- Home

- »

- Advanced Interior Materials

- »

-

U.S. Steel Merchant And Rebar Market Size Report, 2030GVR Report cover

![U.S. Steel Merchant And Rebar Market Size, Share & Trends Report]()

U.S. Steel Merchant And Rebar Market Size, Share & Trends Analysis Report By Product (Merchant Bar, Rebar), By End-use (Construction, Infrastructure, Industrial), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-137-3

- Number of Report Pages: 72

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

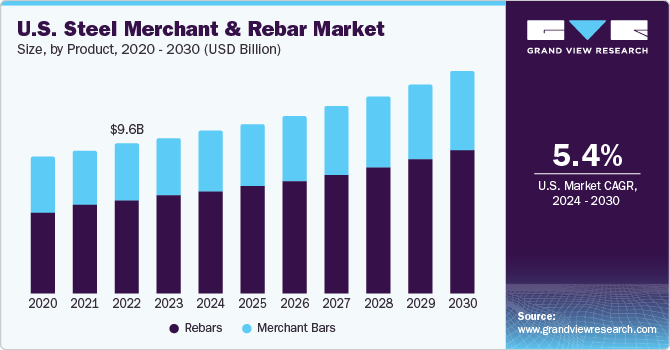

The U.S. steel merchant and rebar market size was estimated at USD 10.00 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.4% from 2024 to 2030. Increased focus on infrastructure development through public and private investments in the U.S. is likely to drive the market in the long run. As reported by USAFacts (Government Portal), nearly USD 36.6 billion was directly spent on infrastructure, while an additional USD 94.5 billion was transferred to states by the federal government. Of total spending, 39% was spent on federal transportation and infrastructure.

Rising awareness about sustainability and environmental concerns are propelling the usage of natural recyclable materials. Steel rebar is required to transform its image from a carbon-intensive sector to a beacon of sustainability. The prospectus of green steel and use of renewables as a power source is likely to present new avenues for this product in the U.S.

The rise in funding by the federal government is projected to provide a push to the market. Under the Infrastructure Investment and Jobs Act (IIJA), the U.S. government announced USD 220 billion in funding for over 32,000 specific projects. Moreover, as reported by the White House, around USD 491 billion in projects were announced by private companies under the manufacturing program.

The Russia-Ukraine war disrupted overall global trade. In 2021, approximately 45 million tons of steel was exported from Russia and Ukraine, accounting for about 10% of global trade. The decline in steel production in Ukraine and sanctions imposed against Russia have affected the global market due to dependency on pig iron, a raw material used in the manufacturing process. From January to March 2022, pig iron production in Russia and Ukraine decreased by 34.1%, reaching 3.49 million tons.

Market Concentration & Characteristics

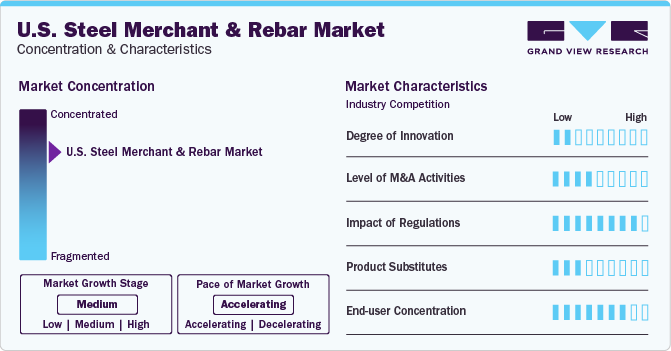

The market growth stage is medium and pace is accelerating. The market is characterized by less innovation, as these products have been used in the construction industry for many years.

The market is characterized by low to moderate merger and acquisition activity for key market participants. This is mainly due to different factors such as integration across value chain which prevents disruption during production process and higher market share.

Steel industry is highly impacted by regulations. Iron ore is a crucial material required in its manufacturing process. Mining iron ore results in air and water pollution due to different gases and heavy metals. Its production is a highly energy-intensive process that results in high levels of carbon dioxide emissions. Thus, due to such emissions, the industry is highly regulated by different government bodies.

There are few substitutes for rebar products. Fiberglass-reinforced polymer (FRP) bars can be used instead of steel rebar alternatively. However, penetration of FRP bars is very low compared to latter and thus does not pose a significant threat to the market.

End-user concentration is high in the steel merchant and rebar industry. Rebar is sold to construction contractors via different building material suppliers. Sometimes, big contracts are directly catered by manufacturers; this also benefits contractors as they get the product at a discounted price. End-users mainly use rebar in residential and non-residential construction and infrastructure.

Product Insights

Based on product type, the rebars segment dominated the market and accounted for a revenue share of 63.2% in 2023. Mild and deformed are two types of rebars used in construction applications to provide reinforcement and support to structures. Mild rebars are now increasingly replaced with deformed ones, as these products exhibit high strength and help increase the lifespan and strength of construction structures.

Deformed rebars have better malleability, ductility, toughness, high yield strength, corrosion, and earthquake resistance. These products are economical and have a wide range of applications, including industrial structures, commercial and residential buildings, and bridges.

Merchant bars include angles, channels, flats, rounds, and beams. They are used in structural applications in the construction sector and in automotive, shipbuilding, rail, appliances, heavy machinery, mining, agriculture, tools, and original equipment manufacturing.

End-use Insights

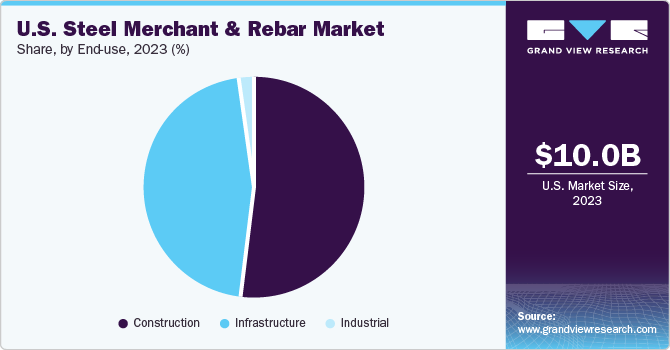

Based on end-use, the construction segment accounted for the largest market revenue share in 2023. Construction spending and economic growth in the U.S. have been observed to be sluggish in 2022 and 2023 due to an aggressive approach by the Federal Reserve to increase interest rates. This decision to raise interest rates was mainly impacted by rapidly growing inflation fueled by supply chain disruptions due to COVID-19 and the Russia-Ukraine war.

As per the Commerce Department, construction spending in the U.S. declined in December 2023, owing to a decline in single-family homebuilding investment amidst high mortgage rates. Construction spending fell by 0.4% in December 2023 compared to the previous month. However, overall construction spending in 2022 observed an increase of 10.2%. The construction sector is expected to follow a gradual recovery in 2024 as interest rates may decline in soon.

Infrastructure applications are expected to register the fastest CAGR during the forecast period. The development of infrastructure plays a crucial role in the economic growth of the U.S. The U.S. Department of Treasury studied of 40 key proposed infrastructure projects to substantiate economic importance of infrastructure. As per this study, completion, or availability of these 40 projects can provide economic benefits of up to USD 500 billion to 1 trillion to the country.

Key U.S. Steel Merchant And Rebar Company Insights

Some of the key players operating in the market include Nucor, Steel Dynamics Inc., and CMC.

-

Nucor is one of the leading players in North America’s steel industry. The company also produces direct reduced iron (DRI), and it recycled nearly 17.8 million tons of ferrous scrap in 2022. Nucor produces plates, bars, structural products, and sheets. It has 15 bar mill facilities providing rebars, rounds, hot-rolled bars, angles, channels, wire rods, and highway products, including alloy and carbon steel.

-

Steel Dynamics is a diversified steel producer and recycler in the U.S. The company has an annual steel production capacity of 13 million tons. It produces coated sheet metal, cold rolled & hot rolled sheets, structural steel products such as beams and channels, bars, merchant bars, and rail steel.

Hybar, Schnitzer Steel Industries, Inc., and JFE Steel Corporation are emerging players in the market. Steel rebar is a capital-intensive industry; thus, there is less threat from new entrants.

-

Schnitzer Steel Industries, Inc. has rebranded itself, and now the brand is known as Radius Recycling. The company deals in ferrous and non-ferrous scrap and sells rebars, wire rods, and round bars.

-

Hybar is a newly formed company expected to be constructed in 22 months, as of August 2023. Hybar is likely to produce high-yield rebar for large infrastructure projects. The company has successfully raised USD 700 million via debt and equity financing.

-

JFE Steel is a leading steel producer in the world with a production base in the U.S. The company is engaged in the production of sheets, plates, shapes, bars, and wire rods, with headquarters in Tokyo, Japan.

U.S. Steel Merchant And Rebar Companies:

The following are the leading companies in the U.S. steel merchant and rebar market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these U.S. steel merchant and rebar companies are analyzed to map the supply network.

- Acerinox S.A.

- CMC Steel

- EVRAZ U.S., Inc.

- Gerdau S.A.

- JFE Steel Corporation

- NIPPON STEEL CORPORATION

- Nucor

- OutoKumpu

- Schnitzer Steel Industries (dba Radius Recycling)

- Steel Dynamics, Inc.

Recent Developments

-

In October 2023, Nucor announced its plan to construct a new rebar micro-mill with a production capacity of 650 kilotons. The investment in this electric arc furnace mill is subject to approval by its board members. This will be Nucor’s fourth micro-mill if approval comes from the board.

-

In August 2023, Hybar secured USD 700 million of financing. It plans to build a rebar mill in Northeast Arkansas with an annual production capacity of 630 kilotons. The construction is expected to be finished in Q4 2025.

U.S. Steel Merchant and Rebar Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.42 billion

Revenue forecast in 2030

USD 14.29 billion

Growth rate

CAGR of 5.4% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Report updated

February 2024

Quantitative units

Volume in Kilotons, revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Volume and revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, end-use

Country scope

U.S.

Key companies profiled

Acerinox S.A.; CMC Steel; EVRAZ U.S., Inc.; Gerdau S.A.; JFE Steel Corporation; NIPPON STEEL CORPORATION; Nucor; Outokumpu; Schnitzer Steel Industries (dba Radius Recycling); Steel Dynamics, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Steel Merchant And Rebar Market Report Segmentation

This report forecasts volume and revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. steel merchant and rebar market report based on product and end-use:

-

Product Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Rebars

-

Merchant Bars

-

Angles

-

Channels

-

Rounds

-

Flats

-

Beams

-

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Construction

-

Infrastructure

-

Industrial

-

Frequently Asked Questions About This Report

b. The key factors that are driving the U.S. steel merchant and rebar market include increased focus of local and regional governments to improve the country’s infrastructure and moderate but study growth in the residential construction sector.

b. The U.S. steel merchant and rebar market size was estimated at USD 10.00 in 2023 and is expected to reach USD 10.42 billion in 2024.

b. The U.S. steel merchant and rebar market is expected to grow at a compound annual growth rate of 5.4% from 2024 to 2030 to reach USD 14.29 billion by 2030.

b. Construction dominated the U.S. steel merchant and rebar market with a volume share of 52% in 2023, owing to long term demand for rebars in single and multi-family dwellings.

b. Some of the key players operating in the U.S. steel merchant and rebar market include Nucor, Gerdau S.A., Nippon Steel Corporation, JFE Steel Corporation, and CMC Steel.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."