- Home

- »

- Automotive & Transportation

- »

-

U.S. Retail Logistics Market Size & Share, 2022 - 2030GVR Report cover

![U.S. Retail Logistics Market Size, Share & Trends Report]()

U.S. Retail Logistics Market (2022 - 2030) Size, Share & Trends Analysis Report By Type, By Solution (Commerce Enablement, Supply Chain Solutions, Transportation Management), By Mode Of Transport, And Segment Forecasts

- Report ID: GVR-4-68039-924-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

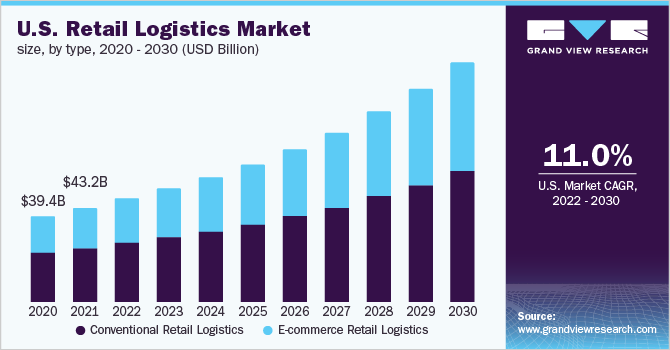

The U.S. retail logistics market size was valued at USD 43.17 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 11.0% from 2022 to 2030. The escalating demand for retail logistics across the U.S. due to the pandemic is expected to propel market growth in the forthcoming years. A retail logistics company provides services, including inventory management, packaging, cross-docking, and door-to-door delivery. The rapid growth of the global e-commerce sector and the development of new technologies drive the demand for logistics services. The end-use industries and manufacturers generally lack the internal control needed for addressing logistics issues. Such factors have provided a boost to the growth of the logistics industry.

Globalization has increased international trades and demands for greater efficiency, in transportation and logistics activities by the end-users, to enable on-time delivery. Regardless of whether the supply chain is international or domestic, effective management of the purchased transportation process, to reduce cost and complexity and improve control, is essential.

Retail logistics include the entire process between a customer ordering a product and receiving it after a few days. The value chain of the target market encompasses each stage of the product movement from the warehouse and final delivery to the customer. It includes receiving the goods, warehousing inventory, processing the order, and delivering them after the requisite packaging and labeling process. During this entire process, a specific value is added at each stage of the process, therefore, contributing to the final value of the delivered product.

The retail logistics value chain constitutes the basic elements such as clients, material suppliers, customers, and vendors. Several clients or companies outsource a part or all of their logistics activities to service providers or vendors. These vendors typically handle more than one client at any given time. The client communicates the receipts or shipments to the logistics vendor, who then conducts the transaction on the client’s behalf. The client is thus either a buyer or seller for a transaction. The activities that are typically carried out by logistics vendors are warehousing, inventory management, cross-docking, transportation, and freight forwarding.

COVID-19 Impact Analysis

The Coronavirus pandemic has affected supply chain operations globally. The crisis placed an unprecedented strain on the transportation industry. The shippers faced uncertainty in the movement of goods owing to the lockdowns in certain countries. The logistics networks were disrupted due to the supply/demand imbalance and lack of capacity for the long-haul and last-mile fulfillment services. The limited staff and reduced working time further limited the logistics activities. The outbreak of COVID-19 had a domino effect on the transportation management service. There has been an imbalance between the incoming and outgoing freights in the infected areas, which is increasing the lead times.

Service providers face numerous problems, such as disruption of transportation due to boundary closures and increased demand for warehouse facilities to store the existing goods that can no longer be sold due to lockdown. To tackle this situation, logistics companies have started short-term storage identification services. DB Schenker Logistics is implementing a service that identifies unused space for warehouses. This service is expected to inform customers about the storage space across 794 locations in 60 countries to find additional warehouse space near the manufacturing facility.

Type Insights

The conventional retail logistics segment accounted for the largest revenue share of 57.31% in 2021 and is expected to remain dominant during the forecast period. The high share is attributable to the rising adoption of conventional retail logistics services by consumers who have limited dependence on the internet, and therefore prefer buying from conventional retail stores. It has been observed that around 36% of shoppers prefer to buy products from traditional retail stores after checking them online. Besides, retail stores enable consumers to pick up and inspect a product. It also provides instant gratification, as shoppers can purchase a product instantly.

The e-commerce retail logistics segment is expected to emerge as the fastest-growing segment, registering a CAGR of 11.8% from 2022 to 2030. The growth is primarily attributed to the emergence of the coronavirus pandemic across the globe, wherein e-commerce channels witnessed sudden growth in terms of sales. Moreover, the growing internet penetration coupled with benefits such as easy & free returns/exchange, fast delivery, reduced shipping charges, and humongous product options, among others, are contributing to the high growth of e-commerce retail. Therefore, to cater to the rapidly growing e-commerce market, logistics companies are investing in developing and broadening their services.

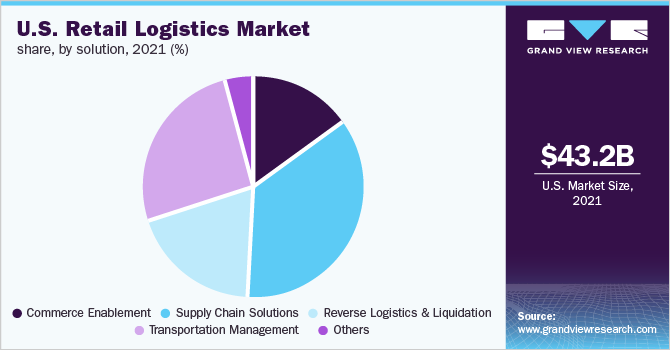

Solution Insights

The supply chain solutions segment accounted for the largest revenue share of 35.98% in 2021 and is expected to continue its dominance during the forecast period. The supply chain enables on-time delivery, optimizes omnichannel operations, personalizes kitting and order fulfillment, and effectively processes customer returns. It also enables fast direct-to-consumer and direct-to-store shipping, which improves warehouse efficiencies as well as optimizes inventory. Further, the segment is anticipated to register the fastest compound annual growth rate (CAGR) of over 12.4% from 2022 to 2030, owing to the rising use of cloud-based supply chain solutions as it helps to track & optimize transportation and manage returns.

The reverse logistics & liquidation segment is expected to register considerable growth during the forecast period. The surging e-commerce industry and the consecutive increase in the number of e-shoppers are resulting in the increasing demand for robust reverse logistics services. Customers are increasingly preferring easy & fast returns/exchanges; therefore, retailers are emphasizing making the process of returning online goods simple and convenient for customers.

Mode of Transport Insights

The roadways mode of transport segment accounted for the largest revenue share of 53.18% in 2021 and is expected to continue its dominance during the forecast period. The high share is attributable to the growing demand for roadways vehicles in long distances transportation of retail products, especially in last-mile deliveries. Also, it provides a high carrying capacity, making it a preferable option. Besides, several government initiatives are supporting segmental growth. For instance, the recent regulations imposed by the Federal Motor Carrier Safety Administration allowing the use of the cameras as a substitute for rearview mirrors are likely to benefit truck drivers in terms of safety.

Moreover, increasing road connectivity and great connectivity by roads is another major factor boosting demand for roadways mode of transport segment. The majority of Tier 2 and Tier 3 cities in several countries are well connected by roads, therefore making it easier for the retail logistics companies to deliver and pick up the products. This trend is expected to continue in the forthcoming years due to road transportation systems advancements and the betterment of roadways across the globe.

Key Companies & Market Share Insights

Key industry participants are FedEx International, A.P Moller- Maersk, C.H. Robinson Worldwide Inc., and United Parcel Service of America, Inc. These companies are focusing on acquisitions, which helps in strengthening their market presence. For instance, in March 2020, C.H. Robinson Worldwide Inc. announced the acquisition of the outstanding shares of Prime Distribution Services, a retail consolidation services provider in North America, for USD 222.7 million. The acquisition aimed to add value-added warehouse capabilities to C.H. Robinson Worldwide Inc.’s retail consolidation platform.

Additionally, market players are continually expanding their logistics capability to stay ahead of the competition by expanding the warehousing capacity. For instance, in April 2022, DSV Panalpina A/S opened a new facility in Lancaster, Texas with over one million square feet of warehousing capacity. It supports over 90,000 pallet positions and has a 40-foot height, 130 dock doors, and 13,000 square feet of temperature-controlled space. It is located close to the DFW Airport, major interstate highways, and intermodal terminals. The logistics facility will serve as a strategic hub for transportation and an entry point for trade with Mexico. Some prominent players in the U.S retail logistics market include:

-

APL Logistics Ltd

-

A.P. Moller – Maersk

-

C.H. Robinson Worldwide, Inc.

-

DSV

-

DHL International GmbH

-

FedEx

-

Kuehne + Nagel International

-

Nippon Express

-

Schneider

-

United Parcel Service

-

XPO Logistics, Inc.

U.S. Retail Logistics Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 43.33 billion

Revenue forecast in 2030

USD 109.31 billion

Growth Rate

CAGR of 11.0% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Type, solution, mode of transport

Country scope

The U.S.

Key companies profiled

APL Logistics Ltd; A.P. Moller – Maersk; C.H. Robinson Worldwide, Inc.; DSV; DHL International GmbH; FedEx; Kuehne + Nagel International; Nippon Express; Schneider

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. retail logistics market report based on type, solution, and mode of transportation:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Conventional Retail Logistics

-

E-Commerce Retail Logistics

-

-

Solution Outlook (Revenue, USD Million, 2017 - 2030)

-

Commerce Enablement

-

Supply Chain Solutions

-

Reverse Logistics & Liquidation

-

Transportation Management

-

Others

-

- Mode of Transport Outlook (Revenue, USD Million, 2017 - 2030)

-

Railways

-

Airways

-

Roadways

-

Waterways

-

Frequently Asked Questions About This Report

b. The U.S. retail logistics market size was estimated at USD 43.17 billion in 2021 and is expected to reach USD 47.33 billion in 2022.

b. The U.S. retail logistics market is expected to grow at a compound annual growth rate of 11.0% from 2022 to 2030 to reach USD 109.31 billion by 2030.

b. The conventional retail logistics segment accounted for the largest revenue share of 57.3% in 2021 and is expected to remain dominant over the forecast period in the market.

b. Some key players operating in the U.S. retail logistics market include APL Logistics Ltd, A.P. Moller – Maersk, C.H. Robinson Worldwide, Inc., DSV, DHL International GmbH, FedEx, Kuehne + Nagel International, Nippon Express, Schneider, among others.

b. Key factors that are driving the U.S. retail logistics market growth include the rapid growth of the global as well as U.S. e-commerce sector and the development of new technologies

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.