- Home

- »

- Electronic & Electrical

- »

-

U.S. Smart Toys Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Smart Toys Market Size, Share & Trends Report]()

U.S. Smart Toys Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Interactive Games, Robots, Educational Toys), By Distribution Channel (Online, Offline), And Segment Forecasts

- Report ID: GVR-4-68040-241-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Smart Toys Market Size & Trends

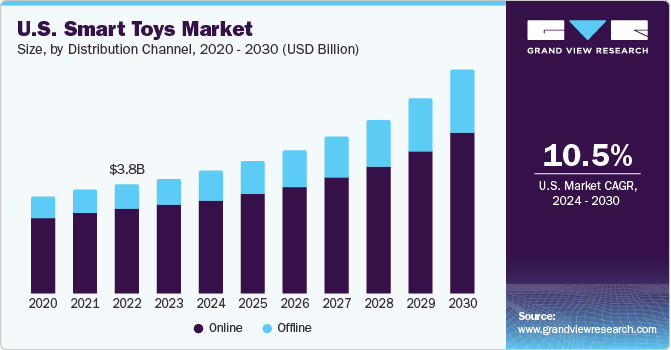

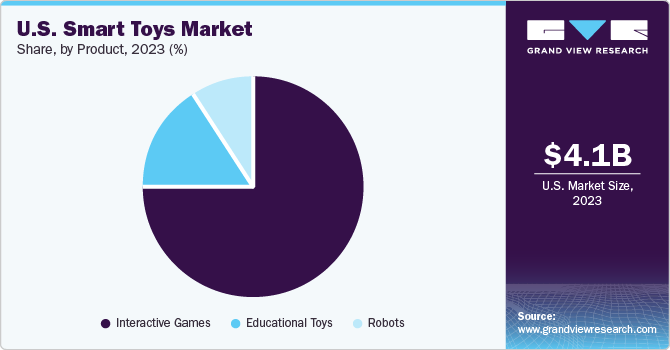

The U.S. smart toys market size was estimated at USD 4.10 billion in 2023 and is expected to grow at a CAGR of 10.5% from 2024 to 2030. The influence of the media and entertainment industry drives the smart toys market in the U.S. The region's strong media and entertainment industry, including film, television, and digital content, influences consumer preferences and expectations for interactive and engaging experiences. Smart toys that align with popular media franchises or incorporate characters from popular shows can capitalize on the existing fan base, driving demand.

U.S. smart toys market accounted for the share of 32.98% of the global smart toys market in revenue 2023. The influence of popular culture and media trends in the U.S. drive the smart toys market. Licensing agreements with popular characters from movies, TV shows, and digital content contribute to the market's growth. Smart toys featuring characters often gain popularity, and partnerships with entertainment franchises allow manufacturers to create engaging and sought-after products that resonate with U.S. consumers.

The influence of retro themes drives the growth of the U.S. smart toys market. The market's diversity is further stimulated by incorporating both traditional and contemporary elements, which broaden its appeal across a wide range of age groups. This blending of past and present contributes to the market's expansion and underscores the importance of nostalgia and innovation in the field of smart toys.

According to Argos in 2023, there is a growing trend of nostalgic shoppers purchasing iconic toys from the past, driven by increased interest following the release of the Barbie movie and a resurgence of classic toys. The demand for classic toys has surged, with sales of the original virtual pet Tamagotchi rising by 123% and the 90s toy Furby experiencing a substantial 371% increase in 2023.

Market Concentration & Characteristics

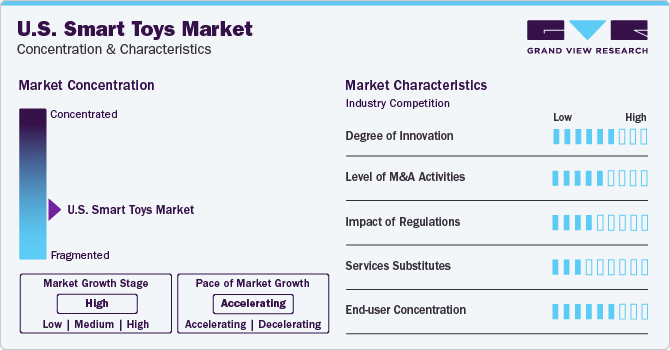

The U.S. smart toys market is characterized by high degree of innovation, with businesses continuously focusing on differentiating themselves through unique experiences and offerings. The rising adoption of artificial intelligence (AI) and Internet of Things (IoT) technologies drives the growth of the smart toys market. As AI algorithms advance, they are being integrated into smart toys to enhance interactive features, personalization, and learning capabilities. These technologies enable smart toys to adapt to a child's preferences, offer dynamic responses, and provide personalized learning experiences, thereby increasing engagement and educational value. The integration of AI also allows for continuous improvement through data analysis, ensuring that smart toys evolve to meet the changing needs of children and parents.

Collaborations in the smart toys market are pivotal as they allow companies to tap into diverse expertise and creativity. Collaborative ventures, illustrated by associations with attractive designs and shapes, artisanal brands, and retail giants, not only expand product offerings but also bring a blend of design innovation and functionality.

End-user concentration is a significant factor in the U.S. smart toys market. Consumers are also leaning toward smart toys that prioritize eco-friendly materials and manufacturing processes. Parents, in particular, prefer products aligned with sustainable practices, prompting smart toy manufacturers to adopt green initiatives, utilize recyclable materials, and integrate sustainability into product design and packaging. According to The Toy Association in 2022, 64% of parents in the U.S. with children aged 3-9 are willing to invest more in environmentally friendly toys. It highlights the opportunity for brands to integrate sustainability into their manufacturing processes.

Product Insights

The interactive games market in the U.S. held the revenue share of over 75.18% in 2023.The increasing demand for personalized and adaptive learning experiences significantly contributes to the popularity of interactive toys in the market. These toys use AI algorithms to tailor content and challenges based on a child's individual preferences, learning pace, and abilities. Interactive smart toys offer a personalized approach, ensuring that each child's educational journey is uniquely tailored to their needs, enhancing the overall effectiveness of the learning experience.

The demand for educational robots in the U.S. is anticipated to grow at a CAGR of 13.2% from 2024 to 2030. The rising trend of homeschooling and alternative education methods influences the demand for educational robots. With an increasing number of parents choosing to educate their children outside of traditional school systems, there is a growing need for effective and engaging educational tools that complement home-based learning. Educational robots, with their ability to combine entertainment with educational content, align with the preferences of homeschooling families, driving their adoption as valuable learning aids.

Distribution Channel

The offline sales of smart toys in the U.S. accounted for a revenue share of 76. 83 in 2023. Offline stores, such as toy stores and department stores, allow consumers to physically interact with smart toys before purchasing. This hands-on experience provides a tangible understanding of the product's features and functionalities, catering to those who prefer a sensory connection with the toys before deciding to buy. The offline segment drives on the immersive and interactive nature of in-store shopping experiences.

The online sales of smart toys in the U.S. is expected to grow at a CAGR of 13.5% over the forecast period of 2024 to 2030.The convenience and accessibility offered by online shopping have made it easier for consumers to explore and purchase a diverse range of smart toys from various brands. Online platforms provide a comprehensive space for manufacturers to showcase their products, reach a global audience, and capitalize on the digital landscape. The emergence of online marketplaces has transformed the traditional retail model, offering consumers a seamless shopping experience and contributing to the overall expansion of the smart toys market. Around 30.6% of U.S. parents opt to buy toys for their children through online channels, as per information from the U.S. National Library of Medicine.

Key U.S. Smart Toys Company Insights

Some of the key players operating in the market Playmobil, Pillar Learning, and LeapFrog Enterprises Inc.

-

Playmobil, a subsidiary of Horst Brandstätter Group, is a toy manufacturing company. The company's product range covers diverse themes, including pirates, knights, and fairies. The modular nature of Playmobil toys allows children to mix and match sets, fostering a limitless world of storytelling possibilities. The brand's emphasis on promoting constructive play aligns with educational objectives, making it a popular choice for parents and educators.

-

Pillar Learning is an AI-enabled educational toy company. Pillar Learning also offers interactive and adaptive learning applications for tablets and other digital devices. These applications cater to various age groups, offering diverse educational content that aligns with early childhood development milestones. The company strongly emphasizes creating a safe and secure digital environment for young learners. Rigorous testing and adherence to child privacy and safety standards are integral to the development process.

Mattel, Inc., Hasbro, and MindWare, Inc. are some of the other participants in the U.S. smart toys market,

-

MindWare, Inc. is a manufacturer, creator, and distributor of Brainy Toys for kids. The company adopts a direct-to-consumer model to deliver its unique collection of toys and games to customers worldwide. MindWare's product line includes coloring books, educational toys, games, brainteasers, building sets, robot toys, and creative play activities. The company is developing its own line of products, which were initially offered exclusively in the MindWare catalog.

-

Hasbro is a global toy and game company. The company functions through three business segments: Consumer Products, Entertainment, and Wizards of the Coast and Digital Gaming. The Consumer Products segment involves the marketing, sourcing, and selling of game and toy products. This segment also advertises & promotes its brands through the obtainable authorization of trademarks and other brands by selling recognized consumer products, including apparel and toys. The company trades its goods to retailers, wholesalers, distributors, drug stores, discount stores, catalog stores, department stores, mail order houses, and other traditional retailers, as well as e-commerce retailers & directly to customers through Hasbro PULSE, an e-commerce website.

Key U.S. Smart Toys Companies:

- Playmobil

- Pillar Learning

- LeapFrog Enterprises Inc.

- Mattel, Inc.

- Hasbro

- MindWare, Inc

- Dynepic

- Neurala

- Lego System A/S

- Arduino

Recent Developments

-

In June 2023, Mattel, Inc. launched an innovative edition of Pictionary, the classic quickdraw game, called Pictionary Vs. AI. It marks the first instance of a board game seamlessly incorporating AI technology into its traditional gameplay. In this new version, the players draw while the AI guesses.

-

In June 2023, LEGO System A/S launched a Dakar rally Audi RS Q e-tron construction set. It features a 914-piece construction with realistic details like individual suspension on each wheel. The model features mechanisms that help children explore engineering skills.

U.S. Smart Toys Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.34 billion

Revenue forecast in 2030

USD 7.88 billion

Growth rate

CAGR of 10.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

product, distribution channel

Country scope

U.S.

Key companies profiled

Playmobil; Pillar Learning; LeapFrog Enterprises Inc.; Mattel, Inc.; Hasbro; MindWare, Inc; Dynepic; Neurala; Lego System A/S; Arduino

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

U.S. Smart Toys Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. smart toys market report based on product, distribution channel:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Interactive Games

-

Robots

-

Educational Toys

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online

-

Offline

-

Frequently Asked Questions About This Report

b. The U.S. smart toys market was estimated at USD 4.10 billion in 2023 and is expected to reach USD 4.34 billion in 2024.

b. The U.S. smart toys market is expected to grow at a compound annual growth rate of 10.5% from 2024 to 2030 to reach USD 7.88 billion by 2030.

b. Interactive games dominated the U.S. smart toys market with a share of around 75% in 2023. The increasing demand for personalized and adaptive learning experiences significantly contributes to the popularity of interactive toys in the market.

b. Some of the key players operating in the U.S. smart toys market include Playmobil; Pillar Learning; LeapFrog Enterprises Inc.; Mattel, Inc.; Hasbro; MindWare, Inc; Dynepic; Neurala; Lego System A/S; Arduino

b. The influence of the media and entertainment industry drives the smart toys market in the U.S. The region's strong media and entertainment industry, including film, television, and digital content, influences consumer preferences and expectations for interactive and engaging experiences.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.