- Home

- »

- Advanced Interior Materials

- »

-

U.S. Sludge Dewatering Equipment Market Size Report 2033GVR Report cover

![U.S. Sludge Dewatering Equipment Market Size, Share & Trends Report]()

U.S. Sludge Dewatering Equipment Market (2025 - 2033) Size, Share & Trends Analysis Report By Technology Type (Belt Filter Press, Centrifuges, Screw Press), By Application (Industrial, Municipal), And Segment Forecasts

- Report ID: GVR-4-68040-677-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Sludge Dewatering Equipment Market Summary

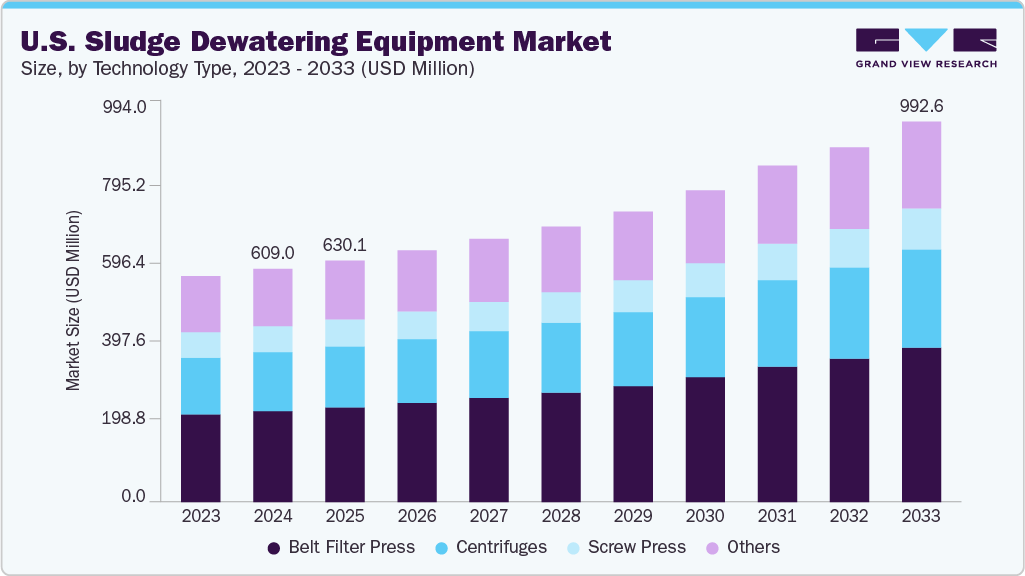

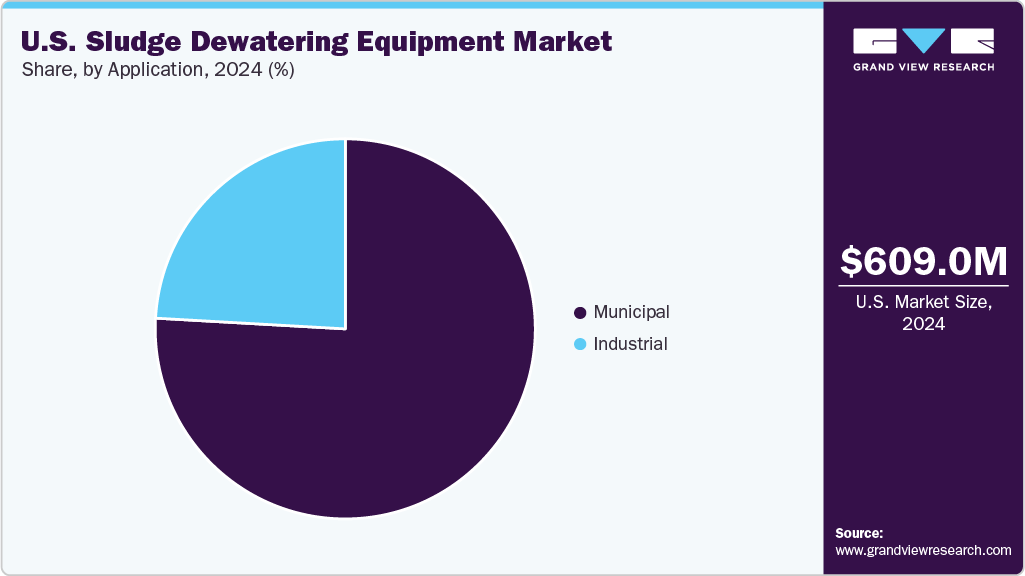

The U.S. sludge dewatering equipment market size was estimated at USD 609.0 million in 2024 and is projected to reach USD 992.6 million by 2033, growing at a CAGR of 5.8% from 2025 to 2033. The rising investments in wastewater infrastructure, stricter environmental regulations, and increasing industrial waste generation are expected to drive the market growth.

Key Market Trends & Insights

- By technology type, the belt filter press segment dominated the U.S. sludge dewatering equipment market in 2024, capturing a 39.0% share.

- By application, the industrial segment is expected to grow at a considerable CAGR of 6.2% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 609.0 Million

- 2033 Projected Market Size: USD 992.6 Million

- CAGR (2025-2033): 5.8%

Government initiatives promoting sustainable water management and technological advancements in dewatering systems are further driving demand across municipal and industrial sectors nationwide. Technological advancements are accelerating the growth of the U.S. sludge dewatering equipment industry by improving treatment efficiency and aligning with strict EPA standards. Innovations like high-capacity belt filter presses, energy-efficient centrifuges, and IoT-enabled systems support real-time monitoring and automation. These technologies help utilities reduce sludge volumes, cut disposal costs, and meet environmental compliance more effectively.

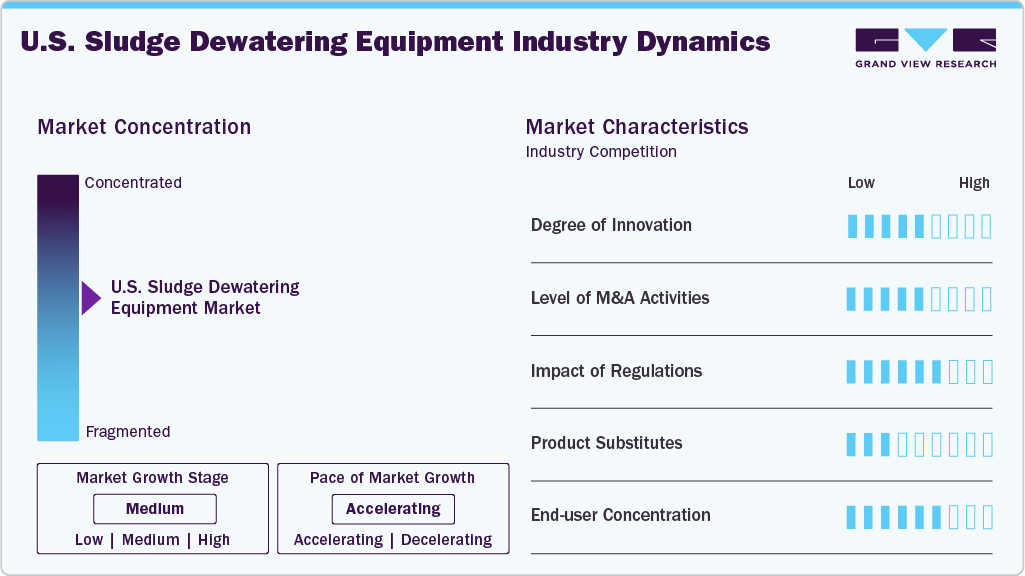

Market Concentration & Characteristics

The U.S. sludge dewatering equipment market is moderately consolidated, featuring several prominent domestic and multinational corporations. Major companies leverage advanced technologies, strong production capacity, and wide distribution to serve municipal and industrial projects. Meanwhile, regional manufacturers gain ground by offering economic, customized solutions. Strategic initiatives such as mergers, partnerships, and investments in R&D are fueling market expansion.

In the U.S., the sludge dewatering equipment industry is experiencing rapid innovation, with a strong emphasis on automation, energy efficiency, and smart monitoring technologies. Domestic manufacturers and suppliers are incorporating IoT-enabled systems and predictive maintenance tools to optimize performance, enhance throughput, and reduce environmental impact across municipal and industrial wastewater facilities.

Mergers and acquisitions remain a key strategy among U.S.-based companies, aiming to broaden their technology portfolios and strengthen their geographic reach. These activities are fostering competition and accelerating the adoption of specialized sludge treatment solutions tailored to U.S. infrastructure and environmental needs.

Stringent EPA regulations and federal wastewater mandates are significantly shaping the U.S. market. These policies require advanced sludge handling practices to reduce waste volume, cut disposal costs, and meet sustainability benchmarks. There is growing investment in high-performance centrifuges, screw presses, and membrane filtration systems that offer long-term operational efficiency and regulatory compliance.

Drivers, Opportunities & Restraints

A major driver of the U.S. sludge dewatering equipment market is the stringent environmental regulations imposed by the Environmental Protection Agency (EPA). These mandates require municipalities and industries to implement effective sludge treatment processes to minimize environmental damage and comply with wastewater discharge norms. As a result, demand for advanced dewatering technologies such as belt filter presses, centrifuges, and screw presses has increased significantly.

The increasing investment in upgrading aging wastewater treatment infrastructure across the U.S. presents a key opportunity for the sludge dewatering equipment market. With many municipal and industrial facilities operating on outdated systems, modernization initiatives are fueling demand for smart, energy-efficient dewatering solutions. The integration of IoT, automation, and AI-driven monitoring in sludge processing offers untapped potential for innovation, cost savings, and performance optimization.

A significant restraint in the U.S. sludge dewatering equipment industry is the high initial capital investment required for installing advanced dewatering systems. Small- and medium-sized facilities, particularly in rural or less affluent municipalities, may struggle to justify or secure the funding needed for such upgrades. Additionally, complex installation procedures, space limitations, and maintenance requirements can deter some end users from adopting modern equipment.

Technology Type Insights

In the U.S., the belt filter press segment dominated the U.S. sludge dewatering equipment market in 2024, capturing a 39.0% share. This is attributed to its cost-efficiency, ease of operation, and suitability for high-volume municipal and industrial wastewater treatment. Its continuous operation and low energy use make it an attractive solution for large facilities aiming to optimize sludge management.

The centrifuges segment is experiencing robust growth across the U.S. industries. Known for their compact design, high-speed separation efficiency, and adaptability to different sludge types, centrifuges are increasingly favored for applications requiring high throughput and automation. Their ability to minimize manual labor and footprint makes them ideal for modern treatment facilities.

Application Insights

The municipal segment dominated the U.S. sludge dewatering equipment industry in 2024 and continues to expand significantly. Urban growth and aging wastewater infrastructure are placing increasing pressure on sewage treatment systems. Federal and state governments are investing in advanced dewatering technologies to improve operational efficiency, meet stringent EPA standards, and ensure sustainable waste management across municipalities.

The industrial segment is also growing steadily in the U.S. sludge dewatering equipment market, driven by increasing sludge output from sectors like food processing, pharmaceuticals, chemicals, and mining. Industrial players are adopting energy-efficient and automated dewatering solutions to comply with environmental regulations, reduce landfill costs, and support corporate sustainability goals.

Key U.S. Sludge Dewatering Equipment Company Insights

Some of the key players operating in the market include Alfa Laval, ANDRITZ, Veolia Water Technologies, and HUBER SE.

-

Alfa Laval is a global provider of specialized products and engineering solutions based on its key technologies of heat transfer, separation, and fluid handling. In the sludge dewatering equipment market, the company holds a prominent position due to its extensive range of decanter centrifuges and belt filter presses that serve both municipal and industrial wastewater treatment applications. Alfa Laval’s dewatering solutions are designed to optimize dry solids content while minimizing energy consumption and operational costs.

-

ANDRITZ is a globally recognized engineering group headquartered in Austria, offering innovative and sustainable technology solutions across multiple sectors, including water and wastewater management. In the sludge dewatering equipment market, ANDRITZ stands out for its robust portfolio of mechanical dewatering technologies such as belt presses, screw presses, and decanter centrifuges. The company’s innovative solutions, like the ANDRITZ C-Press screw press and D-Series decanter centrifuges, are designed for maximum performance, reliability, and cost-efficiency.

Key U.S. Sludge Dewatering Equipment Companies:

- ALFA LAVAL

- ANDRITZ

- HUBER SE

- Evoqua Water Technologies LLC

- Kontek Ecology Systems Inc.

- Flottweg SE

- Kurita Water Industries Ltd.

- Veolia Water Technologies

- Komline

- Phoenix Process Equipment

Recent Developments

-

In May 2025, Pelagia acquired aquaculture equipment supplier Fjord Solutions. Through its Blue Ocean Technology brand, Pelagia offers sludge and water treatment systems focused on dewatering, storage, and value creation, expanding its reach in sustainable aquaculture operations.

-

In October 2024, the Los Angeles Department of Water and Power announced an investment exceeding USD 6 billion in an advanced water infrastructure initiative, previously known as Operation Next (OpNEXT). This initiative focuses on enhancing local water supply resilience against risks such as aging infrastructure, droughts, earthquakes, and dependence on imported water. The project also includes the integration of sludge dewatering equipment throughout the city, which is expected to support market growth.

U.S. Sludge Dewatering Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 630.1 million

Revenue forecast in 2033

USD 992.6 million

Growth rate

CAGR of 5.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Technology type, application

Country scope

U.S.

Key companies profiled

ALFA LAVAL; ANDRITZ; HUBER SE; Evoqua Water Technologies LLC; Kontek Ecology Systems Inc.; Flottweg SE; Kurita Water Industries Ltd.; Veolia Water Technologies; Komline; Phoenix Process Equipment

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Sludge Dewatering Equipment Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research, Inc. has segmented the U.S. sludge dewatering equipment market report based on technology type, and application:

-

Technology Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Belt Filter Press

-

Centrifuges

-

Screw Press

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Industrial

-

Pulp & Paper

-

Textile

-

Food & Beverage

-

Chemical

-

Others

-

-

Municipal

-

Frequently Asked Questions About This Report

b. The U.S. sludge dewatering equipment market size was estimated at USD 609.0 million in 2024 and is expected to reach USD 630.1 million in 2025.

b. The U.S. sludge dewatering equipment market is expected to grow at a compound annual growth rate of 5.8% from 2025 to 2033 to reach USD 992.6 million by 2033.

b. In the U.S., the belt filter press segment dominated the sludge dewatering equipment market in 2024, capturing a 39.0% share. This is attributed to its cost-efficiency, ease of operation, and suitability for high-volume municipal and industrial wastewater treatment.

b. Some of the key players operating in the U.S. sludge dewatering equipment market include ALFA LAVAL, ANDRITZ, HUBER SE, Evoqua Water Technologies LLC, Kontek Ecology Systems Inc., Flottweg SE, Kurita Water Industries Ltd., Veolia Water Technologies, Komline, Phoenix Process Equipment.

b. Key factors driving the U.S. sludge dewatering equipment market include stringent environmental regulations, rising municipal and industrial wastewater generation, and increasing demand for cost-effective waste management solutions. Technological advancements in dewatering systems and government initiatives for sustainable infrastructure further support market growth across wastewater treatment and industrial applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.