- Home

- »

- Automotive & Transportation

- »

-

U.S. Solar Powered Cold Storage Market Size Report, 2030GVR Report cover

![U.S. Solar Powered Cold Storage Market Size, Share & Trends Report]()

U.S. Solar Powered Cold Storage Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Photovoltaic Operated Refrigeration Cycle, Solar Mechanical Refrigeration, Absorption Refrigeration), By Industry, And Segment Forecasts

- Report ID: GVR-4-68040-620-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The U.S. solar powered cold storage market size was estimated at USD 11.60 billion in 2024 and is projected to grow at a CAGR of 10.1% from 2025 to 2030. The growth is driven by the rising demand for sustainable energy solutions in the agricultural and food distribution sectors. Heightened concerns about carbon emissions from traditional refrigeration systems have prompted the shift toward solar-powered alternatives. The growing focus on minimizing food spoilage and ensuring uninterrupted cold chain logistics, particularly in remote or off-grid areas, has facilitated market expansion. Additionally, the rising cost of conventional energy and the push for greater energy independence have made solar-powered cold storage systems more economically attractive for both businesses and cooperatives.

Technological innovation has improved the functionality and adoption of solar-powered cold storage systems in the U.S. Advances in solar panel efficiency and battery storage technologies, including lithium-ion and phase-change materials, have increased system reliability and cooling duration. Remote monitoring capabilities, utilizing IoT and cloud-based analytics, have been integrated to enhance performance and reduce system downtime. Additionally, hybrid systems that combine solar with other renewable sources or grid backup are being adopted to maintain continuous operation under varying environmental conditions.

Investments in the U.S. solar-powered cold storage industry have received support from both the government and private sectors. Federal agencies, such as the Department of Energy (DOE) and the U.S. Department of Agriculture (USDA), have allocated funding for demonstration projects and infrastructure development in rural and underserved areas. Involvement from the private sector has grown, notably from venture capital firms focusing on clean technology startups. Many agricultural cooperatives and cold chain service providers have invested in solar-integrated storage to lower long-term operating costs and achieve corporate sustainability objectives.

The regulatory framework in the U.S. has played a crucial role in promoting the adoption of solar-powered cold storage solutions. Policies like the federal Investment Tax Credit (ITC) have significantly reduced the cost of solar installations. State-level initiatives, such as net metering and solar renewable energy credits (SRECs), provide additional financial incentives for businesses that invest in solar technologies. Compliance with environmental regulations and green building standards has also encouraged the use of clean energy-based refrigeration systems in commercial and agricultural applications.

However, several challenges continue to hinder market growth. The significant initial capital expenditure required for solar-powered cold storage units remains a major barrier, especially for small-scale farmers and distributors. Technical limitations regarding battery life, storage scalability, and system integration can impact operational efficiency. Geographic factors, such as inconsistent sunlight availability in northern and coastal states, have also affected system performance.

Type Insights

The photovoltaic-operated refrigeration cycle segment accounted for the largest market share of 58.9% in 2024. The abundance of solar resources in many U.S. states, such as California, Arizona, Texas, and Nevada, provides high levels of solar irradiance, making PV-based systems particularly viable and cost-effective. By directly converting sunlight into electricity, these systems reduce dependence on fossil fuels and lower operational costs associated with diesel-powered or grid-dependent refrigeration. This advantage is especially important in off-grid or underserved rural areas where consistent grid access is limited.

The solar mechanical refrigeration segment is expected to grow at a significant CAGR during the forecast period. The ease of integrating solar mechanical refrigeration into existing cold storage infrastructure drives the segment's expansion. Many warehouses and distribution centers currently utilize mechanical refrigeration systems; therefore, retrofitting these units with solar panels to offset energy consumption offers a more straightforward and cost-effective upgrade path. This compatibility minimizes the need for major redesigns or system overhauls, making adoption more appealing for businesses aiming to lower operational costs while achieving sustainability goals.

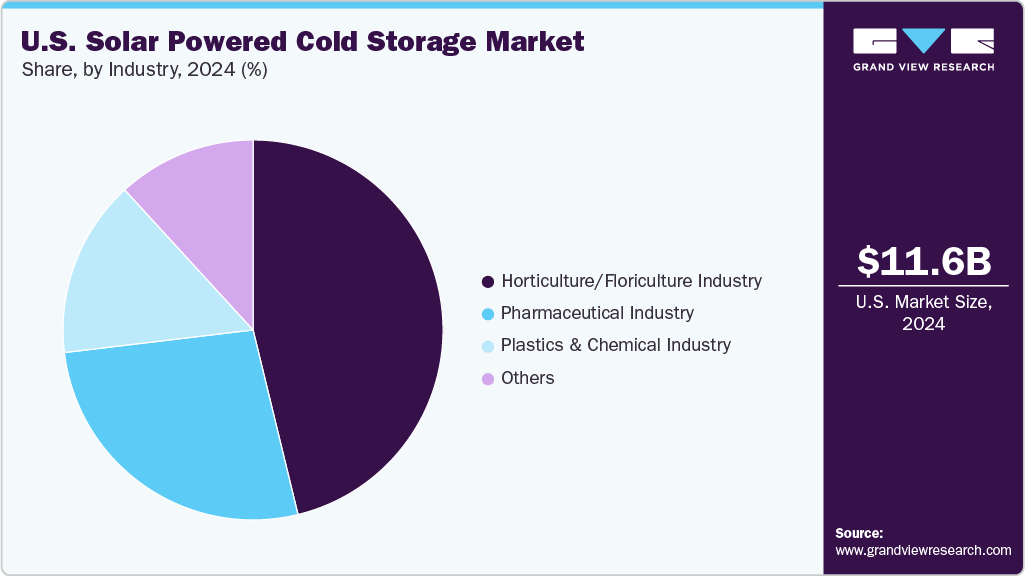

Industry Insights

The horticulture/floriculture industry segment held the largest market share of 46.2% in 2024. There is increasing market pressure from retailers, consumers, and certification bodies for sustainably grown and stored produce. U.S. horticulture and floriculture producers are responding by adopting greener technologies to align with ESG targets and meet organic or sustainability certification requirements. Solar-powered cold storage systems, by eliminating reliance on non-renewable energy sources, enhance the sustainability profile of growers. This shift opens access to premium markets and strengthens brand reputation and competitiveness in export-oriented segments.

The pharmaceutical industry segment is expected to register the fastest CAGR of 10.5% during the forecast period. The increasing demand for cold chain logistics, driven by the rising volume of temperature-sensitive pharmaceuticals such as vaccines, biologics, insulin, and cell/gene therapies, fuels the market growth. These products necessitate precise and uninterrupted temperature control throughout the distribution process to maintain their efficacy and safety. Solar-powered cold storage systems, especially those with battery backup or thermal storage, offer a reliable alternative to grid-dependent refrigeration, particularly in regions prone to power outages or in remote areas lacking strong infrastructure.

Key U.S. Solar Powered Cold Storage Company Insights

Some of the key companies in the U.S. solar powered cold storage market include Viking Cold Solutions, Inc., GoSun, Aldelano Solar Solutions, and Sundanzer. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are implementing several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

SunDanzer is an off-grid refrigeration solutions provider that employs cutting-edge technology. The company introduced the world’s first battery-free solar-powered refrigerator, which utilizes thermal energy storage instead of batteries, eliminating the recurring costs and environmental issues associated with battery replacement. SunDanzer’s products, including solar refrigerators and freezers, are designed for remote and off-grid consumers, providing reliable, energy-efficient cooling with minimal maintenance.

-

Viking Cold Solutions, Inc. is a thermal energy management company that specializes in enhancing the efficiency, flexibility, and sustainability of cold storage and refrigeration systems. The company’s core innovation is its patented Thermal Energy Storage (TES) technology. This technology uses environmentally friendly Phase Change Materials (PCM), coupled with intelligent controls and 24/7 cloud-based monitoring, to store cold energy for later use. This system allows refrigeration equipment to be powered off for extended periods, up to 13 hours, while maintaining stable temperatures. As a result, it achieves energy cost reductions of 35% or more and improves temperature stability, which in turn protects food quality.

Key U.S. Solar Powered Cold Storage Companies:

- Sundanzer

- DGridEnergy, LLC

- Promethean Power Systems

- Viking Cold Solutions, Inc.

- GoSun

- PLUSS

- Aldelano Solar Solutions

- Coldwell Solar

Recent Developments

-

In May 2024, the U.S. government, in partnership with Manamuz Electric, launched a solar-powered cold storage facility in Enugu, Nigeria. This initiative, coordinated by the U.S. Consul General in Lagos, Will Stevens, and led by Mandela Washington Fellow Uzo Mbamalu, founder of Manamuz Electric, aims to address Nigeria’s significant post-harvest losses, estimated at USD 9 billion annually, which are largely due to inadequate cold storage and agro-processing infrastructure. Supported by a grant from the U.S. Africa Development Foundation, the project provides a reliable and cost-effective means for farmers and agricultural stakeholders to preserve perishable produce, thereby reducing food waste and enhancing food security.

U.S. Solar Powered Cold Storage Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 12.29 billion

Revenue forecast in 2030

USD 19.85 billion

Growth rate

CAGR of 10.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report industry

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, industry

Key companies profiled

Sundanzer; DGridEnergy, LLC; Promethean Power Systems; Viking Cold Solutions, Inc.; GoSun; PLUSS; Aldelano Solar Solutions; Coldwell Solar

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Solar Powered Cold Storage Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. solar powered cold storage market report based on type and industry:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Photovoltaic Operated Refrigeration Cycle

-

Solar Mechanical Refrigeration

-

Absorption Refrigeration

-

-

Industry Outlook (Revenue, USD Billion, 2018 - 2030)

-

Horticulture/Floriculture Industry

-

Plastics and Chemical Industry

-

Pharmaceutical Industry

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. solar powered cold storage market size was estimated at USD 11.60 billion in 2024 and is expected to reach USD 12.29 billion in 2025.

b. The U.S. solar powered cold storage market is expected to grow at a compound annual growth rate of 10.1% from 2025 to 2030 to reach USD 19.85 billion by 2030.

b. The photovoltaic operated refrigeration cycle segment accounted for the largest share of 58.9% in 2024. The availability of abundant solar resources in many regions of the U.S. States, such as California, Arizona, Texas, and Nevada, offers high solar irradiance levels, making PV-based systems especially viable and cost-effective.

b. Some key players operating in the U.S. solar powered cold storage market include Sundanzer; DGridEnergy, LLC; Promethean Power Systems; Viking Cold Solutions, Inc.; GoSun; PLUSS; Aldelano Solar Solutions; Coldwell Solar

b. Key factors that are driving the solar powered cold storage market growth include the growing demand for sustainable energy solutions in the agricultural and food distribution sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.