- Home

- »

- Homecare & Decor

- »

-

U.S. Soap Dispenser Market Size And Share Report, 2030GVR Report cover

![U.S. Soap Dispenser Market Size, Share & Trends Report]()

U.S. Soap Dispenser Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Automatic, Manual), By Application (Residential, Commercial, Healthcare), And Segment Forecasts

- Report ID: GVR-4-68040-104-0

- Number of Report Pages: 65

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

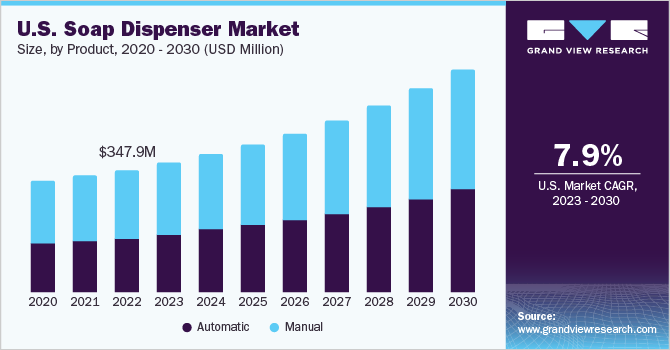

The U.S. soap dispenser market size was estimated at USD 347.92 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.7% from 2023 to 2030. The shifting preference from bar soaps to wall-mounted automatic soap dispensers owing to increased hygiene awareness has resulted in increased product installations across educational institutions and corporate offices. Soap dispensers have gained widespread popularity and have become an essential fixture in residential, workplaces, and various commercial settings where sanitation practices are prioritized. The utilization of liquid soap dispensers offers not only convenience but also cost-effectiveness. Moreover, these dispensers can also be strategically placed in kitchens, serving as a modern accessory that complements the overall cleaning process.

In addition, manufacturers in the soap dispenser market have a significant opportunity for growth due to the expanding portable sanitation market. According to the Portable Sanitation Association International, the global market had 3.6 million portable restrooms in operation in 2019, with the North America region accounting for approximately 2.0 million to 2.2 million units. This data depicts the rise in demand for soap dispensers due to the growth of the portable sanitation industry.

Liquid soap dispensers have gained significant popularity in the U.S., and the product has become an essential fixture in residential, workplace, and commercial settings where sanitation practices are implemented. Employing a liquid soap dispenser offers not only convenience and cost-effectiveness but also enables the maintenance of proper hygiene standards.

In 2019, the State of California enacted a new law aimed at waste reduction, prohibiting hotels having over 50 rooms from supplying guests with individual plastic bottles of personal hygiene products such as hand wash. Larger hotel establishments were required to comply with this regulation from January 1, 2023. The implementation of this law will extend to smaller hotels in 2024.

Furthermore, New York became the second state to enforce a similar law, which will be effective from January 1, 2024, for hotels with 50 or more rooms and a year later for hotels with smaller capacities. This trend of regulatory changes is encouraging commercial establishments nationwide to align their practices with sustainability goals, thereby increasing the demand for products such as soap dispensers nationally.

The soap dispenser market in the U.S. is experiencing significant growth, with key industry players actively introducing innovative solutions that meet the evolving demands of consumers. For instance, in August 2021, Amazon launched a cutting-edge smart soap dispenser called the "Smart Soap Dispenser”. This innovative device includes smart home features such as Wi-Fi connectivity and a built-in timer. However, the standout feature of the Smart Soap Dispenser is its incorporation of 10 LED lights strategically designed to provide a visual countdown as users wash their hands. This unique functionality enhances the user experience and promotes effective hand hygiene.

Product Insights

Manual soap dispensers dominated the market with a revenue share of more than 55% in 2022. The rising awareness among consumers regarding safety is a major driver for market growth. The low cost of manual soap dispensers and the availability of a wide range of products are boosting the demand for this type. Moreover, manual soap dispensers do not require batteries for operation, which lowers their maintenance costs and increases adoption among consumers. Small-scale restaurants, pubs, commercial places, and corporate offices are major consumers of manual soap dispensers.

Automatic soap dispensers are projected to grow at the fastest CAGR of approximately 8.4% from 2023 to 2030. In modern commercial bathrooms, the installation and use of automatic soap dispensers have become essential. These modern technologies are the main key to creating an environment prioritizing health and well-being. These dispensers significantly reduce the transfer of germs, which reduces the spread of viruses and diseases within the bathroom. In addition, the capacity to dispense a consistent amount of liquid soap promotes resource conservation by minimizing waste.

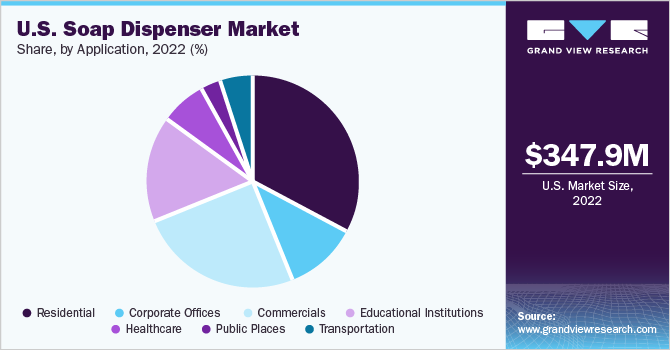

Application Insights

The commercial soap dispenser had a significant revenue share of more than 24% in 2022. Higher consumer spending and footfall in commercial spaces such as malls, dining establishments, and movie theatres have increased the demand for bathrooms with proper amenities, driving the adoption of soap dispensers. The U.S. Census Bureau's preliminary data indicate that on a seasonally adjusted basis, eating and drinking establishments generated total sales of USD 88.0 billion in May 2023. Consumer spending at restaurants increased by 8.0% over the same period in 2022.

The residential soap dispenser segment is projected to grow at the fastest CAGR of 8.4% over the forecast period. Due to the rising costs associated with housing values and mortgage rates, homeowners increasingly engage in home remodeling or home improvement projects to change their traditional household structures. According to the 2022 U.S. Houzz Bathroom Trends report, the median expenditure for primary bathroom projects nationwide has risen by almost 13%, reaching USD 9,000. In the case of higher-budget projects (top 10% of spending), there has been a 17% increase, with expenses totaling USD 35,000 or higher. In addition, homeowners are spending money on improvements to enhance their quality of life rather than purchasing products with basic functionalities. The rise in home renovation is boosting the demand for soap dispensers in the U.S. market.

Key Companies & Market Share Insights

The presence of significant domestic service providers characterizes the market. Major players are acquiring local companies to help them reach a wider nationwide audience. Market participants have acknowledged the significance and dominance of local companies in increasing the consumer base.

-

In January 2023, SC Johnson Professional introduced a cutting-edge washroom soap dispenser, the SCJ Professional Proline WAVE 1-liter model, crafted using 70% reclaimed coastal plastic. This innovative product utilizes post-consumer recycled plastic waste that is sourced from areas within a 31-mile radius of the ocean.

-

In February 2020, Bradley Corporation launched a new product line integrating Verge soap dispensers and faucets. These full sets provide unified and attractive designs that improve the look of Verge washbasins and blend in easily with any basin. They come in four forms and six finishes and include cutting-edge sensor technology for dependability and longevity.

Some prominent players in the U.S. soap dispenser market include:

-

Kohler Co.

-

ASI American Specialties, Inc.

-

simplehuman

-

Bobrick Washroom Equipment, Inc.

-

Bradley Corporation

-

Georgia-Pacific LLC

-

GOJO Industries, Inc.

-

Sloan Valve Company

-

Safetec of America, Inc.

-

SC Johnson Professional

U.S. Soap Dispenser Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 368.66 million

Revenue forecast in 2030

USD 631.00 million

Growth rate

CAGR of 7.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR % from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application

Country scope

U.S.

Key companies profiled

Kohler Co.; ASI American Specialties, Inc.; simplehuman; Bobrick Washroom Equipment, Inc.; Bradley Corporation; Georgia-Pacific LLC; GOJO Industries, Inc.; Sloan Valve Company; Safetec of America, Inc.; SC Johnson Professional

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Soap Dispenser Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. soap dispenser market report based on product and application:

-

Product Outlook (USD Million; 2017 - 2030)

-

Automatic

-

Manual

-

-

Application Outlook (USD Million; 2017 - 2030)

-

Residential

-

Corporate Offices

-

Commercials

-

Educational Institutions

-

Healthcare

-

Public Places

-

Transportation

-

Frequently Asked Questions About This Report

b. The U.S. soap dispenser market was estimated at USD 347.92 million in 2022 and is expected to reach USD 368.66 million in 2023.

b. The U.S. soap dispenser market is expected to grow at a compound annual growth rate of 7.7% from 2022 to 2030 to reach USD 631.00 million by 2030.

b. Manual soap dispensers dominated the faucet market with a share of 55.8% in 2022. The rising awareness among consumers regarding safety is acting as a major driver for market growth. The low cost of manual soap dispensers and the availability of a wide range of products are boosting the demand for this type.

b. Some of the key players operating in the U.S. soap dispenser market include Kohler Co.; ASI American Specialties, Inc.; simplehuman; Bobrick Washroom Equipment, Inc.; Bradley Corporation; Georgia-Pacific LLC; GOJO Industries, Inc.; Sloan Valve Company; Safetec of America, Inc.; SC Johnson Professional

b. Key factors that are driving the U.S. soap dispenser market growth include the rise in consumer attention towards personal hygiene and the increase in commercial establishments in the U.S.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.