- Home

- »

- Pharmaceuticals

- »

-

U.S. Specialty Injectable Generics Market Size Report, 2030GVR Report cover

![U.S. Specialty Injectable Generics Market Size, Share & Trends Report]()

U.S. Specialty Injectable Generics Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Drugs, Biologics), By Application (Oncology, CNS, Cardiovascular), By Distribution Channel (Hospitals, Retail Pharmacy), And Segment Forecasts

- Report ID: GVR-2-68038-014-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

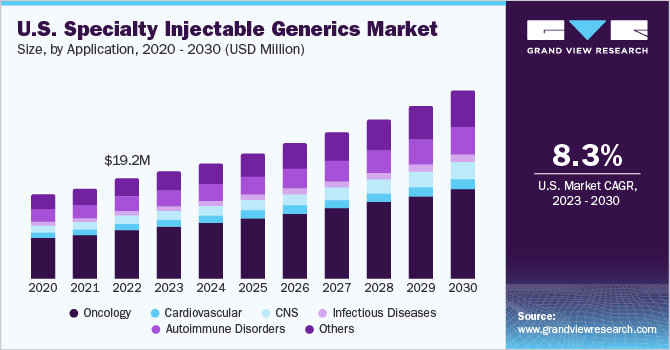

The U.S. specialty injectable generics market size was estimated at USD 19.23 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.33% from 2023 to 2030. The demand for specialty generic drugs has increased significantly due to a rise in the prevalence of target diseases like cancer, hepatitis C, multiple sclerosis, and others. Moreover, the market is witnessing growth due to the increasing number of approvals for injectable generic drugs. For instance, the U.S. FDA mentioned Generic Drug Approvals 2023 which includes Midazolam in 0.9% Sodium Chloride Injection, Aggrastat (Tirofiban Hydrochloride) Injection, Cysteine Hydrochloride Injection, Morphine Sulfate Injection.

Moreover, the growth can be attributed to the improved accessibility and affordability of injectables, offering patients high-quality, safe, and effective treatment options. Furthermore, the introduction of new generics into the market is anticipated to contribute to increased revenue. The U.S. generic & biosimilar medicines savings report revealed that in 2021, out of 6.4 billion prescriptions received by U.S. patients, 91% were accounted for by generic & biosimilar medications.

The COVID-19 pandemic had moderately impacted the U.S. market. Generic drugs play a key role in U.S. population to reduce the burden of diseases. In addition, according to FDA, there are more than 10,000 FDA-approved generic drugs. Additionally, 9 out of 10 prescriptions in the U.S. are generics. Further, during the COVID-19 pandemic, American Hospitals recorded a surge in demand for specialty injectable generics due to an increasing number of critically ill patients, leading attention to increased concern and global medical supplies. This factor has led to innovation in drug development with the efforts of drug safety, effectiveness, high quality, and affordability in the U.S. However, several unique challenges and complexities have led the steady growth.

Additionally, the increased healthcare companies spending on specialty pharmaceuticals has led to new growth avenues for the healthcare sector. Thereby, several pharmaceutical players are entering the potential market of the U.S. to seek opportunities. For instance, in June 2022, Accord BioPharma & EVERSANA announced the partnership to support the CAMCEVI 42mg injection emulsion launch for advanced prostate cancer treatment in adults.

Furthermore, there is an increasing demand for specialty drug therapies for monitoring, administration, and use in treating complex and rare diseases such as multiple sclerosis, cancer, and rheumatoid arthritis. For instance, in August 2022, the U.S. Food and Drug Administration approved Akorn Operating Company’s cetrorelix acetate for injection which is version of Merck Global’s Cetrotide. It is for the inhibition of premature luteinizing hormone in women undergoing controlled ovarian stimulation. This is expected to increase the demand for specialty injectable generics, thereby contributing to profits.

Type Insights

In 2022, the biologics segment gained a major market share of 60.41% owing to the expected commercialization of biologics. For instance, in July 2023, Biocon Biologics launched Hulio (adalimumab-fkjp) injection, a biosimilar to Humira (adalimumab). The Humira product is used for patients with juvenile idiopathic, rheumatoid, and psoriatic arthritis, Crohn’s disease & ulcerative colitis.

Biologics segment is expected to grow at the fastest CAGR of 9.5% over the forecast period Factors responsible for this high growth include specialty injectable biologics offer cost savings compared to expensive biologic drugs, making treatments more accessible. In addition, patent expirations enable the development of affordable versions, meeting increasing demand for biologic therapies due to rising chronic diseases. These factors are expected to contribute for the fastest growth.

Application Insights

In 2022, the oncology segment held the largest share accounting for about 48.9%. The demand for specialty injections in hospitals has been driven by the need to provide high-quality care to cancer patients. Several types of cancer, including breast and lung cancer, among others, have shown a growing demand for these specialty products. For instance, the American Cancer Society predicts that approximately 45% of the 609,820 cancer-related deaths in the United States will occur in 2023.

The increasing prevalence of cancer has led pharmaceutical companies to focus on developing new therapies for its treatment. For instance, In April 2022, Apotex Corp. launched Paclitaxel protein-bound particles for albumin-bound injection, a version of Abraxane in the U.S. This injection is indicated for the treatment of non-small cell lung cancer, metastatic breast cancer, and adenocarcinoma of the pancreas. Such developments provide patients with access to high-quality medication at affordable prices.

On the other side, CNS is expected to show the fastest growth rate over the projected period. The market growth can be attributed to several factors, such as rising number of road accidents leading to brain injuries, increasing prevalence of neurological disorders like Alzheimer’s, and Parkinson’s disease. Consequently, there is a growing demand for specialty injectable generics to address these conditions, and the expected approvals of generic drugs are anticipated to further boost the market. For instance, in January 2023, U.S. FDA granted approval to Leqembi (lecanemab-irmb) through the Accelerated Approval pathway for the treatment of Alzheimer's disease.

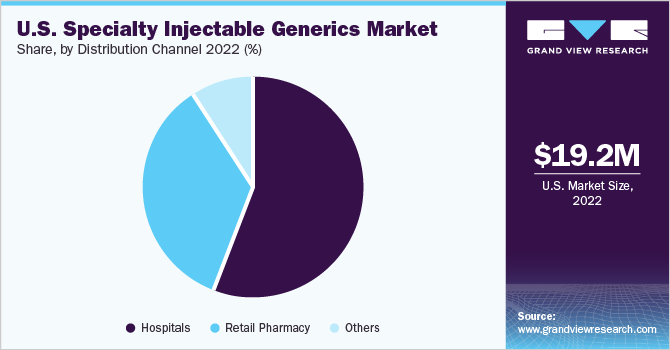

Distribution Channel Insights

The hospital segment held the largest share of 56.35% in 2022 and is expected to maintain its position throughout the forecast period. The market is driven by factors such as well-established key players, advanced healthcare facilities, growing prevalence of cancer, cardiovascular diseases, and rare diseases. Likewise, the market is witnessing significant demand due to the growing number of critically ill patients in hospitals and the need for specialty injectable medications. Additionally, the production and supply of new specialty injectable generics to hospitals have further boosted the U.S. specialty injectable generics market, resulting in increased profitability.

However, retail pharmacy is anticipated to grow at the fastest CAGR during the forecast period. Owing to the increasing demand for affordable healthcare options, the availability of a wider range of injectable generics, and the rising emphasis on cost-effective treatment options. As a result, retail pharmacies are witnessing a surge in the distribution and dispensing of injectable generics, catering to the needs of patients seeking accessible and affordable medication options.

Key Companies & Market Share Insights

Key players operating across the U.S. are adopting strategic initiatives such as new launches, mergers & acquisitions, & partnerships to increase their market share. For instance, in November 2022, Amneal Pharmaceuticals, Inc. announced that the company had received abbreviated new drug application approval from the U.S. FDA for leuprolide acetate. The product is used for advanced prostatic cancer treatment. Furthermore, in June 2022, Dr. Reddy’s Laboratories Ltd. acquired branded & generic injectable products portfolio from Eton Pharmaceuticals, Inc. The acquisition is anticipated to support Dr. Reddy’s to expand affordable medications for patients. Some of the key players in the U.S. specialty injectable generics market include:

-

Pfizer, Inc.

-

Teva Pharmaceutical Industries Ltd.

-

Baxter International

-

Novartis AG

-

Fresenius SE & Co. KGaA

-

Par Pharmaceutical

-

Hikma Pharmaceuticals PLC

-

Dr. Reddy's Laboratories

-

Sagent Pharmaceuticals, Inc.

-

Mylan N.V.

U.S. Specialty Injectable Generics Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 36.16 million

Growth rate

CAGR of 8.33% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in (USD Million) and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, distribution channel

Country scope

U.S.

Key companies profiled

Pfizer, Inc., Teva Pharmaceutical Industries Ltd., Baxter International, Novartis AG, Fresenius SE & Co. KGaA, Par Pharmaceutical, Hikma Pharmaceuticals PLC, Dr. Reddy's Laboratories, Sagent Pharmaceuticals, Inc., Mylan N.V.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

U.S. Specialty Injectable Generics Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the U.S. specialty injectable generics market on the type, application, and distribution channel:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Drugs

-

Biologics

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Cardiovascular

-

CNS

-

Infectious Diseases

-

Autoimmune Disorders

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Retail Pharmacy

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. specialty injectable generics market size was estimated at USD 19.23 million in 2022 and is expected to reach USD 20.65 million in 2023.

b. The U.S. specialty injectable generics market is expected to grow at a compound annual growth rate of 8.33% from 2023 to 2030 to reach USD 36.16 million by 2030.

b. Oncology dominated the U.S. specialty injectable generics market with a share of 48.9% in 2022. This is attributable to the rising incidence of cancer in the nation coupled with increasing screening mandates that are expected to further drive market growth.

b. Some key players operating in the U.S. specialty injectable generics market include Pfizer, Inc.; Fresenius SE & Co. KGaA; Mylan N.V.; Teva Pharmaceutical Industries Ltd.; and Hikma Pharmaceuticals PLC.

b. Key factors that are driving the market growth include the prevalence of target diseases, such as cancer, hepatitis C, multiple sclerosis, and others, which has resulted in high demand for specialty generic drugs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.