- Home

- »

- Pharmaceuticals

- »

-

U.S. Rozanolixizumab (Rystiggo) Market Size Report, 2033GVR Report cover

![U.S. Rozanolixizumab (Rystiggo) Market Size, Share & Trends Report]()

U.S. Rozanolixizumab (Rystiggo) Market (2025 - 2033) Size, Share & Trends Analysis Report By Indication (Generalized Myasthenia Gravis (gMG), Emerging Pipeline Applications), By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-640-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Rozanolixizumab (Rystiggo) Market Summary

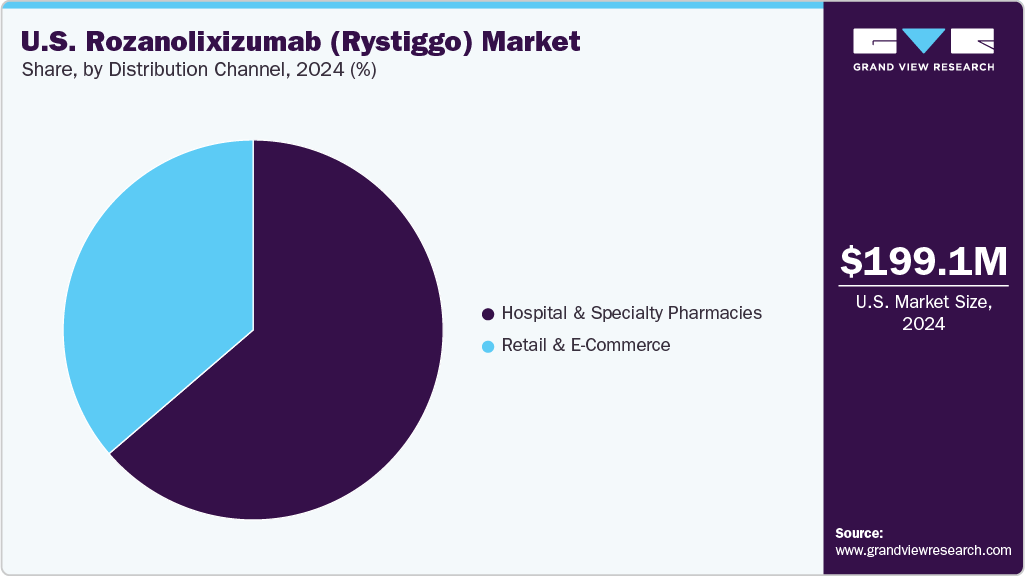

The U.S. Rozanolixizumab (Rystiggo) market size was estimated at USD 199.13 million in 2024 and is expected to grow at a CAGR of 7.30% from 2025 to 2033. The U.S. Rozanolixizumab (Rystiggo) market focuses on treating generalized myasthenia gravis (gMG) in adults with anti-AChR or anti-MuSK antibodies. Growth is driven by demand for targeted biologics, supported by U.S. healthcare infrastructure and reimbursement policies.

The U.S. Rozanolixizumab (Rystiggo) market benefits from the drug’s FDA approval in June 2023 for gMG treatment. Growth is propelled by rising gMG diagnoses, estimated at 3.2 per 100,000 U.S. adults for the MG cases, and increasing demand for biologics targeting autoimmune disorders. UCB Pharma’s focus on subcutaneous administration enhances patient convenience, supporting market expansion. Projections to USD 732.98 million by 3033 reflect a steady CAGR of 7.30%, driven by ongoing clinical advancements and healthcare investments.

Rozanolixizumab (Rystiggo) stands out due to its mechanism of action, reducing IgG levels via FcRn inhibition, offering a novel approach compared to traditional immunosuppressants. Its approval for both anti-AChR and anti-MuSK antibody-positive patients broadens its market scope. Competitive advantages include fewer side effects and flexible dosing, positioning it favorably against alternatives such as efgartigimod. UCB’s marketing efforts emphasize these benefits, targeting neurologists and specialty clinics.

Emerging innovations include trials for additional indications, such as chronic inflammatory demyelinating polyneuropathy (CIDP), which could expand the market beyond gMG. The U.S. leads due to its research infrastructure, with clinical trial data from 2024 suggesting broader applications by 2027. Distribution enhancements via specialty pharmacies and e-commerce platforms further support growth, aligning with patient access trends.

Pricing Analysis

Rystiggo (rozanolixizumab), a selective immunosuppressant for gMG, costs approximately USD 6,549 for a 2 mL supply (140 mg/mL) for cash-paying customers, per Drugs.com. The list price is USD 3,063 per mL vial, but actual costs vary based on health plan coverage. The number of vials per cycle depends on patient weight and symptom-driven provider assessments. Medicare and private insurance may reduce out-of-pocket expenses, with CMS reporting 80% coverage for eligible patients in 2024. Pricing supports Rystiggo’s adoption in the gMG market, balancing cost with its targeted therapeutic value.

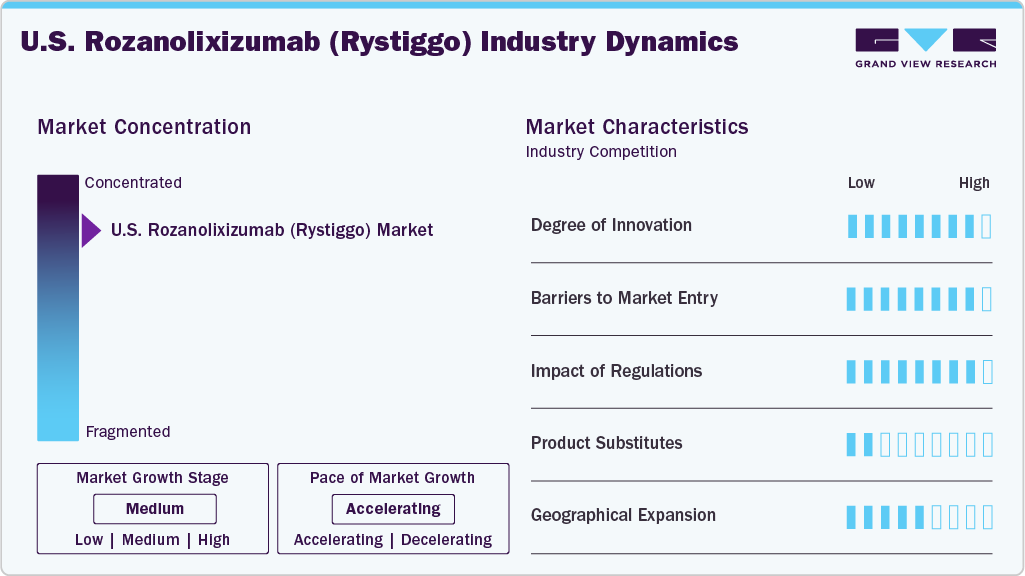

Market Concentration & Characteristics

The U.S. Rozanolixizumab (Rystiggo) market is highly concentrated, with UCB Pharma as the sole provider following its 2023 FDA approval. Competition exists from other gMG treatments like efgartigimod (Argenx), but Rozanolixizumab’s unique subcutaneous delivery provides a niche edge. Market share data from 2024 indicates UCB holds major share of the gMG biologics segment, supported by its established neurology portfolio. Smaller players may emerge as pipeline therapies mature.

Entry barriers include high R&D costs, estimated at USD 500 million per biologic, and stringent FDA requirements for autoimmune drugs. Patent protection until 2038 and exclusivities until 2031 deter generics. Established distribution networks and clinician relationships further limit new entrants, favoring UCB’s dominance through 2030.

The regulatory environment, governed by the FDA, mandates rigorous safety and efficacy data, as seen with Rozanolixizumab’s approval process. Challenges include trial delays and reimbursement negotiations, with Medicare covering major of costs in 2024. Opportunities lie in expanding indications, potentially increasing market size if CIDP approval is secured. U.S. healthcare spending trends support sustained growth.

Strategic partnerships, such as UCB’s collaboration with specialty pharmacies, enhance distribution. Alliances with research institutions accelerate pipeline progress, while marketing agreements with neurologist networks boost adoption. Competitive pressures from biosimilars post-2035 and pricing scrutiny remain risks, but UCB’s early mover advantage sustains its lead.

Indication Insights

Generalized Myasthenia Gravis (gMG) segment dominates, holding major revenue share of 100.00% in 2024, driven by its 2023 FDA approval for anti-AChR and anti-MuSK patients. Prevalence data estimates 75,000-100,000 U.S. MG cases, supporting steady demand. The segment’s CAGR is reflecting consistent uptake in specialty clinics. UCB’s focus on neurologist education reinforces this dominance.

Emerging pipeline applications, including CIDP, account for with a steady growth. Phase III trials (NCT04221477) signal potential approval in upcoming years, targeting 50,000 U.S. CIDP patients. This segment’s growth outpaces gMG due to unmet needs and trial momentum, diversifying UCB’s market footprint.

Distribution Channel Insights

Hospital & Specialty Pharmacies lead the U.S. Rozanolixizumab (Rystiggo) market, with a 68.51% revenue share in 2024. Their dominance stems from gMG treatment complexity, requiring specialized administration and monitoring. A stable growth, supported by partnerships with neurology centers. Reimbursement policies, covering 80% of costs via Medicare, bolster this channel’s position.

Retail & E-Commerce channels is driven by patient demand for convenience and UCB’s 2024 e-pharmacy agreements. This segment’s rise aligns with broader pharmaceutical distribution trends, enhancing market reach.

Key U.S. Rozanolixizumab (Rystiggo) Company Insights

UCB Pharma leads the U.S. Rozanolixizumab (Rystiggo) market, leveraging its 2023 FDA approval and neurology expertise. Rystiggo’s subcutaneous delivery and gMG focus drive its segment share. UCB’s strategies include trial investments for CIDP and partnerships with specialty pharmacies. Competitors such as Argenx (efgartigimod) challenge with alternative biologics, but UCB’s pipeline diversification sustains its edge.

Key U.S. Rozanolixizumab (Rystiggo) Companies:

- UCB

Recent Developments

-

In January 2024, the European Commission approved Rystiggo for adult patients with generalized myasthenia gravis, enabling access across 27 EU countries, Iceland, Liechtenstein, and Norway. Based on the MycarinG study’s significant MG-ADL score improvements, this milestone strengthens UCB’s neurology portfolio and enhances patient access through specialized clinics.

-

In March 2024, UCB announced positive Phase 3 trial results for Rystiggo in CIDP, demonstrating significant improvements in INCAT disability scores and grip strength. This advances Rystiggo’s potential as a novel treatment for nerve disorders, addressing unmet needs compared to IVIG, with regulatory submissions planned for 2026.

-

In June 2024, the FDA granted Rystiggo orphan drug designation for an undisclosed rare autoimmune condition, supporting trials for diseases like MOG-AD. This designation offers incentives for development, potentially broadening Rystiggo’s therapeutic scope and addressing critical gaps in rare disease treatment options.

U.S. Rozanolixizumab (Rystiggo) Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 417.26 million

Revenue forecast in 2033

USD 732.98 million

Growth rate

CAGR of 7.30% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Indication and distribution channel

Key companies profiled

UCB

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Rozanolixizumab (Rystiggo) Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. Rozanolixizumab (Rystiggo) market report based on indication and distribution channel:

-

Indication Outlook (Revenue, USD Million, 2021 - 2033)

-

Generalized Myasthenia Gravis (gMG)

-

Emerging Pipeline Applications

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospital & Specialty Pharmacies

-

Retail & E‑Commerce

-

Frequently Asked Questions About This Report

b. The U.S. Rozanolixizumab (Rystiggo) market size was estimated at USD 199.13 million in 2024 and is expected to reach USD 417.26 million in 2025.

b. The U.S. rozanolixizumab (Rystiggo) market is projected to grow at a CAGR of 7.30% from 2025 to 2033 to reach USD 732.98 million by 2033.

b. Based on indication, Generalized Myasthenia Gravis (gMG) segment dominates, holds a 100.00% revenue share, reflecting its exclusive FDA-approved indication and clinical application in this therapeutic area.

b. UCB Pharma remains the sole company marketing rozanolixizumab (Rystiggo) in the U.S., launching the subcutaneous FcRn‑blocking antibody in June 2023 exclusively for generalized myasthenia gravis, with no competing manufacturers currently offering this therapy

b. The U.S. rozanolixizumab (Rystiggo) market is driven by FDA approval for gMG, increasing disease prevalence, patient preference for subcutaneous administration, limited treatment alternatives, growing neurologist adoption, and its targeted FcRn mechanism offering effective symptom control and improved patient quality of life.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.