- Home

- »

- Clothing, Footwear & Accessories

- »

-

U.S. Stuffed Animals And Plush Toys Market, Industry Report, 2030GVR Report cover

![U.S. Stuffed Animals And Plush Toys Market Size, Share & Trends Report]()

U.S. Stuffed Animals And Plush Toys Market Size, Share & Trends Analysis Report By Product (Stuffed Animals, Cartoon Toys, Action Figures), By Distribution Channel (Online, Offline), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-240-0

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

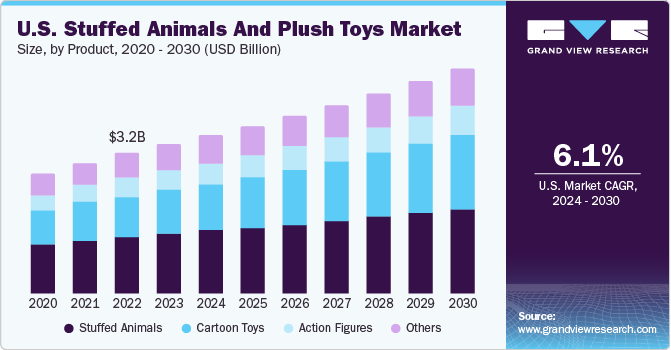

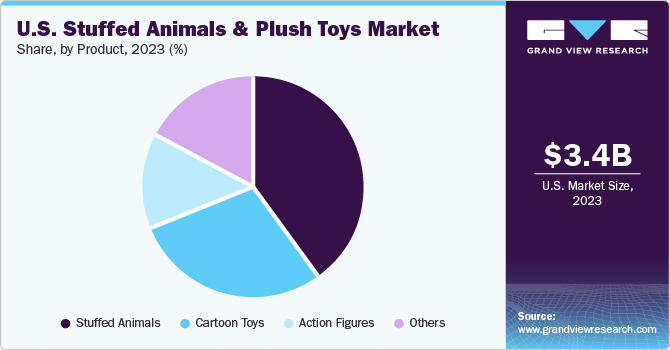

The U.S. stuffed animals and plush toys market size was estimated at USD 3.40 billion in 2023 and it is expected to grow at CAGR of 6.1% from 2024 to 2030. This projected growth can be attributed to numerous factors including growing disposable income of working population, increasing time at work resulting in rising need of toys and games for children, growth in number of people interested in collectibles and limited edition toys released by reputed brands, sustainability practices adopted by the manufacturers and innovation strategies executed with efficiency leading to upsurge in demand.

The U.S. market accounted for 28.9% of the global stuffed animal & plush toys market revenue in 2030. The market in the U.S. is expected to experience rising growth in demand owing to several aspects including easier availability through online distribution, use of cutting-edge technologies and sustainability practices by manufacturers, boom in direct to consumer (DTC) model, diverse offerings and wide range of products available in the market through offline channels, multiple international brands effectively promoting their products in regional market, and unparalleled dynamics of purchasing power of consumers in the United States.

In addition, the impactful marketing strategies of domestic as well as global manufacturers and merchants of the industry are resulting in upsurge in the demand. This entails strategies such as new product launches and invention. Moreover, the emergence of ideas such as toy hospitals is also supporting the growth patterns. These hospitals deliver restoration and maintenance services for toys, such as refurbishing classic toys and collectibles as well as restoring newer toys while endorsing sustainability and planet-friendly practices.

Increasing demand for limited-edition stuffed animal & plush toys, upsurge in availability of do-it-yourself (DIY) and personalised toy kits, inclusion of reprocessed fabrics in the making of stuffed animal & plush toys, and accumulative demand for smart toys are some of the other market driving factors for this industry. In addition, toys prepared with extraordinary quality fabric and with materials that are sourced in planet friendly ways are generating rewarding sales in this country as families choose such fabrics and materials over other less-quality oriented products available for lesser prices. This is often done by consumers in order to consider their children’s safety as priority over other aspects like price of the product.

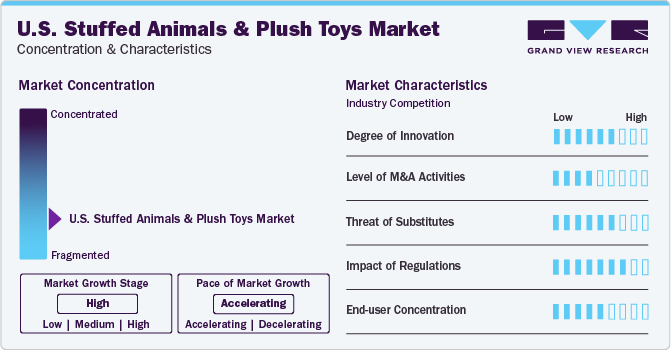

Market Concentration & Characterization

The U.S. stuffed animals and plush toys market is growing at accelerating pace and growth stage is identified as high. This industry is characterised with the presence of world’s renowned brands as well as domestic companies which operate at larger scale. In addition, the market has presence of local vendors, small and medium scale businesses who tend to gain attention from customers using various strategies such as eco-friendly practices, premium range manufacturing and effective promotional campaigning in localities and towns.

The degree of innovation is at moderate level in this market. Primarily, innovation is adopted by the companies as strategy to enhance their product offerings while strengthening their presence in particular segment or market area. Such innovations practices are implemented through various functionalities of the business including manufacturing, packaging, procurement, distribution and more.

Level of M&A activity is moderate in the industry. Mainly such activities take place with a plan of expansion, or enhancement of manufacturing as well as distribution capacities. The deals between companies result in shared workspace, shared effort and share technological know-how. This is done with the aim of improved businesses in terms of revenue, manufacturing, market share and brand value.

Impact of regulations is at moderate stage. Safety and regulatory compliance are key factors shaping the dynamics of the plush toys market in the U.S. One crucial regulatory standard in the toy industry is ASTM F963, developed by the American Society for Testing and Materials (ASTM). Adhering to ASTM F963 ensures that plush toys meet specific safety standards, providing consumers with assurance regarding the products' safety for use, particularly by children.

Product Insights

The U.S. stuffed animal toys market held a revenue share of 40.3% in 2023. Earlier, this market was only relevant for children. However, in recent past this has become contextual for those who are interested in limited-edition products and collectibles. Companies and brands in the industry are keen to launch limited edition products associated with series of events or specific occasions and incidences across the world. These products attract collection enthusiasts and those who value the possession of limited-edition products. In addition, Stuffed animal toys intentionally developed for educational purposes are engaging lot of educators as these toys provide extra-ordinary assistance in teaching children about numerous fundamentals of learning. Furthermore, the unceasing response to e-retail industry is also influencing the positive development of stuffed animals market.

Cartoon toys market in the U.S. is projected to grow at a CAGR of 7.7% from 2024 to 2030. This industry is mainly impacted by the content that has been broadcasted through various means such as television, online channels, magazines and comics. The growing popularity of newly introduced cartoon figures as well as existing popularity of decades old cartoons is influencing this market like never before. Prime target audience of this market was children for many years, however, now collectors and adults interested in limited edition toys are also part of value customer groups for this market.

Distribution Channel Insights

The offline sales of stuffed animal and plush toys in the U.S. accounted for revenue share of 80.88% in 2023. This is mainly due to deep networks of offline distribution channels. This includes supermarkets & hypermarkets, specialty stores, convenience stores, brand outlets, shopping malls, gift centres, children park vendors, and more. The offline shopping experience provides distinguished features such as immediate possession of the products, opportunity to physically examine the quality of fabric and materials used in the product, assistance by sales persons, and easier availability in the vicinities closer to residential areas.

The online sales of the stuffed animal and plush toys in the U.S. is expected to grow at CAGR of 8.3% from 2024 to 2030. This industry empowers the shoppers through unique services such as refund & return, online payment alternatives, customer assistance service through phone calls, unmatched discounts and offers, doorstep deliveries on convenient and conveyed time, and privacy in shopping and shipping experiences.

Key U.S. Stuffed Animals And Plush Toys Company Insights

The market is characterized by the existence of famous brands as well as international market participants. Market in the United States is valued by the brands as well as small and medium scale businesses across the world owing to its unmatched purchasing capacity and growth potential. In addition, some of the new entrants are also gaining noteworthy attention from the customer in this industry.

Key U.S. Stuffed Animals And Plush Toys Companies:

- Mattel Inc.

- Hasbro

- SpinMasterLtd

- BudsiesLLC

- MaryMeyerCorporation

- Ty Inc.

- Build-A-Bear Workshop, Inc.

- Aurora World

- GUND

- Manhattan Toy

Recent Developments

-

In April 2023, Mattel, Inc. partnered with Masters of the Universe, and the Paramount franchise called Teenage Mutant Ninja Turtles to introduce “The Masters of the Universe Origins Turtles of Grayskull” toy line.

-

In November 2023, Build-A-Bear Workshop Inc., launched Bearlieve Bear, an innovative interactive toy that uniquely responds to touch and voice cues.

U.S. Stuffed Animals And Plush Toys Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.60 billion

Revenue Forecast in 2030

USD 5.13 billion

Growth Rate

CAGR of 6.1% from 2024 to 2030

Actuals

2018 - 2023

Forecasts

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast; company ranking; competitive landscape; growth factors; and trends

Segments Covered

Product, distribution channel

Country Scope

U.S.

Key companies profiled

Mattel Inc.; Hasbro; Spin Master Ltd; BudsiesLLC

MaryMeyerCorporation; Ty Inc.; Build-A-Bear Workshop, Inc.; Aurora World; GUND; Manhattan Toy

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Stuffed Animals And Plush Toys Market Report Segmentation

This report forecasts growth at country levels and provides an analysis of the latest industry trends in each of the sub-segment from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. stuffed animals and plush toys market report on the basis of product, and distribution channel:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Stuffed Animals

-

Cartoon Toys

-

Action Figures

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online

-

Offline

-

Frequently Asked Questions About This Report

b. The U.S. stuffed animals and plush toys market was estimated at USD 3.40 billion in 2023 and is expected to reach USD 3.60 billion in 2024.

b. The U.S. stuffed animals and plush toys market is expected to grow at a compound annual growth rate of 6.1% from 2024 to 2030 to reach USD 5.13 billion by 2030.

b. Stuffed animals dominated the U.S. stuffed animals and plush toys market with a share of around 40.3% in 2023. Rising popularity of various cartoon shows is estimated to drive the demand for these toys, thereby contributing to the segment growth.

b. Some of the key players operating in the U.S. stuffed animals and plush toys market include Mattel Inc.; Hasbro; Spin Master Ltd; BudsiesLLC MaryMeyerCorporation; Ty Inc.; Build-A-Bear Workshop, Inc.; Aurora World; GUND; Manhattan Toy

b. The market growth can be attributed to a variety of factors such as the huge number of target audiences in countries such as India, and China, the increasing impact of content distributed through online platforms and social media, and more.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."