- Home

- »

- Advanced Interior Materials

- »

-

U.S. Railing Market Size, Share, Growth, Trends Report, 2030GVR Report cover

![U.S. Railing Market Size, Share & Trends Report]()

U.S. Railing Market (2023 - 2030) Size, Share & Trends Analysis Report By Material (Wood, Metal, Composite, Others), By Application (Residential, Non-Residential), And Segment Forecasts

- Report ID: GVR-4-68040-056-2

- Number of Report Pages: 74

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

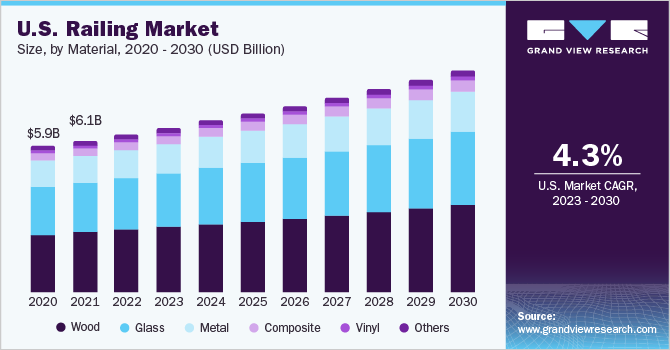

The U.S. railing market size was estimated at USD 5.92 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 3.9% from 2023 to 2030. This growth is attributed to the growing demand for affordable housing coupled with the increasing government investments in residential construction. Furthermore, a rising shift towards the adoption of eco-friendly products owing to increasing environmental concerns can also be attributed to the growth of the railing market in the U.S. Due to modernization and people shifting from rural areas to urban areas for better growth opportunities, the construction industry is increasing rapidly in the US. Also, the U.S. Administration announced the construction of affordable homes in the next few years, which is also another factor leading to the growth of the railing market in the U.S.

In the U.S., the residential segment is anticipated to grow significantly owing to the significant expansion of both remodeling and new residential construction markets. Wood railing is more traditional and is most common in the U.S. owing to its aesthetic appeal. It is expected to face significant competition due to cheaper costs and ease of maintenance associated with composite railing.

However, wooden railings are not sustainable options as their production leads to deforestation, thereby raising environmental concerns. However, a highly environment-friendly substitute for wooden railing is engineered wood railing, as these railings are developed from wood scraps, shredded wood fibers, real wood binding pieces, and sawdust. These engineered wood railings have characteristics similar to the railing developed from wood but with increased strength and durability. Thus, these factors are expected to increase the demand for engineered wood railing in the coming years.

The advancements in technologies such as 3D laser scanners allow the development of highly complex structures as these technologies make it easy to develop 3D designs that were developed manually earlier. The designs of structures can be visualized with the help of scanners and can be changed according to the requirements of clients.

Some manufacturers sell their railing directly through their websites, wherein quotations and railing installation requests can be made by customers. In comparison, a few companies operating in the country’s railing market have offline distributors, which enable manufacturers to supply their railing to the market through their distribution networks.

Contractors have direct tie-ups with manufacturing companies that help them to procure large volumes of railing at low prices. Distributors have their committed stores, and the general public can purchase railing from these stores. This offers end users a broad range of options in terms of railing materials and designs. In addition, it also allows customers to touch and feel the railing for an improved understanding of their quality.

Material Insights

The wood railing segment led the market and accounted for the largest revenue share of 41.5% in 2022. The segment is expected to witness growth on account of the excellent aesthetic properties and affordable prices of wood. Due to its high strength, longevity, and ease of maintenance, wood is extensively used in railing applications.

The demand for metal railing is expected to grow at a CAGR of 4.2% throughout the projected period 2023-2030 on account of their high strength and durability. Metal railings are made of stainless steel, aluminum, brass, wrought iron, and cast iron. Metal railings are robust, sturdy, and require minimal maintenance, which, in turn, is expected to lead to the growth of the railing market in the U.S.

Aluminum railing are widely used in the energy and power, petroleum and chemicals, and military and defense industries. These railings are suitable for use in all types of environments and climates. They also offer benefits to the end-users, including cost, durability, environmental friendliness, and ease of maintenance. The abovementioned factors are anticipated to boost the demand for aluminum railing over the coming years.

Composite railing is a blend of polyvinyl chloride (PVC) and recycled wood flour and provides exceptional aesthetic value, strength, and weatherability. The growing need to improve the aesthetic appeal of the property, as well as the increased availability of lightweight, economical, and easy-to-install railing, is expected to drive the demand for composite railing materials.

Companies in the market are introducing new product lines with advanced composite materials and recycled plastic materials for railing to improve their functionality and reduce the environmental impact of materials. Thus, an increased preference for advanced railing is expected to drive the demand for composite railing in the coming years.

The other segment includes concrete and glass, where the demand for concrete railing is expected to grow throughout the forecast period due to their exceptional strength and durability, enabling them to withstand high impact. In addition, concrete makes an excellent railing material due to its low maintenance requirements and resistance to rotting, warping, and insect damage. In addition, customers prefer glass railing due to their greater aesthetic impact, including the ability to make spaces appear bigger and facilitate the flow of light. They increase the value and elegance of a building while being surprisingly secure and valuable. These factors are anticipated to increase the demand for concrete and glass railing over the coming years.

Application Insights

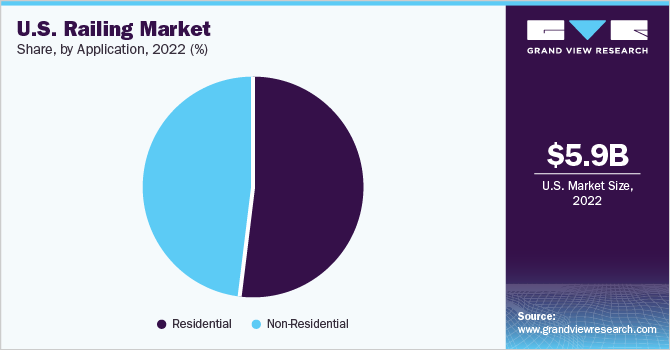

The residential application segment accounted for the highest market share of 52.0% in 2022 and is anticipated to grow at a CAGR of 4.1% over the forecast year. The majority of the revenue generated by the residential railing market comes from metal and composite railing. The residential sector has been growing significantly and is predicted to rise considerably throughout the projection period. The growth in single-family residential construction and remodeling activities in the U.S. are mainly driving the residential sector. Therefore, the demand for railing in the U.S. is anticipated to increase with the increase in residential construction and remodeling activities.

The market is now dominated by professional railing installations and is projected to continue its dominance over the forecast period due to rising disposable income, population growth, and declining unemployment rates, which are predicted to boost the housing demand. This increase in housing demand is expected to fuel the expansion of the railing market, with professional installation becoming more common. Moreover, the increasing demand for DIY housing improvement over the forecast period is due to the growing demand for housing enhancements and decorating interior projects for customized designs.

The non-residential sector accounted for USD 2,848.1 in 2022, and it is growing at a significant rate over the forecast year. The demand for railing in the non-residential sector of the U.S. is expected to increase due to the rebounding of offices and commercial spaces. In addition, corporate buildings, hotels, retail centers, and industrial structures need railing installed across their properties for security purposes. These elements are expected to encourage the expansion of the non-residential railing market in the U.S.

Key Companies & Market Share Insights

The U.S. railing market exhibits high competition owing to the presence of established players in this market with vertical integration across the value chain of railing. Some competitors also focus on increasing their innovations through mergers and acquisitions with top manufacturers in order to gain a competitive edge.

Key participants in the market are also focusing on technological developments for improving the quality of raw materials, components, and installation processes, thus, creating strong competition for new entrants. Additionally, the players are fulfilling the demand for eco-friendly railing systems, and hence their market penetration is higher. Some prominent players in the U.S. railing market include:

-

Q-railing

-

VIVA Railing

-

Century Aluminum Railing

-

GRECO Architectural Metals

-

AMERICAN RAILING SYSTEMS, INC.

-

The Wagner Companies

-

ViewRail

-

Fortress Building Products

-

HDI Railing Systems

-

Trex Company, Inc.

-

Barrette Outdoor Living

-

Digger Specialties, Inc.

-

UFP

-

Fiberon

-

Absolute Distribution Inc.

-

Eastern Wholesale Fence LLC

-

ULTRALOX INTERLOCKING

-

TimberTech

-

The Azek Company Inc.

U.S. Railing Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 8.04 billion

Growth rate

CAGR of 3.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report publlished in

April 2023

Quantitative units

Revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, application

Country scope

U.S.

Key companies profiled

Q-railing; VIVA Railing; Century Aluminum Railing; GRECO Architectural Metals; AMERICAN RAILING SYSTEMS, INC.; The Wagner Companies; ViewRail; Fortress Building Products; HDI Railing Systems; Trex Company, Inc.; Barrette Outdoor Living; Digger Specialties, Inc.; UFP; Fiberon; Absolute Distribution Inc.; Eastern Wholesale Fence LLC; ULTRALOX INTERLOCKING; TimberTech; The Azek Company Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Railing Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the industry trends in each of the sub-segments from 2023 to 2030. For this study, Grand View Research has segmented the U.S. railing market report based on materials, and application:

-

Material Outlook (Revenue, USD Million, 2023 - 2030)

-

Wood

-

Metal

-

Composites

-

Others

-

-

Application Outlook (Revenue, USD Million, 2023 - 2030)

-

Residential

-

Non-Residential

-

Frequently Asked Questions About This Report

b. The U.S. railing market size was estimated at USD 5.92 billion in 2022 and is expected to reach USD 6.13 billion in 2023.

b. The U.S. railing market is expected to grow at a compound annual growth rate, a CAGR of 3.9% from 2023 to 2030, to reach USD 8.04 billion by 2030.

b. The wood railing type accounted for the largest revenue share of 41.5% in 2022. The wood railing market is driven by its characteristics, such as high strength, longevity, and ease of maintenance.

b. Some key players operating in the U.S. railing market include Q-railing, VIVA Railing, Century Aluminum Railing, GRECO Architectural Metals, AMERICAN RAILING SYSTEMS, INC., The Wagner Companies, ViewRail, Fortress Building Products, HDI Railing Systems, Trex Company, Inc.

b. Key factors that are driving the market growth include the rising demand for affordable housing and increasing government investments in residential construction.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.