- Home

- »

- Medical Devices

- »

-

U.S. Pupillometer Market Size, Share, Industry Report, 2030GVR Report cover

![U.S. Pupillometer Market Size, Share & Trends Report]()

U.S. Pupillometer Market (2024 - 2030) Size, Share & Trends Analysis Report By Mobility (Table-top, Hand-held), By Type (Video, Digital), By Application (Neurology, Oncology), By End-use (Hospitals, Eye Clinics), And Segment Forecasts

- Report ID: GVR-4-68040-231-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Pupillometer Market Size & Trends

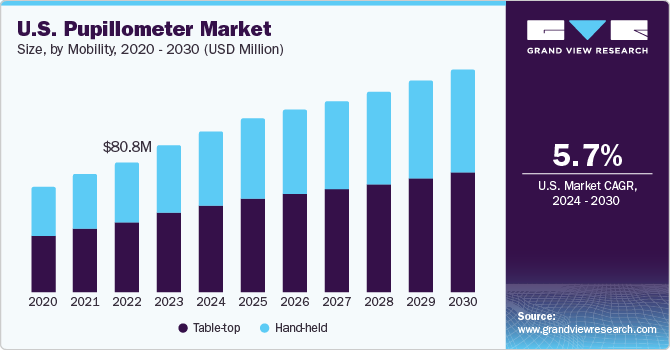

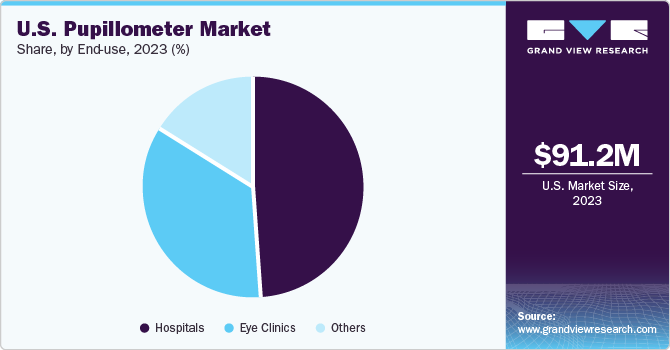

The U.S. pupillometer market size was estimated at USD 91.2 million in 2023 and is expected to grow at a CAGR of 5.7% from 2024 to 2030. Technological advancements coupled with rising prevalence of eye diseases are expected to propel the market growth. Moreover, various factors such as rising government initiatives to create awareness and favorable government policies are expected to boost the market growth. Increase in prevalence of neurological disorders is also expected to contribute significantly to market growth during the forecast period.

Pupillometry, the measurement of pupil dilation, is widely used to gain insights into a variety of conditions. Techniques such as MRI and CT scans have revealed a direct correlation between changes in brain activity and pupil dilation, making pupillometry a valuable tool for understanding cognitive processes. Moreover, abnormal pupillary responses to stimuli have been observed in individuals suffering from depression, anxiety, Parkinson’s disease, and autism spectrum disorder. Thus, pupillometry not only aids in understanding the normal functioning of the eye but also provides insights into how diseases affect brain activity.

The market experienced negative impact during the COVID-19 pandemic. Lockdowns, government-imposed restrictions, heightened attention to COVID-19 patients, and delayed patient visits to medical facilities to prevent virus spread led to a decline in pupillometer sales in 2020. However, the benefits of pupillometry have led to its growing adoption. It is being increasingly used in various critical care units, including neurocritical care, surgical intensive care, cardiac intensive care, medical intensive care, pediatric intensive care, trauma, and emergency departments.

The dilation of the pupil can provide insights into the lives of individuals with neurological conditions. The results of pupillometry can guide the choice of physiological treatment. The use of a pupillometer can be a powerful tool in determining the most effective treatment for a person, which is anticipated to enhance diagnostic results and subsequently boost recovery rates. Moreover, pupillometry can be combined with other systems or processes to improve the diagnosis of neurological disorders. The study of pupil dilation can enhance Brain-Computer Interaction (BCI), serving as an additional signal to interpret neurological signals.

Regular pupil evaluations have become a standard protocol in these units. Pupil size and pupillary light reflex (PLR) are now being used as prognostic indicators and clinical parameters by various associations and centers. The Brain Trauma Foundation and the American Association of Neurological Surgeons endorse the use of pupillary light reflex in each eye as a predictive indicator. This technique, when applied to patients with neurological injuries, aids in the evaluation of pupil dynamics in patients who have been administered prescribed drugs such as sedatives, analgesics, and anesthetic agents. Numerous nursing associations offer education and training on pupillometry, which is emerging as a crucial component of neurological examinations. The American Association of Critical-Care Nurses (AACN) has introduced a new section on pupillometry in its Procedure Manual for High Acuity, Progressive and Critical Care, providing guidance on the use of automated pupillometers.

Market Concentration & Characteristics

Companies functioning in the U.S. pupillometer market are actively participating in activities such as product innovation, mergers and acquisitions, and regional expansion to strengthen their position in the market. These companies are focused on improving their offerings, expanding their reach, and consolidating their market presence.

The industry is experiencing substantial innovation, fuelled by technological progress and a growing need for accurate diagnostic instruments. For instance, in May 2022, Essilor Instruments USA introduced the AKR800NV Auto Kerato-Refractometer. The AKR800NV offers complimentary measurements such automatic peripheral keratometry, white-to-white measurement, and retro-illumination imaging. It is fully automatic and simple to use. To assist eye care professionals in performing thorough eye evaluations for the fitting of contact lenses and media-opacity screening, the AKR800NV has sophisticated capabilities including night vision testing and accommodation evaluation.

Several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies. This strategy accounted for around 16.67% of all strategic initiatives undertaken in the pupillometer market. For instance, in July 2022, NIDEK Technologies S.r.l, a subsidiary of NIDEK CO., LTD., acquired 90% of the shares of NIDEK MEDICAL S.R.L. NIDEK Medical S.r.l is a sales and services company of ophthalmic devices and is now a subsidiary of NIDEK Group.

Favorable reimbursement regulations are expected to further boost industry growth. For instance, in October 2022, Konan Medical USA, Inc. announced that EyeKinetix received an FDA approval and can be purchased in the U.S. EyeKinetix is Konan's second-generation pupillometer. The device is faster, easier to use, smaller, full featured, and less expensive than its prototype-RAPDx-a device that brought key pupillary testing developments, which were not perceived for over a century.

Players in the industry undertake this strategy to strengthen their product portfolios and offer diverse technologically advanced and innovative products to their customers. This strategy is the most prominently adopted strategy by companies to attract more customers in the pupillometer market. For instance, in August 2021, NIDEK CO., LTD announced the launch of NIDEK Experience center. The new virtual center enables visitors to experience state-of-the-art innovations from NIDEK, where they can learn from NIDEK’s experts, core engineers, & expert clinicians, who are all dedicated to driving better patient care.

Geographic expansion in the industry signifies the strategic efforts of pupillometer manufacturers to extend their footprint and influence across diverse regions. The objective of this expansion is to penetrate new markets, amplify market share, and serve a broader clientele. Through such geographic growth, pupillometer firms can strengthen their distribution channels, augment product accessibility, and potentially escalate sales and brand awareness throughout various states or locales.

Mobility Insights

Table-top pupillometer dominated the market and held highest revenue share of 54.2% in 2023. Pupillometers, devices used to measure the size and reactivity of the pupil, are often integrated with other optical instruments such as keratometers, pachymeters, wavefront aberrometers, and corneal topographers. This combination of devices provides a comprehensive tool for eye examinations and diagnostics. Particularly, table-top pupillometers, which are typically more robust and feature-rich, are commonly found in various healthcare facilities, including hospitals. These combined devices offer a more holistic approach to eye care, enhancing the accuracy and efficiency of diagnoses. Leading market players, including HAAG-STREIT GROUP, Johnson and Johnson Vision, and SCHWIND eye-tech-solutions, are at the forefront of this innovation, developing advanced table-top pupillometer devices that offer a combination of functionalities. This trend not only reflects the ongoing advancements in ophthalmic technology but also the industry’s commitment to improving patient care through more precise and comprehensive diagnostic tools.

Hand-held pupillometers is expected to grow at the fastest CAGR of 5.77% during the forecast period. Hand-held pupillometer enables users to capture pupil images efficiently and accurately, which can be instrumental in diagnosing various neurological disorders, including Alzheimer’s disease. The portability of the hand-held pupillometer contributes to its growing development and adoption. NeurOptics, a market leader, develops hand-held pupillometers for both critical care and applied research. In addition, companies like Adaptica have introduced a combined hand-held device named 2WIN, which incorporates pupillometry. An additional feature of this product, the dynamic pupillometry (DP-App), aids in detecting changes in the pupil, pupil distance, and pupil size. The advancement of hand-held pupillometers is anticipated to drive growth in this segment in the future.

Type Insights

Video dominated the type segment and held the largest revenue share of 56.3% in 2023 and is expected to grow at a significant rate during the forecast period. A video pupillometer is a tool that records the full process of pupil dilation, aiding in the comprehension of the alterations and their causes. NeurOptics is a firm that specializes in the field of pupillometry, creating cutting-edge technologies to assist healthcare professionals in delivering superior patient care. The company has introduced a range of video pupillometers for both critical care and applied research. The NPi-200, a video pupillometer designed by NeurOptics for critical care, is one such product. It comes with an infrared camera, a processor, high-accuracy optics, and an LED light source. The video capability of this product allows for the tracking of pupil size changes and reactivity over time.

Digital is expected to experience the fastest CAGR of 5.81% during the forecast period. A digital pupillometer is a device that facilitates the swift and precise evaluation of pupil size. It records multiple frames per second and uses the average of these measurements to ascertain pupil dilation. The digital pupillometer can record all variations in the pupillary response, thereby improving the identification of neurological disorders. Companies such as Essilor, Luneau Technology Group, and Reichert Technologies have manufactured digital pupillometers to aid in accurate diagnosis.

Application Insights

Ophthalmology dominated the market and held for the largest revenue share of 49.2% in 2023. This was primarily due to the increased use of pupillometry to examine pupil dilation, which aids in the diagnosis of retinal diseases. The pupillary light reflex is useful for evaluating the functionality of the visual system. Pupillometry can detect variations in the responses of melanopsin and cone/rod photoreceptors, which helps to identify damage to the outer and inner retina. Furthermore, measuring pupil size assists refractive surgeons in understanding the consequences of LASIK surgery. Patients with larger pupils are more likely to experience increased visual disturbances in low-light conditions following LASIK surgery. As a result, the growing use of pupillometry in ophthalmic diagnostics is anticipated to boost the overall growth of this segment.

Oncology is expected to experience the fastest CAGR of 5.81% during the forecast period. The application of pupillometry in oncology is on the rise. Research trials are underway to evaluate the efficacy and effectiveness of pupillometry in this field. Pupillometry is already being used in various contexts for brain tumours, while research is being conducted to explore its potential in determining the depth of anaesthesia for conditions like breast cancer, thyroid tumours, and stroke. The measurement of pupil size, pupillary response, pupillary unrest, and other characteristics can serve as indicators of conditions such as head trauma, brain tumours, or stroke. Therefore, the increasing number of studies on the use of pupillometry in oncology is expected to drive growth in this segment in the future.

End-use Insights

Hospitals dominated the market and held the largest revenue share of 49.2% in 2023.The increasing use of the pupillometer, particularly in end-use settings, is contributing to its growth. The pupillometer, developed by NeurOptics, is being used by 400 hospitals across the U.S., which is significantly contributing to the growth of this segment. Furthermore, the pupillometer’s expanding use in critical care units is expected to further drive the segment growth. The NeurOptics pupillometer is utilized in a variety of critical care units, including neurocritical care, medical intensive care, the emergency department, and cardiac intensive care.

Eye clinics is expected to grow at the fastest CAGR of 5.80% during the forecast period. Various eye clinics diagnostic departments have included pupillometry as one of the major diagnostic procedures. Ophthalmic clinics has involved pupillometry in its diagnostic examinations and prevention control department. Pupillometry is used as a preoperative measure along with the wavefront technology in the clinic before refractive surgery to avoid post-surgery vision problems. Pupillometry results help in determining the type of laser treatment required for eye treatment. Therefore, growing adoption of pupillometry by various eye clinics is expected to propel segment growth during the forecast period.

Key U.S. Pupillometer Company Insights

Companies in the U.S. pupillometer market are concentrating on a variety of strategic initiatives, including partnerships, expanding their products and services, mergers and acquisitions, and investing in research and development to create advanced applications for gaining a competitive edge. In 2022, the market was dominated by key players such as NeurOptics, Inc., Essilor Instruments USA, HAAG-STREIT GROUP, and SCHWIND eye-tech-solutions. These market leaders are developing digital and integrated pupillometers with advanced features for use in various clinical applications in critical care units. Moreover, companies like brightlamp, Inc. are focusing on incorporating advanced technology into pupillometry to make it easily accessible via mobile devices.

Key U.S. Pupillometer Companies:

- NeurOptics, Inc.

- Reichert Technologies

- Johnson & Johnson Vision

- Brightlamp, Inc.

- Adaptica

- Essilor Instruments USA

- HAAG-STREIT GROUP

- Luneau Technology Group

- NIDEK CO., LTD.

- SCHWIND eye-tech-solutions

- US Ophthalmic

- Konan Medical

Recent Developments

-

In May 2022, Visionix and Right MFG. Co., Ltd. announced that they have entered a long-term strategic partnership agreement aiming toward the growth of both the companies. With this partnership, Visionix will be the partner for Right MFG to distribute Righton products in Europe, the Americas, and Asia Pacific (excluding Japan and China).

-

In March 2022, NeurOptics, launched its NPi-300 automated pupillometer in 15 new countries around the world.

-

In March 2022, Adaptica was honoured and included in the Italia Geniale catalogue to characterize Italian excellence at Expo Dubai, which was assembled by ADI Design. The Iconic 2WIN, which had previously received an award from ADI Design in 2013, received further recognition. The product has been selected as one of the 100 most representative products of 60 years of Italian design.

-

In July 2021, NeurOptics launched NPi-300 in the U.S., which is a technically advanced automated pupillometer that enables the detection of cerebral insult, including stroke, traumatic brain injury, seizure, or other neurological attack after cardiac arrest and other medical conditions.

U.S. Pupillometer Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 99.2 million

Revenue forecast in 2030

USD 138.1 million

Growth rate

CAGR of 5.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Mobility, type, application, end-use

Country scope

U.S.

Key companies profiled

NeurOptics, Inc.; Reichert Technologies; Johnson & Johnson Vision; Brightlamp, Inc.; Adaptica; Essilor Instruments USA; HAAG-STREIT GROUP; Luneau Technology Group; NIDEK CO., LTD.; SCHWIND eye-tech-solutions; US Ophthalmic; Konan Medical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Pupillometer Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. pupillometer market based on mobility, type, application, and end-use:

-

Mobility Outlook (Revenue, USD Million, 2018 - 2030)

-

Table-top

-

Hand-held

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Video

-

Digital

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Ophthalmology

-

Neurology

-

Oncology

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Eye Clinics

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. pupillometer market size was estimated at USD 91.2 million in 2023 and is expected to reach USD 99.2 million in 2024.

b. The U.S. pupillometer market is expected to grow at a compound annual growth rate of 5.7% from 2024 to 2030 to reach USD 138.1 million by 2030.

b. Based on type, the video dominated the U.S. pupillometer market with a share of 56.3% in 2023. This is attributable to rising demand, technical advances in video pupillometer.

b. Some key players operating in the pupillometer market include NeurOptics, Inc., Adaptica, Essilor Instruments USA, HAAG-STREIT GROUP, Johnson & Johnson Vision, Luneau Technology Group, NIDEK CO., LTD., Reichert Technologies, SCHWIND eye-tech-solutions, US Ophthalmic, Konan Medical, and brightlamp, Inc.

b. Key factors that are driving the U.S. pupillometer market growth include an increasing number of neurological disorders, an increasing number of vision-related issues, and a growing number of product launches.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.