- Home

- »

- Advanced Interior Materials

- »

-

U.S. Sealing Membranes Market Size, Industry Report, 2030GVR Report cover

![U.S. Sealing Membranes Market Size, Share & Trends Report]()

U.S. Sealing Membranes Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Sheet Membranes, Liquid-Applied Membranes), By End Use (Residential, Commercial, Industrial), And Segment Forecasts

- Report ID: GVR-4-68040-708-9

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Sealing Membrane Market Summary

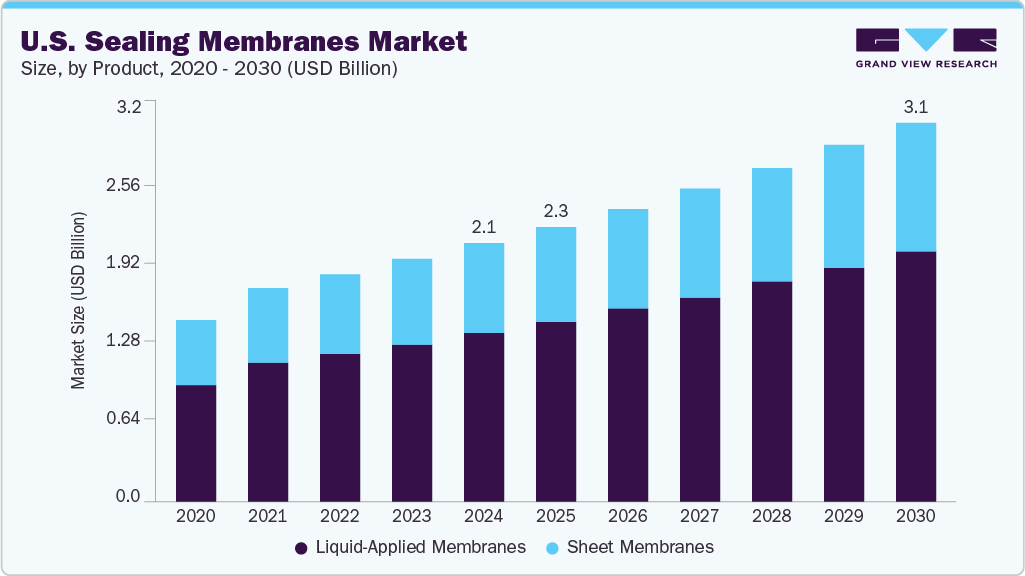

The U.S. sealing membranes market size was estimated at USD 2.12 billion in 2024 and is projected to reach USD 3.11 billion by 2030, growing at a CAGR of 6.6% from 2025 to 2030. This is attributed to the surging demand for dependable waterproofing solutions across the construction industry.

Key Market Trends & Insights

- Based on product type, the liquid-applied membranes segment led the market and accounted for the largest revenue share of 65.1% in 2024

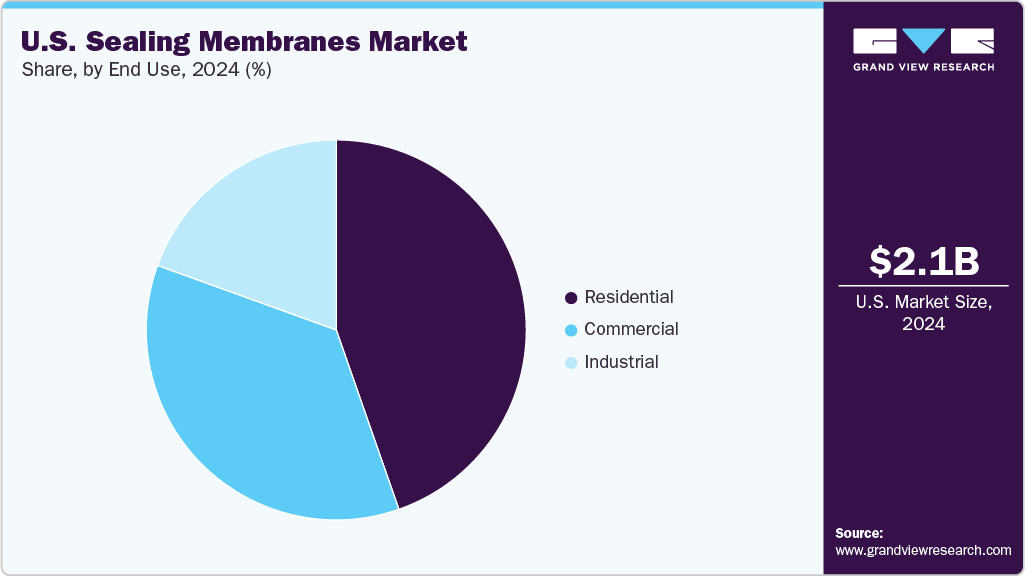

- Based on end use, the residential segment dominated the market and accounted for the largest revenue share of 44.7%, in 2024

Market Size & Forecast

- 2024 Market Size: USD 2.12 Billion

- 2030 Projected Market Size: USD 3.11 Billion

- CAGR (2025-2030): 6.6%

Waterproofing membranes protect buildings from moisture, enhance energy efficiency, and extend structural lifespan. Increased recognition of these advantages, along with regulatory changes and sustainability objectives, is encouraging wider use of these products in residential, commercial, and industrial sectors. Investment in infrastructure development is a major factor driving the growth of the sealing membranes industry. Funding from federal and state governments for transportation, public facilities, and utility projects is boosting the need for durable construction materials. Waterproofing membranes are preferred in such projects due to their effectiveness in preventing water damage and withstanding harsh environmental conditions.

Sustainability is becoming increasingly important in the market, as green building standards and energy regulations encourage the use of environmentally friendly and energy-efficient materials. In response, manufacturers are developing membranes with low emissions, long durability, and compatibility with energy-efficient roofing systems. In February 2025, GAF launched its EnergyGuard NH TCPP-Free Polyiso insulation line, representing a notable advancement in sustainable roofing products.

Product Insights

The liquid-applied membranes segment dominated the market and accounted for the largest revenue share of 65.1% in 2024. It is estimated to expand from 2025 to 2030, demonstrating its increasing prominence in modern construction and renovation practices.Liquid-applied membranes are gaining traction due to their flexibility, seamless application, and adaptability to complex surfaces. Liquid formulations easily conform to irregular shapes, making them ideal for repairs and renovations on uneven surfaces. The ease of applying these membranes without significant demolition further boosts their appeal. Increased housing demands and construction spending in the U.S. also contribute to their growth, particularly in new builds requiring seamless waterproofing in the U.S. sealing membranes industry. Innovation drives the adoption of liquid-applied membranes, with advancements in eco-friendly and fast-curing options. In January 2025, Sika introduced Sikalastic-701 SF, Sikalastic-702, and Sikalastic-702 THX, expanding their liquid-applied membrane offerings.

The sheet membranes segment is expected to experience a significant CAGR of 6.2% for the forecast period. The market is shifting towards materials offering both performance and environmental benefits. Thermoplastic Polyolefin (TPO) is emerging as a leading product due to its UV resistance, energy efficiency, and lightweight properties. TPO's environmental friendliness aligns with sustainability trends, driving its adoption in new construction and renovations.

End Use Insights

The residential segment dominated the market with the largest revenue share of 44.7% in 2024 and is expected to grow at the fastest CAGR over the forecast period. This is due to the continuous demand for new housing construction and renovation activities. Homeowners and builders prioritize effective waterproofing for foundations, roofs, and basements to protect structural integrity and extend property lifespan. Increased awareness of moisture protection's long-term benefits and government incentives have elevated waterproofing from a discretionary expense to a critical investment. Furthermore, a growing focus on maintaining and upgrading an aging housing stock, alongside efforts to enhance durability and energy efficiency, ensures a stable and resilient demand for sealing membranes in this segment.

The commercial sector is expected to experience a significant CAGR of 6.5% for the forecast period. Stricter building codes, sustainability standards, and increasing investments in commercial real estate, including specialized facilities such as data centers, propel demand for advanced, durable, and eco-friendly membranes. The industrial sector, meanwhile, requires highly specialized sealing membranes to ensure operational continuity, protect critical assets, and meet stringent environmental regulations, particularly for sensitive equipment and water management, making long-term, robust solutions essential for ongoing industrial expansion and facility upgrades.

Key U.S. Sealing Membranes Company Insights

Some of the key companies in the U.S. sealing membranes industry include GAF Materials LLC, Carlisle SynTec Systems (Carlisle Construction Materials), Johns Manville. A Berkshire Hathaway Company, and Sika Sarnafil.

- GAF Materials LLC offers various residential, commercial, and industrial roofing and waterproofing products. The company focuses on innovation, sustainability, durability, and contractor support, recently expanding into metal roofing and solar-integrated systems to meet changing market needs.

Key U.S. Sealing Membranes Companies:

- GAF Materials LLC

- Carlisle SynTec Systems (Carlisle Construction Materials)

- Johns Manville. A Berkshire Hathaway Company

- Sika Sarnafil

Recent Developments

-

In June 2025, Elevate introduced V-Force FR, a next-generation vapor barrier designed for speed, strength, and fire performance.

-

In February 2025, Sika Corporation launched the SikaShield brand and introduced the SikaShield HB79 "Hybrid" Modified Bitumen Membrane in the U.S. market.

-

In January 2025, Sika Corporation’s roofing and waterproofing team announced the launch of the Sarnafil Self-Adhered Feltback Membrane (SAFB).

U.S. Sealing Membranes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.26 billion

Revenue forecast in 2030

USD 3.11 billion

Growth Rate

CAGR of 6.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use

Key companies profiled

GAF Materials LLC; Carlisle SynTec Systems (Carlisle Construction Materials); Johns Manville. A Berkshire Hathaway Company; Sika Sarnafil

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Sealing Membrane Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. sealing membranes market report based on product and end use.

-

Product (Revenue, USD Billion, 2018 - 2030)

-

Sheet Membranes

-

Liquid-Applied Membranes

-

-

End use (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

Frequently Asked Questions About This Report

b. The U.S. sealing membranes market size was estimated at USD 2.12 billion in 2024 and is expected to reach USD 2.26 billion in 2025.

b. The U.S. sealing membranes market is expected to grow at a compound annual growth rate of 6.6% from 2025 to 2030 to reach USD 3.11 billion by 2030.

b. The liquid-applied membranes segment led the market and accounted for the largest revenue share, 65.1%, in 2024, due to their flexibility, seamless application, and adaptability to complex surfaces.

b. GAF Materials LLC, Carlisle SynTec Systems (Carlisle Construction Materials), Johns Manville, a Berkshire Hathaway Company, and Sika Sarnafil are prominent companies in the sealing membranes market.

b. Key factors driving market demand include growing infrastructure rehabilitation projects, stringent U.S. building codes, and increasing adoption of high-performance sealing membranes for energy efficiency and durability.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.