- Home

- »

- Medical Devices

- »

-

U.S. Skilled Nursing Facilities Market, Industry Report, 2033GVR Report cover

![U.S. Skilled Nursing Facilities Market Size, Share & Trends Report]()

U.S. Skilled Nursing Facilities Market (2025 - 2033) Size, Share & Trends Analysis Report By Type Of Facility (Freestanding, Hospital), By Ownership (For-profit Facilities, Non-profit Facilities, Government), By Region (West, Southeast, Southwest, Midwest), And Segment Forecasts

- Report ID: GVR-4-68038-059-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Skilled Nursing Facilities Market Trends

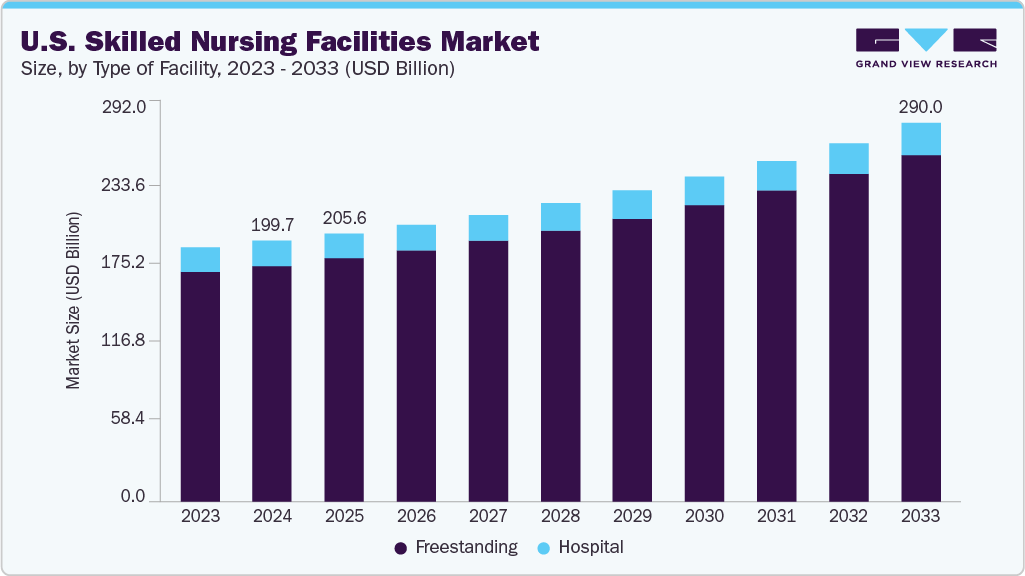

The U.S. skilled nursing facilities market size was estimated at USD 199.72 billion in 2024 and is expected to reach USD 290.02 billion by 2033, growing at a CAGR of 4.39% from 2025 to 2033. There is a high demand for skilled nursing facilities (SNFs) in the U.S. as they can provide quality care at a much lower cost than hospitals. Rising geriatric population and high prevalence of several chronic diseases are boosting the overall acceptance of SNFs in the U.S., driving the market growth.As per data published by the Population Reference Bureau, the number of people in the U.S. aged 65 & above is estimated to reach 52 million by 2050 from 58 million in 2022. Maine (44.8%) accounts for the largest proportion of the population aged 65 & above, and Utah (31.9%) accounts for the lowest proportion.

The risk of diabetes & cardiovascular diseases increases with age, which results in a higher incidence of these diseases in adults aged 60 years and above. SNFs offer on-site dialysis, ventilator care, and orthopedic rehabilitation to the geriatric population, among others. These factors are expected to propel the market. As per the report from the American Diabetes Association released in 2024, diabetes is a widespread health issue among the elderly population. More than 25% of individuals aged 65 and older are diagnosed with diabetes, while about 50% of older adults are classified as having prediabetes.

The prevalence of chronic diseases is increasing at a significant rate. Along with general age-related disabilities, the elderly suffer from chronic diseases such as cancer, heart problems, diabetes, cerebral palsy, Parkinson's disease, multiple sclerosis, dementia, Alzheimer’s disease, and mental stress.The rising prevalence of Alzheimer’s disease, especially dementia, is a key factor boosting the SNFs market in the U.S. According to the Alzheimer's Dement report, in 2024, around 6.9 million Americans aged 65 and above were affected by Alzheimer's dementia. This figure is projected to rise to 13.8 million by the year 2060, unless there are significant advancements in medical science to prevent or treat Alzheimer's disease.

Medicare and Medicaid continue to play a critical role in supporting the U.S. SNFs market, as these programs remain the largest payers for post-acute and long-term care services. Recent updates from the Centers for Medicare & Medicaid Services (CMS) highlight meaningful reimbursement growth, which directly supports SNF operations. For instance, the FY 2024 unadjusted federal per diem rates increased across categories compared to FY 2023. In urban facilities, per diem rates rose from USD 62.82 to USD 70.26 for physical therapy, USD 58.48 to USD 65.40 for occupational therapy, and USD 109.51 to USD 122.47 for nursing. Similarly, rural facilities also recorded growth, with nursing rates increasing from USD 104.63 in FY 2023 to USD 117.01 in FY 2024. These reimbursement improvements strengthen the financial sustainability of SNFs, enabling them to better serve a growing aging population with complex medical needs.

CMS SNFs Unadjusted Federal Rate Per Diem

Category

FY 2023 Urban

FY 2024 Urban

FY 2023 Rural

FY 2024 Rural

Physical Therapy

USD 62.82

USD 70.26

USD 71.61

USD 80.09

Occupational Therapy

USD 58.48

USD 65.40

USD 65.77

USD 73.56

Speech Language Pathology

USD 23.45

USD 26.23

USD 29.55

USD 33.05

Nursing

USD 109.51

USD 122.47

USD 104.63

USD 117.01

Non-Therapy Ancillaries

USD 82.62

USD 92.40

USD 78.93

USD 88.28

Non Case Mix

USD 98.07

USD 109.68

USD 99.98

USD 111.71

Furthermore, private equity investment in SNFs has witnessed significant growth in recent years, a trend that is expected to accelerate as competition within the market intensifies. Since federal and state funding alone is insufficient to support the evolving needs of skilled nursing facilities, private capital has become a critical driver of innovation, infrastructure upgrades, and service expansion. This growing reliance on private investment is expected to create substantial opportunities for stakeholders, while also enhancing the overall quality and efficiency of care delivery in the sector.

According to an ATI advisory analysis commissioned by the National Investment Center for Seniors Housing & Care (NIC), skilled nursing institutions need private capital investments to promote innovation, which enables them to provide care for older people. For instance, in 2021, USD 3.7 billion was spent on skilled nursing transactions. Around 89% were considered private buyers. In addition, market players are raising funds for SNFs, which is expected to propel market growth. For instance, in January 2022, Genesis HealthCare raised about USD 100,000 for the National Alzheimer's Association Walk to End Alzheimer's Disease.

Moreover, increasing technology and telehealth integration is one of the key growth drivers in the U.S. SNFs market. According to the MJH Life Sciences article, telemedicine adoption in SNFs surged from only 0.15% of routine visits before the pandemic to nearly 15% during COVID-19, with 37% of outpatient visits conducted virtually in that period, highlighting a rapid transformation in care delivery models. Furthermore, facilities are also increasingly investing in remote patient monitoring, video-enabled specialist consultations, and AI-assisted decision support tools, thereby fueling the growth of the U.S. skilled nursing facilities (SNFs) industry.

Market Concentration & Characteristics

The U.S. skilled nursing facilities (SNFs) market is fragmented, with many small players entering the market. The degree of innovation is medium, and the level of acquisition and mergeractivities is high. The impact of regulations on the market is medium, and the service expansion of players is medium.

Facilities are increasingly integrating electronic health records (EHRs), telehealth services, and remote patient monitoring to improve clinical efficiency and resident outcomes. Investment in advanced rehabilitation equipment and AI-driven decision support tools is further modernizing care pathways.At the same time, new models such as value-based care and personalized treatment programs are being adopted to enhance quality while containing costs.

The market players are leveraging strategies such as acquisitions and mergers to promote the reach of their offerings and increase their service capabilities. In July 2025, Creative Solutions in Healthcare, Texas's largest operator of SNFs, completed the acquisition of five skilled nursing homes from Diversicare, starting on July 1. This purchase expands the company's presence in the state to 174 properties, which encompasses 153 skilled nursing locations.

State and federal regulations safeguard patients in skilled nursing institutions to stop abuse and provide high-quality care. States differ in the number of regulations they follow; however, nursing homes must at the very least abide by federal law intended to safeguard residents. Stringent government regulations by the U.S. government to start and expand SNFs are likely to put pressure on established players & new entrants. Various federal and state laws regulate such facilities. To receive skilled nursing facility care under Medicare, a person must be certified as terminally ill by a doctor/physician and entitled to Part A of Medicare with a prognosis of 6 months or less.

The level of regional expansion is significant in the U.S. due to various government programs and initiatives. For instance, in July 2024, the Alaska Native Tribal Health Consortium is set to construct an SNF costing USD 70 million, aimed at reducing the strain on the Alaska Native Medical Center in Anchorage. The design for the temporary skilled nursing facility includes a two-story building with a total area of 92,000 square feet, which is expected to be finished by the summer of 2026, according to a statement from the consortium.

Type Of Facility Insights

The freestanding segment dominated the U.S. skilled nursing facilities (SNFs) market with the largest revenue share of 90.45% in 2024. Freestanding SNFs offer 24-hour skilled nursing and personal care. These facilities also provide rehabilitation services such as physical & occupational therapy and speech-language & pathology services. SNF market, benefiting from scale, stronger financial margins, and greater adaptability in adopting technology and value-based care models. Their independence allows them to respond more effectively to rising demand from an aging population with complex chronic conditions such as dementia, diabetes, and cardiovascular disease.

According to MedPAC’s March 2025 Report to Congress, freestanding SNFs comprised 97% of all SNFs in the U.S. and accounted for 98% of fee-for-service (FFS) Medicare stays and spending in 2023. The same report highlights that freestanding SNFs achieved a Medicare margin of 22% in 2023, reflecting their financial resilience and capacity to reinvest in workforce expansion, therapy enhancements, and telehealth infrastructure. With their dominant presence and profitability, freestanding SNFs are expected to continue driving overall market growth and shaping the evolution of post-acute care delivery.

The hospital segment is anticipated to grow at the fastest CAGR during the forecast period. Hospital-based nursing facilities provide better professional nursing services through the joint operation of hospitals and their SNFs. The adoption of better infrastructure and superior communication and coordination in hospitals helps nursing facilities improve services based on patient needs.Hospital SNFs have experienced an increase in medically complex hospitalizations; however, the daily costs of hospital SNFs have increased due to the increase in qualified staff and shorter stays. By moving the patient to the SNF bed, hospitals can shorten the length of stay (LOS) of the inpatient, thereby freeing the inpatient's bed for additional inpatient treatment.

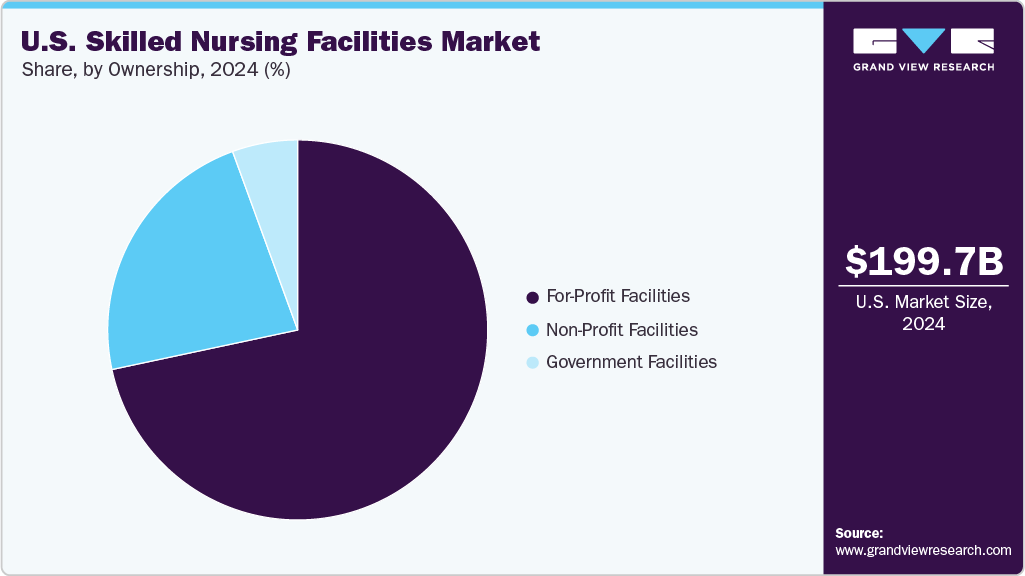

Ownership Insights

The for-profit segment dominated the U.S. skilled nursing facilities (SNFs) industry with the largest revenue share of 71.66% in 2024. Growth in the for-profit segment is primarily driven by the increasing presence of large corporate chains and private equity-backed operators who focus on scaling operations, adopting efficiency-driven models, and expanding into high-demand geographies. These operators leverage economies of scale, advanced technology adoption, and diversified service offerings such as post-acute rehabilitation and memory care to enhance profitability. The rising demand for specialized care, coupled with opportunities to optimize reimbursement through Medicare and managed care contracts, further supports the growth of for-profit facilities.

The non-profit segment is anticipated to grow at the fastest CAGR during the forecast period. Growth in the non-profit segment comes from the practice of reinvesting revenues into facility improvements, workforce development, and care programs. These facilities maintain long-standing ties within local communities, which support patient trust and continuity of care. In addition, many non-profits receive supplemental funding through donations or endowments, allowing them to sustain operations and invest in specialized services. As demand rises from an aging population with diverse care requirements, non-profit SNFs are positioned to expand their role through collaborations with hospitals, health systems, and community organizations that facilitate patient referrals.

Regional Insights

The Southeast U.S. skilled nursing facilities (SNFs) market is expected to grow over the forecast period, due to factors such as demographic and an improving healthcare system. This area has one of the largest concentrations of older adults, with states such as Florida, Georgia, and the Carolinas experiencing rapid growth in their elderly populations. This shift is leading to an increased demand for long-term and post-acute care services. Moreover, Medicaid expansion in several Southeastern states and continued support from Medicare are improving access to and affordability of care. At the same time, growing investments in facility modernization, staff training, and telehealth integration are enhancing the quality of care, making SNFs a critical component of the regional healthcare landscape.

The West U.S. skilled nursing facilities (SNFs) market’s growth is driven by a growing aging population, especially in states such as California, Arizona, and Nevada. The rising prevalence of chronic conditions, such as dementia and diabetes, is increasing the demand for long-term care. Integrated healthcare delivery is on the rise, with hospitals collaborating with skilled nursing facilities to reduce readmissions. Favorable Medicaid and Medicare reimbursement rates support service utilization. In addition, advanced healthcare infrastructure and investments in technology enhance care management, while consumer preference for high-quality nursing care fuels demand.

Key U.S. Skilled Nursing Facilities Company Insights

The U.S. skilled nursing facilities market presents a competitive landscape marked by consolidation among large operators and the continued presence of regional and independent providers. Major national chains are expanding through acquisitions and new developments, seeking economies of scale in staffing, technology adoption, and resident services.

Key U.S. Skilled Nursing Facilities Companies:

- Genesis Healthcare Corp.

- Brookdale Senior Living, Inc.

- The Ensign Group, Inc.

- National HealthCare Corporation

- Sunrise Senior Living, LLC

- Life Care Services

- HCR ManorCare

- Golden LivingCenters

- Life Care Centers of America

- SavaSeniorCare Administrative Services LLC

Recent Developments

-

In August 2025, Pearl Health and Management Network Services (MNS) recently formed a strategic partnership to empower skilled nursing facilities to participate effectively in value-based Medicare programs such as ACO REACH. MNS, with decades of managed-care expertise and proprietary technology used by nearly 5,000 SNFs, brings capabilities in credentialing, contracting, care coordination, claims handling, and payer operations.

-

In June 2025, the Ensign Group officially expanded its footprint in Idaho by acquiring the operations of two skilled nursing facilities in Coeur d’Alene: the Ironwood Rehabilitation and Care Center (80 beds) and the Lakeside Rehabilitation and Care Center (100 beds). These acquisitions are structured under a long-term triple-net master lease with a third-party landlord, allowing Ensign to integrate the operations while maintaining property stability.

-

In December 2024, PACS Group, Inc. finalized the acquisition of operations for 11 skilled nursing facilities in Tennessee, totaling 1,310 skilled nursing beds. The acquisition extends PACS’ reach to 17 states, reinforcing its presence in the post-acute care sector. PACS also highlighted its strong operational metrics with an average 4.0 Quality Measure star rating across skilled nursing facilities and occupancy rates above the industry average—underscoring the stability and quality of its expanding network.

-

In October 2024, CareTrust REIT, along with a joint venture partner, entered into a binding agreement to acquire a portfolio of 31 skilled nursing facilities for approximately USD 500 million, marking its largest acquisition to date. The portfolio comprises 3,290 licensed beds, with 30 facilities located in Tennessee and one in Alabama, purchased from American Health Partners.

U.S. Skilled Nursing Facilities Market Report Scope

Report Attribute

Details

Revenue forecast in 2033

USD 290.0 billion

Growth rate

CAGR of 4.39% from 2025 to 2033

Actual data

2021 - 2024

Forecast data

2025 - 2033

Quantitative units

Revenue in USD billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type of facility, ownership, region

Country scope

U.S.

Key companies profiled

Genesis Healthcare Corp.; Brookdale Senior Living, Inc.; The Ensign Group, Inc.; National HealthCare Corporation; Sunrise Senior Living, LLC; Life Care Services; HCR ManorCare; Golden LivingCenters; Life Care Centers of America; SavaSeniorCare Administrative Services LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Skilled Nursing Facilities Market Report Segmentation

This report forecasts revenue growth at the country and regional levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. skilled nursing facilities (SNFs) market report based on type of facility, ownership, and region:

-

Type of Facility Outlook (Revenue, USD Billion, 2021 - 2033)

-

Freestanding

-

Hospital

-

-

Ownership Outlook (Revenue, USD Billion, 2021 - 2033)

-

For-profit

-

Non-profit

-

Government

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

West

-

Southeast

-

Southwest

-

Midwest

-

Northeast

-

Frequently Asked Questions About This Report

b. The U.S. skilled nursing facility market was estimated at USD 199.72 billion in 2024 and is expected to reach USD 205.62 billion in 2025.

b. The U.S. skilled nursing facility market is expected to grow at a compound annual growth rate of 4.39% from 2025 to 2033 to reach USD 290.02 billion by 2033.

b. Freestanding SNFs dominated the type segment of the U.S. skilled nursing facility market with a share of 90.45% in 2024. This is attributable to the lower costs for services at freestanding SNFs as compared to hospital-based facilities and increased Medicare payments

b. Some key players operating in the U.S. skilled nursing facility market include Genesis Healthcare, Brookdale Senior Living Solutions, The Ensign Group, Inc., Sunrise Senior Living, Brightview Senior Living, Life Care Centers of America, Kindred Healthcare, Atria Senior Living, Inc., Five Star Senior Living (AlerisLife), Sonida Senior Living, Merrill Gardens, Belmont Village, L.P., Holding Company of The Villages, Inc., LCS. (Life Care Services), Erickson Senior Living, Kensington Park Senior Living, Masonicare.org, Azura Memory Care, Robson Senior Living, Kisco Senior Living, Discovery Senior Living, Americare Senior Living, Gardant Management Solutions, Asbury Communities, Inc., Covenant Living, Vetter Senior Living, Eden Senior Care, Stellar Living Communities, Phoenix Senior Living, Trilogy Health Services, LLC (American Healthcare REIT)

b. Key factors that are driving the U.S. skilled nursing facility market growth include high-quality care services offered by SNFs at a much lower cost as compared to hospitals, increasing demand among investors, an increasing geriatric population & a high prevalence of multiple chronic diseases in the U.S.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.