- Home

- »

- Alcohol & Tobacco

- »

-

U.S. Spirits Market Size And Share, Industry Report, 2033GVR Report cover

![U.S. Spirits Market Size, Share & Trends Report]()

U.S. Spirits Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Vodka, Whiskey, Rum, Brandy, Gin), By Price Point (Economy, Mid-Premium, Supper-Premium), By Distribution Channel, By Product - Price Point - Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-826-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Spirits Market Report Summary

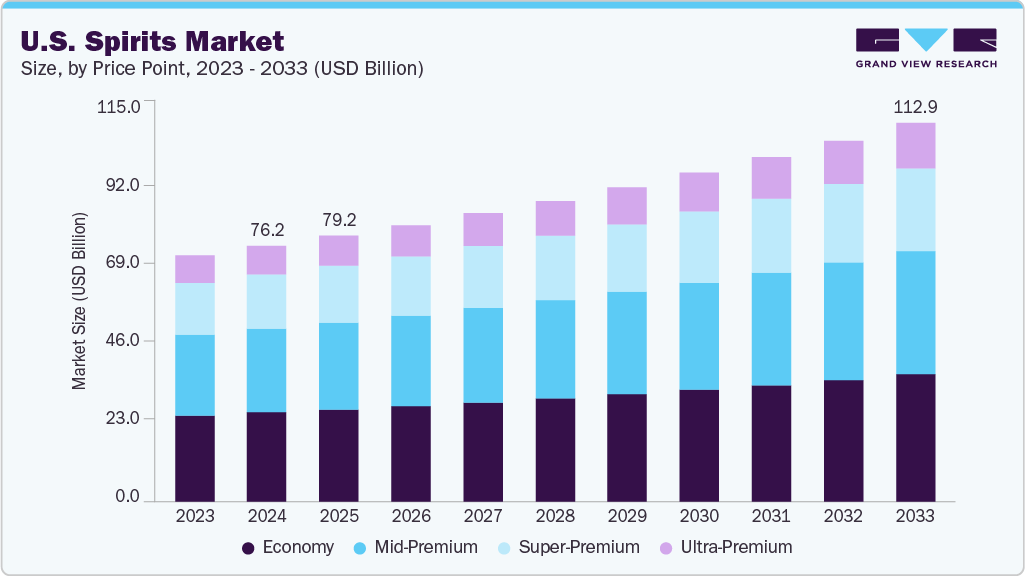

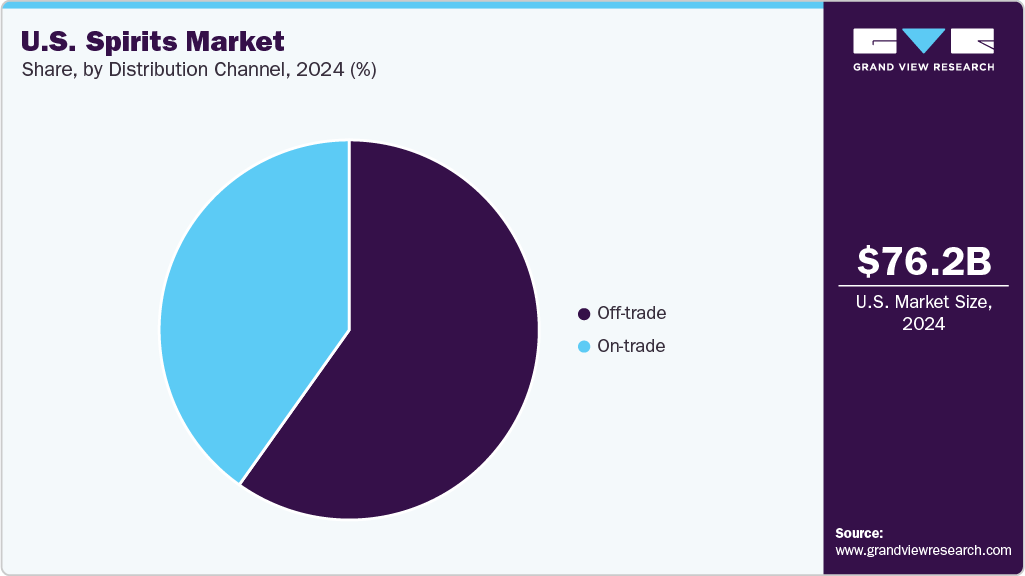

The U.S. spirits market size was estimated at USD 76.16 billion in 2024 and is expected to reach USD 112.87 billion by 2033, growing at a CAGR of 4.5% from 2025 to 2033. This growth is driven by strong consumer demand for premium, craft, and innovative spirit varieties across categories such as whiskey, tequila, vodka, and rum.

Key Market Trends & Insights

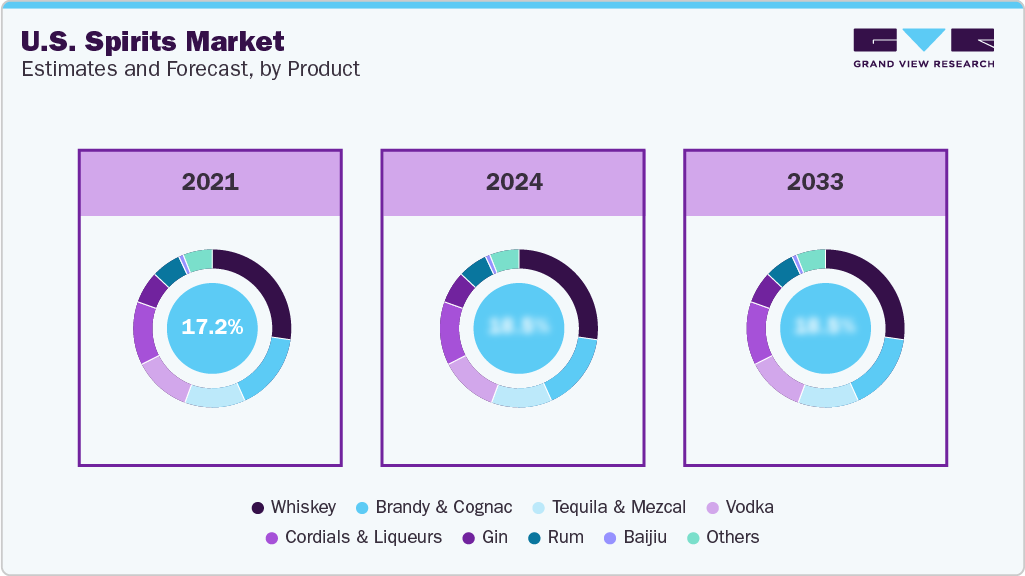

- By product, whiskey led the U.S. spirits market, with a revenue share of 26.26% in 2024.

- By price point, the economic spirits segment led the market, with a revenue share of 35.06% in 2024.

- By distribution channel, the sales of spirits through the off-trade channel led the market, with a revenue share of 59.83% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 76.16 Billion

- 2033 Projected Market Size: USD 112.87 Billion

- CAGR (2025-2033): 4.5%

Premiumization remains a key trend in the U.S. spirits industry, with consumers increasingly willing to spend more on aged, small-batch, and limited-edition releases that emphasize quality, authenticity, and craftsmanship. The expansion of cocktail culture-both in bars and through at-home mixology-continues to boost demand for versatile and high-quality spirits. Additionally, the rise of e-commerce and rapid delivery platforms has broadened consumer access, while marketing collaborations, celebrity-led brands, and experiential promotions enhance brand engagement. Demographic diversity, evolving taste preferences, and the growing influence of younger consumers further support the long-term growth outlook for the U.S. spirits industry.A growing trend in the U.S. spirits market is the rising popularity of flavored and infused spirits-particularly in categories such as vodka, whiskey, rum, and brandy-aimed at attracting younger, experience-driven drinkers. U.S. consumers are increasingly exploring fruit-, spice-, and dessert-inspired variants that offer smoother, sweeter, and more mixable profiles ideal for cocktails and casual social occasions. This aligns with the country’s thriving cocktail culture and demand for approachable, easy-to-enjoy spirits. Major brands continue to expand their flavored portfolios, with launches such as Crown Royal’s flavored whiskies and Smirnoff’s seasonal vodka infusions appealing strongly to millennials and Gen Z, who seek novelty, versatility, and bolder taste experiences.

Another key trend shaping the U.S. spirits landscape is the strong momentum behind premiumization, driven by limited-edition releases and luxury expressions that highlight craftsmanship, aging techniques, and heritage. Distillers are increasingly targeting collectors and high-income consumers with rare blends, unique barrel finishes, and artful packaging that elevate perceived value. For example, brands like Jack Daniel’s and Woodford Reserve have expanded their high-end portfolios through special single-barrel editions and master distiller selections. At the same time, premium tequila and bourbon producers continue to launch ultra-premium expressions in response to rising demand. These offerings resonate deeply with U.S. consumers who seek authenticity, exclusivity, and elevated drinking experiences.

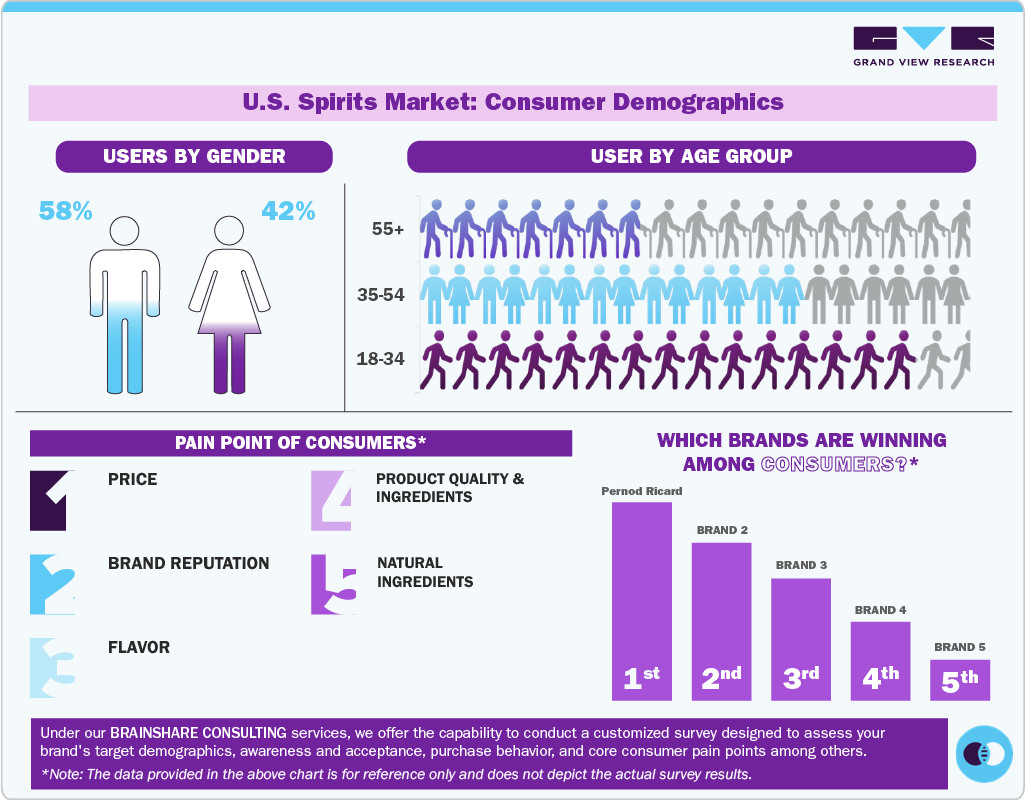

Consumer Insights

The U.S. spirits industry is significantly shaped by a multifaceted consumer landscape, primarily driven by a strong desire for premiumization and novel experiences. Consumers are increasingly discerning, willing to invest in craft quality, unique flavor profiles, and authentic brand narratives, driving sustained growth in categories such as super-premium tequila, Irish whiskey, and innovative botanical gins. Concurrently, a growing focus on health and wellness is evident, with a rising demand for low-ABV and non-alcoholic spirits, alongside products that emphasize natural ingredients and transparent sourcing, as consumers seek mindful consumption options that align with healthier lifestyles. This dual pursuit of indulgence and well-being challenges brands to innovate across product development and marketing.

Furthermore, digital influence, convenience, and ethical considerations are critical factors for today's U.S. spirits consumer. Online communities, social media, and e-commerce platforms play a pivotal role in discovery and purchasing decisions, underscoring the necessity for robust digital engagement from brands. The explosion of ready-to-drink (RTD) cocktails highlights a strong demand for convenience without compromising on quality or sophisticated flavors, catering to evolving at-home consumption habits and on-the-go lifestyles. Additionally, a significant and growing segment of consumers, particularly younger demographics, prioritizes brands demonstrating transparency, sustainability, and social responsibility, indicating that purpose-driven marketing and ethical practices are becoming non-negotiable for fostering lasting brand loyalty.

Product Insights

Whiskey was the largest product segment in the U.S. spirits market, accounting for a revenue share of 26.26% in 2024. This can be attributed to a pervasive trend of premiumization and a strong desire for diversity across categories. Consumers are increasingly trading up, seeking higher-aged statements, single barrel expressions, and craft offerings that promise unique flavor profiles and a sense of exclusivity. American whiskeys, particularly Bourbon and Rye, remain the primary engines of innovation, experiencing significant advancements with new mash bills, finishing techniques, and the proliferation of craft distilleries expanding regional availability. Beyond domestic offerings, Irish whiskey continues its rapid ascent, appealing to a broader demographic with its approachable smoothness. Meanwhile, Scotch whisky maintains a dedicated following, especially in the single malt segment, while Japanese whisky retains its coveted, high-end niche, albeit with supply constraints.

The tequila & mezcal segment is anticipated to witness a CAGR of 5.8% from 2025 to 2033, driven by rising consumer preference for premium agave-based spirits, growing cocktail culture, and strong demand for authentic, craft-focused products. In the U.S., younger consumers are increasingly gravitating toward tequila and mezcal for their smooth profiles, versatility in mixology, and perceived natural, heritage-rich production methods. The surge in celebrity-backed tequila brands, along with continuous innovation in flavors and barrel-aged expressions, is further accelerating category growth. Additionally, the shift toward sipping spirits and the popularity of premium and ultra-premium offerings contribute to sustained demand. Expanding distribution channels, including e-commerce and on-premise establishments, will continue to support the segment’s upward trajectory through 2033.

Price Point Insights

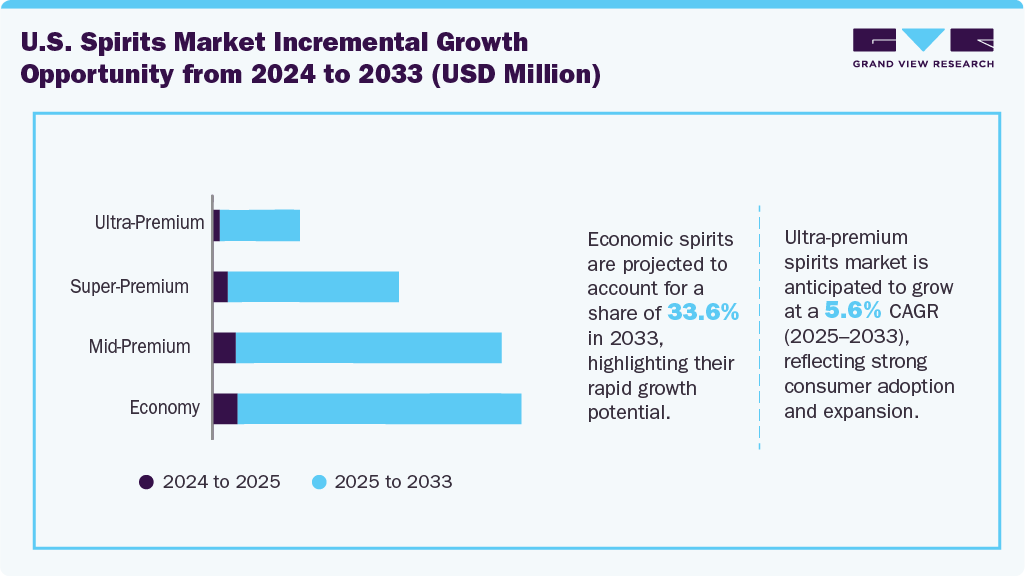

The economic spirits was the largest segment in the U.S. spirits industry, accounting for a revenue share of 35.06% in 2024, due to their strong appeal among cost-conscious consumers and widespread availability across retail channels. These products offer consistent quality at affordable price points, making them a preferred choice for everyday consumption, social gatherings, and value-driven buyers who prioritize accessibility over premium branding. The segment also benefits from high demand in rural and suburban areas, where economic options dominate purchasing patterns. Additionally, inflationary pressures and shifting household budgets have further encouraged consumers to opt for lower-priced spirits without compromising on taste or reliability. Strong marketing efforts by local and regional distillers, combined with broader distribution through supermarkets, convenience stores, and online platforms, continue to reinforce the dominance of economic spirits in the overall market.

The ultra-premium spirits segment is anticipated to witness a CAGR of 5.6% from 2025 to 2033as consumers increasingly associate these spirits with luxury, craftsmanship, and social status. Growing disposable incomes and lifestyle upgrades have fueled the trend of “drinking less but better,” with buyers seeking refined, high-quality experiences. Leading heritage brands, such as The Macallan and Gran Patrón, drive this growth through limited editions, aged blends, and artistic collaborations that emphasize exclusivity and authenticity. This shift is particularly pronounced in the affluent U.S. market, where premium spirits are often seen as symbols of sophistication and success.

Distribution Channel Insights

Sales in the U.S. spirits industry through off-trade channels accounted for a revenue share of around 59.83% in 2024 due to their wider accessibility, convenience, and cost advantages. Most consumers purchase spirits for home consumption, gifting, or social gatherings, making retail and online outlets the most practical buying options. Off-trade channels also enable customers to explore a variety of brands and price ranges at competitive rates compared to on-trade venues, such as bars or restaurants. Additionally, the rapid growth of e-commerce and duty-free retail has strengthened this segment, as consumers increasingly prefer to purchase premium spirits online for convenience, discounts, and exclusive editions.

The spirits sales through on-trade channels are expected to grow at a CAGR of 4.2% from 2025 to 2033, due to the continued revival of bars, restaurants, and nightlife venues, along with increasing consumer interest in premium cocktails and experiential drinking. The expanding craft mixology trend, driven by skilled bartenders and innovative cocktail programs, is encouraging consumers to explore higher-quality and specialty spirits. Rising tourism, growth in fine-dining establishments, and the popularity of themed bars and tasting events also contribute to stronger on-trade demand. Additionally, younger consumers who prioritize social experiences and curated beverage offerings are fueling spending in on-premise settings. Enhanced partnerships between spirit brands and hospitality operators, including exclusive menus and promotional events, will further support sustained growth in this channel.

Key U.S. Spirits Company Insights

Leading players in the U.S. spirits market include Asahi Group Holdings, Ltd., Diageo plc, Pernod Ricard S.A., and Campari Group. The market remains highly competitive, with leading manufacturers strategically expanding their distribution networks across online and offline platforms to improve product accessibility and visibility. Premiumization remains the foundational strategy; companies proactively shift marketing focus and distribution resources toward Super-Premium offerings and aged reserves, increasing the average price per bottle sold and improving profit margins. Furthermore, companies are increasingly investing in data analytics and direct-to-consumer (DTC) models to personalize the purchase experience and better forecast category-specific demand, ensuring that high-growth products, such as aged Bourbons and exotic Tequilas, are allocated efficiently.

Key U.S. Spirits Companies:

- Asahi Group Holdings, Ltd.

- Diageo plc

- Pernod Ricard S.A.

- Campari Group

- Constellation Brands, Inc.

- Tilaknagar Industries Ltd.

- Bacardi Limited

- Suntory Holdings Limited

- Louis Royer

- Cognac Hardy

Recent Developments

-

In March 2025, Brugal Rum launched the Andrés Brugal Edition 02, the second limited edition in its ultra-premium range, with only 416 bottles available globally. Retailing at USD 3,000 per bottle, it features a blend of four single casks aged in American oak, showcasing flavors of coconut, vanilla, and gentle spice.

-

In June 2024, Pernod Ricard strengthened its dedication to its American Whiskey portfolio by launching a new Global Brand Company in the U.S. named North American Distillers (NADL).

-

In January 2024, Asahi Europe & International (AEI), the international arm of Asahi Group Holdings, officially acquired Octopi Brewing, a well-known contract beverage production and co-packing facility located in Wisconsin, U.S.

U.S. Spirits Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 79.19 billion

Revenue forecast in 2033

USD 112.87 billion

Growth rate

CAGR of 4.5% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in million 9-liter cases, and CAGR in % from 2025 to 2033

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, price point, distribution channel, and product - price point - distribution channel

Key companies profiled

Asahi Group Holdings, Ltd.; Diageo plc; Pernod Ricard S.A.; Campari Group; Constellation Brands, Inc.; Tilaknagar Industries Ltd.; Bacardi Limited; Suntory Holdings Limited; Louis Royer; Cognac Hardy

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Spirits Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends and opportunities in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the U.S. spirits market report by product, price point, distribution channel, and product - price Point - Distribution channel:

-

Product Outlook (Volume, Million 9-Liter Cases; Revenue, USD Million, 2021 - 2033)

-

Vodka

-

Whiskey

-

Rum

-

Brandy and Cognac

-

Gin

-

Cordials & Liqueurs

-

Tequila & Mezcal

-

Baijiu

-

Others

-

-

Price Point Outlook (Volume, Million 9-Liter Cases; Revenue, USD Million, 2021 - 2033)

-

Economy

-

Mid-Premium

-

Super-Premium

-

Ultra-Premium

-

-

Distribution Channel Outlook (Volume, Million 9-Liter Cases; Revenue, USD Million, 2021 - 2033)

-

On-trade

-

Off-trade

-

-

Product - Price Point - Distribution Channel Outlook (Volume, Million 9-Liter Cases; Revenue, USD Million, 2021 - 2033)

-

Vodka

-

Unflavored/Regular

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

Flavored

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

-

Whiskey

-

Scotch Whiskey

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

Irish Whiskey

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

Global/American Whiskey

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

Japanese Whiskey

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

Canadian Whiskey

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

Other Whiskey

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

-

Rum

-

Dark & Golden Run

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

White Rum

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

Flavored & Spiced Rum

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

Others

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

-

Gin

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

Brandy & Cognac

-

Unflavored/Regular

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

Flavored

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

-

Tequila Mezcal

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

Baijiu

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

Other Spirits

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

Frequently Asked Questions About This Report

b. The U.S. spirits market was estimated at USD 76.16 billion in 2024 and is expected to reach USD 79.19 billion in 2025.

b. The U.S. spirits market is expected to grow at a compound annual growth rate of 4.5% from 2025 to 2033 to reach USD 112.87 billion by 2033.

b. Based on product type, Baijiu dominated the U.S. spirits market in 2024 with a share of about 37.14%.

b. Key players in the U.S. spirits market are Asahi Group Holdings, Ltd.; Diageo plc; Pernod Ricard S.A.; Campari Group; Constellation Brands, Inc.; Tilaknagar Industries Ltd.; Bacardi Limited; Suntory Holdings Limited; Louis Royer; Cognac Hardy among others.

b. Key factors driving the U.S. spirits market include premiumization, flavored innovation, ready-to-drink growth, rising cocktail culture, expanding on-trade channels, and increasing consumer preference for high-quality, craft spirits.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.