- Home

- »

- Electronic & Electrical

- »

-

U.S. Soda Maker Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Soda Maker Market Size, Share & Trend Report]()

U.S. Soda Maker Market (2025 - 2030) Size, Share & Trend Analysis Report By Product, By Mode Of Operation (Manual, Electric), By Type (Portable, Desktop), By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-795-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Soda Maker Market Summary

The U.S. soda maker market size was valued at USD 299.5 million in 2024 and is expected to reach USD 378.0 million by 2030, growing at a CAGR of 4.0% from 2025 to 2030. The industry is primarily driven by increasing consumer spending power, evolving lifestyle preferences, and rising demand for premium, convenient, and customizable home carbonation solutions.

Key Market Trends & Insights

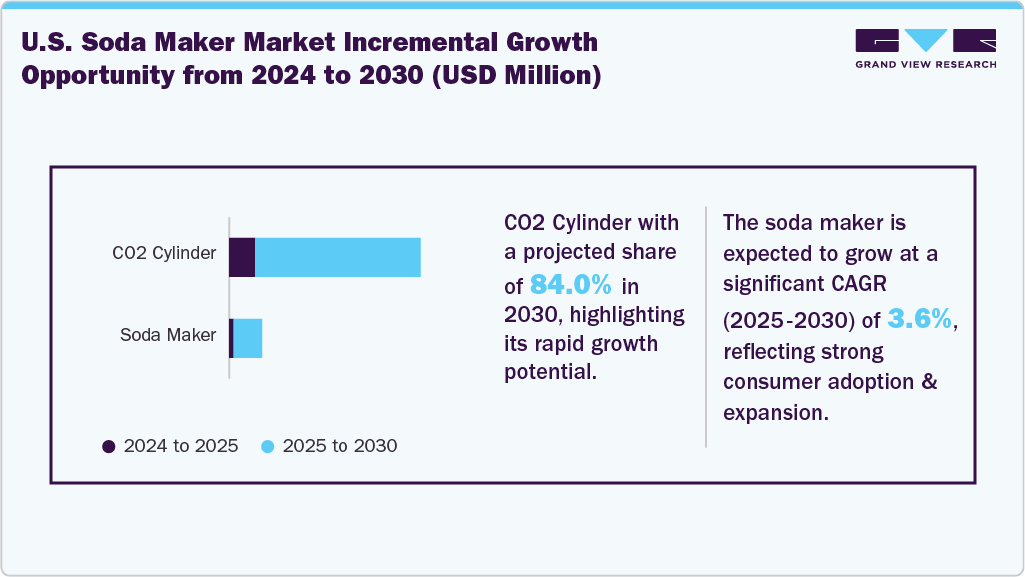

- By product, the CO2 cylinder segment held the largest market share of 83.6% in 2024.

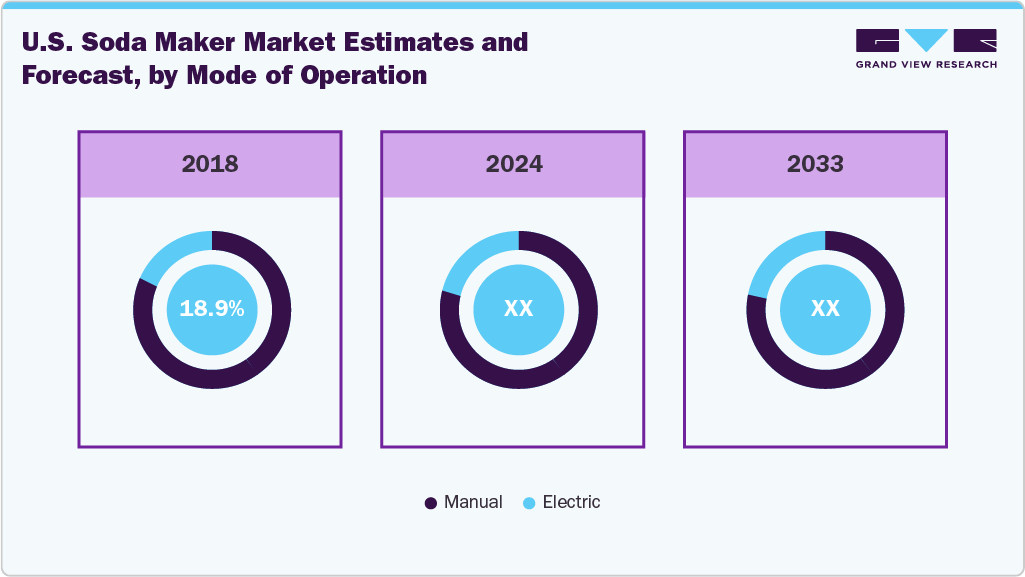

- By mode of operation, the manual segment dominated the market with a 79.6% share in 2024.

- By type, the desktop segment dominated the market, accounting for 85.1% share in 2024.

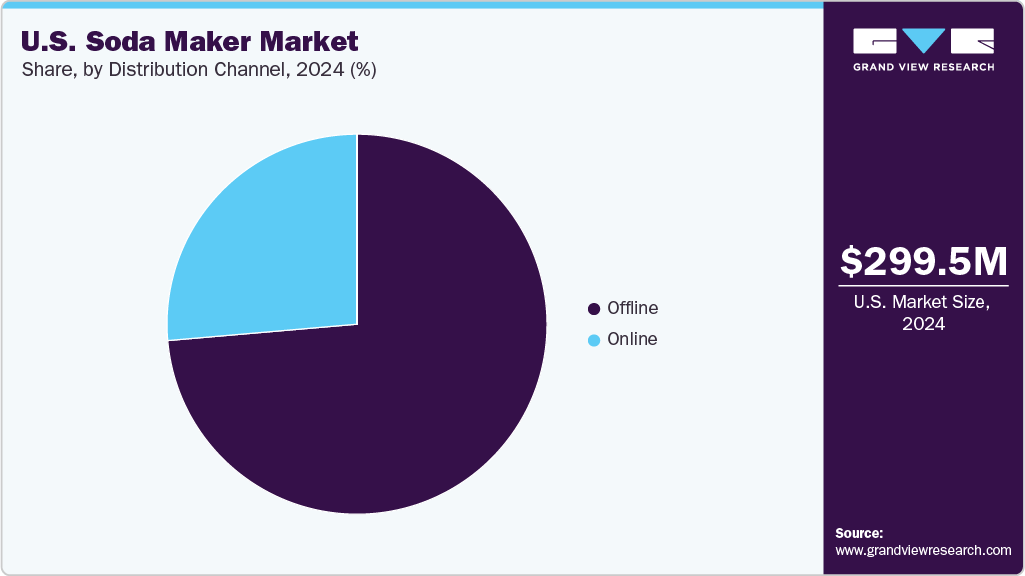

- By distribution channel, the offline segment dominated the U.S. soda maker market, with a share of 73.7% in 2024.

Key Market Trends & Insights

- 2024 Market Size: USD 299.5 Million

- 2030 Projected Market Size: USD 378.0 Million

- CAGR (2025-2030): 4.0%

Consumers are increasingly adopting soda makers to produce healthier, customizable beverages and to minimize single-use plastic waste. Manufacturers are responding by introducing models with adjustable carbonation settings and elegant, space-saving designs that align with current market demands.Manufacturers are increasingly aligning their marketing strategies with these evolving consumer preferences to drive product adoption. For instance, companies like DrinkMate and Aarke target health-conscious, and environmentally aware individuals actively seek healthier beverage options and solutions that reduce plastic waste. By understanding and addressing these consumer priorities, the companies are better positioned to communicate their products' health and environmental benefits and strengthen their market presence.

Moreover, retail and e-commerce distribution channels have played a crucial role in driving the adoption of soda makers by enhancing market accessibility and reach. Among residential consumers, e-commerce has emerged as the preferred distribution method, primarily due to its convenience, broad selection, and ease of access. Online platforms such as Amazon, Walmart, and official brand websites enable consumers to compare various models easily, review customer feedback, and benefit from competitive pricing without leaving their homes. This attracts busy individuals and households seeking a streamlined and informed shopping experience.

Product Insights

The CO2 cylinder segment accounted for the largest share, 83.6%, in 2024 and is expected to record the fastest CAGR over the forecast period. As households look for substitutes to sugary and pre-packaged drinks, soda makers that use refillable CO₂ cylinders have gained popularity, providing customizable carbonation and notable environmental advantages. The practicality and cost savings of home carbonation systems, especially when combined with reusable cylinders, attract consumers interested in minimizing plastic waste and managing their beverage ingredients.

The soda maker segment is projected to grow at a CAGR of 3.6% from 2025 to 2030. The market for soda makers is experiencing notable growth, driven by consumers' preferences for convenience, personalization, and environmental friendliness. Increasingly, consumers are opting for home carbonation options that provide user-friendly functionality, versatility, and sustainable features.

Consumer preferences in the soda maker category are increasingly shifting toward personalization, time efficiency, and health-conscious consumption. In response to these evolving demands, manufacturers such as SodaStream are expanding their products with innovative solutions that enhance functionality and user experience. According to a 2023 article on Culinary Hill Inc., the Drinkmate OmniFizz stood out for its ease of use, allowing users to carbonate water and other beverages such as wine and fruit juice. Expansion through online and retail platforms and the growing emphasis on eco-friendly and health-oriented products strengthen soda maker demand across the U.S. market.

Mode of Operation Insights

The manual soda maker segment accounted for the largest share of 79.6% of the revenue in 2024. Manual soda makers for home use are experiencing a resurgence, driven by growing consumer demand for practical, eco-friendly, and cost-effective solutions. These non-electric devices use CO₂ cartridges to carbonate beverages, allowing users to adjust carbonation levels and create customized drinks. The hands-on, mechanical design appeals to individuals seeking a more tactile and simplified experience, as an alternative to increasingly complex home appliances. In addition, manual soda makers' compact and portable nature makes them well-suited for diverse settings, including home kitchens, outdoor events, and travel scenarios.

The electric segment is projected to grow at the fastest CAGR of 4.8% from 2025 to 2030. The electric soda maker industry is gaining momentum due to increasing consumer demand for convenience, automation, and premium in-home beverage experiences. Unlike manual models, electric soda makers offer one-touch carbonation and adjustable fizz levels and often come with digital displays or smart features, allowing users to create sparkling beverages with ease and consistency.

Type Insights

The desktop segment accounted for the largest share of 85.1% of the global revenue in 2024. Desktop soda makers are gaining popularity in the U.S. for their balance of performance, convenience, and style. Designed to sit on kitchen counters, these models are often more robust than portable versions. They provide consistent carbonation and the ability to handle larger bottles, making them ideal for families or frequent sparkling water drinkers.

The portable segment is projected to grow at the fastest CAGR of 4.2% from 2025 to 2030. Portable soda makers are popular in the U.S. for their convenience, ease of use, and travel-friendly design. Compact and lightweight, these devices operate without electricity and use small CO₂ cartridges, making them easy to carry for home, office, or outdoor use. They allow users to carbonate water, juices, teas, and even re-carbonate flat sodas, providing versatility for various preferences.

Distribution Channel Insights

The offline segment accounted for the largest share, 73.7% of revenue in 2024. In the U.S., offline purchases of soda makers remain popular due to immediate availability and a hands-on shopping experience. This segment allows consumers to inspect products, take them home immediately, and access convenient services like CO₂ cylinder exchanges and flavor syrup purchases.

The online segment is projected to grow at the fastest CAGR of 5.2% from 2025 to 2030. This is driven by convenience, product variety, and health-conscious consumer trends. For instance, SodaStream’s official online platform offers a seamless e-commerce experience, featuring popular models like the Terra and Art, along with CO₂ cylinder refills, flavored syrups, accessories, and subscription services for easy CO₂ exchanges. Major online retailers such as Amazon, Walmart, and Target also support product availability, often through promotional campaigns, further boosting sales and expanding the U.S. online soda maker market.

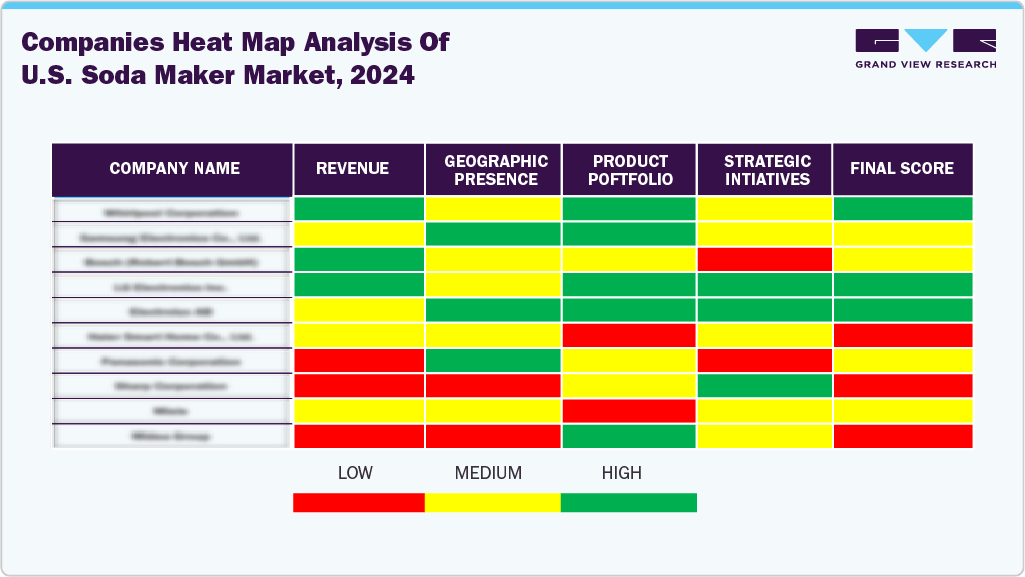

Key U.S. Soda Maker Company Insights

Many brands have recognized untapped opportunities within their product portfolios and are actively working to capitalize on these gaps. These brands aim to increase their market share and strengthen their competitive positioning worldwide by addressing niche segments and emerging preferences.

-

i-Drink Products Inc., operating under the brand name Drinkmate, specializes in home carbonation systems that allow consumers to carbonate a variety of beverages beyond just water. Founded in 2014 and headquartered in Ann Arbor, Michigan, Drinkmate has developed proprietary Fizz Infuser technology, enabling users to safely and quickly carbonate drinks like juice, iced tea, wine, and cocktails.

-

Hamilton Beach Brands Holding Company is a manufacturer and marketer of small electric household and commercial appliances, listed on the New York Stock Exchange. The company boasts a diverse portfolio of brands, including Hamilton Beach, Proctor Silex, Hamilton Beach Professional, Weston, and TrueAir. In the realm of beverage appliances, Hamilton Beach offers a range of products such as blenders, juicers, and drink mixers, catering to home and commercial use.

Key U.S. Soda Maker Companies:

- SodaStream

- Hamilton Beach Brands

- KitchenAid

- Cuisinart

- DrinkMate

- Aarke

- Primo Water Corporation

- Bonne O

- Breville Group

- SodaSparkle

U.S. Soda Maker Market Report Scope

Report Attribute

Details

Market value size in 2025

USD 310.5 million

Revenue Forecast in 2030

USD 378.0 million

Growth rate (Revenue)

CAGR of 4.0% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative (Revenue) units

Revenue in USD Million, Volume in Thousand Units, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, mode of operation, type, distribution channel

Key companies profiled

SodaStream; Hamilton Beach Brands; KitchenAid; Cuisinart; DrinkMate; Aarke; Primo Water Corporation; Bonne O; Breville Group; SodaSparkle

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs.

U.S. Soda Maker Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. soda maker market report on the basis of product, mode of operation, type, and distribution channel:

-

Product Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Soda Maker

-

CO2 Cylinder

-

-

Mode of Operation Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Manual

-

Electric

-

-

Type Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Portable

-

Desktop

-

-

Distribution Channel Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

Frequently Asked Questions About This Report

b. The U.S. soda maker market was valued at USD 299.5 million in 2024

b. The U.S. soda maker market is expected to reach 378.0 million in 2030 and grow at a compound annual growth rate (CAGR) of 4.0% from 2025 to 2030

b. The manual soda maker segment accounted for the largest share of 79.6% of the revenue in 2024. Manual soda makers for home use are experiencing a resurgence, driven by growing consumer demand for practical, eco-friendly, and cost-effective solutions

b. The key player include SodaStream, Hamilton Beach Brands, KitchenAid, Cuisinart, DrinkMate, Aarke, Primo Water Corporation, Bonne O, Breville Group, SodaSparkle

b. SodaStream, Hamilton Beach Brands, KitchenAid, Cuisinart, DrinkMate, Aarke, Primo Water Corporation, Bonne O, Breville Group, SodaSparkle

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.