- Home

- »

- Advanced Interior Materials

- »

-

U.S. Rainscreen Fasteners Market, Industry Report, 2033GVR Report cover

![U.S. Rainscreen Fasteners Market Size, Share & Trends Report]()

U.S. Rainscreen Fasteners Market (2025 - 2033) Size, Share & Trends Analysis Report By Product For Facades (Mechanical Visible Fixing), By Product For Substructure, By Cladding Material, By Substructure Type, By End Use, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-663-4

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Rainscreen Fasteners Market Summary

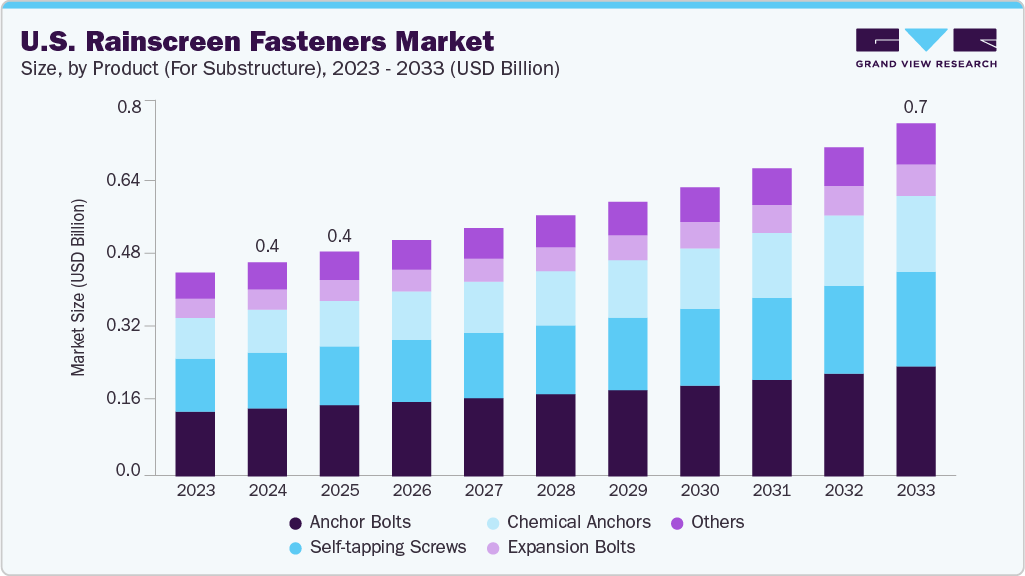

The U.S. rainscreen fasteners market size was estimated at USD 0.4 billion in 2024 and is expected to expand at a CAGR of 6.0% from 2025 to 2033. In the U.S., the increasing implementation of energy codes and green building standards, such as LEED and the International Energy Conservation Code (IECC), is significantly driving the adoption of rainscreen cladding systems.

Key Market Trends & Insights

- By product (for facades), the mechanical visible fixing segment is expected to grow at the fastest CAGR of 6.6% over the forecast period.

- By product (for substructure), the chemical anchors segment is expected to grow at the fastest CAGR of 6.8% over the forecast period.

- By cladding material, the wood & composite panels segment is expected to grow at the fastest CAGR of 7.4% over the forecast period.

- By substructure type, the hybrid substructures segment is expected to grow at the fastest CAGR of 6.9% over the forecast period.

- By end use, the industrial & manufacturing segment is expected to grow at the fastest CAGR of 6.8% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 0.4 Billion

- 2033 Projected Market Size: USD 0.6 Billion

- CAGR (2025-2033): 6.0%

These systems enhance thermal insulation and reduce moisture intrusion, thus improving energy efficiency and extending building longevity. As a result, there is a growing demand for high-performance rainscreen fasteners that can securely hold diverse cladding materials while maintaining thermal integrity and structural reliability. The resurgence of commercial construction, including office buildings, healthcare facilities, and educational institutions, is another major driver for the U.S. market. These structures often require aesthetically appealing, weather-resistant facades, making rainscreen systems a preferred choice. The need for durable and easy-to-install fastening systems that can withstand varying climatic conditions and provide long-term stability is fueling product innovation and consumption across the country.

The U.S. market is also witnessing a surge in the use of advanced cladding materials such as fiber cement, high-pressure laminates, and aluminum composites. These materials demand precision-engineered fasteners that can ensure secure installation, accommodate thermal expansion, and meet stringent fire resistance requirements. Technological developments in mechanical and chemical anchoring systems are supporting faster installation and improved safety compliance, contributing to market growth.

Market Concentration & Characteristics

The market is moderately concentrated, with a mix of global manufacturers, regional suppliers, and specialty façade system providers contributing to competition. Innovation plays a central role in differentiating offerings, particularly in response to evolving building codes and energy efficiency standards. Companies are investing in the development of corrosion-resistant, thermally broken, and easy-to-install fastening systems to meet the growing demand for sustainable and performance-driven façades. The integration of mechanical and chemical anchoring technologies tailored to support new-age cladding materials also underscores the increasing degree of product innovation in the market.

In terms of market dynamics, the industry is experiencing gradual consolidation through strategic partnerships, acquisitions, and mergers-primarily aimed at expanding geographic reach, product portfolios, and technological capabilities.

Regulatory compliance, especially around fire safety, moisture control, and energy performance, has a significant influence on product design and material selection. While product substitution is limited due to the specific engineering and safety requirements of rainscreen systems, some overlap exists with conventional fasteners in low-performance applications.

End-use concentration remains strong in commercial, institutional, and high-density residential sectors, where façade aesthetics, durability, and code compliance are critical, thereby shaping both demand and competitive strategies.

Product (For Facades) Insights

Mechanical visible fixing segment dominated the market and accounted for about 31.9% share of the total revenue in 2024, driven by its ease of installation, structural reliability, and cost-efficiency, particularly in large-scale commercial and institutional projects. These systems allow for direct mechanical fastening of cladding panels, offering visible yet architecturally acceptable finishes. Contractors and installers favor visible fixings for their straightforward alignment and adjustment capabilities, especially when working with dense or non-perforated cladding materials such as fiber cement or metal panels. Additionally, the segment benefits from compliance with fire and seismic codes in regions requiring mechanically robust façades.

Adhesive fixing segment is expected to grow significantly at a CAGR of 6.2% over the forecast period, driven by the growing trend toward seamless façade aesthetics and the ability to reduce thermal bridging. As architectural designs favor clean lines and uninterrupted surfaces, adhesive systems provide a non-invasive method to mount cladding without visible hardware. These systems are particularly suitable for lightweight materials and retrofit applications where drilling may compromise surface integrity. Technological advancements in structural adhesives with improved bonding strength and weather resistance have further bolstered their adoption across commercial and residential buildings.

Product (For Substructure) Insights

Anchor bolts segment dominated the market and accounted for about 31.7% share of the revenue in 2024, driven by their necessity in securing substructures to concrete or masonry substrates. Their high load-bearing capacity makes them critical for high-rise buildings and public infrastructure projects subject to wind loads and seismic activity. With increased investments in urban infrastructure and transit-related developments, the demand for anchor bolts that meet ASTM and ICC-ES standards continues to rise. Their versatility in supporting heavy-duty subframes also contributes to strong demand across industrial and mixed-use constructions.

The chemical anchors segment is expected to grow at the fastest CAGR of 6.8% over the forecast period, driven by their suitability for complex anchoring conditions and retrofit projects. These anchors offer high load resistance and minimal expansion pressure, making them ideal for cracked concrete, edge proximity scenarios, and post-installed applications. Their growing use in seismic retrofitting and energy-efficient façade installations-where preserving structural integrity is critical-is driving adoption. Moreover, increased regulatory emphasis on anchoring reliability and safety, especially in older urban cores, is boosting demand for certified chemical anchoring solutions.

Cladding Material Insights

Metal panels (aluminum, steel, zinc, etc.) dominated the market and accounted for about 23.2% share of the revenue in 2024, driven by widespread use of aluminum, steel, and zinc in commercial, government, and institutional architecture. These panels offer durability, fire resistance, and recyclability, aligning with both aesthetic and sustainability goals. Their compatibility with both mechanical and adhesive fastening systems enhances flexibility in installation methods. As cities pursue modernized, weather-resistant façades with long lifecycle performance, the demand for secure and corrosion-resistant fasteners tailored for metal panels continues to grow.

The wood & composite panels segment is expected to grow at the fastest CAGR of 7.4% over the forecast period, driven by the increasing demand for sustainable and natural-look façade materials in U.S. residential and low-rise commercial projects. These panels require specialized fasteners that accommodate thermal movement and maintain panel integrity over time. As design trends move toward eco-friendly and biophilic architecture, rainscreen systems incorporating wood fiber composites and treated timber are being widely adopted. This trend supports demand for fastening solutions that provide concealed support and resist degradation from moisture and UV exposure.

Substructure Type Insights

The aluminum framing systems segment dominated the market and accounted for about 35.7% share of the revenue in 2024, driven by its lightweight nature, high strength-to-weight ratio, and resistance to corrosion. These framing systems are widely used in both new constructions and retrofits for rainscreen cladding due to their easy assembly and compatibility with various fastener types. Additionally, the push toward prefabricated and modular construction in urban centers has accelerated demand for aluminum-based substructures that support quick, precise, and code-compliant rainscreen installations.

The hybrid substructures segment is expected to grow at the fastest CAGR of 6.9% over the forecast period. These systems are engineered to balance performance, cost, and weight, making them attractive for buildings with complex architectural geometries or demanding environmental conditions. The growing emphasis on reducing carbon footprint without compromising on durability is prompting developers to adopt hybrid substructures that can integrate seamlessly with advanced rainscreen fastening systems. Their adaptability to different cladding materials also supports their expanding use.

End Use Insights

Construction & real estate dominated the market and accounted for about 44.7% share of the revenue in 2024, driven by increased investments in urban residential and commercial developments. As developers prioritize building envelope performance and architectural appeal, rainscreen systems are being widely deployed for both new builds and renovations. Regulatory pressures to meet energy codes and fire safety standards also compel builders to adopt certified fasteners that ensure code-compliant installation and long-term structural performance. This sector's ongoing demand for customizable and efficient façade systems sustains the market's growth.

The industrial & manufacturing segment is expected to grow at the fastest CAGR of 6.8% over the forecast period. In the U.S., industrial and manufacturing facilities are increasingly adopting rainscreen cladding systems to protect against harsh environmental conditions, such as temperature fluctuations, corrosion, and chemical exposure. This has driven the need for robust fasteners that provide durable anchorage while accommodating movement and expansion. Furthermore, as manufacturing plants are modernized for compliance and energy savings, rainscreen systems with resilient fastening components are being installed to improve building performance and reduce operational maintenance.

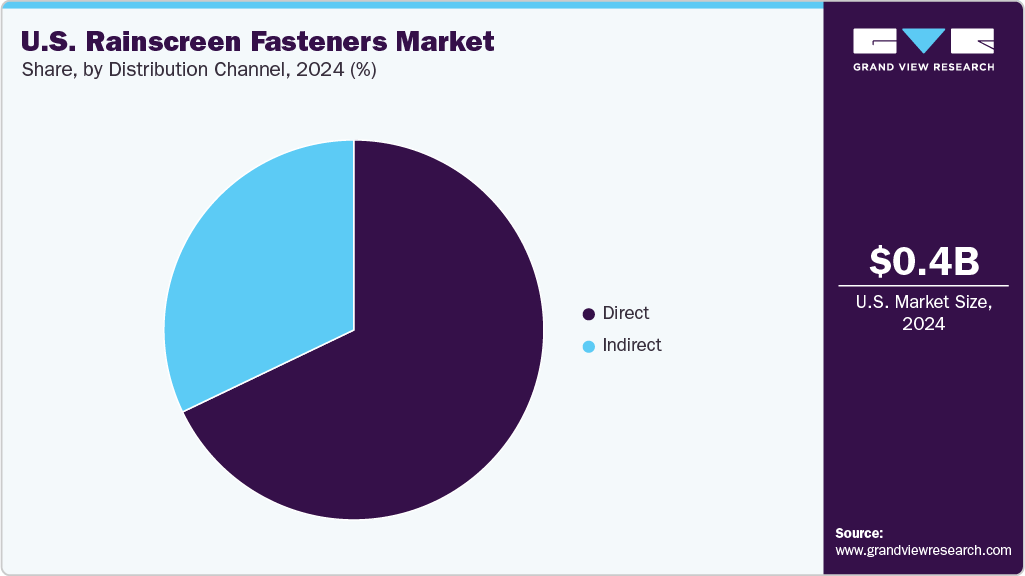

Distribution Channel Insights

The direct segment led the market and accounted for a 68.0% share in 2024. In the U.S., large construction firms and façade contractors often engage directly with manufacturers for bulk procurement and project-specific fastening solutions. This channel enables faster delivery, better product education, and more accurate specification matching, which is particularly important in projects with strict code requirements and unique architectural designs.

The indirect segment is expected to grow significantly at a CAGR of 5.5% over the forecast period. Indirect distribution channels are essential in serving small to mid-sized contractors across diverse geographic areas in the U.S. Distributors, retailers, and third-party suppliers enable wider accessibility to rainscreen fasteners, especially in fragmented regional markets. These channels support faster turnaround times, local inventory availability, and brand reach. The growth of e-commerce platforms and integrated logistics networks has further strengthened indirect distribution, making it a key contributor to market penetration in both established and emerging construction zones.

Key U.S. Rainscreen Fasteners Companies Insights

Key players operating in the U.S. rainscreen fasteners market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key U.S. Rainscreen Fasteners Companies:

- Hilti Inc.

- SFS Group USA, Inc.

- ETANCO North America

- Knight Wall Systems

- Bostik, Inc.

- FastenMaster (a division of OMG, Inc.)

- Hohmann & Barnard, Inc.

- TRUFAST Walls (a brand of Altenloh, Brinck & Co.)

- Laticrete International, Inc.

Recent Developments

-

In September 2021, Kingspan Group revealed its acquisition of Minnesota Diversified Products, Inc., a U.S.-based firm. This strategic move expanded Kingspan’s customer base in the United States and strengthened its core building insulation operations within a market expected to witness significant growth.

U.S. Rainscreen Fasteners Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 0.42 billion

Revenue forecast in 2033

USD 0.66 billion

Growth rate

CAGR of 6.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product (for facades), product (for substructure), cladding material, substructure type, end use, and distribution channel

Country scope

U.S

Key companies profiled

Hilti Inc.; SFS Group USA, Inc.; ETANCO North America; Knight Wall Systems; Bostik, Inc.; FastenMaster (a division of OMG, Inc.); Hohmann & Barnard, Inc.; TRUFAST Walls (a brand of Altenloh, Brinck & Co.); Laticrete International, Inc.,

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Rainscreen Fasteners Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. rainscreen fasteners market report based on product (for facades), product (for substructure), cladding material, substructure type, end use, and distribution channel.

-

Product (For Facades) Outlook (Revenue, USD Million, 2021 - 2033)

-

Mechanical Visible Fixing

-

Mechanical Invisible Fixing

-

Visible Clips

-

Adhesive Fixing

-

Others

-

-

Product (For Substructure) Outlook (Revenue, USD Million, 2021 - 2033)

-

Anchor Bolts

-

Chemical Anchors

-

Self-Tapping Screws

-

Expansion Bolts

-

Others

-

-

Cladding Material Outlook (Revenue, USD Million, 2021 - 2033)

-

HPL (High-Pressure Laminate)

-

Natural Stone (Granite, Marble, etc.)

-

Fibre Cement Panels

-

Ceramic & Porcelain Panels

-

Metal Panels (Aluminum, Steel, Zinc, etc.)

-

Glass Panels

-

Wood & Composite Panels

-

Terracotta

-

Building Integrated Photovoltaics

-

Aluminum Composite Panels

-

Others (Glass Reinforced Concrete, Carbon Fiber Panels, Fibre Reinforced Plastic)

-

-

Substructure Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Aluminum Framing Systems

-

Steel Support Structures

-

Wood Framing

-

Hybrid Substructures

-

Stainless Steel Substructures

-

Others (Fiber Reinforced Polymer, Concrete, Ultra-High-Performance Concrete)

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Construction & Real Estate

-

Energy & Utilities (Solar and Green Roofs)

-

Industrial & Manufacturing

-

Government & Public Sector

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Direct

-

Indirect

-

Frequently Asked Questions About This Report

b. The U.S. rainscreen fasteners market size was estimated at USD 0.40 billion in 2024 and is expected to reach USD 0.42 billion in 2025.

b. The U.S. rainscreen fasteners market is expected to grow at a compound annual growth rate of 6.0% from 2025 to 2033 to reach USD 0.66 billion by 2033.

b. Anchor bolts segment dominated the market and accounted for about 31.7% share of the revenue in 2024, driven by their necessity in securing substructures to concrete or masonry substrates.

b. Some of the prominent companies in the rainscreen fasteners market include Hilti Inc., SFS Group USA, Inc., ETANCO North America, Knight Wall Systems, Bostik, Inc., FastenMaster (a division of OMG, Inc.), Hohmann & Barnard, Inc., TRUFAST Walls (a brand of Altenloh, Brinck & Co.), Laticrete International, Inc

b. Key factors driving the U.S. rainscreen fasteners market include growing demand for energy-efficient façades, increased commercial construction, and stringent building codes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.