- Home

- »

- Healthcare

- »

-

U.S. Red Light Therapy Beds Market, Industry Report, 2033GVR Report cover

![U.S. Red Light Therapy Beds Market Size, Share & Trends Report]()

U.S. Red Light Therapy Beds Market (2025 - 2033) Size, Share & Trends Analysis Report By Device Class (Premium Grade, Economical-Budget Friendly), By Sales Channel, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-768-9

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2033

- Industry: Research

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

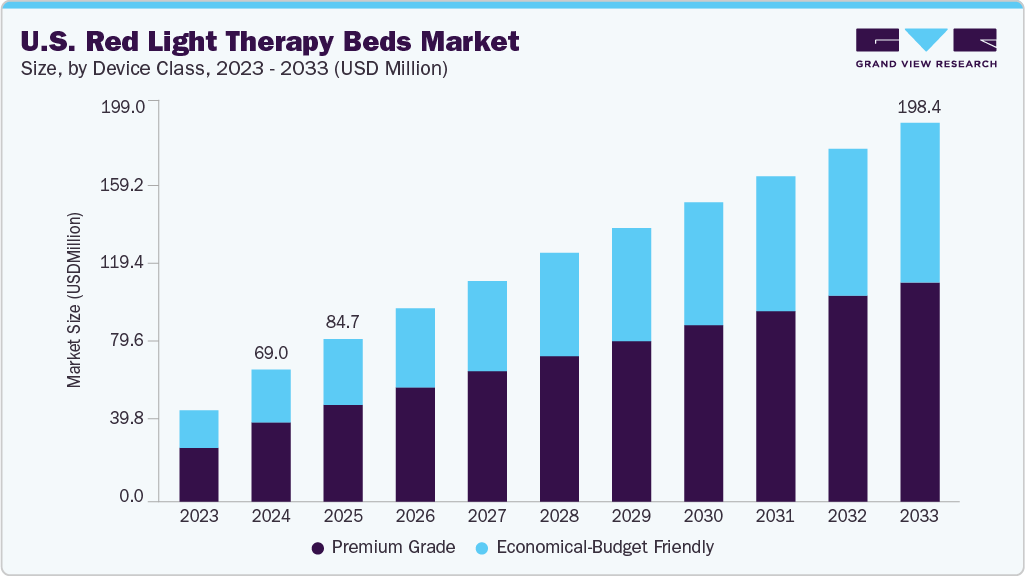

The U.S. red light therapy beds market size was estimated at USD 69.0 million in 2024 and is expected to reach a value of USD 198.4 million in 2033, growing at a CAGR of 11.2% from 2025 to 2033. This growth is driven by rising consumer awareness of non-invasive wellness solutions, expanding adoption in medical and wellness centers, increasing availability of affordable options, and technological advancements enhancing treatment effectiveness and user convenience.

According to the American Med Spa Association’s (AmSpa) 2024 Medical Spa State of the Industry Executive Report Recap released in November 2024, the total number of medical spas grew from 8,899 locations in 2022 to 10,488 in 2023. This remarkable jump underscores both sustained consumer demand for medical aesthetics and the willingness of entrepreneurs and medical professionals to invest in innovative treatments. Red-light therapy beds, once a niche wellness add-on, are now becoming a core fixture in these facilities as owners look for non-invasive, tech-forward ways to attract patients and boost revenue.

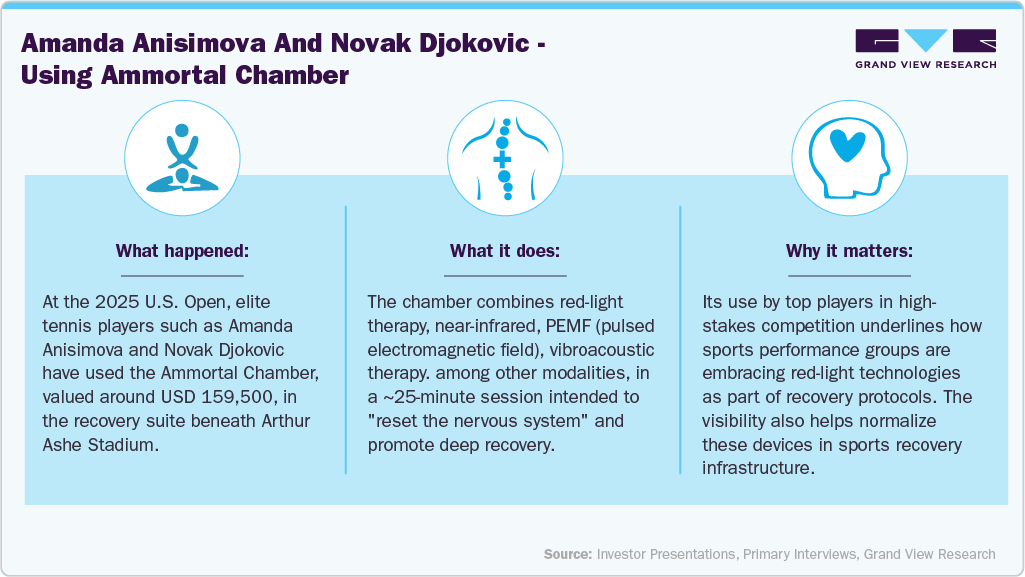

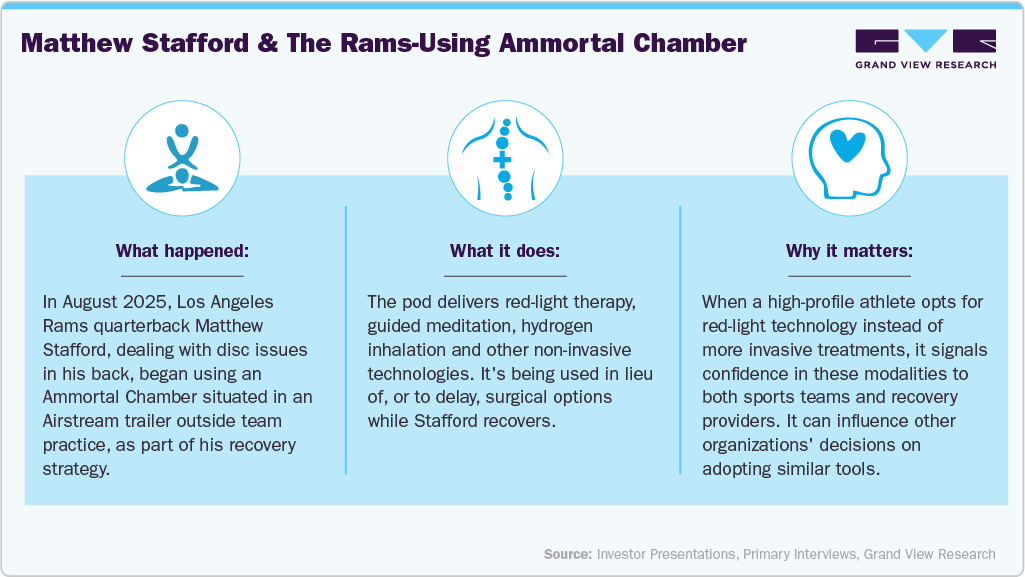

The growth of the U.S. red light therapy beds industry is strongly driven by uptake among athletes, performance teams, fitness centers, and recovery providers, with many high-profile adoptions and scientific endorsements enhancing credibility and accelerating demand. The visibility of athlete usage is powerful: public posts, media coverage, and athlete testimonials bolster consumer awareness. Erling Haaland’s public acquisition of a ~£15,000 (USD 18,900) red-light therapy bed for muscle treatment (August 2024) is one example; by sharing usage on social media, such high-profile athletes popularize red-light therapy among fans, amateur athletes, and fitness-minded consumers alike. Even celebrity anecdotes (Pete Davidson using a red-light wand before red-carpet events) add to the cultural cachet. The striking examples are:

Emerging scientific evidence is increasingly showing that red-light therapy beds (via photobiomodulation, PBM) offer therapeutic benefits for a wide variety of health conditions beyond cosmetic and recovery contexts, representing a major growth opportunity in the U.S. market; multiple systematic reviews and clinical/preclinical trials conducted in 2024-2025 document improved outcomes in autoimmune, neurological, musculoskeletal, and skin conditions with low adverse risk, which enables product companies and operators to legitimately target disease management use-cases and partner with medical and health care providers. For instance, a 2024 systematic review of PBM in multiple sclerosis (MS) patients found modulation of brain markers related to inflammation, oxidative stress, and apoptosis, along with improvements in motor, sensory, and cognitive functions after PBM therapy.

Therefore, for red-light therapy beds, the opportunity lies in shifting from strictly wellness/aesthetic positioning toward being viewed and utilized as adjunctive therapies for chronic conditions: autoimmune disorders like MS, skin conditions like psoriasis, chronic pain syndromes, superficial or even deeper wound healing (diabetic ulcers, pressure sores), recovery after injury or surgery, possibly early neurological recovery or neuro-protection, among others.

These patient success stories highlight how consumer-focused red-light therapy brands emerged to meet unmet health needs.

“In 2016, Jake Kreuz, founder of Vital Red Light, was diagnosed with Lyme disease and suffered debilitating fatigue, pain, and brain fog. Dissatisfied with conventional medicine, he turned to photobiomodulation in his doctor’s office, which transformed his health. Noting the high cost and limited access of consumer devices, he launched Vital Red Light to bring medical-grade red-light therapy directly to consumers.”

- Founder of Vital Red Light

“We decided to get the Prism Light Pod to help people who suffer from the debilitating effects of Multiple Sclerosis. Over the past 5 years, we have helped over 1000 people who not only suffer from MS but many other autoimmune disorders and pain issues to live their best quality of life with little to no pain at all. We have helped MS patients who had lost the ability to do things on their own regain their independence just by getting in the red light for 15 min 3-4 times per week. Patients who suffered with chronic pain have left in tears of joy after their 4th or 5th session in the pod because their pain was either gone or down to a tolerable level. Thank you, Prism Light (Life) Pod, for making this possible.”

- Coastal Contours & Wellness

The U.S. red light therapy beds market is witnessing a technological revolution, integrating advanced features such as AI, IoT connectivity, multi-wavelength light therapy, and smart user interfaces. These innovations are enhancing therapeutic efficacy, improving user experience, and enabling precise tracking and optimization of treatment sessions. Full-body light therapy beds offer non-invasive solutions that penetrate deeply to stimulate cellular function, reduce inflammation, accelerate recovery, and support overall wellness.

Technology delivers transformative wellness benefits, much like it does for Dave Asprey, Founder of Bulletproof 360. Advanced tools such as light therapy beds boost energy, accelerate recovery, and enhance overall performance. By integrating science-backed innovations, individuals can achieve measurable improvements in health and longevity.

5-Point Buying Checklist: What Consumers Use to Evaluate Devices

Consumers are turning more to checklists to separate reliable devices from inferior ones. Observing the questions they ask offers insight into key product features and guides marketing positioning.

Checklist Item

Key Concern

What Good Devices Deliver

Circuit Boards vs Strip Lights

Power consistency, durability, coverage

Rigid circuit boards with high-density diodes and good heat management

Made in the USA vs Resold Overseas

Quality control, support, part supply

Clearly labeled domestic manufacturing / transparent import supply, warranty support

Certifications & Legit Specs

Safety, legality, accurate claims

FDA registration, UL / ETL / NRTL lab safety marks, full spec sheets

Prove Certifications

Credibility, trust

Public registration numbers, lab test results, visible documentation

Proximity to Skin

Efficacy of treatment (light intensity)

Design ensuring LEDs no farther than ~1-2 inches from skin; contoured housings, side panels, adjustable positioning

Market Concentration & Characteristics

The U.S. red light therapy beds industry is moderately concentrated, with a mix of established companies, specialized wellness equipment manufacturers, and emerging players in aesthetics and fitness. Market concentration stems from the presence of key players who dominate through advanced technology integration, FDA clearances, and strong distribution networks. However, the industry also features a significant number of small and mid-sized companies targeting niche applications in beauty, sports recovery, and wellness centers, adding to its competitive dynamics.

The industry is characterized by increasing adoption in spas, gyms, dermatology clinics, and wellness facilities, driven by rising consumer demand for non-invasive skin rejuvenation, pain management, and body recovery treatments. Technological advancements such as full-body beds with customizable wavelengths, energy-efficient LEDs, and integration with complementary therapies enhance product differentiation. Regulatory compliance, especially FDA guidelines, and growing awareness of potential health benefits further shape the industry landscape. Additionally, rental models and subscription-based business approaches are expanding accessibility. Overall, the sector combines innovation, wellness-driven consumer trends, and diversified business models, making it both competitive and growth-oriented while maintaining opportunities for new entrants in specialized niches.

The market demonstrates a high degree of innovation, with companies integrating advanced LED technology, customizable wavelengths, and user-friendly designs. Innovations focus on enhancing cellular recovery, skin rejuvenation, and pain relief. For example, Senior Associate Athletic Trainer Owen Stanley highlighted the TheraLight 360, explaining how just 20 minutes in bed promotes cellular recovery and stimulates new cell production. Such advancements illustrate the industry’s emphasis on non-invasive, science-backed therapies that appeal to wellness, sports, and medical sectors. Continuous product upgrades and clinical validation are driving broader acceptance, making innovation a key competitive differentiator.

Partnerships and collaborations increasingly drive the U.S. red light therapy beds market’s growth to enhance credibility and market reach. For instance, in May 2025, Ammortal secured strong early backing through its partnership with the Denver Broncos and support from MLB’s Matt Chapman, who joined its advisory board. The company’s wellness chambers are strategically installed in high-profile venues such as Proper Hotel Santa Monica, Yellowstone Club, SWTHZ sites, Padel United, and Infinity Club. These collaborations demonstrate how industry players utilize partnerships in sports, hospitality, and fitness to expand their reach, foster trust, and accelerate adoption in the growing wellness and recovery market.

Regulations significantly impact the U.S. red light therapy beds industry, shaping product safety, market access, and consumer trust. FDA clearances and registrations ensure that devices meet strict standards, influencing adoption in medical, wellness, and fitness settings. Compliance also drives innovation, as companies must align technology with regulatory expectations while maintaining therapeutic effectiveness. For instance, in February 2025, Health and Med launched the SpectraLight Full Spectrum Therapy Bed through Spectra Red Light LLC. As an FDA-registered Class 1 medical device, it uses red, blue, green, and near-infrared light to enhance circulation, cellular recovery, and discomfort relief, highlighting the regulation’s role in credibility.

The U.S. market for red light therapy beds faces competition from several product substitutes that address similar wellness, recovery, and aesthetic needs. Competition from alternative therapies is a significant restraint on the market. As consumers seek faster recovery and holistic wellness, red-light beds leveraging photobiomodulation and ATP enhancement compete with cryotherapy, cold-plunge services, infrared saunas, PEMF, and multi-modal recovery chambers, hyperbaric oxygen therapy, IV vitamin infusions, compression systems, and traditional modalities like massage and acupuncture. According to an NCBI study (December 2023), whole-body cryostimulation reduces pain, inflammation and improves metabolic, mental health, and sleep outcomes. These substitutes challenge adoption by competing on efficacy, immediacy, cost, and integration into memberships or athlete-focused packages.

The U.S. industry for red light therapy beds is experiencing notable expansion, driven by growing consumer demand for wellness, recovery, and clinical applications. In October 2024, TheraLight extended its presence to 21 countries, including the U.S., Canada, Europe, and Asia, offering full-body LED light therapy systems such as TheraLight 360 and FIT. This international growth underscores increasing acceptance of red and near-infrared therapies for cellular recovery, pain relief, and overall well-being. Rising adoption in spas, fitness centers, and medical facilities, combined with technological innovations, is fueling industry growth and positioning the U.S. market as a key segment in global expansion strategies.

Device Class Insights

The premium grade segment dominated the U.S. red light therapy beds market in 2024, accounting for the largest revenue share due to high demand from wellness centers, clinics, and athletic facilities. These beds offer high irradiance, precise wavelength control, full-body coverage, and durable construction, delivering clinically relevant results in shorter sessions. Leading brands like NovoTHOR provide U.S.-made beds with red and near-infrared LEDs used by elite athletes and military personnel for recovery, pain relief, and circulation improvement. LightStim beds are also preferred for skin rejuvenation and anti-inflammatory care, supported by precise calibration, long operational life, and reliable customer service.

The economical, budget-friendly segment is projected to experience the fastest growth in the U.S. red light therapy beds market over the forecast period, driven by rising awareness of non-invasive wellness solutions and demand for affordable at-home and professional recovery systems. Brands like Mito Red, MitoRecharge, Vital 2.0, and NEO Science offer cost-effective alternatives while maintaining therapeutic efficacy. The MitoRecharge bed, priced around USD 23,000, features over 4,200 LEDs across four wavelengths, motorized height adjustment, and a modular design for easy setup. It delivers benefits such as improved circulation, recovery, pain relief, and skin rejuvenation, making high-quality light therapy accessible to more users.

Sales Channel Insights

The direct manufacturer sales segment dominated the U.S. red light therapy beds industry in 2024, driven by growing demand for medical-grade, reliable, and safe devices. Purchasing directly offers users certified devices, transparent specifications, and comprehensive support, including installation, training, and warranties. Brands like ARRC LED and Red-Light Wellness leverage direct sales to deliver professional- and home-use beds, implement innovations quickly, and maintain quality standards. This model reduces costs by eliminating intermediaries, making devices more accessible while fostering long-term customer relationships. Direct engagement also enables tailored product design and community-building, enhancing user confidence and driving market adoption across wellness centers, clinics, and homes.

The direct-to-consumer (D2C) online segment is expected to register the fastest CAGR over the forecast period, driven by rising demand for home-focused or dual-use devices. Brands like LightStim and Red-Light Wellness offer FDA-cleared, modular, and user-friendly beds that deliver professional-grade benefits safely at home. Online channels provide lower costs, convenience, and rapid access to innovations such as adjustable panels, app integration, and foldable designs. Enhanced digital experiences, including virtual demos, AR previews, and influencer endorsements, reduce purchase risk, making high-value red light therapy beds more accessible and appealing to individual consumers.

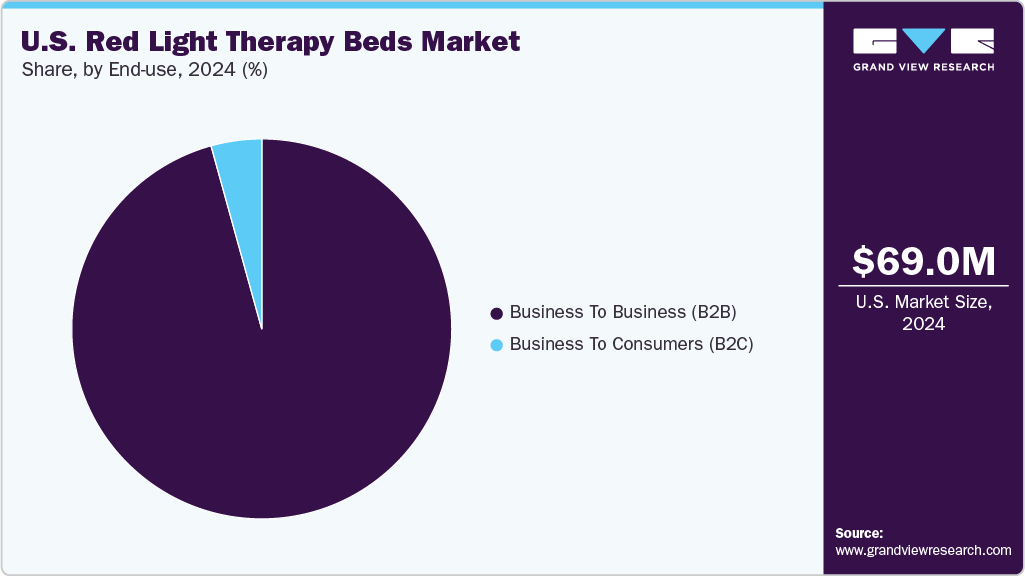

End Use Insights

The B2B segment dominated the U.S. red light therapy beds market in 2024, driven by adoption among clinics, wellness centers, and medical practices integrating these devices into their service offerings. For example, a clinic purchasing TheraLight 360 and Aspen Laser systems enrolled ten patients on the first day and generated USD 13,000 in the first month, prompting a second purchase to meet rising demand. B2B adoption is fueled by immediate revenue potential, professional support, and measurable patient benefits, including improvements in psoriasis, arthritis, pain relief, mental clarity, and overall wellness, highlighting both clinical and financial advantages of advanced red light therapy beds.

The B2C segment is poised to achieve the fastest growth during the forecast period, due to increasing consumer demand for home-based wellness solutions. Buyers are drawn to non-invasive therapies that offer pain relief, reduced inflammation, improved circulation, and skin rejuvenation. Convenience and the ability to integrate treatments into daily routines further drive adoption. Millennials and Gen Z are incorporating red light therapy into fitness and wellness regimens. Rising awareness of long-term health benefits, coupled with affordable, user-friendly home devices, is accelerating growth in the B2C segment across the U.S. market.

Regional Insights

Southeast Red Light Therapy Beds Market Trends

Florida led the Southeast U.S. red light therapy beds market in 2024, driven by its booming tourism and retirement industries. Florida’s 1,350 miles of coastline and world-class resorts have positioned it as a leading wellness destination. Recent investments underscore this shift: in August 2024, Tavistock Development Company announced the USD 1 billion redevelopment of Fort Lauderdale’s Pier Sixty-Six, debuting the Zenova Spa & Wellness with nine treatment rooms and high-tech therapies including LED and red-light treatments. In October 2024, Amrit Ocean Resort in Palm Beach County launched Florida’s largest spa, a 103,000-square-foot facility integrating Eastern and Western wellness traditions with advanced technologies, including red-light therapy, hydrothermal experiences, and MediSpa facial rejuvenation systems.

Midwest Red Light Therapy Beds Market Trends

Michigan led the Midwest U.S. red light therapy beds industry in 2024, influenced by Michigan’s 96,714 square miles, a GDP of USD 706.6 billion, and a population of 10,140,459. The state’s median income is USD 41,662, with 42.4% of residents holding a college degree. In April 2025, Michigan State University (MSU) announced the USD 150 million Spartan Gateway District. Covering 14 acres at Trowbridge and Harrison roads, the development features a 6,000-seat Olympic sports arena, hotel, housing, retail, restaurants, offices, parking, and a future academic or healthcare facility, creating potential for advanced wellness and red-light therapy integration across sports, healthcare, and hospitality sectors.

West Red Light Therapy Beds Market Trends

The California red light therapy beds market is growing due to California’s wellness and sports sectors actively incorporating red-light therapy for recovery, skin health, and performance enhancement. High-profile examples, such as the USD 160,000 Ammortal Chamber featured at the 2025 U.S. Open, highlight rising interest in advanced recovery technologies that combine red-light therapy, near-infrared therapy, PEMF, and vibroacoustic therapy. In April 2025, the Placentia-Yorba Linda Unified School District transformed its multipurpose room into a high-tech gym and recovery center at the Universal Sports Institute, providing students with recliners equipped with red-light therapy for muscle recovery and illustrating adoption beyond private spas into public institutions.

Northeast Red Light Therapy Beds Market Trends

The New York red light therapy beds market is growing due to advanced systems like the USD 160,000 Ammortal Chamber (launched 2023) being introduced at wellness and sports facilities across the state. This device integrates red and near-infrared light, PEMF/PEF, vibroacoustic therapy, molecular hydrogen, guided meditation, and breathwork, offering multiple therapeutic benefits in a single session. Ammortal reports that 95% of users achieve deep relaxation, 85% notice improved focus, and 90% experience a “caffeinated calm.” Professional athletes, including MLB’s Bobby Miller, credit it for faster recovery, while teams like the Arizona Diamondbacks and the NFL’s Denver Broncos have incorporated it into their training programs.

Southwest Red Light Therapy Beds Market Trends

The Texas red light therapy beds market is growing due to increasing adoption within athletic institutions. Texas Christian University (TCU) in Fort Worth unveiled the USD 50 million Simpson Family Restoration Center ahead of the September 2025 football season, featuring infrared therapy beds, relaxation pods, cryo lounges, and hydrotherapy pools. These innovations support student-athletes by accelerating recovery from bone and soft-tissue injuries, enhancing blood circulation, and reducing inflammation at the cellular level. Coupled with Texas’s diverse population, strong wellness culture, and rapid integration of advanced recovery technologies, the state is emerging as one of the fastest-expanding regional markets for red light therapy beds in the U.S.

Key U.S. Red Light Therapy Beds Company Insights

Market players such as TheraLight and NovoTHOR have positioned themselves prominently in the U.S. red light therapy beds market by focusing on innovation, quality, and competitive pricing. Companies are developing advanced full-body LED systems with precise wavelength control, high irradiance, and user-friendly designs to meet growing demand in wellness, fitness, and clinical sectors. Strategic initiatives include direct-to-consumer sales, digital engagement, and professional support services, enhancing accessibility and customer trust. By combining technological advancements with effective marketing and service models, these players are driving adoption, strengthening brand recognition, and maintaining a competitive edge in a rapidly expanding the market.

Key U.S. Red Light Therapy Beds Companies:

- THOR PHOTOMEDICINE LTD (NovoThor)

- TheraLight

- Prism Light Pod

- Red Light Wellness

- Ammortal

- Body Balance System

- Mito Red

- LightStim

- NEO Science

- Spectra Red Light LLC (Vasindux)

- Vital Red Light

- Precor

- ARRC LED

Recent Developments

-

In May 2025, TheraLight unveiled the TheraLight 360i, a cutting-edge whole-body therapy bed integrating Photobiomodulation, PEMF, and Acoustic Resonance. This multi-modality system enhances cellular repair, circulation, relaxation, and recovery. With 45,000 LEDs and synchronized therapies, it delivers drug-free, non-invasive solutions for longevity, performance optimization, and holistic body-mind revitalization.

-

In July 2024, the podcast "Yours Mine Away," hosted by Mark Howard, has renewed its sponsorship with Mito Red Light, a company specializing in red light therapy devices. This partnership will provide listeners with valuable health insights, new product information, and special promotions from Mito Red Light

-

In October 2023, Prism Light Pod launched its fourth-generation red light therapy bed, delivering 30% more irradiance with 17,000 LEDs, improved reflective shelves, and wavelengths of 630nm, 660nm, and 850nm. Designed for spas and recovery centers, it accelerates healing, relieves pain, supports anti-aging, and is energy-efficient and safe.

U.S. Red Light Therapy Beds Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 84.7 million

Revenue forecast in 2033

USD 198.4 million

Growth rate

CAGR of 11.2% from 2025 to 2033

Actual data

2018 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in units, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Device class, sales channel, end use, region

Regional scope

U.S. (Southeast, Midwest, West, Northeast, Southwest)

State scope

Arizona, New Mexico, Oklahoma, Texas, Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island, Vermont, New Jersey, New York, Pennsylvania, Delaware

Maryland, Alaska, California, Colorado, Hawaii, Idaho, Montana, Nevada, Oregon, Utah, Washington, Wyoming,Illinois, Indiana, Michigan, Ohio, Wisconsin, Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota

South Dakota, Alabama, Arkansas, Florida, Georgia, Kentucky, Louisiana, Mississippi, North Carolina, South Carolina, Tennessee, Virginia, West Virginia.

Key companies profiled

NovoTHOR; TheraLight; Prism Light Pod; Red Light Wellness; Ammortal; Body Balance; Mito Red; LightStim; NEO Science; Spectra Red Light LLC; Vital Red Light; Precor; ARRC LED

Customization scope

Free report customization (equivalent upto 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Red Light Therapy Beds Market Report Segmentation

This report forecasts volume & revenue growth at the country level and analyzes the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the U.S. red light therapy beds market report based on device class, sales channel, end use, and region:

-

Device Class Outlook (Volume, Units; Revenue, USD Million, 2018 - 2033)

-

Premium Grade

-

Economical-Budget Friendly

-

-

Sales Channel Outlook (Volume, Units; Revenue, USD Million, 2018 - 2033)

-

Direct Manufacturer Sales

-

Authorized Distributors/Dealers

-

Direct-to-Consumer (D2C-Online)

-

-

End Use Outlook (Volume, Units; Revenue, USD Million, 2018 - 2033)

-

Business to Business (B2B)

-

Wellness Clinics & Spas

-

Medical/Therapeutical Clinics

-

Sports Facilities

-

-

Business to Consumers (B2C)

-

-

Regional Outlook (Volume, Units; Revenue, USD Million, 2018 - 2033)

-

Southeast

-

Alabama

-

Arkansas

-

Florida

-

Georgia

-

Kentucky

-

Louisiana

-

Mississippi

-

North Carolina

-

South Carolina

-

Tennessee

-

Virginia

-

West Virginia

-

-

Midwest

-

Illinois

-

Indiana

-

Michigan

-

Ohio

-

Wisconsin

-

Iowa

-

Kansas

-

Minnesota

-

Missouri

-

Nebraska

-

North Dakota

-

South Dakota

-

-

West

-

Alaska

-

California

-

Colorado

-

Hawaii

-

Idaho

-

Montana

-

Nevada

-

Oregon

-

Utah

-

Washington

-

Wyoming

-

-

Northeast

-

Connecticut

-

Maine

-

Massachusetts

-

New Hampshire

-

Rhode Island

-

Vermont

-

New Jersey

-

New York

-

Pennsylvania

-

Delaware

-

Maryland

-

-

Southwest

-

Arizona

-

New Mexico

-

Oklahoma

-

Texas

-

-

Frequently Asked Questions About This Report

b. The U.S. red light therapy beds market size was estimated at USD 69.0 million in 2024 and is expected to reach USD 84.7 million in 2025.

b. The U.S. red light therapy beds market is expected to grow at a compound annual growth rate of 11.2% from 2025 to 2033 to reach USD 198.4 million by 2033.

b. The premium grade segment dominated the U.S. red light therapy beds market in 2024, accounting for the largest revenue share due to high demand from wellness centers, clinics, and athletic facilities. These beds offer high irradiance, precise wavelength control, full-body coverage, and durable construction, delivering clinically relevant results in shorter sessions.

b. The key players operating in the U.S. red light therapy beds market are NovoTHOR, TheraLight, Prism Light Pod, Red Light Wellness, Ammortal, Body Balance, Mito Red, LightStim, NEO Science, Spectra Red Light LLC, Vital Red Light, Precor, ARRC LED.

b. Key factors that are driving the market growth include rising consumer awareness of non-invasive wellness solutions, expanding adoption in medical and wellness centers, increasing availability of affordable options, and technological advancements enhancing treatment effectiveness and user convenience.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.