- Home

- »

- Advanced Interior Materials

- »

-

U.S. Semiconductor Diffusion Equipment Market Report, 2030GVR Report cover

![U.S. Semiconductor Diffusion Equipment Market Size, Share & Trends Report]()

U.S. Semiconductor Diffusion Equipment Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Vertical Diffusion Systems, Horizontal Diffusion Systems), By End Use (Foundries, Memory Manufacturers), By Technology, By Wafer Size, And Segment Forecasts

- Report ID: GVR-4-68040-681-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Semiconductor Diffusion Equipment Market Summary

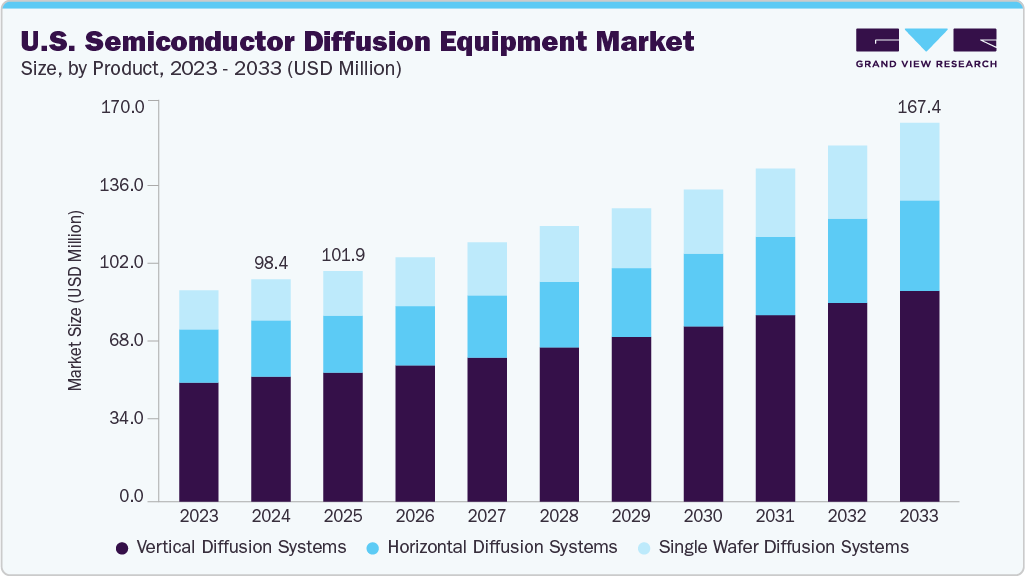

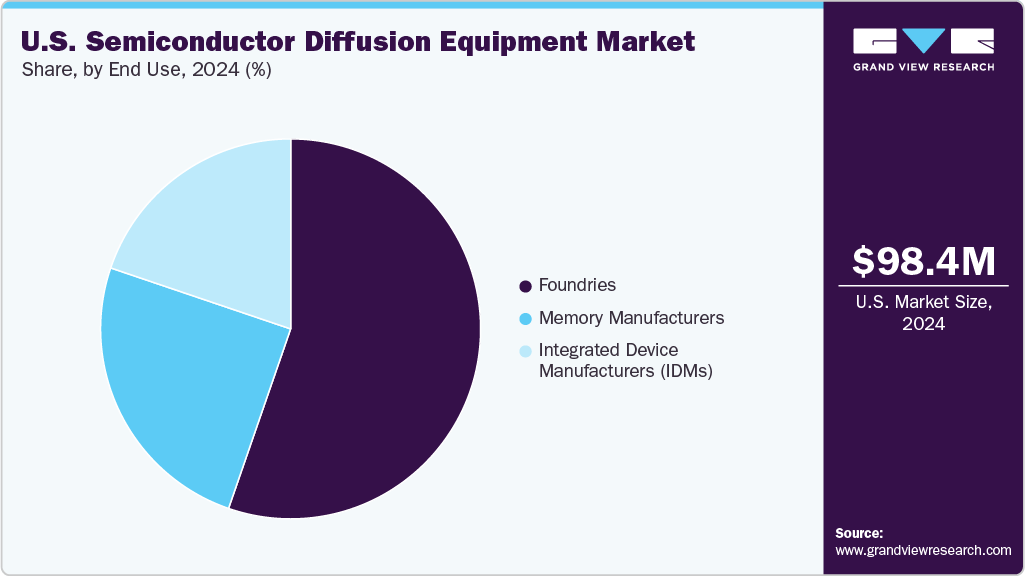

The U.S. semiconductor diffusion equipment market size was estimated at USD 98.4 million in 2024 and is projected to reach USD 167.4 million by 2033, growing at a CAGR of 6.4% from 2025 to 2033. The rapid growth of domestic semiconductor manufacturing initiatives, spurred by the CHIPS and Science Act, is significantly driving demand for diffusion equipment in the U.S.

Key Market Trends & Insights

- The semiconductor diffusion equipment market in the U.S. is expected to grow at a substantial CAGR of 6.4% from 2025 to 2033.

- By product, the single wafer diffusion systems segment is expected to grow at a considerable CAGR of 7.1% from 2025 to 2033.

- By technology, the rapid thermal processing (RTP) segment is expected to grow at a considerable CAGR of 7.1% from 2025 to 2033.

- By end use, the memory manufacturers segment is expected to grow at a considerable CAGR of 7.2% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 98.4 Million

- 2033 Projected Market Size: USD 167.4 Million

- CAGR (2025-2033): 6.4%

This legislation has boosted investments in new fabs and the expansion of existing facilities. Another key driver is the technological shift toward advanced nodes and 3D architectures, requiring more precise and uniform diffusion processes. The U.S. is home to several R&D hubs focusing on leading-edge semiconductor technologies, fueling demand for high-performance diffusion systems. Additionally, the growth in sectors such as AI, electric vehicles, and 5G infrastructure is boosting the need for advanced chips. This surge in demand translates directly into increased investment in high-capacity diffusion equipment.

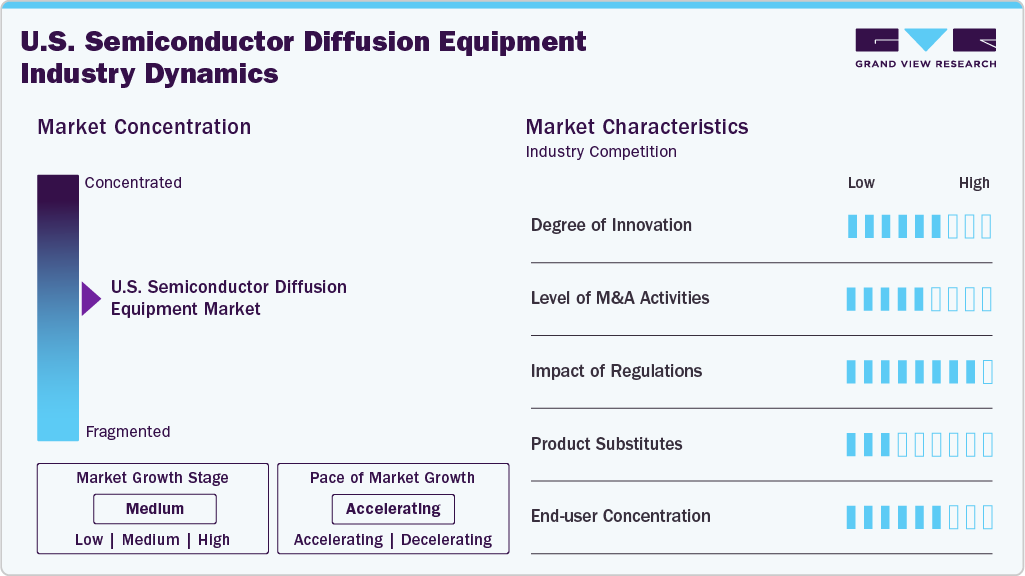

Market Concentration & Characteristics

The U.S. semiconductor diffusion equipment market is moderately concentrated, with a few dominant players holding significant market share. Companies like Applied Materials and Kokusai Electric maintain a strong presence due to their advanced technology and extensive customer base. High capital requirements and complex manufacturing processes create significant entry barriers. However, niche players and emerging startups continue to find opportunities in specialized or customized solutions.

The U.S. semiconductor diffusion equipment market is driven by continuous innovation aimed at enhancing precision, scalability, and process control. Companies invest heavily in R&D to support next-generation chip designs and node transitions. Innovations in thermal processing and automation are becoming critical for competitiveness. Collaboration between equipment manufacturers and chipmakers accelerates the development of cutting-edge technologies.

The market has seen steady merger and acquisition activity as firms seek to expand product portfolios and strengthen their position in a competitive landscape. Larger players often acquire smaller firms with unique technologies or IP. These strategic moves help streamline operations and accelerate innovation cycles. M&A activity also supports vertical integration, offering customers more complete process solutions.

Regulatory frameworks in the U.S. significantly influence the semiconductor equipment industry, especially concerning trade and export controls. Restrictions on equipment sales to certain countries affect global sales strategies. Environmental regulations also shape equipment design, requiring compliance with emission and energy efficiency standards. Federal support programs, such as the CHIPS Act, create a favorable regulatory environment for domestic expansion.

Drivers, Opportunities & Restraints

The increasing demand for advanced semiconductors across sectors such as artificial intelligence (AI), automotive electronics, and data centers is prompting substantial investment in new and upgraded fabrication facilities. As manufacturers push toward smaller nodes and larger wafer sizes, the need for high-precision diffusion equipment becomes even more critical. Additionally, a combination of federal incentives and private capital is accelerating the pace of equipment procurement, reinforcing the U.S. semiconductor supply chain, and boosting demand for cutting-edge thermal processing solutions.

There is a significant opportunity for companies developing energy-efficient and high-throughput diffusion systems tailored for advanced chip production. Growth in emerging technologies such as quantum computing, 5G, and EVs is expected to create new demand segments. Government incentives for semiconductor R&D provide a fertile ground for equipment innovation. Moreover, reshoring trends and supply chain diversification offer room for expansion and new partnerships within the U.S.

High capital costs associated with diffusion equipment development and installation remain a major barrier for new entrants. Supply chain disruptions and component shortages continue to affect delivery timelines and project scalability. Strict environmental and export regulations may also hinder global competitiveness for U.S.-based firms. Furthermore, intense international competition puts pressure on pricing and profit margins.

Product Insights

Vertical diffusion systems segment dominated the market and accounted for a revenue share of 56.1% in 2024, due to their high throughput and suitability for batch processing in large-scale semiconductor fabs. These systems are widely adopted in mature nodes and memory chip production, where uniformity and efficiency are critical. Their cost-effectiveness and ability to handle multiple wafers at once make them ideal for established manufacturing lines. Leading U.S. fabs prefer vertical systems for consistent performance in volume production.

Single wafer diffusion systems are projected to witness the fastest growth in the U.S over the forecast period due to their precision and process control in advanced node fabrication. These systems are essential for next-generation chips used in AI, 5G, and high-performance computing. Their ability to support flexible process recipes and reduced cross-contamination makes them suitable for R&D and low-volume, high-value chips. The shift toward miniaturization and performance optimization is accelerating their adoption.

Technology Insights

The thermal diffusion segment dominated the market and accounted for a revenue share of 45.7% in 2024, owing to its reliability and suitability for mature process nodes. It is widely used in volume production for doping and oxidation steps, particularly in memory and logic devices. Its compatibility with batch processing and vertical furnace systems makes it ideal for large-scale fabs. U.S.-based manufacturers favor thermal diffusion for its stability, cost-efficiency, and well-established process control.

Rapid Thermal Processing (RTP) is expected to grow at the fastest rate over the forecast period, driven by the demand for precise and localized thermal control in advanced semiconductor devices. RTP enables faster processing times and supports shrinking node geometries, making it essential for cutting-edge chip production. Its flexibility and minimal thermal budget are well-suited for applications like annealing and dopant activation. U.S. fabs adopting next-gen technologies increasingly rely on RTP for high-performance and energy-efficient

Wafer Size Insights

The 300 mm media segment accounted for a revenue share of 62.9% in 2024. 300 mm wafer size leads the market due to its high productivity and cost-efficiency in advanced chip manufacturing. Major U.S. fabs utilize 300 mm wafers to maximize yield and reduce production costs per chip, particularly in logic and memory applications. This size supports automation and high-throughput processing, making it ideal for large-scale manufacturing. The continued investment in new 300 mm fabs under the CHIPS Act reinforces its leading position.

The 200 mm segment is anticipated to experience fastest CAGR in the U.S. over the forecast period due to its relevance in analog, power, and specialty semiconductor applications. As demand rises for chips used in automotive, IoT, and industrial devices, older 200 mm fabs are being upgraded rather than replaced. Equipment upgrades and capacity expansions for 200 mm lines are cost-effective for mid-volume production. U.S. foundries and IDMs are increasingly investing in 200 mm tools to meet the growing demand from niche markets.

End Use Insights

Foundries dominated the U.S. semiconductor diffusion equipment market and accounted for a 55.3% revenue share in 2024, as they serve a wide range of clients across various chip types and technologies. Leading U.S.-based and foreign-invested foundries are expanding their domestic operations to meet demand for customized and advanced chips. Foundries require versatile diffusion equipment to handle diverse wafer sizes and process requirements. Government incentives are further driving investment in foundry infrastructure, reinforcing their leading market position.

Memory manufacturers are projected to witness the fastest CAGR in the U.S. over the forecast period due to surging demand for DRAM and NAND in AI, cloud computing, and consumer electronics. Recent federal funding and private investment are supporting new memory fabs and capacity expansion. Advanced diffusion equipment is critical for precision doping and oxidation processes in high-density memory chip production. As memory technology scales to meet performance and efficiency needs, U.S. players are ramping up investment in state-of-the-art tools.

Key U.S. Semiconductor Diffusion Equipment Company Insights

Some key players operating in the market include Expertech, Carlo Gavazzi, and Thermco Systems.

-

Expertech specializes in manufacturing advanced thermal processing systems, particularly diffusion and oxidation furnaces. The company focuses on custom-built vertical and horizontal furnace systems designed for research and production environments. Its equipment is widely used in universities, pilot fabs, and specialty semiconductor applications. Expertech is known for supporting legacy wafer sizes and offering flexible process capabilities. The company also provides refurbishment and upgrade services for existing diffusion tools.

-

Carlo Gavazzi designs and manufactures automation components tailored for semiconductor and industrial equipment applications. Its products include sensors, relays, and power monitoring systems integrated into wafer processing and diffusion tools. The company supports semiconductor equipment manufacturers by enhancing safety, process control, and energy efficiency. Carlo Gavazzi’s offerings are optimized for reliability in cleanroom and high-precision environments. It emphasizes modularity and scalability in its automation solutions for fabs and OEMs.

Key U.S. Semiconductor Diffusion Equipment Companies:

- Expertech

- Carlo Gavazzi

- Thermco Systems

- Bruce Technologies

- Watlow Electric Manufacturing Company.

- ASM International N.V.

- Sunred Electronic Equipment (Wuxi)Co., Ltd.

- Syn-thermal

- Tempress

- Ohkura Electric Co., Ltd.

Recent Developments

-

In October 2023, Watlow launched ASSURANT HT, a high-temperature heating solution designed for advanced semiconductor processing applications. The system enhances temperature stability and process control in high-temperature environments. It is engineered to support critical steps in diffusion, oxidation, and LPCVD processes. This innovation demonstrates Watlow’s commitment to improving thermal solutions for semiconductor manufacturing.

-

In March 2023, Bristol University successfully produced its first wafer with all transistors functioning, marking a key milestone in its semiconductor research capabilities. The achievement was made possible using Thermco Systems’ diffusion furnace technology. This development validates the university's growing in-house fabrication capabilities. It also highlights Thermco’s role in supporting academic innovation in chip manufacturing.

U.S. Semiconductor Diffusion Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 101.9 million

Revenue forecast in 2033

USD 167.4 million

Growth rate

CAGR of 6.4% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, wafer size, end use

Country scope

U.S.

Key companies profiled

Expertech; Carlo Gavazzi; Thermco Systems; Bruce Technologies; Watlow Electric Manufacturing Company.; ASM International N.V.; Sunred Electronic Equipment (Wuxi)Co., Ltd.; Syn-thermal; Tempress; Ohkura Electric Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Semiconductor Diffusion Equipment Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. semiconductor diffusion equipment market report based on product, technology, wafer size, and end use:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Vertical Diffusion Systems

-

Horizontal Diffusion Systems

-

Single Wafer Diffusion Systems

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Thermal Diffusion

-

Plasma Diffusion

-

Rapid Thermal Processing (RTP)

-

-

Wafer Size Outlook (Revenue, USD Million, 2021 - 2033)

-

300 mm

-

200 mm

-

Less Than 200 mm

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Integrated Device Manufacturers (IDMs)

-

Foundries

-

Memory Manufacturers

-

Frequently Asked Questions About This Report

b. The U.S. semiconductor diffusion equipment market size was estimated at USD 98.4 million in 2024 and is expected to be USD 101.9 million in 2025.

b. The U.S. semiconductor diffusion equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.4% from 2025 to 2033 to reach USD 167.4 million by 2033.

b. 300 mm media segment accounted for a share of 62.9% in 2024. 300 mm wafer size leads the market due to its high productivity and cost-efficiency in advanced chip manufacturing. Major U.S. fabs utilize 300 mm wafers to maximize yield and reduce production costs per chip, particularly in logic and memory applications.

b. Some of the key players operating in the U.S. semiconductor diffusion equipment market include Expertech; Carlo Gavazzi; Thermco Systems; Bruce Technologies; Watlow Electric Manufacturing Company.; ASM International N.V.; Sunred Electronic Equipment (Wuxi)Co.,Ltd.; Syn-thermal; Tempress; Ohkura Electric Co., Ltd.

b. Key factors driving the U.S. semiconductor diffusion equipment market include increasing investments in domestic chip manufacturing fueled by the CHIPS Act and rising demand from advanced industries like AI, 5G, and automotive.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.