessing a considerable amount of growth with several activities and growth strategies being adopted by companies. This includes mergers and acquisitions (M&A), partnerships, collaborations, product developments and launches, geographical expansions, and investments.

Companies in the product design and development services market undertake strategies such as new launches, and product expansions, to strengthen their service portfolios and offer diverse technologically advanced, and pioneering services to their customers. For instance, in December 2021, Planet Innovation (PI) launched a product that can connect medical devices with electronic health records (EHR) and is called Neosync. In addition, there is a growing trend for small and more portable products, which requires advanced manufacturing technologies, components, and automation techniques.

Companies are also adopting strategies like geographical expansion to avail their products and services to a larger group of audiences. For instance, In February 2024, Endava announced the acquisition of GalaxE Solutions intending to expand and boost its position in North American healthcare as a step towards geographical expansion.

Several companies are acquiring smaller participants to strengthen their market position. This strategy enables companies to increase their capabilities, expand their service portfolios, and improve their competencies. For instance, in November 2021, Planet Innovation (PI) acquired the North American operations of BIT Analytical Instruments GmbH, which manufactures regulated medical devices. A key aim of the acquisition is for PI to expand its US manufacturing capabilities to support its growing US customer base.

The design practices for medical devices are subject to audit by the U.S. FDA. Development of a medical device often involves strict regulations and cutting-edge technology, which increases the level of complexity. With increase in the R&D, drug pipeline, registration of products, and application of clinical trials, companies are under constant pressure to obtain timely approvals from regulators. Hence, they are required to comply with regulatory requirements in the U.S., which are generally complex and involve submitting huge amounts of documents to regulatory bodies for approval.

Service Insights

The research, strategy, & concept generation segment accounted for the largest share of 39.7% in 2023. Factors considered during this stage are the device and its interaction with patients (contact or non-contact), the instrument’s operational environment, and the life cycle and/or durability of the apparatus. Risks- Benefit analysis must also be conducted at this point and communicated to the client.

The process validation, manufacturing transfer & design validation segment is expected to witness the highest CAGR over the forecast period. As per the Quality System Regulations (QSR), process ought to be validated with a high degree of assurance when the output of a process cannot be fully verified by following testing and inspection. Process validation is a very powerful tool that can assist to achieve highly effective processes. Process validation ensures that consistent quality products are produced, and the required level of compliance is met at every single stage.

Application Insights

The surgical instruments segment accounted for the largest share of 27.7% in 2023. Introduction of minimally invasive and noninvasive surgeries has led to an increase in the number of surgeries being performed in a year. The biomedical industry in the U.S. is leading worldwide research in surgical & biomedical instrument development. The perfect instrument is a result of a deliberate, strong, and effective core design team. It enhances dexterity, control, and precision while minimizing exposure to strain and stress.

The consumables segment is expected to witness the highest CAGR over the forecast period. Increasing geriatric, as well as physically disabled population, is creating more need for devices that assist them in daily activities. There is an increasing need for home healthcare devices mainly associated with geographic changes & developments in the healthcare system. Hence, the need for personalized care medicine and services is driving demand for consumables designed for specific applications and patient needs.

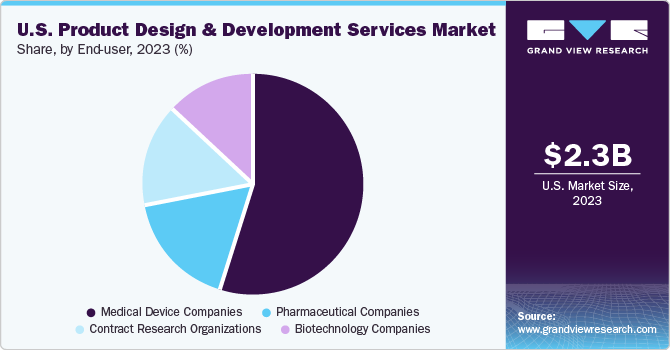

End-user Insights

The medical device companies segment accounted for the largest share of 55.7% in 2023. This can be attributed to the increasing demand for advanced medical products to improve patient lives. The medical device development firms are leading to innovations by adopting the latest technologies, such as miniaturization, portability, and enhanced reliability & connectivity. Hence, innovation & increase in R&D activities are anticipated to drive the market.

The pharmaceutical companies segment is expected to witness a considerable amount of CAGR over the forecast period. It includes companies involved in R&D and marketing of drugs made from chemical & synthetic processes for combination products. This is due to the shift from large-scale production to smaller batches to cater to the development of complex medicines and personalized treatments tailored to individual patients.

Key U.S. Product Design And Development Services Company Insights

Some of the prominent U.S. product design and development services market companies operating are Ximedica; Celestica Inc.; DeviceLab, Inc.; Jabil, Inc.; Plexus Corp.; Planet Innovation; Flex Ltd.; Starfish Medical; Nordson MEDICAL; and Donatelle. As manufacturers of medical devices have incorporated software into their products, technology companies have entered into the medical device landscape to leverage market opportunity.

Manufacturers have expedited the undertaking of new product development due to the increasing geriatric population as well as health concerns and rising healthcare costs. Key companies are witnessing a considerable increase in revenue due to growing opportunities. This can be attributed to the availability of a skilled workforce & raw materials at affordable prices and increasing demand for advanced technologies.

Key U.S. Product Design And Development Services Companies:

- Ximedica (Veranex)

- DeviceLab, Inc.

- Jabil Inc.

- Flex Ltd.

- Plexus Corp.

- Celestica Inc.

- StarFish Medical

- Nordson Medical

- Planet Innovation

- Donatelle

- Cambridge Design Partnership Ltd.

- Integer Holdings Corporation

- Cirtec

Recent Developments

-

In May 2022, Jabil announced the launch of Qfinity, which is an autoinjector platform. It is an affordable market option for the self-administration of drugs subcutaneously, and it is modular & reusable

-

In February 2022, Planet Innovation (PI) collaborated with Lumos Diagnostics to develop an innovation hub and rapid diagnostics manufacturing facility in Victoria to locally manufacture Rapid Antigen Tests (RATS)

U.S. Product Design And Development Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.58 billion

Revenue forecast in 2030

USD 5.32 billion

Growth rate

CAGR of 12.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Services, application, end-user

Country scope

U.S.

Key companies profiled

Ximedica (Veranex), DeviceLab, Inc., Jabil Inc., Flex Ltd., Plexus Corp., Celestica Inc., StarFish Medical, Nordson Medical, Planet Innovation, Donatelle, Cambridge Design Partnership Ltd., Integer Holdings Corporation, Cirtec

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

U.S. Product Design And Development Services Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. product design and development services market report based on service, application, and end-use:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Research, Strategy, & Concept Generation

-

Concept & Requirements Development

-

Detailed Design & Process Development

-

Design Verification & Validation

-

Process Validation & Manufacturing Transfer

-

Production & Commercial Support

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostic Equipment

-

Therapeutic Equipment

-

Clinical Laboratory Equipment

-

Surgical Instruments

-

Biological Storage

-

Consumables

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical Device Companies

-

Pharmaceutical Companies

-

Biotechnology Companies

-

Contract Research Organizations

-

Frequently Asked Questions About This Report

b. The U.S. product design and development services market size was estimated at USD 2.34 billion in 2023 and is expected to reach USD 2.58 billion in 2024.

b. The U.S. product design and development services market is expected to grow at a CAGR of 12.1% from 2024 to 2030 to reach USD 5.32 billion in 2030.

b. In 2023, The medical device companies segment accounted for the largest share of 55.7%. The medical device development firms are leading to innovations by adopting the latest technologies, such as miniaturization, portability, and enhanced reliability & connectivity

b. Key U.S. product design and development services companies include Ximedica (Veranex), DeviceLab, Inc., Jabil Inc., Flex Ltd., Plexus Corp., Celestica Inc., StarFish Medical, Nordson Medical, Planet Innovation, Donatelle, Cambridge Design Partnership Ltd., Integer Holdings Corporation, Cirtec.

b. The increasing investment in new launches, and product expansions, to strengthen their service portfolios and offer diverse technologically advanced, and pioneering services to their customer

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.