- Home

- »

- Homecare & Decor

- »

-

Educational Toys Market Size, Share & Trends Report, 2030GVR Report cover

![Educational Toys Market Size, Share & Trends Report]()

Educational Toys Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Building & Construction Sets, STEM Toys), By Age (Toddlers, Preschoolers), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-146-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Educational Toys Market Summary

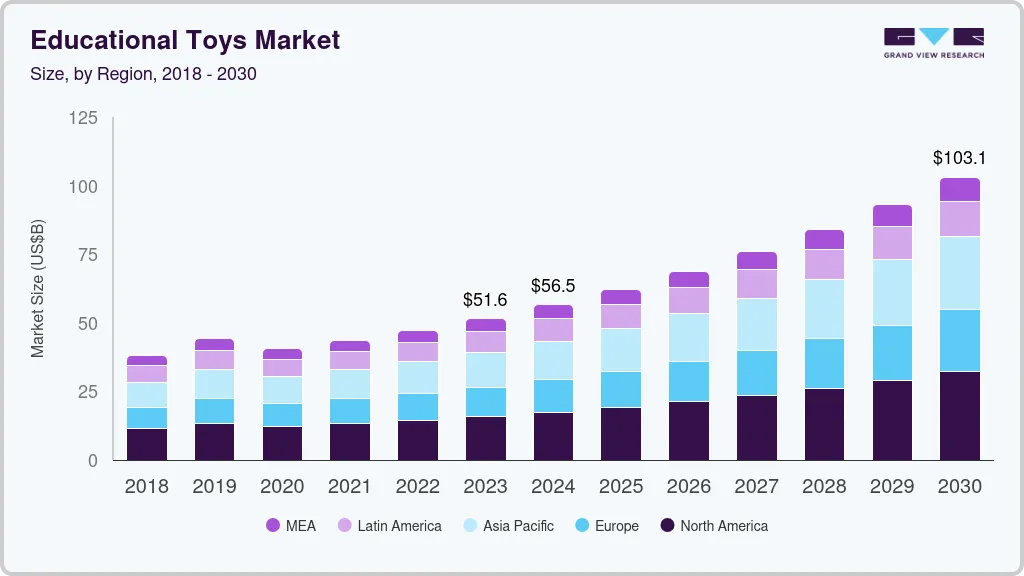

The global educational toys market size was estimated at USD 54.00 billion in 2023 and is projected to reach USD 118.79 billion by 2030, growing at a CAGR of 12.0% from 2024 to 2030. Increasing awareness of the benefits of early childhood education among parents and educators is driving the demand for educational toys.

Key Market Trends & Insights

- The North America educational toys market held a revenue share of about 30.5% in 2023.

- The educational toys market in the U.S. accounted for nearly 74% of the total revenue of the North America regional market in 2023.

- The Asia Pacific educational toys market is projected to expand at a CAGR of about 13.1% over the forecast period.

- In terms of age insights, the toddlers (1-3 years) age group segment accounted for the largest market share of about 51.0% in 2023.

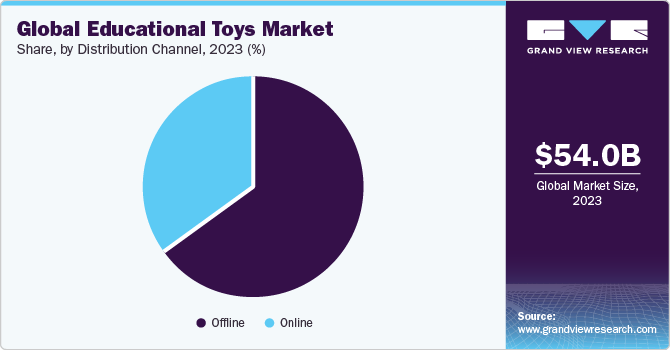

- Based on distribution channel, the offline channel segment dominated the global market in 2023 with a share of about 64% of the overall revenue.

Market Size & Forecast

- 2023 Market Size: USD 54.00 billion

- 2030 Projected Market Size: USD 118.79 billion

- CAGR (2024-2030): 12.0%

- North American: Largest market in 2023

These toys are instrumental in enriching the cognitive development of children. The integration of technology into educational toys has heightened interactivity and appeal, consequently propelling market growth. Parents prefer toys that are free from harmful chemicals, such as Bisphenol A and Phthalate. The rising awareness of the adverse effects of the plastics used in the production of educational toys is resulting in the demand for products manufactured from non-harmful materials. Children are encouraged to explore, experiment, and develop a deeper comprehension of their surroundings using these toys.

By integrating educational toys into early childhood education, a comprehensive approach to development is nurtured, preparing children for a lifetime of learning and success. According to a survey conducted by the Toy Association in 2023, a substantial 94% of parents acknowledged the significant role of toys in their child's development, with 91% emphasizing the importance of educational toys in fostering their child's learning and overall growth.

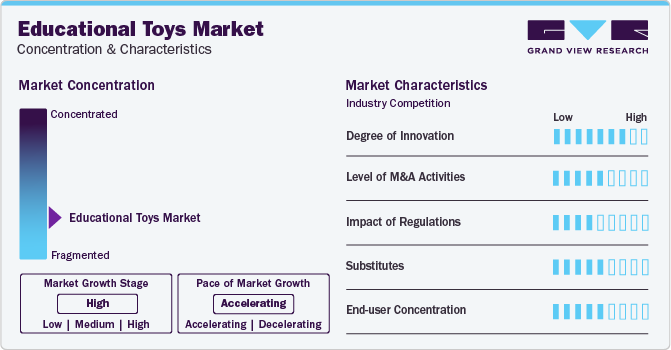

Market Concentration & Characteristics

The degree of innovation in the market is high, with manufacturers constantly developing new products that integrate technology, promote learning through play, and cater to specific educational needs. This innovation is driven by a growing focus on STEAM education (science, technology, engineering, arts, and mathematics) and a desire to create engaging, interactive toys that align with educational standards.

Regulations play a crucial role in the market by ensuring product safety, quality standards, and age-appropriate content. Compliance with regulations can increase consumer confidence, drive innovation in toy design, and ultimately contribute to the market's overall growth and sustainability.

The market has a moderate level of substitute availability, with traditional toys and games often serving as alternatives. However, the rise of digital learning tools and devices presents a growing substitute threat, particularly for STEM-focused educational toys. Despite this, the tactile and interactive nature of physical educational toys continues to differentiate them in the market.

The end-user concentration in the market is diverse, ranging from parents and caregivers to educators and schools. While parents drive a significant portion of the consumer demand, schools & educational institutions play a crucial role in influencing purchasing decisions, especially for bulk or institutional purchases. Online retailers and specialty stores cater to this varied end-user base, offering a wide range of educational toys to meet different needs and preferences.

Product Insights

The building & construction sets segment dominated the market in 2023 with a share of over 27.0%. The segment growth can be attributed to the increasing awareness among parents and caregivers about the importance of educational play. Such toys not only entertain but also contribute to cognitive and motor skill development in preschoolers. In November 2023, Tytan Tiles, a children’s toy brand under Upexi Inc., experienced remarkable success, achieving the number one New Release status for Preschool Building sets on Amazon within a month of launching its Disney Frozen Kit on October 17, 2023.

The product also secured the 3rd spot in Magnetic Building Sets and entered the top 400 in all toys and games on Amazon. The demand for STEM toys is forecasted to grow at the fastest CAGR of 14.6% from 2024 to 2030. Key product lines and manufacturers are emphasizing market expansion into mainstream retail outlets. In January 2024, Team Genius Squad, a toy brand by an 11-year-old entrepreneur Ava N. Simmons, launched its STEM toy line in Whole Foods Market stores. The collaboration aims to make STEM toys more accessible to families, showcasing the increasing recognition of STEM’s positive impact on education and development.

Age Insights

The toddlers (1-3 years) age group segment accounted for the largest market share of about 51.0% in 2023. The demand for educational toys for toddlers is driven by the understanding that children at this age are rapidly developing their language skills and physical abilities while also engaging in problem-solving and imaginative play. According to the National Association for the Education of Young Children, toys that promote problem-solving, creativity, physical activity, and fine motor skills are likely to be popular among 2-year-olds. The preschoolers segment is expected to register the fastest CAGR of 13.4% from 2024 to 2030.

There is a growing demand for such products for this age group as parents increasingly seek toys that not only entertain but also provide valuable learning experiences for their children. Companies like LeapFrog Enterprises, Inc. are responding to this demand by introducing innovative and interactive toys that combine fun with educational content. In April 2022, the company introduced the latest additions to its infant and preschool lines, such as My Pal Scout Smarty Paws, Clean Sweep Learning Caddy, and Ironing Time Learning Set. These offer a range of activities that help children develop skills like counting, colors, shapes, and more, all while engaging in imaginative play.

Distribution Channel Insights

The offline channel segment dominated the global market in 2023 with a share of about 64% of the overall revenue. Companies in the market are focused on increasing the visibility of educational toys, such as craft kits, in retail stores. The widespread availability of educational toys across retail channels will attract more customers who prefer to shop in physical retail locations, thereby driving market growth. In March 2023, one of the leading content and experience companies in the UK, Hearst UK, partnered with one of the discount retailers in the UK, The Works, to launch a custom-made range of Prima branded craft products. The company launched a collection of 25 unique kits designed for both adults and children across The Works’ 525 stores across the UK.

The products will have a significant offline presence, making them easily accessible to a wide range of audience. The online distribution channel segment is estimated to grow at a CAGR of 13.5% during the forecast period. As technology advances and e-commerce becomes more prevalent, online platforms have gained traction as a popular way for consumers to purchase educational toys. This growth in online sales channels has allowed for greater accessibility and reach for both domestic and global players in the educational toys market, especially in countries like India, which has the largest child population globally, according to the United Nations.

Regional Insights

The North America educational toys market held a revenue share of about 30.5% in 2023. The regional market is experiencing robust growth, propelled by increasing awareness of the importance of early childhood education. Parents are actively seeking toys that foster cognitive development and prepare children for academic success. On average, American families allocate approximately USD 600 annually toward toys, as reported by The Guardian in November 2022.

U.S. Educational Toys Market Trends

The educational toys market in the U.S. accounted for nearly 74% of the total revenue of the North America regional market in 2023 and is projected to witness rapid growth in the coming years. This growth can be attributed to the increasing popularity of educational toys and STEM-focused games that parents seek to provide their children with entertainment and learning opportunities. In April 2021, the National Association for the Education of Young Children (NAEYC) reported that approximately 90% of preschool-aged children in the U.S. engage with toys that facilitate various educational activities, such as building blocks. This reflects a growing interest in toys that offer developmental benefits.

Asia Pacific Educational Toys Market Trends

The Asia Pacific educational toys market is projected to expand at a CAGR of about 13.1% over the forecast period. In Asia, the integration of toy-based pedagogy into educational modules reflects a growing recognition of the importance of hands-on, experiential learning methods. This emphasis on using indigenous toys, games, and puppets in classroom settings highlights a demand for educational toys that facilitate imaginative play and interactive learning experiences among children.

Key Educational Toys Company Insights

The global educational toys industry is highly competitive, marked by the presence of numerous small-scale regional companies as well as multinational players, such as LEGO System A/S; Ravensburger; Melissa & Doug; Mattel, Inc.; Spin Master; VTech Holdings Limited; Hasbro; Osmo; Sphero, Inc.; MindWare, Inc.; and Fat Brain Toys, LLC.

Key Educational Toys Companies:

The following are the leading companies in the educational toys market. These companies collectively hold the largest market share and dictate industry trends.

- LEGO System A/S

- Ravensburger

- Melissa & Doug

- Mattel, Inc.

- Spin Master

- VTech Holdings Limited

- Hasbro

- Osmo

- Sphero, Inc.

- MindWare, Inc.

- Fat Brain Toys, LLC

Recent Developments

-

In February 2024, Spin Master launched a year-long campaign for its Rubik’s brand, aiming to inspire the next generation of problem solvers with the introduction of a comprehensive range of new products. Leveraging the Cube’s iconic status in pop culture, the campaign featured limited-edition collaborations with renowned brands and personalities, including The Beatles, Hello Kitty, Barbie, and Albert Einstein. In addition, partnerships were formed with Levi’s, U.S. Soccer, NBALAB, and others

-

In February 2024, LEGO System A/S revealed its LEGO Icons Medieval Town Square, a modern reinterpretation of a classic set from 2009. This product incorporates advanced construction techniques, updated architecture, and intricate details. The set consists of 3,304 pieces

-

In January 2024, Melissa & Doug announced the nationwide release of Sticker WOW! in celebration of National Sticker Day. This new product line introduces a fresh approach to playing with stickers, featuring collectible and refillable sticker stampers that are mess-free and inspire creativity through an open-ended creative experience. Each stamper comes with a 24-page activity pad filled with engaging activities, such as counting and matching, designed to enhance fine motor skills and problem-solving abilities and encourage imaginative play

Educational Toys Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 60.19 billion

Revenue forecast in 2030

USD 118.79 billion

Growth rate (Revenue)

CAGR of 12.0% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, age, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Germany; Spain; Italy; China; India; Japan; Australia & New Zealand; Brazil; Argentina; South Africa; UAE

Key companies profiled

LEGO System A/S; Ravensburger; Melissa & Doug; Mattel, Inc.; Spin Master; VTech Holdings Limited; Hasbro; Osmo; Sphero, Inc.; MindWare, Inc.; Fat Brain Toys, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

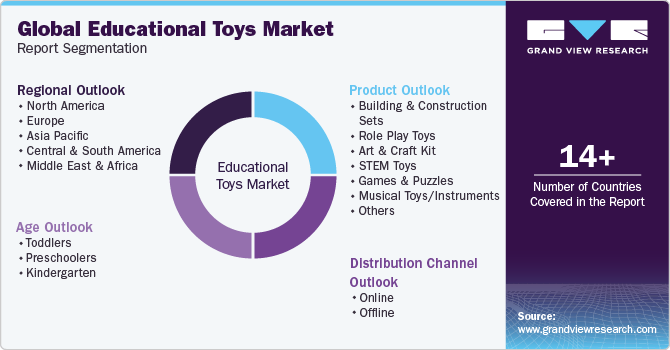

Global Educational Toys Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the educational toys market report based on product, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Building & Construction Sets

-

Role Play Toys

-

Art & Craft Kit

-

STEM Toys

-

Games & Puzzles

-

Musical Toys/Instruments

-

Others

-

-

Age Outlook (Revenue, USD Billion, 2018 - 2030)

-

Toddlers

-

Preschoolers

-

Kindergarten

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online

-

Offline

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Others

-

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the educational toys market growth include factors such as growing awareness among parents regarding the significance of early education and the incorporation of technology into educational toys making it more interactive and engaging.

b. The global educational toys market was estimated at USD 54.00 billion in 2023 and is expected to reach USD 60.19 billion in 2024.

b. The global educational toys market is expected to grow at a compound annual growth rate of 12.0% from 2024 to 2030 to reach USD 118.79 billion by 2030.

b. North America dominated the educational toys market with a share of around 30.3% in 2023. This is owing to the product launches by prominent market players in the region introducing innovative and appealing educational toys for children in the market.

b. Some of the key players operating in the educational toys market include The Lego World, Hasbro, Ravensburger, Melissa & Doug, Mattel, Spin Master, VTech Holdings Limited, Osmo (by Tangible Play), Sphero, Inc., MindWare, Inc., Fat Brain Toys, LLC.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.