- Home

- »

- Consumer F&B

- »

-

U.S. Seasoning Blends Market Size, Industry Report, 2030GVR Report cover

![U.S. Seasoning Blends Market Size, Share & Trend Report]()

U.S. Seasoning Blends Market (2025 - 2030) Size, Share & Trend Analysis Report By Product (BBQ Rubs, Cajun Rubs), By Brand (National Brand, Private Label Brand), By Distribution Channel (Foodservice, Retail), And Segment Forecasts

- Report ID: GVR-4-68040-621-1

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Seasoning Blends Market Trends

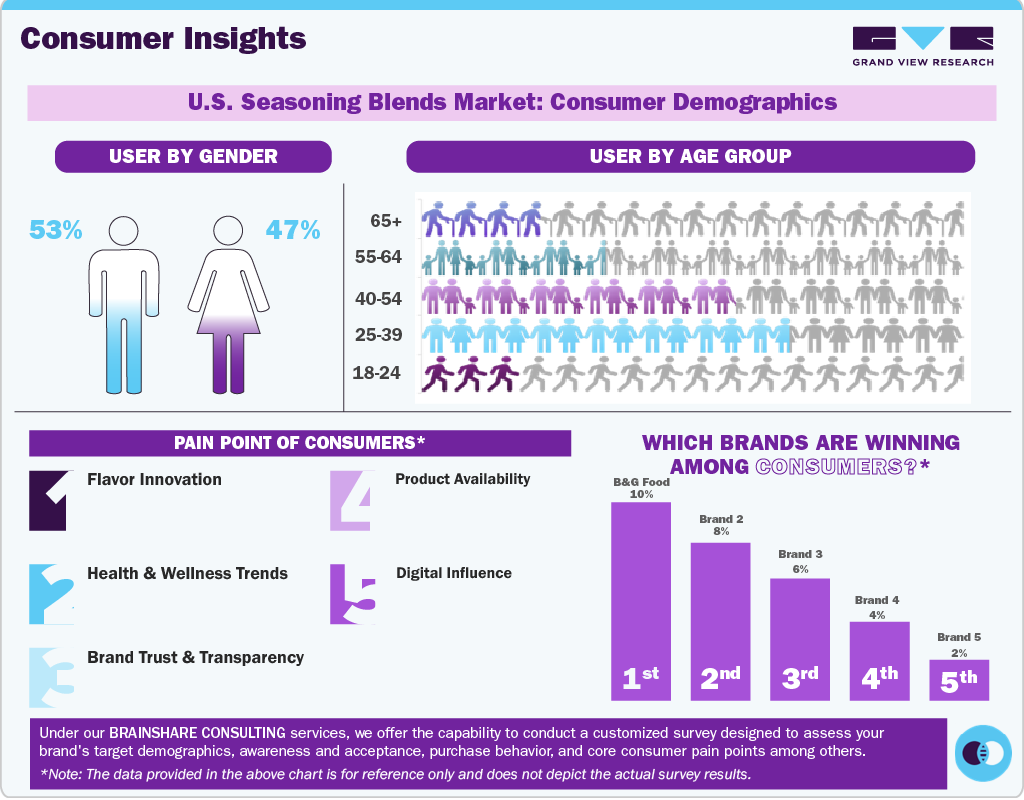

The U.S. seasoning blends market size was estimated at USD 5.28 billion in 2024 and is projected to grow at a CAGR of 4.4% from 2025 to 2030. The U.S. seasoning blends industry is expanding, fueled by the country’s large, diverse population and a vibrant food culture that values both flavor and convenience.

Steady growth is expected as consumer tastes evolve and interest in culinary exploration rises. More Americans are gravitating toward bold, umami-rich, and globally inspired flavors, with Mexican, Asian, and Mediterranean blends gaining significant popularity.

Health and wellness trends are strongly influencing the market, as U.S. consumers increasingly prefer clean-label, organic, and low-sodium seasoning options. This shift is reflected in the strong sales growth of organic and specialty spice blends, which have surpassed those of traditional products in recent years. Regulatory initiatives, including the FDA’s push to reduce sodium intake, have encouraged brands to develop healthier formulations, helping to drive demand for premium seasoning blends.

The U.S. foodservice sector plays a key role in driving market growth, with restaurants, meal kit providers, and ready-to-eat food manufacturers turning to high-quality seasoning blends to ensure bold, consistent flavors. The rise of plant-based and protein-focused diets has further boosted demand for savory blends, which are now commonly used in both meat and plant-based dishes to align with evolving dietary preferences. For instance, in 2023, The Kraft Heinz Company announced the U.S. launch of Just Spices, a direct-to-consumer spice brand in which it had acquired a majority stake the previous year. Just Spices offered over 170 seasoning blends tailored for various meal occasions. The initial U.S. lineup featured ten popular products, including Chicken, Vegetable, Pasta, BBQ, Salmon, and Caprese Allrounders, along with Egg and Avocado Toppings, and Fajita and Enchilada Seasonings.

Product Insights

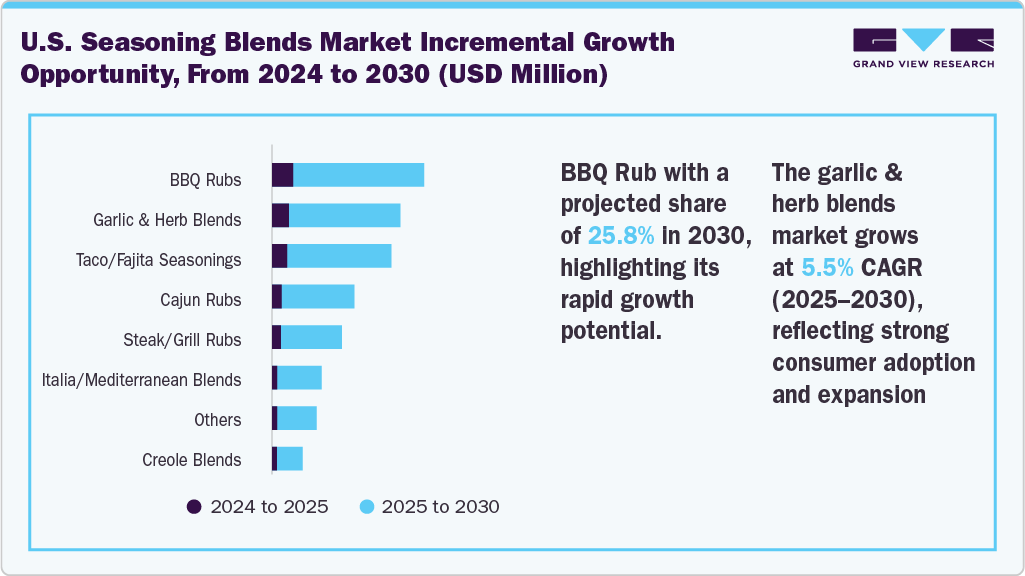

The BBQ Rubs segment led the market with the largest revenue share of 26.8% in 2024. BBQ rubs are gaining popularity in the U.S. seasoning blend market, driven by the strong cultural tradition of grilling and outdoor cooking. Consumer interest in bold, smoky, and regional flavors, such as Texas-style or Carolina-inspired rubs, continues to fuel demand. The rise of at-home cooking, especially post-pandemic, has led many consumers to experiment with barbecue techniques.

In addition, the growth of meat alternatives has spurred innovation in rubs tailored for plant-based grilling. Premium rubs featuring clean labels, artisanal ingredients, and unique spice combinations are particularly appealing to flavor-seeking consumers. Companies such as International Spice and Kraft Heinz offer BBQ rub seasoning blends to cater to the rising consumer demand. For instance, in May 2025, International Spice introduced a range of seasoning blends, including Caribbean Jerk Blend and Creole Seasoning, to pair with BBQ cuisines. It aims to launch a limited-time offer for BBQ seasoning from their collection.

The garlic & herb blends segment is projected to grow at the fastest CAGR of 5.5% from 2025 to 2030. Garlic and herb blends are a staple in the U.S. seasoning market, driven by their versatility and broad consumer appeal across a wide range of cuisines. Their popularity is supported by the growing demand for convenient, ready-to-use flavor solutions that enhance everyday cooking. Health-conscious consumers are drawn to these blends for their natural ingredients and association with heart-healthy diets, particularly Mediterranean-inspired meals. The rise of home cooking and simple meal prep trends has further increased their usage. In addition, clean-label and salt-free garlic and herb options are gaining traction among shoppers seeking healthier seasoning alternatives. For instance, in May 2025, International Spice unveiled its summer collection of seasoning blends with garlic & herb seasoning to pair with vegetables, seafood, and white meat.

The italian/mediterranean blends market is experiencing significant growth due to consumers' evolving tastes and preferences. Italian/Mediterranean blends are gaining momentum due to shifting consumer preferences toward authentic, health-focused, and adaptable flavors inspired by Mediterranean cuisine. These blends often feature herbs such as basil, oregano, rosemary, sage, and marjoram, valued for both their savory taste and health benefits, including antioxidant and anti-inflammatory properties. Their appeal is strengthened by the rising popularity of the Mediterranean diet, known for its balanced and nutritious approach. As a result, these blends are favored by consumers seeking flavorful yet wholesome seasoning options. They pair well with a variety of dishes, from pasta and pizza to grilled meats and vegetables, fueling the market growth.

Brand Insights

The national brand segment led the market with the largest revenue share of 77.4% in 2024. In the U.S., national brands drive growth through strong retail distribution, extensive marketing campaigns, and product innovation that caters to evolving consumer tastes. These brands capitalize on health and wellness trends by offering organic, low-sodium, and clean-label blends. Their ability to introduce globally inspired flavors and limited-edition products keeps consumers engaged and loyal. Partnerships with celebrity chefs, cooking shows, and digital influencers also enhance brand visibility. In addition, consistent quality and trust in legacy brands continue to attract a broad consumer base.

The private brand segment is projected to grow at the fastest CAGR of 5.0% from 2025 to 2030. Private brands in the U.S. seasoning blends industry are gaining traction by offering cost-effective alternatives without compromising on quality. Retailers focus on value-driven consumers seeking affordable yet flavorful options, often positioning these products as comparable to national brands. Flexibility in quickly adapting to emerging trends, such as clean labels and ethnic flavors, allows private labels to respond to consumer demand rapidly. Enhanced in-store visibility and promotions boost their appeal. In addition, private brands benefit from retailer loyalty programs, encouraging repeat purchases.

Distribution Channel Insights

The foodservice segment led the market with the largest revenue share of 59.9% in 2024. The U.S. foodservice sector drives demand for seasoning blends through its focus on consistency, efficiency, and bold flavors that appeal to diverse customer bases. Foodservice operators prioritize bulk packaging and cost-effective, versatile blends that simplify kitchen operations. The rise of fast-casual and ethnic dining concepts fuels demand for unique, globally inspired seasonings. In addition, the growing plant-based and health-conscious menus encourage suppliers to innovate with clean-label and allergen-free blends. Strong partnerships between seasoning manufacturers and foodservice distributors ensure timely supply and customization options.

The retail segment is projected to grow at the fastest CAGR of 5.1% from 2025 to 2030. In the U.S., retail distribution drives seasoning blend sales by offering wide product availability across supermarkets, specialty stores, and online platforms. Retailers focus on strategic product placement and promotional activities to attract diverse consumer segments. The growth of e-commerce has expanded access to niche and international blends, catering to adventurous home cooks. Retailers also respond to consumer demand for clean-label and organic options by dedicating shelf space to premium and health-focused products. Loyalty programs and private-label offerings further strengthen consumer engagement and repeat purchases.

Country Insights

The seasoning blends market in the U.S. is propelled by a strong culture of culinary experimentation and diverse food influences, encouraging consumers to explore new and exotic flavors. Increased interest in convenient meal solutions boosts demand for ready-made seasoning blends that simplify cooking. Innovation in packaging, such as resealable and single-serve options, enhances product usability and freshness.

Rising disposable incomes and a growing foodie culture drive the willingness to pay for premium and specialty blends. In addition, an expanding food delivery and meal kit industry supports seasoning blend usage beyond traditional home cooking. Companies recognizing the rising demand are introducing new seasoning blends. For instance, in May 2025, Dan-O's Seasoning launched a seasoning blend under its brand Outlaw in variants including Spicy BBQ, Sweet & Tangy BBQ, and Sweet Caribbean blends.

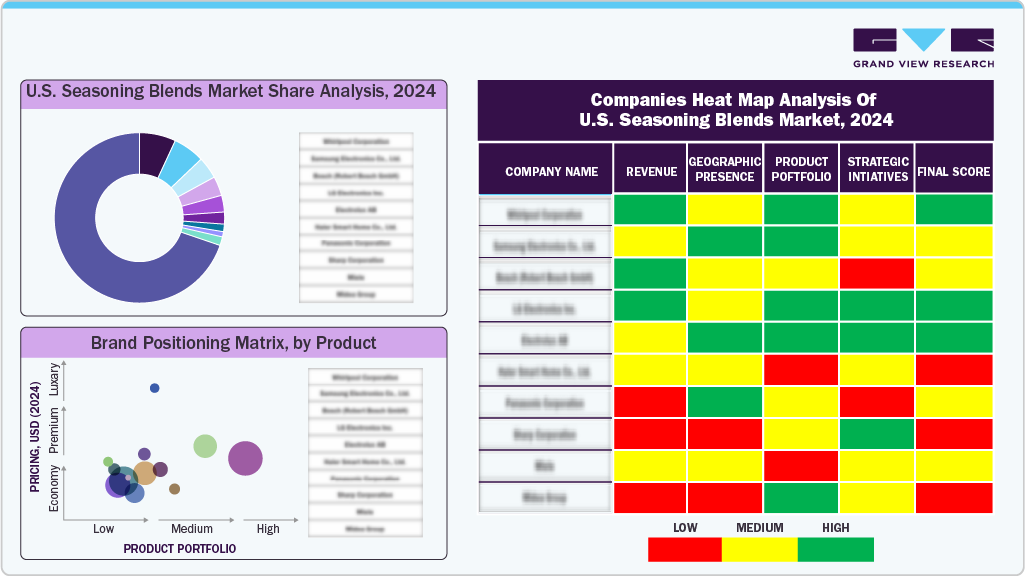

Key U.S. Seasoning Blends Company Insights

Many brands in the U.S. seasoning blends industry have identified untapped opportunities within their product lines and are taking steps to address these market gaps. This often involves developing new product designs or marketing campaigns to better meet consumer needs and preferences.

Key U.S. Seasoning Blends Companies:

- Ajinomoto Co., Inc.

- McCormick & Company, Inc.

- Badia Spices

- Spiceology

- B&G Foods, Inc.

- PS Seasoning

- Baron Spices & Seasonings

- The Spice House, LLC

- House of Q

- Tastefully Simple, Inc.

- The Kraft Heinz Company

- The Campbell's Company

- Siete foods (PepsiCo)

- KindersBBQ

- Trader Joe’s

- Olam Group (Olde Thompson)

U.S. Seasoning Blends Market Report Scope

Report Attribute

Details

Market value size in 2025

USD 5.49 billion

Revenue Forecast in 2030

USD 6.84 billion

Growth rate

CAGR of 4.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, brand, distribution channel, region

Country scope

U.S.

Key companies profiled

Ajinomoto Co., Inc.; McCormick & Company, Inc.; Badia Spices; Spiceology; B&G Foods, Inc.; PS Seasoning; Baron Spices & Seasonings; The Spice House, LLC; House of Q; Tastefully Simple, Inc.; The Kraft Heinz Company; The Campbell's Company; Siete foods (PepsiCo); KindersBBQ; Trader Joe’s; Olam Group (Olde Thompson)

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Seasoning Blends Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. seasoning blends market report based on the product, brand, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

BBQ Rubs

-

Cajun Rubs

-

Creole Blends

-

Taco/Fajita Seasonings

-

Italia/Mediterrranean Blends

-

Steak/Grill Rubs

-

Garlic & Herb Blends

-

Others

-

-

Brand Outlook (Revenue, USD Million, 2018 - 2030)

-

National Brand

-

Private Label Brand

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Foodservice

-

Retail

-

Supermarkets and Hypermarkets

-

Convenience Store

-

Online

-

Others

-

-

Frequently Asked Questions About This Report

b. The U.S. seasoning blends market size was estimated at USD 5.28 billion in 2024 and is expected to reach USD 5.49 billion in 2025.

b. The U.S. seasoning blends market is expected to grow at a compound annual growth rate (CAGR) of 4.4 % from 2025 to 2030 to reach USD 6.84 billion by 2030.

b. BBQ Rubs accounted for a revenue share of 26.8% in 2024, driven by rising consumer interest in outdoor cooking and authentic regional flavors, fueling the demand for BBQ rubs.

b. Some key players operating in the U.S. seasoning blends market include McCormick & Company, Inc., Badia Spices, Siete foods (PepsiCo), B&G Foods, Inc., Great American Spice Company, and Spiceology.

b. Key factors driving growth in the U.S. seasoning blends market include rising consumer demand for convenient and time-saving home-cooking solutions, along with a growing interest in diverse global and ethnic flavors. Continuous innovation in spice blends, introduction of premium and artisanal offerings, and enhanced product availability through both traditional retail and e-commerce channels are also propelling market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.