- Home

- »

- Next Generation Technologies

- »

-

U.S. Smart Lock Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Smart Lock Market Size, Share & Trends Report]()

U.S. Smart Lock Market (2025 - 2030) Size, Share & Trends Analysis Report By Product, By Application, By Protocol (Bluetooth, Wi-Fi, Z-Wave, Zigbee & Others), By Authentication Method, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-315-3

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Smart Lock Market Size & Trends

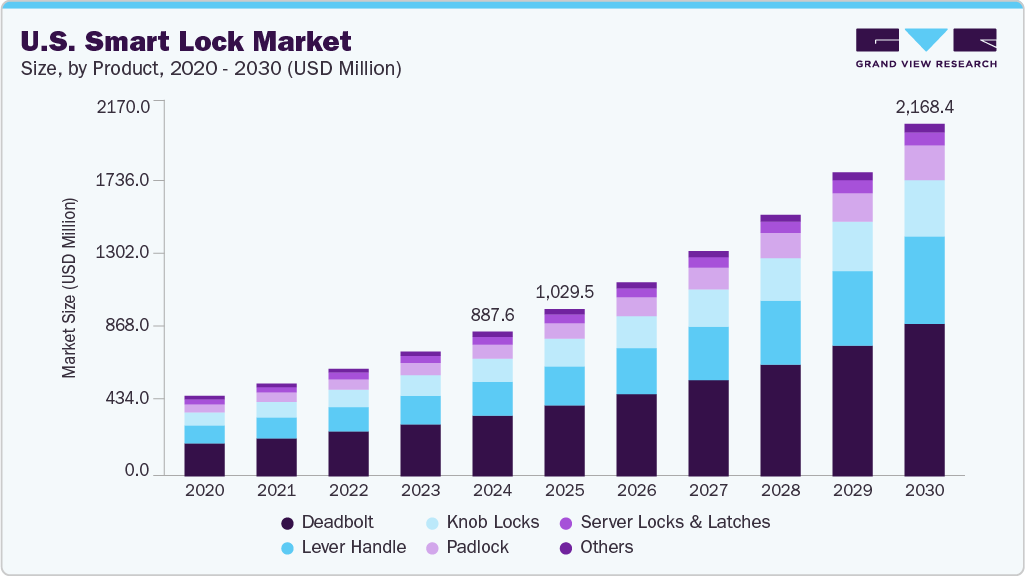

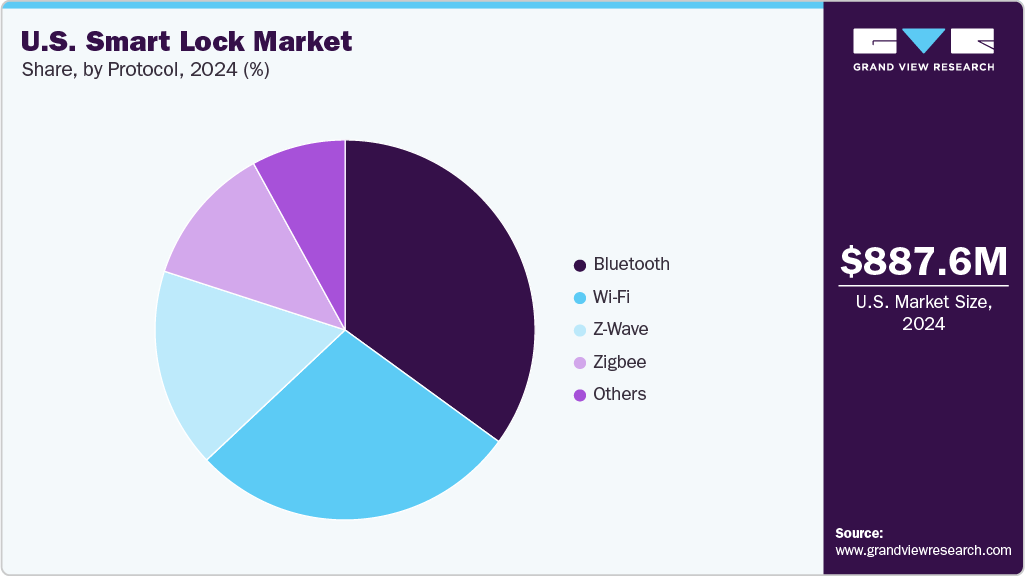

The U.S. smart lock market size was estimated at USD 887.6 million in 2024 and is projected to grow at a CAGR of 16.1% from 2025 to 2030. The U.S. market is experiencing robust growth, as American consumers increasingly prioritize home security and convenience in their daily lives. High internet penetration, rising disposable incomes, and a tech-savvy population are accelerating smart home adoption across the country, with smart locks emerging as a key feature in modern American households. Across the country, homeowners and property managers are increasingly turning to smart locks for their advanced security features, keyless entry, and remote access functionality, positioning them as a high-value upgrade for both newly built and existing American homes, and thereby driving the U.S. smart lock industry expansion.

The growing integration of smart locks with the broader Internet of Things (IoT) ecosystem and other smart devices is a major growth driver for the U.S. smart lock market. The growing solutions that work cohesively with security cameras, alarm systems, and smart lighting create a unified security environment. Compatibility with leading smart home platforms such as Amazon Alexa and Google Home enhances user convenience, allowing centralized control through apps or voice commands. This trend is pushing manufacturers to innovate, offering versatile products that meet evolving consumer expectations for interoperability and automation, thereby driving the market growth.

Additionally, technological advancements are reshaping the U.S. smart lock industry, with new features such as facial recognition, fingerprint scanning, geofencing, and AI-powered adaptive security. These innovations improve reliability and user experience and address sophisticated security needs in homes, offices, and public spaces. AI and machine learning enable smart locks to analyze user patterns, anticipate needs, and detect fraudulent activities, while biometric enhancements boost accuracy and trust in digital access control. Such factors are expected to drive the U.S. smart lock industry growth.

The U.S. market for smart locks is also benefiting from changing lifestyle trends, such as the rise of remote work and e-commerce. Touchless entry and secure delivery solutions have gained traction, supporting demand among property managers, short-term rental operators, and businesses seeking efficient access management. The growing popularity of DIY smart lock solutions, available through major retailers and online channels, further democratizes access and fuels the market expansion.

Moreover, major players are investing heavily in R&D to develop advanced features such as biometric authentication, AI-driven predictive analytics, and enhanced cybersecurity, differentiating their products in a competitive landscape. Strategic partnerships, mergers, and acquisitions are also major strategies adopted by key companies, enabling firms to expand product portfolios and accelerate market penetration. In contrast, multi-channel distribution, including direct-to-consumer, e-commerce, and retail partnerships, ensures wide accessibility and brand visibility.

Product Insights

The deadbolt segment accounted for the largest market share of over 42% in 2024, owing to their enhanced security features and easy integration into existing door systems. Consumers appreciate the added convenience of keyless entry combined with the robustness of traditional locking mechanisms. Their growing popularity in both new construction and retrofitting projects, especially in North America and Europe, continues to drive demand. In addition, insurance incentives for enhanced home security and increased awareness of home safety contribute to their widespread adoption.

The level handler segment is expected to witness the highest CAGR of over 17% from 2025 to 2030. These locks are gaining traction in the U.S., particularly in commercial and multi-unit residential buildings where accessibility and frequent use are priorities. These locks are favored for their ergonomic design and ease of use, especially in settings that require ADA compliance or high-traffic access points. The trend toward touchless entry and the need for secure, flexible access management in offices, hotels, and shared spaces are driving the adoption of lever-handle smart locks, with manufacturers focusing on durability and seamless integration with building management systems.

Application Insights

The residential segment accounted for the largest share of the U.S. smart lock industry in 2024, driven by the surge in smart home adoption, heightened safety concerns, and the appeal of connected living. Homeowners are increasingly investing in integrated security ecosystems where smart locks work alongside video doorbells, security cameras, and smart lighting. The convenience of remote access, real-time monitoring, and compatibility with popular platforms such as Amazon Alexa and Google Home are key drivers, making smart locks a staple in American homes.

The commercial segment is expected to witness the fastest CAGR from 2025 to 2030, fueled by the need for scalable, centralized access control in offices, hospitality, healthcare, and educational institutions. Businesses value the ability to manage multiple entry points remotely, track access logs, and enhance security in response to rising concerns around workplace safety and unauthorized access. The hospitality sector, in particular, is rapidly deploying smart locks for contactless guest entry and streamlined property management.

Protocol Insights

The Bluetooth segment accounted for the largest market share in 2024, owing to their ease of installation, energy efficiency, and ability to connect directly to smartphones without requiring a Wi-Fi network. This segment appeals to consumers seeking affordable, straightforward solutions for keyless entry and temporary digital access sharing. The trend toward mobile-first access control and the proliferation of Bluetooth-enabled devices in American households continue to drive this segment’s growth.

The Wi-Fi segment is expected to witness the fastest CAGR from 2025 to 2030, as consumers and businesses seek remote access, real-time notifications, and integration with broader smart home and security systems. Wi-Fi connectivity enables users to control locks from anywhere, receive instant alerts, and integrate with cloud-based platforms for advanced automation and monitoring. As home and business owners prioritize convenience and security, Wi-Fi-enabled smart locks are becoming increasingly prevalent.

Authentication Method Insights

The smartphone-based segment accounted for the largest share of the U.S. smart lock market in 2024, owing to the widespread adoption of mobile devices and the desire for app-centric home management. These locks allow users to lock, unlock, and monitor access directly from their smartphones, often with additional features like digital key sharing and activity logs. The convenience of managing home security on the go and the integration with other smart home apps are key factors driving this segment.

The biometric segment is expected to witness the fastest CAGR from 2025 to 2030, as consumers and businesses seek higher levels of security and convenience. Featuring fingerprint and facial recognition, these locks provide advanced authentication that reduces the risk of unauthorized access. The integration of biometric technology appeals to tech-savvy Americans and is increasingly being adopted in both residential and commercial settings for its speed, reliability, and enhanced protection against traditional lock-picking or code theft.

Key U.S. Smart Lock Company Insights

Some of the key players operating in the market are Honeywell International, Inc. and Kwikset (ASSA ABLOY).

-

Honeywell International, Inc. is a major player in the U.S. smart lock market, leveraging its deep expertise in building automation, security, and IoT solutions. The company’s smart lock offerings are designed to integrate seamlessly with broader building management and home automation systems, appealing to both residential and commercial customers across the United States. The company’s focus on advanced security features, such as encrypted communications and remote monitoring, aligns with the demand of U.S. consumers for safety and convenience. The company’s robust distribution network and established relationships with property managers, builders, and institutional clients have helped it maintain a strong presence in the rapidly growing American smart lock sector.

-

Kwikset is recognized for its innovation, reliability, and wide adoption in American homes. The company specializes in smart deadbolts and lever handle locks that are compatible with popular U.S. smart home platforms like Amazon Alexa, Google Home, and Apple HomeKit. Kwikset’s products are widely available through major U.S. retailers such as Home Depot, Lowe’s, and Best Buy, making them accessible to a broad consumer base. The brand’s emphasis on user-friendly installation, robust security features, and continuous innovation in connected home technology has solidified its position as a top choice for American homeowners seeking smart, secure, and convenient access solutions.

Avent Security and HavenLock, Inc. are some of the emerging market participants in the smart lock market.

-

RemoteLock is a cloud-based access control software that specializes in enabling property managers across multifamily, vacation rental, and commercial sectors to remotely manage and control access to any space from anywhere in the world. Their platform is compatible with a wide range of smart lock brands, offering flexibility and scalability for diverse property needs. RemoteLock's software integrates with various property management systems and booking platforms, streamlining operations and enhancing security.

-

Danalock expanded its presence in the U.S. by establishing an office in Miami, Florida, in 2018. The company specializes in smart lock solutions for both residential and commercial applications, offering products compatible with various home automation protocols. Danalock's product portfolio includes the Danalock V3, which has been adopted by service providers, logistics companies, and alarm companies integrating smart lock technology into their solutions.

Key U.S. Smart Lock Companies:

- August Home (ASSA ABLOY)

- Kwikset (ASSA ABLOY/Spectrum Brands)

- Yale Locks (ASSA ABLOY)

- Schlage (Allegion Plc)

- Honeywell International Inc.

- Onity, Inc. (Honeywell International Inc.)

- RemoteLock

- MUL-T-LOCK TECHNOLOGIES LTD. (ASSA ABLOY)

- Danalock

- Salto Systems, S.L.

Recent Developments

-

In January 2025, August Home launched a new line of smart locks featuring biometric fingerprint scanning and enhanced battery life, aiming to boost both security and convenience for U.S. smart home users.

-

In January 2025, at CES 2025, Schlage unveiled two major innovations: the Schlage Sense Pro Smart Deadbolt and the Schlage Arrive Smart WiFi Deadbolt. The Schlage Sense Pro Features Matter-over-Thread compatibility and introduces Schlage Converge technology, which uses Ultra-Wideband and a user’s authorized device to provide intuitive, hands-free unlocking as you approach the door.

-

In March 2024, Yale Locks (ASSA ABLOY) expanded its U.S. product lineup by integrating voice control capabilities with Amazon Alexa and Google Assistant, enabling users to manage access and security hands-free for greater ease of use and flexibility.

U.S. Smart Lock Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,029.5 million

Revenue forecast in 2030

USD 2,168.4 million

Growth rate

CAGR of 16.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, volume in thousand units, and CAGR from 2025 to 2030

Report Product

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, protocol, authentication method

Country scope

U.S.

Key companies profiled

August Home (ASSA ABLOY); Kwikset (ASSA ABLOY/Spectrum Brands); Yale Locks (ASSA ABLOY); Schlage (Allegion Plc); Honeywell International Inc.; Onity, Inc. (Honeywell International Inc.); RemoteLock; MUL-T-LOCK TECHNOLOGIES LTD. (ASSA ABLOY); Danalock; Salto Systems, S.L.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

U.S. Smart Lock Market Report Segmentation

This report forecasts volume & revenue growth at the country level and provides an analysis of the latest technological trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. smart lock market report based on product, application, protocol, and authentication method:

-

Product Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Deadbolt

-

Level Handlers

-

Padlock

-

Server Locks & Latches

-

Knob Locks

-

Others

-

-

Application Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Individual Household

-

Commonhold

-

-

Commercial

-

Hospitality

-

Healthcare

-

BFSI

-

Enterprise

-

Critical Infrastructure

-

Educational Institution

-

-

Industrial

-

Manufacturing

-

Energy & Utilities

-

Oil & Gas

-

-

Institutional & Government

-

Transportation & Logistics

-

Others

-

-

Protocol Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Bluetooth

-

Wi-Fi

-

Z-Wave

-

Zigbee

-

Others

-

-

Authentication Method Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Keypad

-

Card Key

-

Touch-based

-

Key Fob

-

Smartphone-based

-

Biometric

-

Frequently Asked Questions About This Report

b. The U.S. smart lock market size was estimated at USD 887.6 million in 2024 and is expected to reach USD 1,029.5 million in 2025.

b. The U.S. smart lock market is expected to grow at a compound annual growth rate of 16.1% from 2025 to 2030 to reach USD 2,168.4 billion by 2030.

b. The deadbolt segment accounted for the largest market share of over 42% in 2024, owing to their enhanced security features and easy integration into existing door systems

b. Some key players operating in the U.S. smart lock market include August Home (ASSA ABLOY), Kwikset (ASSA ABLOY/Spectrum Brands), Yale Locks (ASSA ABLOY), Schlage (Allegion Plc), Honeywell International Inc., Onity, Inc. (Honeywell International Inc.), RemoteLock, MUL-T-LOCK TECHNOLOGIES LTD. (ASSA ABLOY), Danalock, and Salto Systems, S.L.

b. The key factors driving the U.S. smart lock market include the rising demand for connected home security solutions, increasing adoption of Internet of Things (IoT) devices, and the expansion of smart home ecosystems supported by major tech players.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.