- Home

- »

- Advanced Interior Materials

- »

-

U.S. Solar Fasteners Market Size, Industry Report, 2033GVR Report cover

![U.S. Solar Fasteners Market Size, Share & Trends Report]()

U.S. Solar Fasteners Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Metric Fasteners, Fastening Set For Metal Roofs, Fastening Set For Fiber Cement Roofs, Wood Screws For Roof Hook Installation), By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-672-5

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Solar Fasteners Market Summary

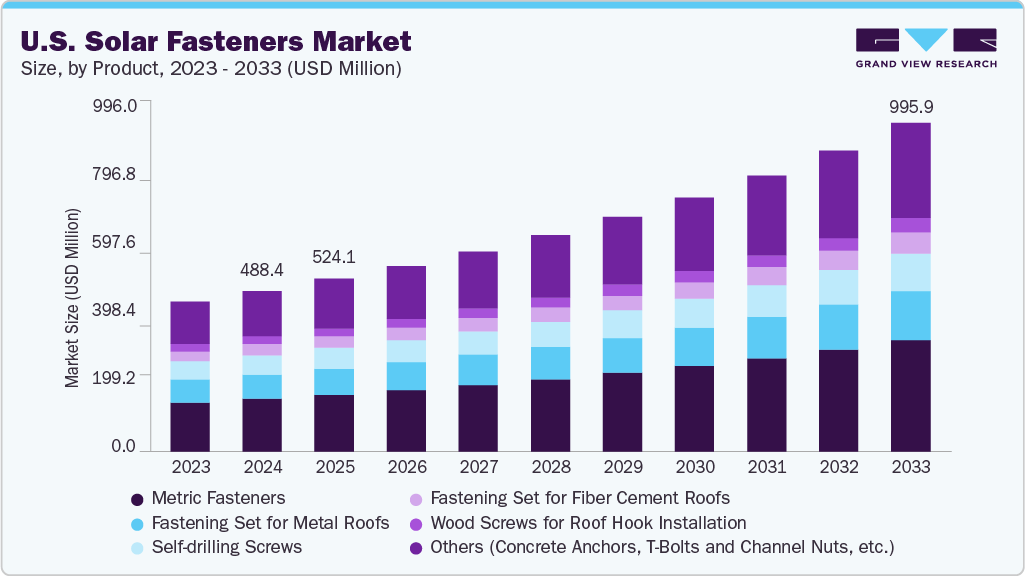

The U.S. solar fasteners market size was estimated at USD 488.4 million in 2024 and is projected to reach USD 995.9 million by 2033, growing at a CAGR of 8.4% from 2025 to 2033. In the U.S., the market growth is driven by supportive federal and state-level policies that encourage the adoption of solar energy.

Key Market Trends & Insights

- By product, the metric fasteners segment is expected to grow at the fastest CAGR of 8.8% over the forecast period.

- By end use, the construction & real estate segment is expected to grow at the fastest CAGR of 8.7% over the forecast period.

- The U.S. solar fastener market’s growth is driven by the rising adoption of solar energy systems supported by federal tax incentives, state-level clean energy mandates, and increasing demand for durable, weather-resistant mounting solutions.

Market Size & Forecast

- 2024 Market Size: USD 488.4 Million

- 2033 Projected Market Size: USD 995.9 Million

- CAGR (2025-2033): 8.4%

Programs such as the Investment Tax Credit (ITC), net metering, and renewable portfolio standards (RPS) have created favorable conditions for solar installations across residential, commercial, and utility-scale segments. These policies have led to a steady increase in photovoltaic deployments, directly boosting the demand for high-quality solar fasteners used in mounting and securing solar panels. The continuation and expansion of such incentives under recent federal initiatives further strengthen the prospects for the U.S. solar fasteners industry.The rapid growth in residential and commercial rooftop solar systems across the United States is another major factor contributing to the rising demand for solar fasteners. As homeowners and businesses seek energy independence and reduced utility costs, the need for secure, lightweight, and easy-to-install fasteners has increased. In urban areas, especially in states like California, Texas, and Florida, the diversity of roof types has driven the development of fasteners tailored to metal, tile, and asphalt shingle roofs, enhancing the relevance and specialization of fastener solutions.

In recent years, the U.S. has placed increasing emphasis on strengthening domestic manufacturing of solar components, including fasteners, to reduce dependency on imports and enhance supply chain resilience. Legislative measures, such as the Inflation Reduction Act, incentivize local production and sourcing of renewable energy equipment. This shift is encouraging the development of domestically produced solar fasteners that comply with stringent quality and safety standards like UL 2703, fostering innovation and creating opportunities for U.S.-based manufacturers and suppliers.

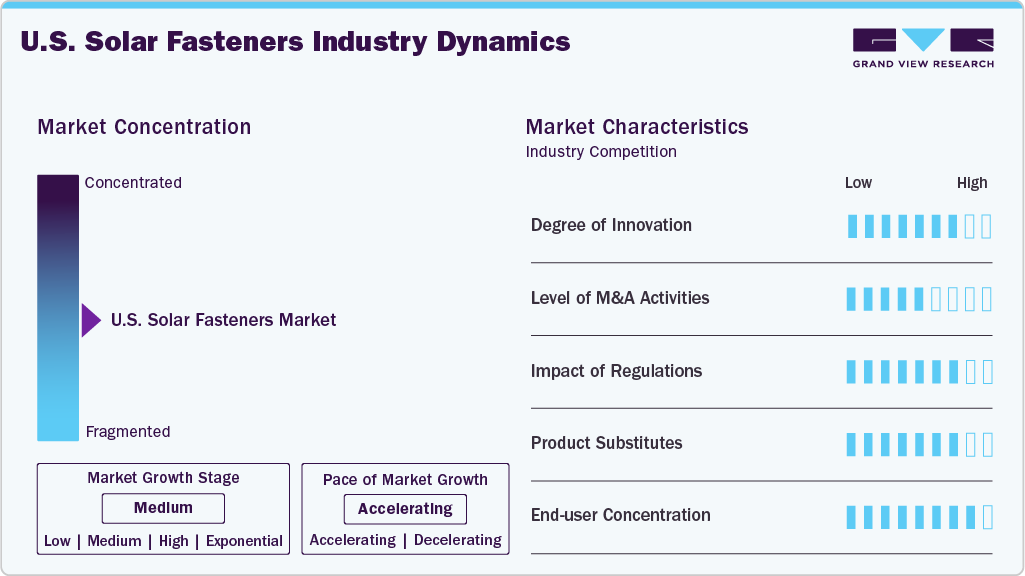

Market Concentration & Characteristics

The U.S. solar fasteners market exhibits a moderately fragmented structure, with the presence of both global manufacturers and domestic suppliers catering to diverse regional demands. The degree of innovation in this market is high, particularly due to the need for fasteners that support various roof types, environmental conditions, and regulatory standards. Leading companies continually invest in research and development to create lightweight, corrosion-resistant, and structurally robust fasteners that are compatible with evolving solar racking systems. While the market has seen limited large-scale consolidation, there is a gradual increase in strategic mergers and acquisitions as firms seek to expand their product portfolios, gain technical expertise, and secure a broader geographic presence, especially in high-growth states like California, Texas, and Arizona.

Regulations play a significant role in shaping the competitive landscape, with compliance with safety and building codes such as UL 2703 and local fire and electrical standards being mandatory for market participation. These regulations drive product standardization and ensure quality, which in turn increases customer trust and adoption. In terms of substitutes, traditional general-purpose fasteners may occasionally be used in cost-sensitive projects. Still, they lack the specialized design features and compliance required for solar applications, making them inadequate in most cases. End-user concentration in the U.S. market is balanced across residential, commercial, and utility-scale segments, with utility-scale projects holding a larger market share due to volume demand. However, the residential and commercial sectors are growing steadily, driven by rooftop solar incentives and increasing awareness of energy independence.

Product Insights

The metric fastener segment dominated the U.S. solar fasteners industry and accounted for about 32.90% of the revenue share in 2024, driven by its alignment with global engineering and manufacturing standards. As the U.S. solar industry increasingly integrates imported solar panels, racking systems, and mounting hardware, particularly from Europe and Asia, there is a growing need for metric fasteners that match these international components. The standardized sizing and thread design of metric fasteners ensure ease of assembly, reduce compatibility issues, and facilitate smoother installation processes, particularly for multinational engineering, procurement, and construction (EPC) firms operating in the country.

The fastening set for metal roofs segment is expected to grow significantly at a CAGR of 8.1% over the forecast period. The increasing deployment of rooftop solar systems on commercial and industrial buildings in the U.S. is a key driver for the fastening set for metal roofs segment. Metal roofs are widely used in these sectors due to their durability, low maintenance, and suitability for long-span structures. As more businesses seek to reduce energy costs and meet sustainability goals, the demand for solar installations on existing metal roofs has surged. Fastening sets designed specifically for metal roofs provide secure attachment of solar modules without penetrating or damaging the roof structure, making them essential components in such installations.

End Use Insights

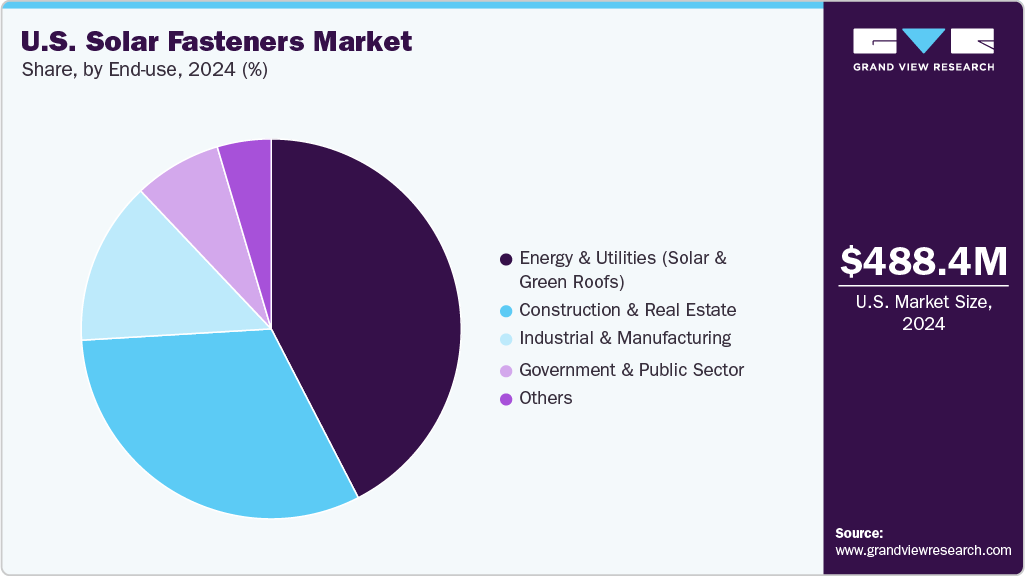

The energy & utilities (solar and green roofs) segment dominated the U.S. solar fasteners market and accounted for a revenue share of 42.46% in 2024. The growth is driven by the rapid expansion of utility-scale solar projects aimed at meeting clean energy targets and reducing carbon emissions. Government-backed programs, long-term power purchase agreements (PPAs), and increasing investment from private energy companies are driving the development of large solar farms. These installations require high-performance fasteners that can withstand significant mechanical loads and environmental stress.

The construction & real estate segment is expected to grow at the fastest CAGR of 8.7% over the forecast period. A growing number of property owners in the U.S. are opting to retrofit existing buildings with solar systems to reduce energy costs and increase property value. The retrofit market often involves complex roof types and space constraints, which require adaptable fastening solutions capable of accommodating diverse structural conditions. Fasteners that are corrosion-resistant, lightweight, and compatible with low-penetration mounting techniques are particularly in demand. As the real estate sector continues to seek energy-efficient upgrades, the need for flexible, easy-to-install fasteners tailored to retrofit scenarios is becoming increasingly prominent.

Key U.S. Solar Fasteners Company Insights

Some of the key players operating in the U.S. market include Hilti Corporation and EJOT Group.

-

Hilti Corporation, headquartered in Liechtenstein, is a prominent player in the U.S. solar fasteners market, offering high-quality fastening and installation systems for solar energy applications. Its portfolio includes stainless steel bolts, screws, anchors, and structural fasteners designed specifically for PV module mounting systems. Hilti’s fasteners are engineered for extreme durability, high load-bearing capacity, and compliance with U.S. standards such as UL 2703, making them ideal for utility-scale solar farms and commercial rooftops.

-

EJOT Group, based in Germany, has a strong presence in the U.S. through its specialized range of fastening systems for metal and flat roofs used in solar panel installations. EJOT’s solar fastener offerings include self-drilling screws, solar mounting brackets, and membrane-compatible solutions that ensure watertight sealing and structural stability. The company focuses on providing high-performance fasteners suitable for long-term exposure to UV radiation and varying weather conditions, making them suitable for both residential and industrial solar projects.

Würth Group and SFS Group AG are some of the emerging participants in the U.S. solar fasteners market.

-

Würth Group, one of the largest fastener distributors globally, supplies a comprehensive line of solar fastening products in the U.S. market. These include hex head screws, anchor bolts, solar module clips, and specialty washers designed for solar racking and roof attachment systems. Würth emphasizes corrosion resistance and long product life, offering both standard and customized fastening kits for different roof types, particularly in retrofit and solar-ready construction.

-

SFS Group AG, headquartered in Switzerland, provides mechanical fastening solutions optimized for photovoltaic systems in the U.S. solar market. Its product lineup includes rivets, tensioning systems, and self-tapping fasteners for a range of roof applications. SFS’s engineering expertise supports the design of reliable and easy-to-install fasteners that integrate seamlessly with prefabricated mounting systems, contributing to efficient and secure PV module installations on flat and sloped roofs.

Key U.S. Solar Fasteners Companies:

- Hilti Corporation

- EJOT Group

- Würth Group

- SFS Group AG

- Bossard Group

- PENN Engineering

- Fastenal Company

- Solar Connections International

- Unirac Inc.

- IronRidge Inc.

U.S. Solar Fasteners Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 524.1 million

Revenue forecast in 2033

USD 995.9 million

Growth Rate

CAGR of 8.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use

Country scope

U.S

Key companies profiled

Hilti Corporation; EJOT Group; Würth Group; SFS Group AG; Bossard Group; PENN Engineering; Fastenal Company; Solar Connections International; Unirac Inc.; IronRidge Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Solar Fasteners Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. solar fasteners market report based on product and end use:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Self-drilling Screws

-

Fastening Set for Metal Roofs

-

Fastening Set for Fiber Cement Roofs

-

Wood Screws for Roof Hook Installation

-

Metric Fasteners

-

Others (Concrete Anchors, T-Bolts and Channel Nuts, etc.)

-

-

End Use Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Construction & Real Estate

-

Energy & Utilities (Solar and Green Roofs)

-

Industrial & Manufacturing

-

Government & Public Sector

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. solar fasteners market size was estimated at USD 488.4 million in 2024 and is expected to reach USD 524.1 million in 2025.

b. The U.S. solar fasteners market is expected to grow at a compound annual growth rate of 8.4% from 2025 to 2033 to reach USD 995.9 million by 2033.

b. Metric fastener segment dominated the market and accounted for about 32.90% share of the revenue in 2024, driven by its alignment with global engineering and manufacturing standards.

b. Some of the prominent companies in the solar fasteners market include Hilti Corporation, EJOT Group, Würth Group, SFS Group AG, Bossard Group, PENN Engineering, Fastenal Company, Solar Connections International, Unirac Inc

b. Key factors driving the U.S. solar fasteners market include rapid expansion of residential, commercial, and utility-scale solar installations supported by favorable federal and state-level policies such as the Investment Tax Credit (ITC) and renewable energy mandates.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.