- Home

- »

- Advanced Interior Materials

- »

-

U.S. Rental Air Compressor Market, Industry Report, 2033GVR Report cover

![U.S. Rental Air Compressor Market Size, Share & Trends Report]()

U.S. Rental Air Compressor Market (2025 - 2033) Size, Share & Trends Analysis Report By Technology (Reciprocating, Rotary/Screw), By Product (Stationary, Portable), By Lubrication, By Rental Type, By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-653-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Rental Air Compressor Market Summary

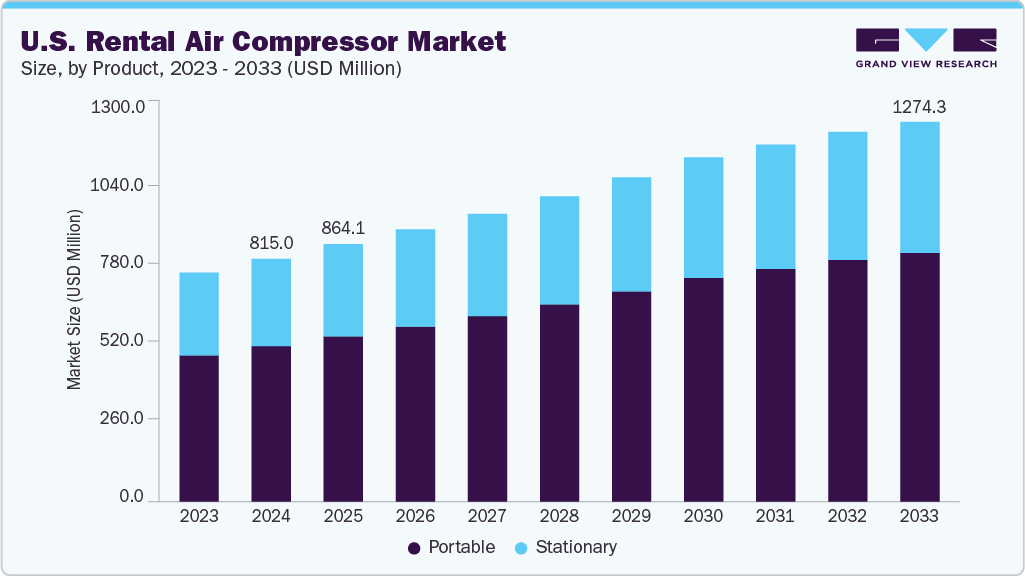

The U.S. rental air compressor market size was estimated at USD 815.0 million in 2024 and is projected to reach USD 1,274.3 million by 2033, growing at a CAGR of 5.0% from 2025 to 2033. The growing demand from the construction and infrastructure sectors is a major driver of the U.S. rental air compressor industry.

Key Market Trends & Insights

- The rental air compressor market in the U.S. is expected to grow at a substantial CAGR of 5.0% from 2025 to 2033.

- By product, the portable air compressor segment is expected to grow at a considerable CAGR of 5.2% from 2025 to 2033 in terms of revenue.

- By technology, the rotary segment is expected to grow at a considerable CAGR of 5.2% from 2025 to 2033 in terms of revenue.

- By end use, the manufacturing segment is expected to grow at a considerable CAGR of 6.2% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 815.0 Million

- 2033 Projected Market Size: USD 1,274.3 Million

- CAGR (2025-2033): 5.0%

Contractors increasingly prefer rental options to reduce upfront costs, improve flexibility, and avoid long-term equipment maintenance. Another key factor is the expanding use of air compressors in the industrial and oil & gas sectors. These industries often require temporary compressed air solutions for plant shutdowns, maintenance, or unplanned outages. Renting allows them to access advanced and efficient systems without capital investment. Moreover, technological advancements in portable and energy-efficient compressors are making rentals more attractive.

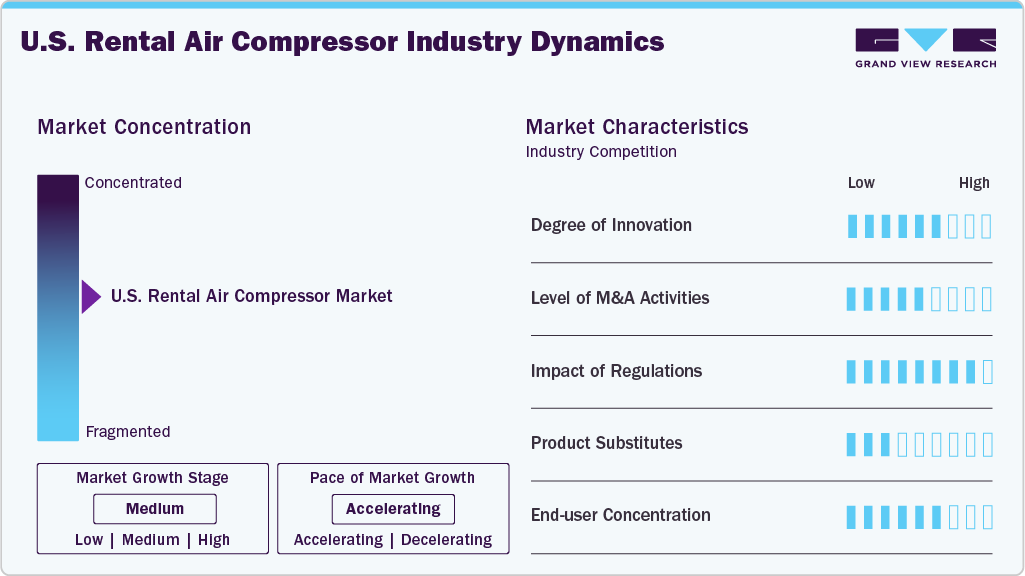

Market Concentration & Characteristics

The U.S. rental air compressor industry is moderately concentrated, with a mix of large national players and several regional providers. Major companies hold a significant market share, offering wide-ranging fleets and nationwide coverage. However, the presence of numerous local and specialized firms adds a degree of fragmentation. This structure fosters healthy competition, driving service innovation and price competitiveness across the industry.

The U.S. rental air compressor industry is witnessing steady innovation focused on energy efficiency, noise reduction, and digital monitoring. Manufacturers are integrating IoT and remote diagnostics to improve performance and reduce downtime. Rental providers are adopting these advanced models to meet customer demand for reliability and cost savings. Innovation is also helping companies align with environmental and operational efficiency goals.

The market has seen notable merger and acquisition activity, driven by the need to expand regional presence and diversify product offerings. Large rental firms continue to acquire smaller, niche players to strengthen their service portfolios. These deals help consolidate the market and improve economies of scale. M&A activity is also enabling rapid entry into emerging industrial and energy segments.

Environmental and safety regulations play a significant role in shaping the U.S. rental air compressor industry. Emission standards from agencies like the EPA influence the design and adoption of low-emission compressor models. Rental firms must maintain compliance by upgrading fleets and following strict maintenance practices. These regulations also push innovation toward cleaner, more efficient equipment.

Drivers, Opportunities & Restraints

The fastest growth in construction, manufacturing, and oil & gas sectors is a primary driver for the U.S. rental air compressor industry. Short-term projects and fluctuating demand encourage businesses to rent rather than purchase equipment. Advancements in compressor technology enhance reliability and energy efficiency, boosting rental appeal. In addition, cost control and operational flexibility further support market growth.

The growing emphasis on green and energy-efficient equipment creates new opportunities for rental providers offering eco-friendly compressors. Expansion into underserved regions and industrial sectors can widen market reach. Demand for digital monitoring and smart compressor solutions also opens up value-added service possibilities. Partnerships with contractors and industries for long-term rental agreements can enhance revenue streams.

High maintenance costs and frequent wear and tear can reduce profitability for rental companies. Intense competition among local and national players pressures pricing and margins. Regulatory compliance adds to operational complexity, requiring regular equipment upgrades. Moreover, economic downturns or project delays can reduce rental activity and market stability.

Technology Insights

Reciprocating air compressor segment is expected to grow at the fastest CAGR of 4.6% from 2025 to 2033 in terms of revenue. The rotary/screw air compressor segment led the market with the largest revenue share of 55.7% in 2024, due to their high efficiency and continuous airflow capabilities. These units are increasingly preferred for industrial and large-scale applications that demand consistent performance. Their lower noise levels, compact design, and energy-saving features appeal to environmentally conscious users. Advancements in variable-speed drives and digital controls are further accelerating their adoption in the rental market.

The reciprocating compressors segment is anticipated to grow at the fastest CAGR during the forecast period, due to their affordability and simple maintenance. These compressors are well-suited for intermittent and small-scale applications, commonly found in construction and workshops. Their rugged design and ability to operate without continuous airflow make them a reliable choice. As a result, they remain a staple in many rental fleets across the country.

Product Insights

Stationary air compressor segment is expected to grow at the fastest CAGR of 4.5% from 2025 to 2033 in terms of revenue. The portable air compressor segment led the market with the largest revenue share of 64.0% in 2024, due to their flexibility and ease of transport across job sites. They are widely used in construction, roadwork, and utility projects where mobility is essential. Their compact design and compatibility with various pneumatic tools enhance their practicality. High demand for temporary and remote operations further solidifies their leading position in rental fleets.

The stationary compressors segment is anticipated to grow at the fastest CAGR during the forecast period, due to rising demand from industrial and manufacturing sectors. These compressors offer high power output and efficiency for continuous, long-duration operations. Businesses prefer renting stationary units for plant maintenance, shutdowns, or supplemental air supply. Their ability to support critical, large-scale applications is driving their increased adoption.

Lubrication Insights

The oil-free compressor segment is expected to grow at the fastest CAGR of 5.8% from 2025 to 2033 in terms of revenue. The oil-filled compressor segment led the market with the largest revenue share of 54.7% in 2024, due to their durability and ability to handle high-demand applications. They are ideal for construction, automotive, and industrial uses where performance and longevity are critical. Their superior cooling and lubrication systems allow for extended operation under tough conditions. As a result, they are widely preferred in heavy-duty rental scenarios.

The oil-free compressors segment is anticipated to grow at the fastest CAGR during the forecast period, due to increasing demand in cleanroom, pharmaceutical, and food processing industries. These compressors eliminate the risk of oil contamination, making them suitable for sensitive applications. Their low maintenance needs and eco-friendly operation also appeal to environmentally focused customers. Regulatory pressure and industry standards are further encouraging their adoption in specialized sectors.

Rental Type Insights

The long term rentals segment is expected to grow at the fastest CAGR of 4.8% from 2025 to 2033 in terms of revenue. The short term rental compressor segment led the market with the largest revenue share of 64.3% in 2024, owing to their suitability for temporary projects and emergency needs. Construction sites, event setups, and maintenance shutdowns often require compressors for limited durations. Customers prefer short-term options to avoid long-term commitments and reduce upfront costs. This flexibility and quick availability make short-term rentals the preferred choice across various sectors.

The long-term rentals segment is anticipated to grow at the fastest CAGR during the forecast period, as industries seek stable, cost-effective solutions for ongoing operations. Manufacturing plants, utilities, and large-scale infrastructure projects benefit from consistent access to equipment without ownership costs. Companies also use long-term rentals to test equipment performance before making capital investments. The trend toward outsourcing non-core functions further supports long-term rental growth.

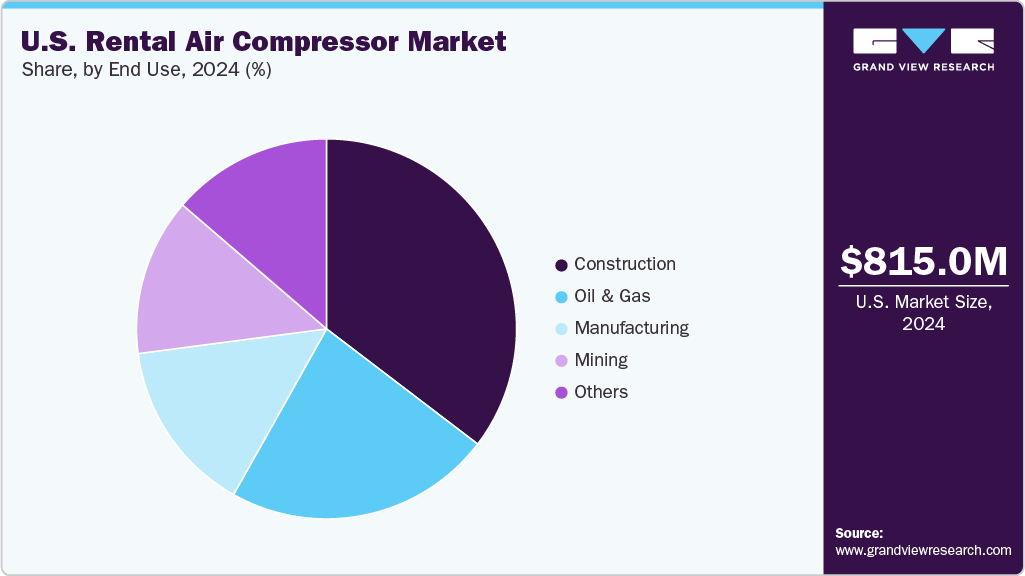

End Use Insights

The manufacturing segment is expected to grow at the fastest CAGR of 6.0% from 2025 to 2033 in terms of revenue. The construction segment led the market with the largest revenue share of 35.4% in 2024, due to its constant need for mobile and reliable equipment. Air compressors are essential for powering tools, sandblasting, and other on-site operations. The preference for renting over buying in short-term or seasonal projects supports high rental demand. Ongoing infrastructure development and urban projects continue to drive this dominance.

The manufacturing sector is anticipated to grow at the fastest CAGR during the forecast period, due to rising demand for continuous, high-capacity compressed air solutions. As facilities seek efficiency and cost control, many opt for long-term rentals over capital expenditure. Oil-free and energy-efficient compressors are particularly in demand for clean and precision-based production. Growth in automotive, food processing, and electronics manufacturing further accelerates this trend.

Key U.S. Rental Air Compressor Company Insights

- Some of the key players operating in the market include Atlas Copco; OTC Industrial Technologies; United Rental Inc.

-

OTC Industrial Technologies is an industrial equipment, service, and supply company in the United States. Its product portfolio includes air compressors, pumps, bearings, motors, filtration systems, and other industrial machinery and tools. The company owns multiple companies such as OTP industrial solutions, Advanced Industrial Products, and others. Its air supply group of companies includes DIRECTAIR, Air Technologies, IDG COMPRESSOR, CAS Compressed Air Systems, PK Controls, and LARON Air Supply.

-

United Rentals Inc. provides a wide range of equipment, including heavy machinery, aerial work platforms, portable generators, general construction tools, and more. Their inventory of air compressors comprises stationery and portable air compressors from Atlas Copco, Hitachi U.S. Air Power, US LLC, Doosan Corporation, and Mi-T-M Corporation.

Key U.S. Rental Air Compressor Companies:

- CATERLPILLAR INC.

- Atlas Copco

- OTC Industrial Technologies

- United Rental Inc

- Sunbelt Rentals

- Texas First Rentals

- Empire Tool Rentals

- Pro Rental & Sales

- Mountain Air Compressor

- MacAllister Rentals

Recent Developments

-

In October 2024, Atlas Copco merged its North American rental businesses, Prime Service Inc. and Rental Service Corporation, into a single organization. The integration aims to improve operational efficiency and enhance service delivery across the industrial and construction sectors. The merged entity will continue to serve customers under two specialized brands while operating under a unified management structure. This strategic move strengthens Atlas Copco’s presence and competitiveness in the equipment rental market.

-

In July 2023, OTC Industrial Technologies opened a new distribution center in Cincinnati, Ohio, to improve logistics and streamline operations. The facility is designed to speed up order processing and ensure better inventory control. It also aims to enhance coordination with suppliers, offering a wider range of products and faster delivery times. This development strengthens OTC’s ability to provide efficient, customer-focused industrial distribution services.

U.S. Rental Air Compressor Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 864.1 million

Revenue forecast in 2033

USD 1,274.3 million

Growth rate

CAGR of 5.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Technology, product, lubrication, rental type, end use

Country Scope

U.S.

Key companies profiled

CATERLPILLAR INC.; Atlas Copco; OTC Industrial Technologies; United Rental Inc.; Sunbelt Rentals; Texas First Rentals; Empire Tool Rentals; Pro Rental & Sales; Mountain Air Compressor; MacAllister Rentals

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Rental Air Compressor Market Report Segmentation

This report forecasts revenue growth at the U.S. level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. rental air compressor market report based on product, rental type, lubrication, technology, and end use

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Stationary

-

Portable

-

-

Rental Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Short Term Rental

-

End Use

-

-

Long Term Rental

-

End Use

-

-

-

Lubrication Outlook (Revenue, USD Million, 2021 - 2033)

-

Oil Free

-

Oil Filled

-

-

Technology Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Reciprocating

-

Rotary/Screw

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Manufacturing

-

Construction

-

Mining

-

Oil & Gas

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. rental air compressor market size was estimated at USD 815.0 million in 2024 and is expected to reach USD 864.1 million in 2025.

b. The U.S. rental air compressor market is expected to grow at a compound annual growth rate of 5.0% from 2025 to 2033 to reach USD 1,274.3 million by 2033.

b. The portable air compressor segment dominates the market and accounted for the 64.0% share, due to their flexibility and ease of transport across job sites. They are widely used in construction, roadwork, and utility projects where mobility is essential.

b. Some of the key players operating in the rental air compressor market include CATERLPILLAR INC.; Atlas Copco; OTC Industrial Technologies; United Rental Inc; Sunbelt Rentals; Texas First Rentals; Empire Tool Rentals; Pro Rental & Sales; Mountain Air Compressor; MacAllister Rentals

b. The key factors driving the U.S. rental air compressor market include increasing infrastructure development and industrial expansion, which require flexible and cost-effective equipment solutions. Additionally, the shift toward energy-efficient and low-maintenance compressors enhances rental demand across various end-use sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.