U.S. SMS Marketing Market Size & Trends

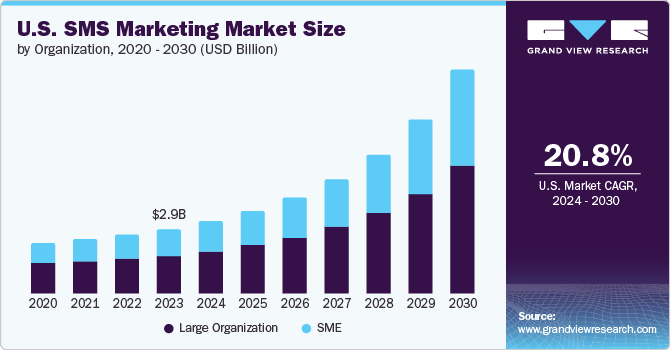

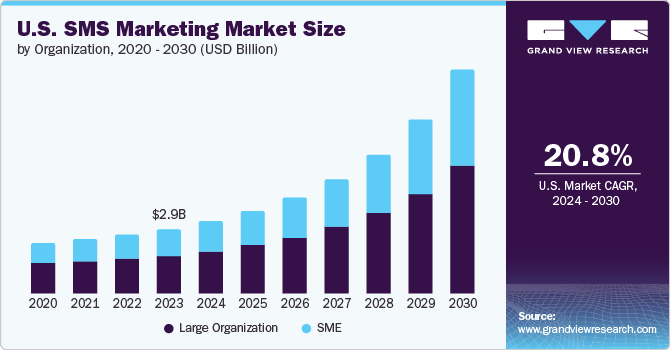

The U.S. SMS marketing market size was valued at USD 2.86 billion in 2023 and is projected to grow at a CAGR of 20.8% from 2024 to 2030. The United States has a high mobile phone user rate, with nearly every adult owning a smartphone. This widespread adoption provides an extensive and accessible audience for SMS marketing. SMS messages reach users instantly without internet access, specific apps, or anywhere. This ability makes SMS a powerful tool for marketers across all industries, aiming to reach a broad and diverse audience.

SMS marketing is cost-effective, offering a higher return on investment (ROI) than other marketing channels. The relatively low cost of sending bulk SMS messages and the high engagement rates result in a favorable cost-per-acquisition. Businesses achieve significant outreach without the need for substantial marketing budgets. Additionally, the simplicity of SMS campaigns, which do not require elaborate design or extensive content creation, further reduces costs. This affordability makes SMS marketing accessible to small and medium-sized businesses, not just large corporations.

Businesses use SMS to support customers, handle inquiries, and manage service appointments. This use is particularly beneficial for its convenience and efficiency, allowing customers to resolve issues quickly without requiring lengthy phone calls or navigating complex web portals. Integrating SMS into customer service enhances overall customer experience and can increase customer satisfaction and loyalty. SMS is increasingly being used as a tool for customer service and support, further driving its adoption in the marketing landscape.

SMS Type Insights

The transactional SMS segment dominated the market and accounted for a market revenue share of 45.2% in 2023. Transactional SMS messages, such as order confirmations, shipping notifications, and appointment reminders, have exceptionally high open and read rates. Recipients typically anticipate these messages, making them more possible to open and read immediately. This high level of engagement ensures that important information is delivered promptly, enhancing customer satisfaction and trust. The immediate approach and reliability of transactional SMS make it a preferred communication channel for conveying time-sensitive information.

The promotional SMS segment is expected to register the fastest CAGR during the forecast period. In the U.S., almost everyone owns a mobile phone, and the majority use their phones regularly. This wide reach allows businesses to connect with a broad demographic, spanning different age groups, income levels, and geographic locations. Companies send instant updates about flash sales, limited-time offers, and exclusive promotions, creating a sense of urgency that encourages immediate action. Real-time communication is particularly effective for driving short-term campaigns and boosting sales during specific periods, such as holidays, events, or product launches. Delivering timely and relevant promotions enhances customer engagement and drives market demand.

Organization Insights

The large organization segment accounted for the largest market revenue share in 2023. Large organizations use customer relationship management systems to manage customer interactions. SMS marketing platforms integrate with these CRM systems, enabling organizations to automate and personalize their SMS campaigns. This integration allows for the efficient collection and use of customer data, ensuring that messages are customized to individual preferences and behaviors. The ability to send targeted and relevant SMS messages enhances the effectiveness of marketing campaigns and improves customer experience.

The SME segment is anticipated to witness the fastest CAGR over the forecast period. For small and medium-sized enterprises (SMEs), cost-effectiveness is a crucial factor driving the adoption of SMS marketing. SMS marketing offers a highly affordable alternative compared to traditional marketing channels such as print advertising, television, or radio. The relatively low cost of sending bulk SMS messages allows SMEs to reach a large audience without a significant financial cost. This affordability enables SMEs to allocate their marketing budgets more efficiently, ensuring they achieve substantial outreach.

End use Insights

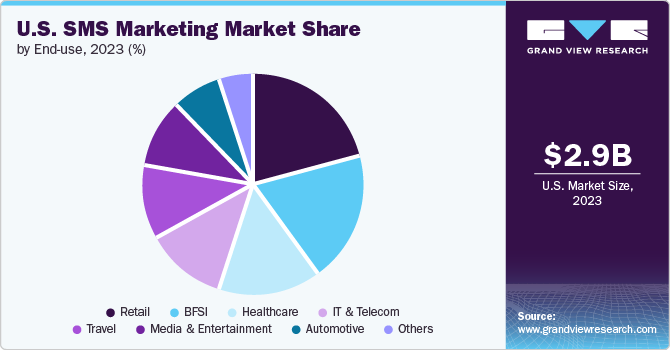

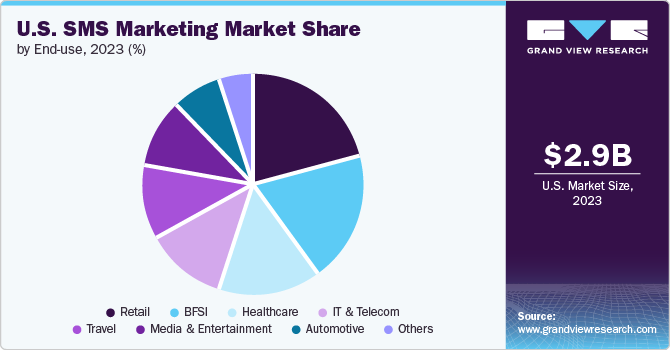

The retail sector accounted for the largest market revenue share in 2023. Retailers benefit from the ability to personalize and target their SMS marketing campaigns. Advanced SMS marketing platforms allow retailers to segment their customer base based on various criteria such as purchase history, demographics, and behavior. This enables retailers to send personalized offers, discounts, and recommendations customized to individual customer preferences. This targeted approach allows retailers to build stronger customer relationships and enhance customer loyalty.

The healthcare segment is anticipated to register the fastest CAGR over the forecast period. The adoption of SMS marketing in the healthcare sector is its effectiveness in sending appointment reminders and managing scheduling. Missed appointments are a significant issue for healthcare providers, leading to lost revenue and inefficiencies. SMS reminders help reduce the rate of missed appointments by providing patients with timely notifications. These reminders include details such as the date, time, location of the appointment, and preparatory instructions. The convenience of receiving reminders directly on their mobile devices ensures that patients are more able to attend their appointments.

Key U.S. SMS Marketing Company Insights

Key players in U.S. SMS marketing market include Alibaba Cloud, Amazon Web Services, Inc., Cisco Systems, Inc., Hewlett Packard Enterprise Development LP and others.

-

Amazon Web Services, Inc. (AWS) is a subsidiary of Amazon that provides a comprehensive and widely adopted cloud platform offering featured services from global data centers. AWS’s product offerings span various solutions, including computing power through Amazon EC2, storage with Amazon S3, and databases with Amazon RDS and DynamoDB.

-

Alibaba Cloud, a subsidiary of Alibaba Group, is a leading global cloud computing and artificial intelligence (AI) provider that offers a wide range of cloud services to businesses worldwide. Its product portfolio includes elastic computing with Elastic Compute Service (ECS), scalable storage solutions through Object Storage Service (OSS), and relational databases such as ApsaraDB for RDS (Relational Database Service).

Key U.S. SMS Marketing Companies:

- Alibaba Cloud

- Amazon Web Services, Inc.

- Cisco Systems, Inc.

- Dell Inc.

- Google Cloud Platform (GCP)

- Hewlett Packard Enterprise Development LP

- IBM Corporation

- Microsoft

- Oracle

- Red Hat, Inc.

- Salesforce, Inc.

- SAP SE

- ServiceNow.

- Tencent Cloud.

- Broadcom.

Recent Developments

-

In March 2024, Constant Contact partnered with Telgorithm to offer SMS marketing to sole proprietorships. Constant Contact and Telgorithm partnership allow sole proprietorships to leverage SMS marketing as part of their omnichannel digital marketing strategy. They have built automation for managing 10DLC messaging and guarantee message deliverability with their unique, patent-pending throughput/rate limit management technology

-

In October 2021, Button launched PostTap SMS powered by Twilio. This product offers SMS marketing capabilities and aims to help accelerate the adoption of SMS as a marketing channel for enterprise brands. By leveraging Twilio's customer engagement platform, Button enables enterprise customers to launch an integrated SMS marketing strategy without code integration.

U.S. SMS Marketing Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 3.21 billion

|

|

Revenue forecast in 2030

|

USD 9.96 billion

|

|

Growth Rate

|

CAGR of 20.8% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

SMS type, organization, end use

|

|

Key companies profiled

|

Alibaba Cloud, Amazon Web Services, Inc., Cisco Systems, Inc., Dell Inc., Google Cloud Platform (GCP), Hewlett Packard Enterprise Development LP, IBM Corporation, Microsoft, Oracle, Red Hat, Inc., Salesforce, Inc., SAP SE, ServiceNow., Tencent Cloud., Broadcom.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. SMS Marketing Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. SMS marketing market report based on SMS type, organization, and end use:

-

SMS Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Transactional SMS

-

Promotional SMS

-

Service Alerts

-

Organization Outlook (Revenue, USD Million, 2018 - 2030)

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

Media & Entertainment

-

Travel

-

Automotive

-

Healthcare

-

IT & Telecom

-

BFSI

-

Others