- Home

- »

- Water & Sludge Treatment

- »

-

U.S. Sludge Management And Dewatering Market, Industry Report, 2030GVR Report cover

![U.S. Sludge Management And Dewatering Market Size, Share & Trends Report]()

U.S. Sludge Management And Dewatering Market (2024 - 2030) Size, Share & Trends Analysis Report By Category (CWT, POTW, FOTW), By Source (Municipal, Industrial), By Services, And Segment Forecasts

- Report ID: GVR-4-68040-026-2

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

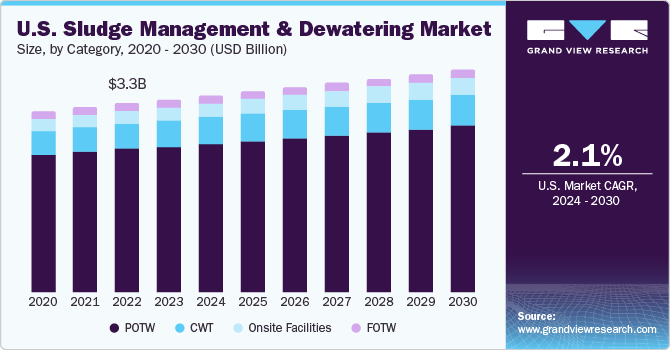

The U.S. sludge management and dewatering market size was estimated at USD 3,353.1 million in 2023 and is projected to grow at a CAGR of 2.1% from 2024 to 2030. The continuously growing population, coupled with the rising demand for wastewater treatment plants in the U.S. is driving the market growth. Ongoing urbanization and increasing population in the U.S. have led to a surge in the volume of wastewater generated in the country. As a large number of people are migrating to urban centers in search of economic opportunities and improved living standards, the demand for infrastructure, including wastewater treatment facilities, is surging correspondingly in the country.

In the U.S., this urban population growth translates into high wastewater generation rates, thereby necessitating the requirement for robust sludge management and dewatering solutions to effectively handle the rising volume of sewage sludge.

The Census Bureau forecasts a significant increase in the U.S. population, with a projected rise of 72 million people over the next 30 years. The population in the country is estimated to reach 338,016 thousand by 2025 and 360,639 thousand by 2050, up from 296 million in 2005. In addition, Pew Research indicates that a substantial 82% of this growth from 2005 to 2050 can be attributed to the number of immigrants arriving in the U.S. within this timeframe, as well as their offspring. Due to this factor, the wastewater generation is likely to remain high in the U.S., which will drive the demand for sludge management and dewatering services.

The presence of stringent government regulations for sludge management and dewatering in the U.S. acts as a significant driver for the market growth in the country as these regulations shape industry practices and spur technological advancements. These regulations enforced by federal and state agencies aim to safeguard public health and protect the environment, as well as ensure the proper handling and disposal of sewage sludge.

For instance, the regulation (EPA 40 CFR Part 503 - Standards for the Use or Disposal of Sewage Sludge) issued by the Environmental Protection Agency (EPA), establishes comprehensive standards for the management, treatment, and disposal of sewage sludge generated during wastewater treatment processes. It outlines requirements for biosolid quality, pathogen reduction, metal limits, and land application practices to protect human health and the environment.

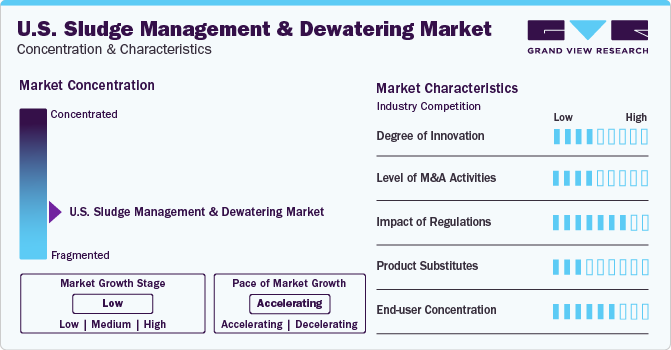

Market Concentration & Characteristics

The industry growth stage is low, and the pace is accelerating. The sludge management industry is characterized by a high degree of competition, owing to the continuous emphasis on new technology adoptions. These advancements are primarily focused on improving efficiency, reducing costs, and minimizing the environmental footprint of sludge management processes. In addition, to improve the service offering, the industry players are incorporating major technologies involved in liquid waste management, such as incineration, sedimentation, and distillation.

The impact of regulations on this industry is likely to remain high over the forecast period. The U.S. market is governed by stringent regulations set down by different associations and ministries. The organizations specify the precautions against risks associated with the collection, transportation, and recycling/disposal activities. For instance, The Clean Water Act (CWA) of 1972 and its amendments govern water pollution in the U.S. and are central to EPA’s mission to protect public health and the environment.

Key industry players adopted strategies like acquisitions and regional expansion in the U.S. Strategic acquisitions can lead to increased industry penetration for an industry player by entering new segments and expanding its customer base. In June 2023, Gardner announced the expansion of the sludge waste landfill in Massachusetts. This expansion is expected to reduce the contamination of wetlands and groundwater. The proposed expansion project area is within 1,300 feet of the Otter River and contains several Millers River Watershed Council (MRWC)-certified vernal pools.

Category Insights

Based on category, the publicly owned treatment works (POTW) segment led the market with the largest revenue share of 75.7% in 2023. POTWs are designed to treat domestic sewage. They collect wastewater from various sources, such as residential, commercial, and industrial facilities, and transport it to the treatment plant. These sources are responsible for the total amount of organic compounds that enter the POTW and produce emissions through evaporation on the surface of wastewater during the treatment process.

The onsite facilities segment is anticipated to witness at the fastest CAGR over the forecast period. Onsite facilities cater to the requirements of waste treatment of a diverse range of industries, institutions, and small municipalities that generate sludge but may not have access to CWT infrastructures. Onsite facilities segment of the U.S. market has been experiencing notable evolution in terms of technologies and expansion in recent years.

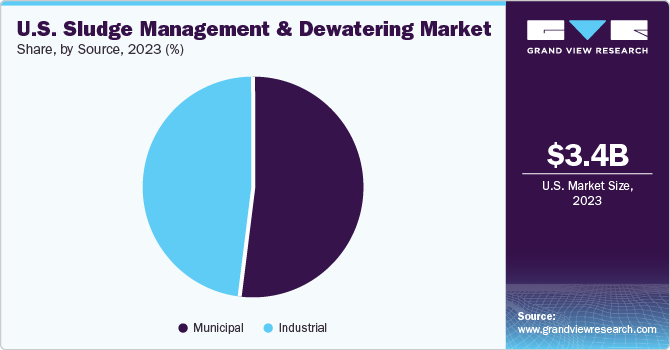

Source Insights

Based on source, the municipal segment led the market with the largest revenue share of 51.70% in 2023. It plays a critical role in addressing the challenges associated with the treatment and disposal of sludge generated from cities, towns, and other populated areas. With the increasing urbanization and population growth in the U.S., municipal wastewater treatment plants are facing growing volumes of sludge that require efficient management solutions.

The industrial segment is expected to witness at the fastest CAGR over the forecast period. One of the key drivers of the industrial segment is the growing emphasis on environmental sustainability and regulatory compliance within the industrial sector. Industries are subject to stringent environmental regulations governing the treatment and disposal of sludge to minimize environmental pollution and protect public health.

Services Insights

Based on service, the treatment segment led the market with the largest revenue share of 51.7% in 2023 and is anticipated to witness at the fastest CAGR over the forecast period. Conventional sludge treatment consists of several steps, including thickening, anaerobic digestion, and dewatering, before the disposal of sludge. This step deals with pollution from part per billion to part per million levels and frequently uses oxidation or fine filtering techniques.

The collection & hauling segment remained in second position in terms of market domination in 2023. Sludge contains certain hazardous materials and specific measures must be taken while collecting and handling the waste. Hazardous waste cannot be disposed of in landfills. Sludge collection and hauling services include segregation, loading & unloading, selecting a suitable area, setting up that area for storage of sludge at a minimum distance from where the waste is generated, and maintenance of the sludge.

Key U.S. Sludge Management And Dewatering Company Insights

Some of the key players operating in the market include Veolia, U.S. Ecology; Evoqua Water Technologies LLC, Texas Sludge Disposal; and Clean Harbors, Inc.

-

Veolia is a multinational company that designs and manufactures water, waste, and energy management solutions. It operates through three business segments mainly water management, waste management, and energy management

-

The water management business segment focuses on several aspects of water management including the production and delivery of industrial process water & drinking water, resource management, collection, treatment, & wastewater recycling, design & construction of treatment and network infrastructure, and customer relationship management

-

U.S. Ecology, Inc., majorly operates through two reporting segments: environmental services and industrial and field services. The environmental services segment consists of transportation, disposal, treatment, and recycling of radioactive, non-hazardous, and hazardous waste. The industrial and field services segment includes the collection and packaging of hazardous waste along with total waste management solutions at client locations

Some of the emerging players operating in the market include Waterleau, Merrell Bros, Inc., DredgIT, and All Waste Corp.

-

Waterleau, offers wastewater treatment and discharge compliance services for energy, water, and nutrient recovery, allowing communities and enterprises to achieve their sustainability objectives

-

Merrell Bros., Inc., is a biosolids management company that provides biosolids transportation, disposal, storage, dewatering, digester cleaning, lagoon, hydraulic dredging, and sediment disposal solutions. It supplies towns, industries, and agricultural businesses across the U.S.

Key U.S. Sludge Management And Dewatering Companies:

- Wastewater Transport Services

- J.P. Mascaro & Sons

- Franc Environmental, Inc.

- Veolia

- All Waste Corp.

- Aqua Zyme

- U.S. Ecology, Inc.

- Waterleau

- Evoqua Water Technologies LLC

- Texas Sludge Disposal, Inc.

- Clean Harbours

- Synagro

- Merrell Bros

- Denali Water

- Bio-Nomic (Carlylon Corp.)

- DredgIT

- GFL Environmental, Inc.

- Oscar Renda

- Eagle Dynamic Solutions

- MP Environmental Services

Recent Developments

-

In December 2023, J. P. Mascaro & Sons attained a 10-year sludge hauling contract from Pottstown Borough Authority. The contract is expected to be serviced by Mascaro's Berks County Division, and Mascaro is responsible for the transportation and disposal of all bio-solids generated at the Pottstown Borough Authority's wastewater treatment plant

-

In November 2023, Synagro announced the acquisition of a privately held company, New England Fertilizer Company (NEFCO), headquartered in Massachusetts. The acquisition enhances Synagro’s leadership in efficiently utilizing biosolids produced from thermal drying plants. The additional portfolios provide Synagro with additional capacity and an expanded range of innovative customer solutions to meet growing customer needs

U.S. Sludge Management And Dewatering Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3,421.8 million

Revenue forecast in 2030

USD 3,885.0 million

Growth rate

CAGR of 2.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Category, source, services

Country scope

U.S.

Key companies profiled

Wastewater Transport Services; J.P. Mascaro & Sons; Franc Environmental, Inc.; Veolia; All Waste Corp, Aqua Zyme; U.S. Ecology, Inc.; Waterleau; Evoqua Water Technologies LLC; Texas Sludge Disposal, Inc; Clean Harbours,, Synagro; Merrell Bros; Denali Water; Bio-Nomic (Carlylon Corp.); DredgIT; GFL Environmental, Inc.; Oscar Renda; Eagle Dynamic Solutions; MP Environmental Services

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Sludge Management And Dewatering Market Report Segmentation

This report forecasts revenue growth at country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. sludge management and dewatering market report based on category, source, and services.

-

Category Outlook (Revenue, USD Million, 2018 - 2030)

-

CWT

-

POTW

-

FOTW

-

Onsite Facilities

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Municipal

-

Industrial

-

-

Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Collection & Hauling

-

Treatment

-

Disposal

-

Frequently Asked Questions About This Report

b. The U.S. sludge management and dewatering market size was estimated at USD 3,353.1 million in 2023 and is expected to be USD 3,421.8 million in 2024.

b. The U.S. sludge management and dewatering market, in terms of revenue, is expected to grow at a compound annual growth rate of 2.1% from 2024 to 2030 to reach USD 3,885.0 million by 2030.

b. Some of the key players operating in the U.S. sludge management & dewatering market include Wastewater Transport Services, J.P. Mascaro & Sons, Franc Environmental, Inc., Veolia, All Waste Corp, Aqua Zyme, U.S. Ecology, Inc., Waterleau, Evoqua Water Technologies LLC, Texas Sludge Disposal, Inc, Clean Harbours, Synagro, Merrell Bros, Denali Water, Bio-Nomic (Carlylon Corp.), DredgIT, GFL Environmental, Inc., Oscar Renda, Eagle Dynamic Solutions, MP Environmental Services.

b. The key factors that are driving the U.S. sludge management & dewatering market include continuously growth in population, coupled with rising demand for wastewater treatment plants and presence of stringent government regulations for sludge management and dewatering in the U.S.

b. POTW segment dominated the U.S. sludge management and dewatering market with a revenue share of 75.7% in 2023.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.