- Home

- »

- Medical Devices

- »

-

U.S. Skilled Nursing Facility Devices Market, Report, 2030GVR Report cover

![U.S. Skilled Nursing Facility Devices Market Size, Share & Trends Report]()

U.S. Skilled Nursing Facility Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Lifts, Hygiene Products, Therapeutic Mattress Surfaces, Medical Bed Frames), And Segment Forecasts

- Report ID: GVR-4-68040-461-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

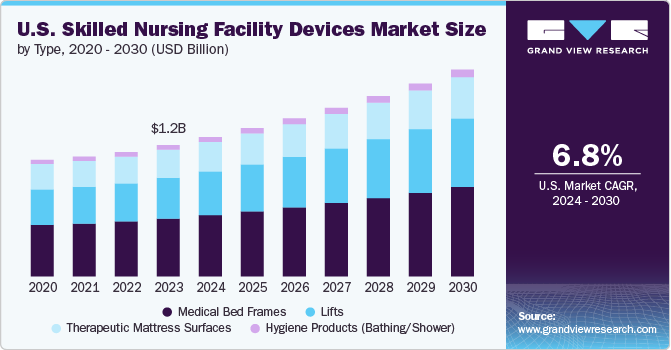

The U.S. skilled nursing facility devices market size was estimated at USD 1.22 billion in 2023 and is expected to grow at a CAGR of 6.78% from 2024 to 2030. The market is expected to grow significantly due to the need for advanced patient care devices, such as lifts, hygiene products, and therapeutic mattress surfaces. In addition, technological advancements in medical bed frames and other essential equipment enhance patient outcomes and operational efficiency in SNFs, further propelling market growth. According to the CDC 2023 data, 6 in 10 adults in the U.S. have a chronic disease. As chronic conditions often require long-term care, SNF are expanding their device offerings to include advanced therapeutic mattress surfaces and patient lifts.

As the incidence of chronic conditions in an aging population rises, there is an increasing need for advanced therapeutic mattresses that help prevent & manage pressure sores. These mattresses, equipped with alternating pressure, low-air-loss, and gel overlays, provide crucial support and improve comfort for immobile or bedridden patients. For instance, in June 2023, Hill-Rom Holdings, Inc. (Baxter) launched the Hillrom Progressa+ bed for the ICU in the U.S. The bed is designed to enhance patient care and recovery with advanced technology & features. Progressa+ aims to streamline nursing workflows and improve patient outcomes in critical care settings. The focus on enhancing patient care quality and reducing complications associated with pressure ulcers is thus fueling the demand for these specialized mattress surfaces, which is expected to drive the market growth.

Moreover, key players undertake product innovations and geographic expansion to increase their foothold in the market and provide innovative products to healthcare organizations. For instance, in November 2022, Invacare Corporation launched the Birdie Evo XPLUS in the U.S., a cutting-edge patient lift designed for post-acute care. Its modern design features advanced technology to enhance comfort and safety, including the Slow’R Integrated Dampener for stable lifts and an ergonomic sling hook to prevent accidental slips and improve ease of use.

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, market characteristics, and market participants. The x-axis represents the level of market concentration, ranging from low to high. The y-axis represents various market characteristics, including the degree of innovation, industry competition, product substitutes, and impact of regulations, level of partnerships & collaboration activities, and geographic expansion. For instance, the market is fragmented, with many small players entering the market and launching new innovative products. The degree of innovation is medium, the level of partnerships & collaboration activities is medium, the impact of regulations on the market is high, and the regional expansion of the market is low.

Innovations include smart beds with integrated sensors for monitoring patient vitals and movement. For instance, in January 2024, Joerns Healthcare launched new 2024 models of its renowned EasyCare and UltraCare beds, featuring enhanced clinical and caregiver functionalities. These updated beds, known for their unmatched strength and stability, now offer advanced controls & increased weight capacity.

The market saw notable consolidations as larger operators sought to expand their reach and capabilities. For instance, in June 2023, Joerns Healthcare partnered with Winncare, a top European innovator in mobility solutions, to introduce Winncare’s moving and handling product range to the U.S. market. This collaboration enhanced Joerns’ leadership in long-term and post-acute care fall management solutions.

The impact of regulations on the industry is high, with strict guidelines influencing device development and deployment. Regulatory bodies such as the FDA enforce rigorous medical device standards, including safety, efficacy, and quality control requirements. The stringent regulatory environment ensures patient safety and quality of care but can also create barriers to entry and increase operating costs for market participants.

Regional expansion efforts are evident as skilled nursing facilities aim to penetrate underserved markets across the U.S., particularly in rural areas where access to healthcare is limited. While there is notable regional growth, the pace is more measured than in other sectors, with companies often prioritizing strategic rather than extensive geographic expansion.

Type Insights

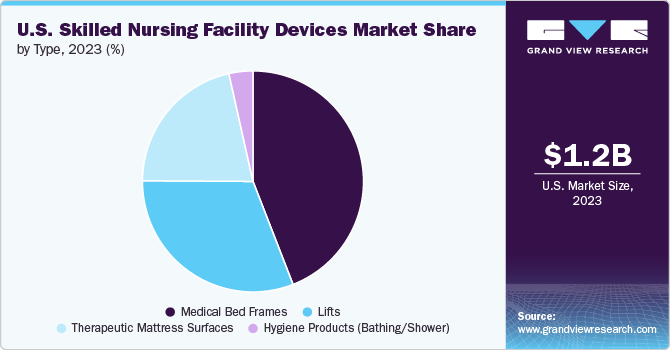

Based on type, the medical bed frames segment held the largest revenue share of 44.07% in 2023. Its dominance is attributed to the increasing elderly population requiring specialized beds to address various medical and mobility needs. Technological advancements in bed design, such as enhanced adjustability and integrated support features, are expected to improve patient care and facility efficiency. For instance, in September 2023, Arjo launched the Evenda bed range designed for long-term care.

The lifts segment is expected to grow at the fastest CAGR over the forecast period. Its growth is attributed to the increasing need for efficient and safe patient handling and rising requirements for advanced lift solutions to aid mobility and reduce the risk of injury for caregivers and patients. As the population ages, more facilities require advanced lifting solutions to aid mobility and reduce the risk of injury for patients & caregivers. According to the Administration for Community Living, in 2022, about 17.3% of the U.S. population was 65 years and above, expected to rise to 22% by 2040. Of the elderly aged 65 years and older living in communities, 59% lived with their spouse or partner in 2023, with about 28% living alone.

Key U.S. Skilled Nursing Facility Devices Company Insights

Some of the major companies in the market are Invacare Corporation; Hill-Rom Holdings, Inc.; Medline Industries, LP.; Direct Supply, Inc.; Agiliti Health, Inc.; Drive DeVilbiss Healthcare; Arjo; Joerns Healthcare; and others. The strategies of key players to strengthen their market presence include new product launches, partnerships & collaborations, mergers & acquisitions, and geographical expansion. For instance, in May 2024, Thomas H. Lee Partners, L.P., a private equity investment firm, acquired Agiliti Health, Inc., a medical technology management & service solutions provider, at an enterprise value of USD 2.5 billion. Some emerging players include IndeeLift, US Med-Equip, MediLogix, and others.

Key U.S. Skilled Nursing Facility Devices Companies:

- Invacare Corporation

- Drive DeVilbiss Healthcare (Medical Depot, Inc.)

- Medline Industries, LP.

- Guldmann Inc.

- Hill-Rom Holdings, Inc. (Baxter)

- Direct Supply, Inc.

- Joerns Healthcare

- Savaria

- McKesson Medical-Surgical Inc.

- Arjo

Recent Developments

-

In August 2023, Apollo Corporation enhanced its ReGen Walk-in Bathtub, tailored for seniors, by incorporating the Remedy U.V. Germicidal water purification system to purify water and minimize bacteria. In addition, the bathtub now has 16 air & water jets, seat & back warmers, an in-line water heater, an integrated disinfectant & cleaning system, and added storage for Apollo’s Turbo Clean & Cid-A-L II.

-

In April 2023, Paramount Bed Co., Ltd. partnered with US Med-Equip as its exclusive U.S. distributor. This partnership allowed US Med-Equip to supply hospitals and clinicians nationwide with Paramount Bed’s durable, safety-focused beds and assistive devices, designed for extended lifespans, enhanced early mobility, & easy maintenance.

-

In January 2023, US Med-Equip partnered with Turn Medical, LLC to offer hospitals on-demand access to an advanced automated prone therapy bed developed for critically ill respiratory patients.

U.S. Skilled Nursing Facility Devices Market Report Scope

Report Attribute

Details

Revenue forecast in 2024

USD 1.29 billion

Revenue forecast in 2030

USD 1.91 billion

Growth rate

CAGR of 6.78% from 2024 to 2030

Actual data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type

Country scope

U.S.

Key companies profiled

Invacare Corporation; Drive DeVilbiss Healthcare (Medical Depot, Inc.); Medline Industries, LP.; Guldmann Inc.; Hill-Rom Holdings, Inc. (Baxter); Direct Supply, Inc.; Joerns Healthcare; Savaria; McKesson Medical-Surgical Inc.; Arjo

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Skilled Nursing Facility Devices Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. skilled nursing facility devices market report based on type:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Lifts

-

Floor Lift

-

Ceiling Lift

-

Stand Assist Lifts

-

-

Hygiene Products (Bathing/Shower)

-

Therapeutic Mattress Surfaces

-

Purchase

-

Rental

-

-

Medical Bed Frames

-

Purchase

-

Rental

-

-

Frequently Asked Questions About This Report

b. The U.S. skilled nursing facility devices market size was estimated at USD 1.22 billion in 2023 and is expected to reach USD 1.29 billion in 2024.

b. The U.S. skilled nursing facility devices market is expected to grow at a compound annual growth rate of 6.78% from 2024 to 2030 to reach USD 1.91 billion by 2030.

b. Medical bed frames dominated the overall market with a revenue share of around 44% in 2023 owing to the increasing elderly population requiring specialized beds to address various medical and mobility needs.

b. Some key players operating in the U.S. skilled nursing facility devices market include Invacare Corporation, Drive DeVilbiss Healthcare (Medical Depot, Inc.), Medline Industries, LP., Guldmann Inc., Hill-Rom Holdings, Inc. (Baxter), Direct Supply, Inc., Joerns Healthcare, Savaria, McKesson Medical-Surgical Inc., and Arjo.

b. Key factors that are driving the U.S. skilled nursing facility devices market growth include increasing aging population, technological advancements, rising prevalence of chronic diseases

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.