- Home

- »

- Medical Devices

- »

-

U.S. Structural Heart Imaging Market Size Report, 2030GVR Report cover

![U.S. Structural Heart Imaging Market Size, Share & Trends Report]()

U.S. Structural Heart Imaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Modality (Echocardiogram, Angiogram), By Procedure (TAVR, SAVR, TMVR), By Application, By End-use, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-498-7

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Structural Heart Imaging Market Trends

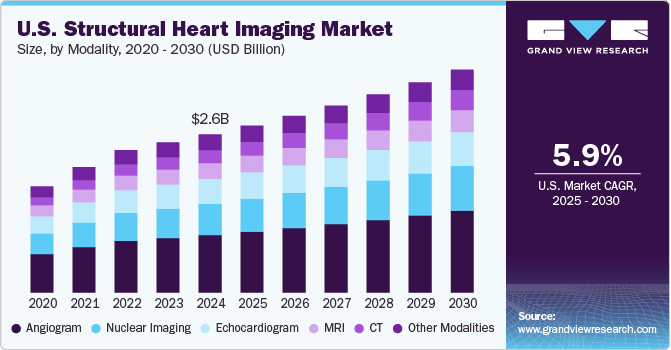

The U.S. structural heart imaging market size was estimated at USD 2.58 billion in 2024 and is expected to grow at a CAGR of 5.9% from 2025 to 2030. The rising prevalence of structural heart diseases, an aging population, and increasing adoption of minimally invasive procedures like TAVR and TMVR. Technological advancements such as 3D/4D echocardiography, AI-powered diagnostics, and fusion imaging have improved accuracy and efficiency in diagnosis and treatment planning. Expanding hospital infrastructure, increased awareness of early diagnosis, and collaborations between imaging companies and healthcare providers further fuel market growth.

The expansion of structural heart imaging in the U.S. is primarily driven by the growing prevalence of heart diseases and an increasing emphasis on preventive health checkups. Structural heart diseases, such as aortic stenosis, mitral regurgitation, and congenital heart defects, are becoming more common, particularly among the aging population, which is more vulnerable to these conditions. Early detection and accurate diagnosis are essential for managing these diseases effectively, fueling the demand for advanced imaging technologies. Simultaneously, patients are increasingly aware of the importance of preventive healthcare. People are increasingly opting for regular health screenings to detect potential cardiovascular issues before they become severe, which has led to a greater reliance on structural heart imaging solutions.

The presence of major manufacturers, such as Siemens Healthineers, GE Healthcare, and Koninklijke Philips N.V., is significantly driving market growth in the U.S. These industry leaders are consistently innovating and introducing advanced imaging products to meet the growing demand for accurate and efficient diagnostic solutions. For instance, in August 2024, Siemens Healthineers received FDA clearance for the ACUSON Origin, an advanced cardiovascular ultrasound system integrated with artificial intelligence (AI) capabilities. This advanced system is designed to enhance diagnostic accuracy and streamline workflows, demonstrating the industry's focus on leveraging AI to improve imaging outcomes. The continuous efforts of these key players to develop and commercialize new technologies not only cater to the rising prevalence of structural heart diseases but also strengthen the market's growth by offering healthcare providers state-of-the-art tools for patient care.

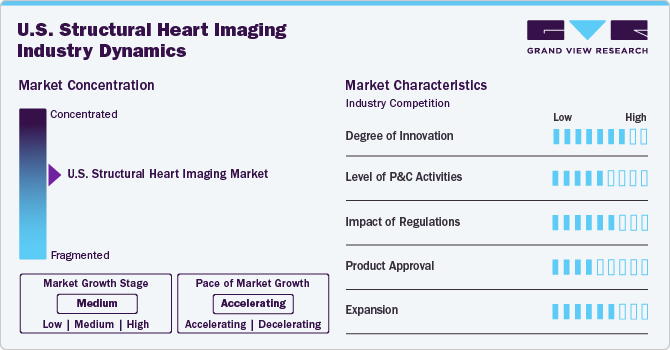

Market Concentration & Characteristics

The U.S. structural heart imaging industry is experiencing significant growth, owing to advancements in imaging technologies, the rising prevalence of structural heart diseases, and increasing patient awareness of early diagnosis and preventive healthcare. Innovations such as 3D/4D echocardiography, AI-powered diagnostic tools, and hybrid imaging systems have improved diagnostic accuracy and procedural guidance, making them essential in managing conditions like aortic stenosis and mitral regurgitation. The growing adoption of minimally invasive treatments, such as TAVR and TMVR, which rely heavily on imaging for planning and execution, further drives industry expansion.

Industry players are adopting various strategies to maintain their competitive edge, such as expanding product portfolios, forming partnerships, and fostering collaborations. For instance, in May 2024, University Hospitals (UH) and Siemens Healthineers announced a 10-year strategic partnership, building on their 40-year history of clinical and research collaboration. This new phase of their alliance is focused on advancing UH’s mission to improve oncology, cardiovascular, and neurovascular care for patients throughout Ohio.

The U.S. structural heart imaging industry is experiencing a high degree of innovation, driven by technological advancements and the increasing demand for accurate diagnostic and treatment solutions.

The U.S. structural heart imaging industry is seeing a significant rise in partnerships and collaborations, as companies work to broaden their service offerings and reach a wider customer base. In February 2024, GE Healthcare and MedQuest Associates (MedQuest) announced a three-year collaboration aimed at delivering excellence in patient care. This partnership combines GE Healthcare's innovative technologies with MedQuest's infrastructure and resources, enhancing the optimization of multi-site outpatient imaging networks for success. The collaboration underscores a commitment to providing access to advanced healthcare solutions while prioritizing patient care and satisfaction.

Regulations play a significant role in shaping the U.S. structural heart imaging industry, ensuring the safety, efficacy, and quality of imaging technologies used to diagnose and treat structural heart diseases. The U.S. Food and Drug Administration (FDA) closely monitors and evaluates new imaging systems before granting clearance or approval, which impacts the pace at which innovations reach the market.

Market players are increasingly seeking product approval to ensure their devices meet regulatory standards and gain access to the market. In October 2024, GE Healthcare introduced the Versana Premier, the newest member of its Versana ultrasound family. This system delivers reliable, affordable, and user-friendly ultrasound technology, offering versatile solutions to address a broad spectrum of clinical requirements.

Industry players are actively pursuing expansion strategies to broaden their reach and improve service offerings. An example is the strengthening partnership between GE HealthCare and Tampa General Hospital (TGH), a leading academic health system in the U.S. The two organizations have deepened their collaboration with an agreement to deploy GE HealthCare’s advanced imaging and ultrasound technology solutions across TGH Imaging’s outpatient facilities throughout Florida.

Modality Insights

The angiogram segment held the largest market share of about 36.4% in 2024. This dominance can be attributed to its widespread use in diagnosing and evaluating structural heart diseases, such as coronary artery disease and congenital heart defects. Angiograms provide detailed imaging of blood vessels, enabling precise visualization of blockages, abnormalities, or structural issues, which are critical for treatment planning. In addition, advancements in imaging technologies, such as digital subtraction angiography (DSA) and 3D angiography, have further enhanced the accuracy and efficiency of these procedures, driving their adoption.

The CT segment is expected to grow at the fastest CAGR of 8% over the forecast period; this can be attributed to its increasing adoption in diagnosing and evaluating structural heart diseases. Computed tomography (CT) provides high-resolution, 3D images of the heart and surrounding structures, offering unparalleled accuracy in detecting anomalies such as valve defects, congenital abnormalities, and coronary artery disease. The integration of advanced technologies, such as dual-energy CT and AI-powered image processing, has further enhanced its diagnostic capabilities and efficiency. Moreover, the growing demand for non-invasive diagnostic methods and the expanding use of CT in pre-procedural planning for interventions like TAVR and TMVR contribute to this segment growth.

Procedure Insights

Transcatheter Aortic Valve Replacement (TAVR) segment dominated the market by capturing a share of 23.4% in 2024. This dominance is owing to the growing preference for minimally invasive procedures to treat aortic stenosis, especially among high-risk and elderly patients who cannot undergo open-heart surgery. TAVR offers numerous benefits, including faster recovery times, lower procedural risks, and better patient outcomes, making it a suitable option for both patients and healthcare providers. Moreover, advancements in imaging technologies such as 3D echocardiography and CT have improved procedural planning and guidance, further boosting the adoption of TAVR. The rising prevalence of aortic stenosis and expanding FDA approvals have increased the segment's leading position in the structural heart imaging industry.

The Transcatheter Mitral Valve Repair (TMVR) segment is expected to grow significantly with a CAGR of 7.24% over the forecast period 2025 to 2030. This growth is driven by the increasing prevalence of mitral valve diseases, such as mitral regurgitation, particularly among the aging population. TMVR offers a minimally invasive alternative to open-heart surgery, making it an attractive option for high-risk patients or those ineligible for traditional surgical procedures. Advancements in imaging technologies, including 3D/4D echocardiography and fusion imaging, have enhanced procedural accuracy and outcomes, further encouraging the adoption of TMVR.

Application Insights

The interventional cardiology segment dominated the market by capturing a share of more than 59.8% in 2024 and is also expected to grow at the fastest CAGR over the forecast period. This dominance is attributed to the increasing prevalence of cardiovascular diseases, including structural heart conditions, which require advanced interventional procedures for treatment. Furthermore, the adoption of minimally invasive techniques, such as Transcatheter Aortic Valve Replacement (TAVR) and Transcatheter Mitral Valve Repair (TMVR), depends on interventional cardiology devices and imaging technologies. Advancements in imaging systems, including 3D/4D echocardiography and intravascular ultrasound (IVUS), have significantly improved these procedures' precision and success rates, contributing to their growing popularity.

The diagnostic imaging segment is also expected to grow over the forecast period. This is owing to the increasing demand for accurate and non-invasive diagnostic tools for detecting and evaluating structural heart diseases. Advancements in imaging technologies, such as 3D/4D echocardiography, cardiac MRI, and CT, are enhancing diagnostic precision and procedural planning, driving adoption. Furthermore, the rising prevalence of cardiovascular conditions and the growing focus on early diagnosis and preventive healthcare are further contributing to the segment's expansion.

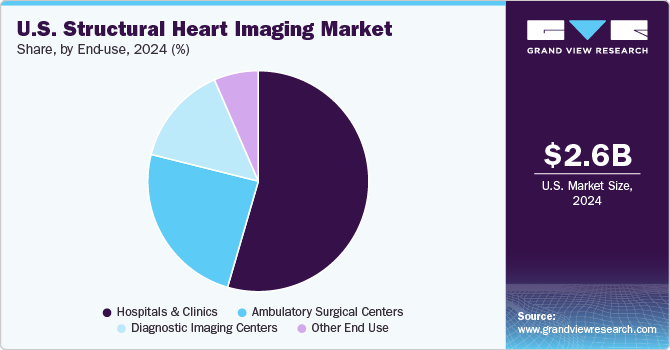

End-use Insights

Hospitals & clinics segment dominated the market with a share of nearly 54.5% in 2024, driven by the availability of advanced diagnostic and imaging technologies, skilled healthcare professionals, and comprehensive patient care services. These facilities are primary points of care for diagnosing and treating structural heart diseases, offering access to advanced equipment and minimally invasive procedures such as TAVR and TMVR. Moreover, the growing prevalence of cardiovascular diseases and increasing patient visits for early diagnosis and treatment further contribute to the segment's growth.

The ambulatory surgical centers segment is anticipated to experience the fastest growth of 6.80% over the forecast period. This growth is driven by the increasing demand for cost-effective, efficient, and minimally invasive procedures performed in outpatient settings. ASCs offer shorter wait times, reduced hospital stays, and lower procedural costs compared to traditional hospital settings, making them an attractive option for patients and providers. In addition, advancements in portable imaging technologies and the growing preference for same-day procedures are fueling this segment's expansion.

Key U.S. Structural Heart Imaging Company Insights

Major U.S. structural heart imaging players play an essential role in shaping market dynamics by actively striving to expand their market share and customer base. These leading companies are investing in research and development to innovate and launch new products that cater to the changing needs of healthcare providers and patients. Beyond innovation, they are also engaging in strategic initiatives such as partnerships, collaborations, mergers, and acquisitions. These efforts help enhance their product portfolios, strengthen their market presence, extend their reach, and tap into new customer segments, driving overall market growth.

Key U.S. Structural Heart Imaging Companies:

- Siemens Healthineers

- GE Healthcare

- Koninklijke Philips N.V.

- Canon Medical Systems

- Fujifilm Holdings Corporation

- Shanghai United Imaging Healthcare Co., LTD

- Abbott

- Terumo Corporation

- Samsung Medison Co., Ltd.

- Lepu Medical Technology

Recent Developments

-

In July 2024, GE Healthcare announced its agreement to acquire Intelligent Ultrasound Group PLC’s (Intelligent Ultrasound) clinical artificial intelligence (AI) software business for a total consideration of approximately USD 51 million.

-

In January 2024, Siemens Healthineers expanded its partnership with City Cancer Challenge (C/Can) on a global scale, aiming to provide support for C/Can city projects in low- and middle-income countries.

-

In October 2024, Shanghai United Imaging Healthcare Co., LTD announced a strategic partnership with INVIA, a leading provider of medical imaging software, at the European Association of Nuclear Medicine (EANM) 2024 Congress. This collaboration aims to improve nuclear cardiology solutions by fully integrating INVIA’s Corridor4DM into United Imaging’s AI-powered advanced visualization workspace, uOmnispace.

-

In January 2024, Siemens Healthineers announced FDA clearance for the MAGNETOM Cima.X, a 3 Tesla (3T) whole-body magnetic resonance imaging (MRI) scanner. Featuring the most powerful gradient system ever in a clinically approved whole-body MRI scanner, it enables visualization of smaller anatomical structures and captures images more quickly than its predecessors.

U.S. Structural Heart Imaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.73 billion

Revenue forecast in 2030

USD 3.64 billion

Growth rate

CAGR of 5.9% from 2025 to 2030

Actual period

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Modality, procedure, application, end-use

Key companies profiled

Siemens Healthineers; GE Healthcare; Koninklijke Philips N.V.; Canon Medical Systems; Fujifilm Holdings Corporation; Shanghai United Imaging Healthcare Co., LTD; Abbott; Terumo Corporation; Samsung Medison Co., Ltd.; Lepu Medical Technology

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Structural Heart Imaging Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 - 2030. For the purpose of this study, Grand View Research has segmented the U.S. structural heart imaging market report on the basis of modality, procedure, application, and end-use:

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Echocardiogram

-

Angiogram

-

CT

-

MRI

-

Nuclear Imaging

-

Other Modalities

-

-

Procedure Outlook (Revenue, USD Million, 2018 - 2030)

-

Transcatheter Aortic Valve Replacement (TAVR)

-

Surgical Aortic Valve Replacement (SAVR)

-

Transcatheter Mitral Valve Repair (TMVR)

-

Left Atrial Appendage Closure (LAAC)

-

Tricuspid Valve Replacement and Repair

-

Paravalvular Leak Detection and Repair

-

Annuloplasty

-

Valvuloplasty

-

Other Structural Heart Procedures

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostic Imaging

-

Interventional Cardiology

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Ambulatory Surgical Centers

-

Diagnostic Imaging Centers

-

Other End Use

-

Frequently Asked Questions About This Report

b. The U.S. structural heart imaging market size was valued estimated at USD 2.58 billion in 2024 and is expected to reach USD 2.73 billion in 2025.

b. The U.S.structural heart imaging market is expected to grow at a compound annual growth rate of 5.94% from 2025 to 2030 to reach USD 3.64 billion by 2030.

b. The Transcatheter Aortic Valve Replacement (TAVR) segment dominated the market in 2024, capturing a share of 23.4%. This dominance is owing to the growing preference for minimally invasive procedures to treat aortic stenosis, especially among high-risk and elderly patients who cannot undergo open-heart surgery

b. Some key players operating in the structural heart imaging market include Siemens Healthineers; GE Healthcare; Koninklijke Philips N.V.; Canon Medical Systems; Fujifilm Holdings Corporation; Shanghai United Imaging Healthcare Co., LTD; Abbott; Terumo Corporation; Samsung Medison Co., Ltd.; and Lepu Medical Technology

b. The U.S. structural heart imaging market is experiencing significant growth, driven by several key factors. The rising prevalence of structural heart diseases, an aging population, and increasing adoption of minimally invasive procedures like TAVR and TMVR. Technological advancements such as 3D/4D echocardiography, AI-powered diagnostics, and fusion imaging have improved accuracy and efficiency in diagnosis and treatment planning

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.