U.S. Prostate Cancer Nuclear Medicine Diagnostics Market Size, Share & Trends Analysis Report By Type (SPECT, PET), By PET Product (F-18, SR-82/RB-82), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-584-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Market Size & Trends

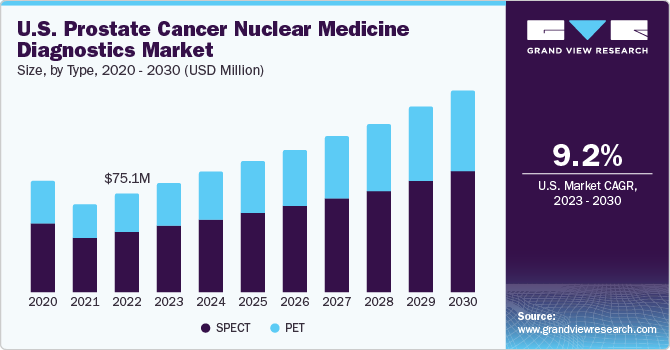

The U.S. prostate cancer nuclear medicine diagnostics market size was valued at USD 75.06 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 9.2% from 2023 to 2030. The rising incidence of prostate cancer is expected to propel the demand for early and accurate diagnosis of the disease. According to the American Society of Clinical Oncology (ASCO), prostate cancer, after skin cancer, is the most prevalent cancer among men. In 2023, around 288,300 men in the U.S. are expected to be diagnosed with prostate cancer. Globally, an estimated 1,414,259 individuals were diagnosed with prostate cancer in 2020, making it the fourth most commonly diagnosed cancer form worldwide. Approximately 60% of the cases are detected in people aged 65 or older, with the average age of diagnosis standing at 66 years. It is uncommon in individuals under 40. Notably, the number of new cases in black men is 70% higher than in white men in the United States.

Rising research activities for developing novel imaging agents to improve prostate cancer detection are key factors driving growth of nuclear medicine diagnostics. Researchers are conducting several studies to introduce new diagnostic agents for PET more efficiently than existing ones. For instance, in March 2018, researchers in Italy introduced a unique PET agent called Copper-64 Chloride (64CuCl2) for detecting prostate cancer, in a study published in The Journal of Nuclear Medicine. Results revealed that this novel imaging agent outperformed Fluorine-18-Choline (18F-choline) in terms of detection rate.

The adoption of PET as a diagnostic tool is greatly increasing, as it offers better accuracy than other diagnostic techniques. Accuracy has a direct impact on decision-making and treatment monitoring processes. Increasing demand for these diagnostic procedures is expected to fuel the growth of the U.S. prostate cancer nuclear medicine diagnostics market during the forecast period. For instance, Cheyenne Regional Medical Center is the sole medical facility in Wyoming, and one of three in the region, to provide the advanced Siemens Biograph Vision PET/CT scanner. This state-of-the-art scanner offers highly precise and efficient medical imaging with lower radiation exposure than older scanners.

The presence of reimbursement policies is expected to fuel the demand for nuclear medicine diagnostics further. Several programs, such as Medicaid, Medicare, and Health Insurance programs in the U.S., are expected to create growth opportunities for the market players.

For instance, in 2018, the U.S. Preventive Services Task Force (USPSTF) changed its recommendation for prostate cancer screening. For men between 55 and 69 years of age, the decision to have a PSA test (a blood test for prostate cancer) should be based on individual preferences and discussions with their doctor. The USPSTF still advises against PSA screening for men aged 70 and older. Medicare and many private insurance companies cover the cost of PSA testing for eligible individuals.

Type Insights

Based on type, the market is segmented into Single-Photon Emission Computed Tomography (SPECT) and Positron Emission Tomography (PET). Currently, SPECT and PET techniques are widely used in radiopharmaceutical diagnostic procedures. Affordability, ease of handling, the compatible half-life of radioisotopes, and a wide range of applications are the prime factors driving the diagnostic nuclear medicine market.

The SPECT segment held the largest market share of 60.75% in terms of revenue in 2022, owing to the low cost of scans and the ability to use easily obtained radioisotopes with a longer life than PET. Furthermore, an increase in clinical studies on SPECT radiopharmaceuticals to enable early diagnosis of prostate cancer is anticipated to propel the growth of the U.S. market.

According to the University of Utah Health, SPECT scanning has advantages over PET scanning. Firstly, it is easier to find, is more commonly used, and is less expensive. A SPECT scanner costs around USD 400,000 to USD 600,000, while a PET-CT scanner can cost over USD 1.5 million. Another benefit is that SPECT radiotracers remain in the body for a longer time of up to six hours, allowing doctors more time to capture images. On the contrary, PET tracers only last about 75 seconds. In addition, SPECT radiotracers are more affordable and readily available than PET tracers, making them a cost-effective choice for many hospitals and clinics.

On the other hand, the PET segment is expected to witness a lucrative growth rate of 9.4% over the forecast period, owing to superior image quality and higher reimbursement for its procedures compared to the traditional SPECT nuclear medicine diagnostic procedures. Radioisotopes used with PET prostate cancer diagnosis are Gallium-68, Fluorine-18, zirconium-89, copper-64, and Carbon-11.

According to the Journal of Nuclear Medicine Technology, claims from freestanding facilities are managed by regional Medicare Part B Carriers. These carriers process and pay the claims. Regarding PET scans, the CMS (Centers for Medicare & Medicaid Services) does not set standard payment rates for the technical component. Instead, each carrier decides how much to pay for the technical part of PET scans in their area.

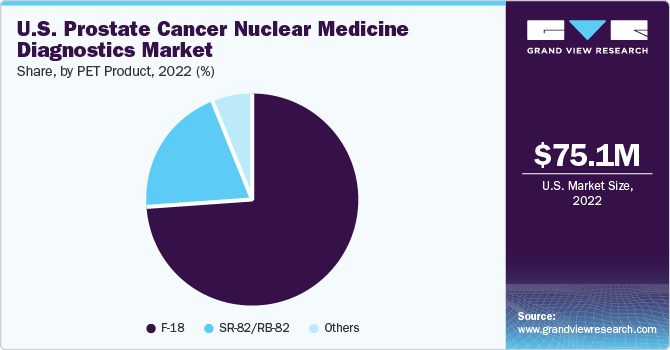

PET Product Insights

The PET diagnostics market is segmented in terms of products into F-18 and SR-82/RB-82. F-18 held the largest market share of 74.23% in terms of revenue owing to its efficient bio-distribution and relatively low urinary excretion. Fluorine-18 fluciclovine and Fludeoxyglucose F18 (F-18 FDG) are approved radioisotopes, whereas F18 sodium fluoride (18F-NaF) and 18F-Choline are the PET tracers widely studied due to their potential ability to detect tumors, including prostate cancer.

For instance, in May 2023, the FDA approved POSLUMA (flotufolastat F18) by Blue Earth Diagnostics as a PET imaging agent to detect PSMA-positive lesions in men with prostate cancer. This imaging method is suitable for men considering initial definitive treatment or suspected cancer recurrence based on elevated PSA levels. The FDA's decision to approve POSLUMA is backed by positive outcomes from the phase 3 SPOTLIGHT and LIGHTHOUSE trials. POSLUMA is thus now approved for use in PET imaging to find specific lesions in men with prostate cancer based on their PSA levels.

The SR-82/RB-82 segment is expected to expand at a CAGR of 9.9% over the forecast period, owing to factors such as the increased demand for PET scans for the diagnosis and staging of cancer, growing awareness of the benefits of PET scans, and development of new PET/CT scanners that are more efficient and easier to use. For instance, GE Healthcare launched the MI PET/CT Scanner. It is the first PET/CT scanner to use a new type of detector called a Silicon Photomultiplier (SiPM) detector.

SiPM detectors are more sensitive than traditional detectors, meaning they can detect lower levels of radioactivity. This can improve the accuracy of PET scans, especially in patients with low levels of cancer activity. The Discovery MI PET/CT Scanner is also more efficient than previous PET/CT scanners, which means it can scan patients faster and with less radiation exposure.

Key Companies & Market Share Insights

Key players in the market are focusing on adopting growth strategies, such as mergers and acquisitions, developing existing devices, promotional events, and technological advancements. For instance, United Imaging Healthcare launched the uMI 510 PET/CT Scanner, a high-resolution scanner with 110,592 LYSO crystals. This makes it one of the most sensitive PET/CT scanners available. The uMI 510 PET/CT Scanner is also more efficient than previous PET/CT scanners, which means it can scan patients faster and with less radiation exposure.

Key U.S. Prostate Cancer Nuclear Medicine Diagnostics Companies:

- Blue Earth Diagnostics

- Siemens Healthcare Private Limited

- Cardinal Health

- CURIUM PHARMA

- Lantheus

- Jubilant Draximage Radiopharmacies, Inc.

- NCM-USA LLC

- Telix Pharmaceuticals Limited

- ARICEUM THERAPEUTICS

- Novartis AG

- Life Molecular Imaging

U.S. Prostate Cancer Nuclear Medicine Diagnostics Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2030 |

USD 153.97 million |

|

Growth rate |

CAGR of 9.2% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Report updated |

November 2023 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, PET product |

|

Country scope |

U.S. |

|

Key companies profiled |

Blue Earth Diagnostics; Siemens Healthcare Private Limited; Cardinal Health; CURIUM PHARMA; Lantheus; Jubilant Draximage Radiopharmacies, Inc.; NCM-USA LLC; Telix Pharmaceuticals Limited; ARICEUM THERAPEUTICS; Novartis AG; Life Molecular Imaging |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail of customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Prostate Cancer Nuclear Medicine Diagnostics Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. prostate cancer nuclear medicine diagnostics market report on the basis of type and PET product:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

SPECT

-

PET

-

-

PET Product Outlook (Revenue, USD Million, 2018 - 2030)

-

F-18

-

SR-82/RB-82

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. prostate cancer nuclear medicine diagnostics market was estimated at USD 75.06 million in 2022 and is expected to reach USD 83.18 million in 2023

b. The U.S. prostate cancer nuclear medicine diagnostics market is expected to grow at a compound annual growth rate of 9.2% from 2023 to 2030 to reach USD 153.97 million by 2030.

b. In the product segment, fluorine-18 dominated the U.S. prostate cancer nuclear medicine diagnostics market in 2022 with a share of 74.22% owing to its efficient bio-distribution and relatively low urinary excretion.

b. Key players in the U.S. prostate cancer nuclear medicine diagnostics market are Blue Earth Diagnostics, Inc.; PETNET Solutions, Inc.; Lantheus Medical Imaging; Jubilant Pharma Ltd. (Triad Isotopes, Inc.); NCM-USA LLC; Progenics Pharmaceuticals, Inc.; ImaginAb, Inc.; Theragnostics Ltd.; Novartis AG; and others.

b. The growth of this market can be attributed to the increasing incidence of prostate cancer, growing development of novel radiopharmaceuticals, and presence of new agents targeting Prostate-specific Membrane Antigen (PSMA) under clinical trials are expected to be launched over the forecast period.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."