- Home

- »

- Homecare & Decor

- »

-

U.S. Serviced Apartment Market Size, Industry Report, 2033GVR Report cover

![U.S. Serviced Apartment Market Size, Share & Trends Report]()

U.S. Serviced Apartment Market (2025 - 2033) Size, Share & Trends Analysis Report By Type, By End-use (Corporate/Business Traveler, Leisure Travelers, Expats & Relocations), By Booking Mode (Direct Booking, Corporate Contracts), And Segment Forecasts

- Report ID: GVR-4-68040-720-0

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Serviced Apartment Market Trends

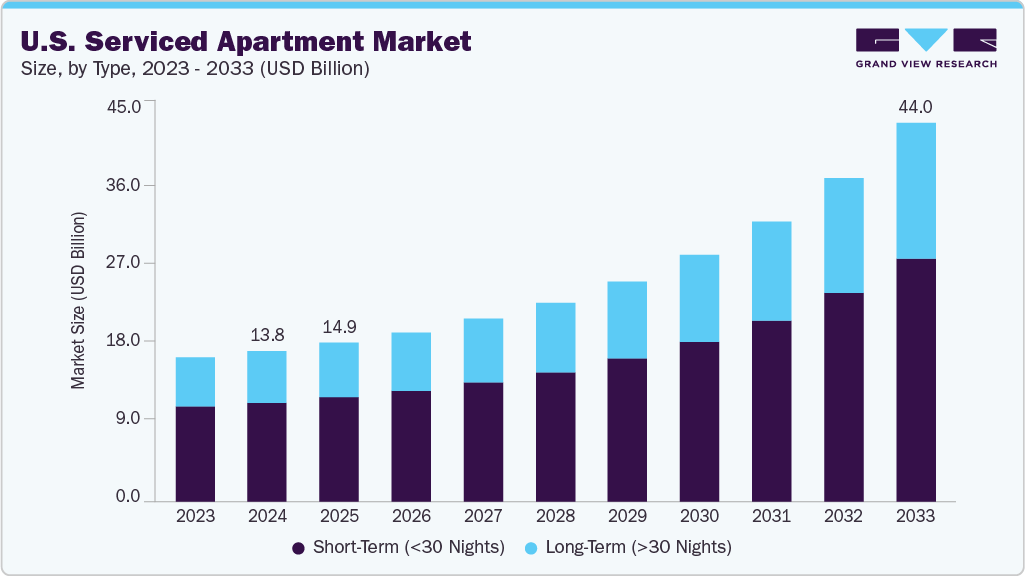

The U.S. serviced apartment market size was estimated at USD 13.80 billion in 2024 and is projected to reach USD 44.03 billion by 2033, growing at a CAGR of 14.5% from 2025 to 2033. In the U.S., the serviced apartment market is fueled by strong corporate and relocation demand. Businesses seek cost-efficient, home-like accommodations for extended stays, alongside a growing population of digital nomads and remote workers. Rising urban migration and higher disposable incomes are expanding the customer base, while companies increasingly favor direct corporate contracts and bookings for greater convenience and cost savings. These factors, combined with a preference for privacy, fully equipped amenities, and locations near business hubs, drive sustained growth in the sector.

The rise of hybrid accommodation models reflects a shift in hospitality toward flexibility, personalization, and lifestyle-oriented stays. By blending the self-sufficiency and home-like environment of serviced apartments with the amenities, service standards, and convenience of hotels, these spaces cater to modern travelers, especially remote workers, digital nomads, and extended-stay guests, who value comfort without sacrificing service. This approach meets the growing demand for longer, more immersive stays, while appealing to those seeking both independence and curated hospitality experiences.

The ongoing growth of remote work and digital nomad lifestyles drives strong demand for long-stay accommodations that blend comfort with functionality. In response, serviced apartment operators and corporate housing providers are enhancing their portfolios with fully furnished units, high-speed internet, dedicated workspaces, and amenities that replicate the convenience of home. These offerings cater to professionals seeking stability, privacy, and productivity during extended assignments or travel, making them a preferred alternative to traditional hotel stays.

Wellness and sustainability have become core pillars in the U.S. serviced apartment market, with upscale properties integrating features like in-room fitness equipment, communal yoga areas, and health-focused interior design to enhance guest well-being. At the same time, eco-friendly initiatives, such as installing energy-efficient systems, using sustainable building materials, and implementing waste reduction programs, are increasingly prioritized to meet growing environmental awareness among travelers. This dual focus appeals to health-conscious guests and aligns with global trends toward responsible and sustainable hospitality.

Consumer Insights

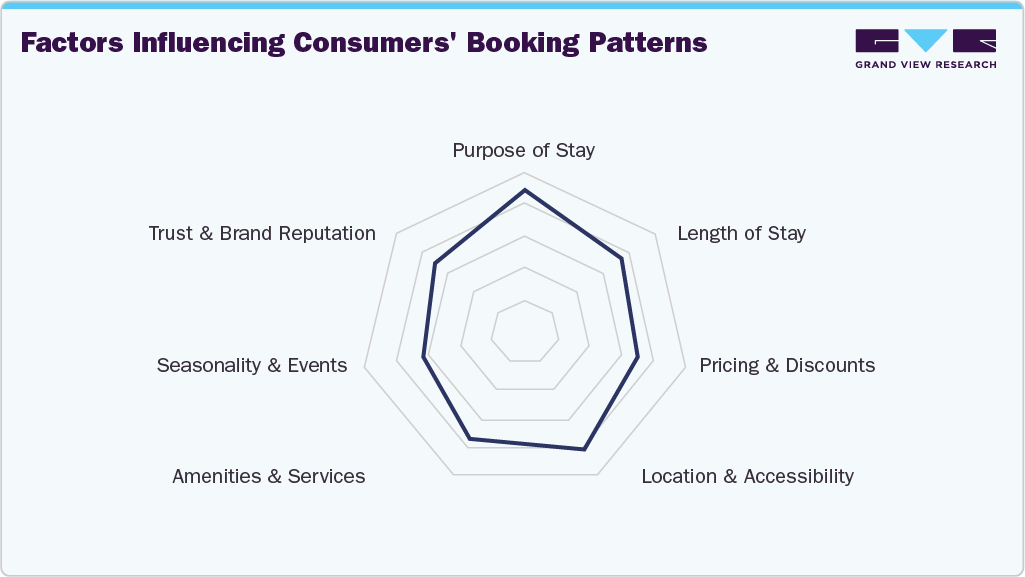

In the U.S., consumer preferences for serviced apartments are driven by a desire for flexibility, home-like comfort, and value for money, particularly among business travelers, remote workers, and extended-stay guests. Many travelers prefer locations close to business hubs, transportation links, and local attractions, with growing interest in wellness-focused and eco-friendly properties. Compared to traditional hotels, personalization, privacy, and competitive pricing further enhance their appeal for short- and long-term stays.

Type Insights

Serviced apartments for short-term stays accounted for a revenue share of 65.47% of the U.S. serviced apartment market in 2024 due to their flexibility, cost-effectiveness, and home-like comfort for stays under 30 nights. They appeal strongly to business and leisure travelers seeking spacious, fully equipped accommodations without long-term commitments, making them ideal for project-based work, bleisure trips, and relocations. Enhanced by digital booking, self-check-in systems, and operational efficiency, these units offer a convenient, value-driven alternative to hotels while meeting the growing demand for adaptable, short-duration stays.

Serviced apartments for long-term stays are expected to grow at a CAGR of 15.2% from 2025 to 2033 due to shifting lifestyle and work patterns. The growth of remote and hybrid work, corporate relocations, extended business projects, and the influx of digital nomads have fueled interest in flexible, home-like accommodations for several weeks or months. These stays provide cost savings compared to hotels, along with fully equipped kitchens, dedicated workspaces, and community amenities that support living and working needs. Additionally, industries like healthcare, film production, and construction frequently require extended housing for staff, further boosting demand for long-term serviced apartments.

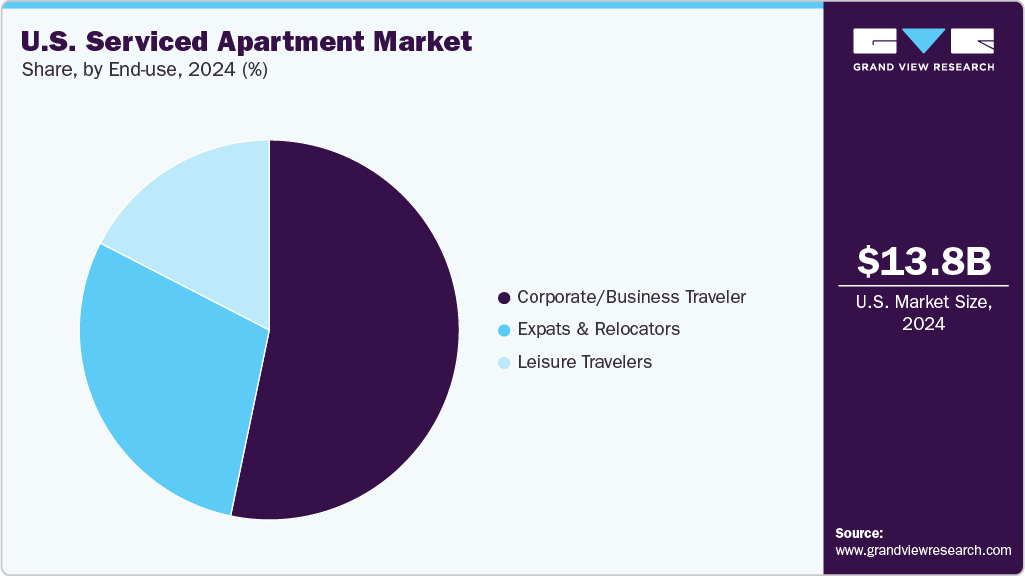

End-use Insights

Serviced apartments for corporate/business travelers accounted for a revenue share of 53.27% of the U.S. serviced apartment market in 2024. They align perfectly with the needs of professionals on extended assignments, relocations, or project-based work. These travelers value the balance of comfort and functionality, spacious layouts, fully equipped kitchens, high-speed internet, dedicated work areas, and the convenience of hotel-like services. For companies, they offer a cost-effective alternative to long hotel stays, while supporting employee well-being and productivity. Consistent demand from finance, technology, consulting, and healthcare industries keeps corporate bookings a primary growth engine.

The demand for serviced apartments among expats and relocators is expected to grow at a CAGR of 15.4% from 2025 to 2033 due to rising global mobility, corporate transfers, and immigration for work or education. These travelers often require temporary housing while settling into a new city, and serviced apartments provide a seamless solution with furnished living spaces, flexible lease terms, and essential amenities. They eliminate the hassle of setting up utilities or buying furniture, allowing newcomers to focus on their transition. Additionally, the supportive services and community-oriented environments help expats and relocators adapt more comfortably to unfamiliar surroundings.

Booking Mode Insights

Direct booking accounted for a revenue share of 46.45% of the serviced apartment industry in 2024. Direct booking offers cost savings, personalized service, and greater control over the booking process for providers and guests. By bypassing third-party platforms, operators avoid commission fees and can pass on competitive rates or added customer benefits. Direct channels also allow stronger brand relationships, tailored promotions, and clearer communication about amenities, stay policies, and special requests. Direct booking ensures consistency, trust, and flexibility for frequent corporate clients and long-stay guests, making it the preferred choice for consumers.

Bookings through corporate contractors are expected to grow at a CAGR of 15.6% from 2025 to 2033. Companies seek reliable, cost-effective, and hassle-free accommodation solutions for employees on extended assignments, relocations, or project work. Corporate contracts offer negotiated rates, guaranteed availability, and standardized service quality, which help businesses manage travel budgets while ensuring staff comfort and productivity. These agreements also streamline the booking process, reduce administrative overhead, and foster long-term partnerships between serviced apartment providers and corporate clients, making them an increasingly attractive option for organizations across industries.

Key U.S. Serviced Apartment Company Insights

The U.S. serviced apartment market features a mix of established brands and emerging players, with leading providers continuously adapting to shifting hospitality trends. They are enhancing guest experiences by introducing innovative comfort solutions, improving durability, and integrating sustainable practices. By expanding their service offerings and focusing on evolving customer needs, these companies are able to maintain a strong competitive advantage and secure their position in the market.

-

The Ascott Limited is a Singapore-based leading international lodging owner-operator and a wholly owned subsidiary of CapitaLand Investment. Established in 1984, Ascott has grown into one of the world’s largest serviced residence and extended stay operators, managing a diverse portfolio of brands including Ascott The Residence, Somerset, Citadines, and Lyf. The company operates across over 200 cities in over 40 countries, catering to business and leisure travelers with fully furnished apartments that combine home comfort with hotel-like services.

-

Habicus Group is a UK-headquartered global serviced apartment provider specializing in corporate accommodation solutions. Founded in 1999, the group operates primarily through its flagship brand, SilverDoor Apartments, and its technology platform, Orbital Platforms. Habicus partners with an extensive network of property operators worldwide to offer fully serviced apartments tailored for business travelers, relocations, and extended stays.

Key U.S. Serviced Apartment Companies:

- The Ascott Limited

- Habicus Group

- The Squa.re Serviced Apartments

- Adagio

- Marriott International, Inc.

- Blueground Holdings Limited

- Synergy Global Housing

- Execustay Boutique Guesthouse

- Hospitality Net

- National Corporate Housing

Recent Developments

-

In May 2025, rental rates for mid-priced serviced apartments in Hanoi surged by 14%, reaching approximately USD 25 per square meter per month, while occupancy stood at 77%. High-end apartments held steady at USD 35/m²/month, with slightly higher occupancy of 82%. Overall, the market saw average rents climb by 5% year-on-year to around US USD23/m²/month, with an average occupancy of 86%, a 2-percentage-point gain over the previous quarter.

-

In July 2024, Ascott Limited announced a global partnership with Chelsea FC to boost its brand visibility and engagement through the exclusive Chelsea FC Global Hotels Partnership. This collaboration seeks to harness Chelsea FC’s worldwide popularity to promote Ascott’s serviced apartments and expand its market presence. The alliance will feature co-branded marketing campaigns and offer exclusive benefits to Chelsea FC fans, strengthening Ascott’s standing as a key player in the global serviced apartment industry while connecting with the vast fanbase of one of football’s most iconic clubs.

-

In July 2022, Marriott International launched "Apartments by Marriott Bonvoy," a new brand tailored for the upper-upscale to luxury segments that blends the independence of apartment-style accommodations with Marriott's trusted service and loyalty ecosystem. Designed for travelers, from long-term business guests to families blending work and leisure, these apartments include a separate living room, full kitchen, and in-unit laundry, distinguishing them from traditional hotel offerings that may consist of food and beverage or meeting facilities.

U.S. Serviced Apartment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 14.86 billion

Revenue forecast in 2033

USD 44.03 billion

Growth rate

CAGR of 14.5% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, booking mode

Country scope

U.S.

Key companies profiled

The Ascott Limited; Habicus Group; The Squa.re Serviced Apartments; Adagio; Marriott International, Inc.; Blueground Holdings Limited; Synergy Global Housing; Execustay Boutique Guesthouse; Hospitality Net; National Corporate Housing

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Serviced Apartment Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. serviced apartment market report based on type, end use, and booking mode:

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Long Term (>30 Nights)

-

Short Term (<30 Nights)

-

-

End-use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Corporate/Business Traveler

-

Leisure Travelers

-

Expats and Relocators

-

-

Booking Mode Outlook (Revenue, USD Billion, 2021 - 2033)

-

Direct Booking

-

Online Travel Agencies

-

Corporate Contracts

-

Frequently Asked Questions About This Report

b. The U.S. serviced apartment market was estimated at USD 13.80 billion in 2024 and is expected to reach USD 14.86 billion in 2025.

b. The U.S. serviced apartment market is expected to grow at a compound annual growth rate of 14.5% from 2025 to 2033 to reach USD 44.03 billion by 2033.

b. Serviced apartments for short term stays accounted for a revenue share of 65.47% of the U.S. serviced apartment market in 2024 due to their flexibility, cost-effectiveness, and home-like comfort for stays under 30 nights.

b. Some of the key players in the U.S. serviced apartment market The Ascott Limited; Habicus Group; The Squa.re Serviced Apartments; Adagio; Marriott International, Inc.; Blueground Holdings Limited; Synergy Global Housing; Execustay Boutique Guesthouse; Hospitality Net; National Corporate Housing.

b. In the U.S., the serviced apartment market is fueled by strong corporate and relocation demand. Businesses seek cost-efficient, home-like accommodations for extended stays, alongside a growing population of digital nomads and remote workers. Rising urban migration and higher disposable incomes are expanding the customer base, while companies increasingly favor direct corporate contracts and bookings for greater convenience and cost savings.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.