- Home

- »

- Homecare & Decor

- »

-

U.S. Residential Organic Compost Market Size Report, 2030GVR Report cover

![U.S. Residential Organic Compost Market Size, Share & Trends Report]()

U.S. Residential Organic Compost Market (2022 - 2030) Size, Share & Trends Analysis Report By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-956-2

- Number of Report Pages: 50

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

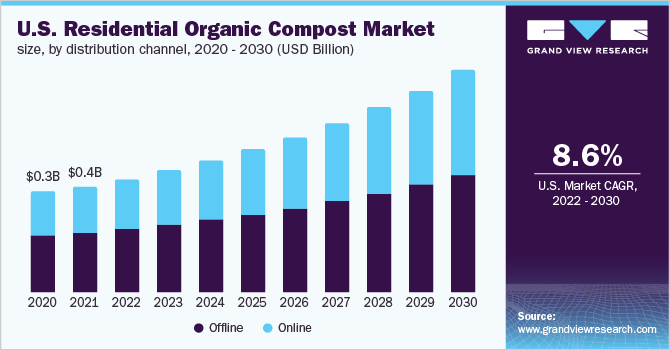

The U.S. residential organic compost market size was valued at USD 363.2 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 8.6% from 2022 to 2030. The popularity of gardening as a hobby is increasing, especially among the younger generation is driving the demand for organic compost. The COVID-19 pandemic has positively impacted the demand from the households in the country. As the pandemic restricted people inside their homes during the lockdowns, a higher number of people engaged in gardening activities. Also, some families started growing vegetables and fruits for self-consumption as the pandemic increased the interest of consumers in healthier foods.

Even after the pandemic subsided and restrictions have been eased, the trend toward eating healthier, which had picked up during the pandemic, is continuing. Consumers have continued to be indulged in the consumption of self-grown organic vegetables and fruits, thereby generating demand for organic compost.

In addition, people in the U.S. are becoming more environmentally conscious and adopting environment-friendly production practices. An increasing number of people are becoming conscious of reducing the use of pesticides and fertilizers, owing to their harmful impacts on soil and produce. As a result, a rising number of people are replacing the use of harmful chemicals with organic compost, leading to increased market revenues.

The trend for landscaping has been seen increasing in the U.S., especially in the last few years. An increasing number of people are looking to transform residential outdoor spaces by accommodating areas such as lawns, outdoor kitchens, and party spots for entertainment and leisure. Furthermore, consumers living in urban areas are increasingly interested in being surrounded by greenery but continuing to live in urban spaces. Such trends have up-surged the demand for organic compost in the U.S.

The growing residential construction activities in the U.S. is another prominent factor contributing to the rising demand for organic compost. According to U.S. Census Bureau, the number of housing units in the U.S. increased from 135.3 million in July 2015 to 142.1 million in July 2020, witnessing a growth of around 5% during the period. The growth in housing construction is driving the demand for lawn & gardening consumables, including residential organic compost used in landscaping activities at newly constructed buildings.

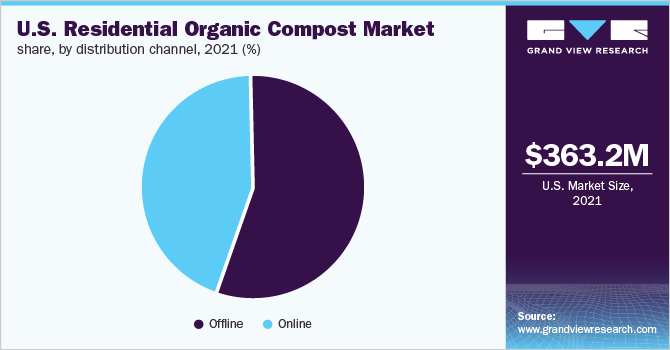

Distribution Channel Insights

The offline segment accounted for the largest contribution in the U.S. market for residential organic compost of more than 55% in 2021. Most residential U.S. consumers still prefer buying organic compost from garden centers, topsoil suppliers, or other brick-and-mortar stores. Consumers like to have a look at and physically examine the products before buying as there is a lot of difference in the quality of organic compost provided by the manufacturers.

Some manufacturers in the U.S. use human sewage sludge, terming them biosolids, from hospitals and industrial plants which contain harmful chemicals and heavy metals. Due to the concerns regarding the usage of such stuff, consumers like to check the compost by themselves by smelling and feeling it in their hands, while also asking the seller a lot of questions about its ingredients and formation. This is one of the prominent reasons for the offline segment generating the major part of the revenue in the U.S. residential organic compost market.

The online distribution channel is projected to register a CAGR of 9.3% during the forecast period, significantly higher than the offline segment. The surge in internet penetration among the population has given rise to a large number of online shoppers in the U.S. Especially the COVID-19 pandemic has been a significant contributor to the rise in digitalization. Since the pandemic, many manufacturers focus on strengthening their sales from the online channel.

Manufacturers are providing discounts on online purchases, which are attracting new customers to the online channel. Amazon is a popular e-commerce platform in the U.S. from where residential consumers buy organic compost. Charlie’s Compost is one of the well-liked organic compost manufacturers in the U.S. which sells its products directly on Amazon. Its compost is certified organic by the state of Kentucky and sells its regular compost at USD 20 for 10lbs.

Key Companies & Market Share Insights

The market includes both international and domestic participants. Key market players focus on strategies such as innovation and new product launches in retail about organic compost to enhance their portfolio offering in the market.

-

In January 2022, the U.S.-based Atlas Organics announced a transformational transaction with Generate Capital to expand its organic compost facilities nationwide.

-

In December 2020, Atlas Organics announced the expansion of its operations in San Antonio, Texas. The new composting facility has residential food waste processing and composting management.

Some prominent players operating in the U.S. residential organic compost market include:

-

Malibu Compost

-

American Composting, Inc.

-

Cedar Grove

-

Atlas Organics

-

Blue Ribbon Organics

-

Garden-Ville

-

Dairy Doo

-

Vermont Compost Company

-

The Compost Company

-

Walt's Organic

U.S. Residential Organic Compost Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 388.2 million

Revenue forecast in 2030

USD 763.8 million

Growth Rate

CAGR of 8.6% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Distribution channel

Country scope

U.S.

Key companies profiled

Malibu Compost; American Composting, Inc.; Cedar Grove; Atlas Organics; Blue Ribbon Organics; Garden-Ville; Dairy Doo; Vermont Compost Company; The Compost Company; Walt's Organic

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Residential Organic Compost Market Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. residential organic compost market report based on distribution channel:

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Online

-

Offline

-

Frequently Asked Questions About This Report

b. The U.S. Residential Organic Compost Market was estimated at USD 363.2 million in 2021 and is expected to reach USD 388.2 million in 2022.

b. The U.S. Residential Organic Compost Market is expected to grow at a compound annual growth rate of 8.6% from 2022 to 2030 to reach USD 763.8 billion by 2030.

b. Offline dominated the U.S. Residential Organic Compost Market with a share of 55.30% in 2021. This is attributed to the consumer behavior of preference to have a look at and physically examine the products before buying.

b. Some key players operating in the canned seafood market includes StarKist Co., Nippon Suisan Kaisha, Ltd, Maruha Nichiro Corporation, Icicle Seafoods Inc., LDH (La Doria) Ltd, Wild Planet Foods, Thai Union Frozen Products, American Tuna, Inc., Universal Canning, Inc., Tri Marine Group, Trident Seafoods Corporation, Connors Bros. Ltd. (Brunswick Seafoods)

b. Key factors that are driving the U.S. Residential Organic Compost Market growth include the popularity of gardening as a hobby is increasing, especially among the younger generation, in the U.S. which is giving way to a rise in demand for organic compost.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.