- Home

- »

- Homecare & Decor

- »

-

U.S. Surgical Pet Collar Market Size & Share Report, 2021-2028GVR Report cover

![U.S. Surgical Pet Collar Market Size, Share & Trends Report]()

U.S. Surgical Pet Collar Market (2021 - 2028) Size, Share & Trends Analysis Report By Product (Plastic Collar, Soft Fabric, Inflatable, Cervical, Avian Spherical), By End-use (Dogs, Cats), And Segment Forecasts

- Report ID: GVR-4-68038-264-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2016 - 2019

- Forecast Period: 2021 - 2028

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

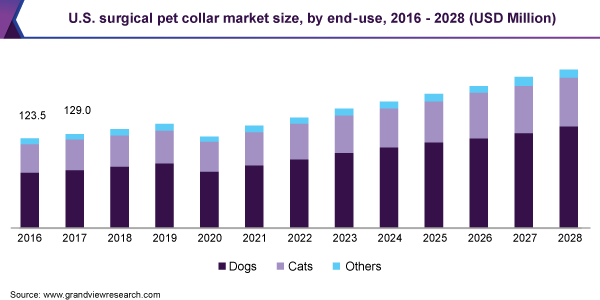

The U.S. surgical pet collar market size was valued at USD 126.0 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 7.2% from 2021 to 2028. The surgical pet collar, also known as Elizabethan collar, e-collar, Buster collar, protective collar, or pet cone, has been gaining popularity among most pet owners in the U.S. This medical device has a hollow frustum shape and is used to keep an animal from biting, licking, or scratching itself. The medical collar is generally designed to be attached to the pet’s general collar using a variety of fasteners provided with the product. The growing usage of surgical pet collars has widened their availability in pet stores and veterinarian dispensaries.

The market has been booming over the past few years. However, in the wake of COVID-19, it has witnessed unprecedented challenges. The pandemic has impacted the supply chain, thereby causing stress on the workforce and the availability of key inputs. With respect to retail sales in the country, manufacturers are more inclined towards online channels as social distancing has significantly changed consumer buying habits. As a result, most veterinary clinics supplying these surgical pet collars have begun accepting online orders for clients and their furry animals in order to help them safely fight the spread of COVID-19.

Over the last few years, the pet market worldwide has been growing at a significant rate, as many countries have experienced an overall rise in the number of pet adoptions and an increase in animal health spending. People are spending more on the welfare of their pets as they view them as family members. Thus, they are willing to invest money to keep their pets healthy, which has led to an increase in the health expenditure of pets.

Additionally, the growing prevalence of diseases, including the diseases that cause wounding or need surgery, among pet animals is majorly driving the U.S. surgical pet collar market. Moreover, the rising demand for pet insurance to help limit out-of-pocket expenditure for critical medical conditions, such as cancer and accidental injuries, among pets is anticipated to boost the adoption of clinical procedures on pets. Consumer spending on pet medical care has been consistently rising year on year. This is expected to drive demand for surgical pet collars in the U.S. over the forecast period.

The pet adoption rate in the U.S. is on the rise, according to Spots.com, a provider of information about pets and pet products in the U.S., in 2020, there were 3.2 million pets in shelters. Pets ease loneliness, increase sociability, and diminish stress. Thus, the rising rate of pet adoption in the U.S. for various reasons including companionship is expected to lead to the increasing adoption of surgical pet collars in the U.S.

Despite a positive outlook, several research studies have been confirming that surgical pet collars can damage the mental and physical health of more than three-quarters of pets. A research study published by the Sydney School of Veterinary Science in February 2020 concluded that the surgical pet collar negatively impacts animal welfare and the overall quality of life in a range of important domains for 77% of dogs and cats. These domains included nutrition (eating and drinking), environment (movement and navigation), health (skin irritation and new wounds), behavior, and mental status (stress and depression). This is likely to restraint the growth of the market to some extent in the coming year.

End-use Insights

The dogs segment dominated the market and accounted for the largest revenue share of over 61.0% in 2020. This segment is projected to witness a maximum CAGR of 7.5% over the forecast period. Dogs are the most popular pets in the U.S. The 2019-2020 National Pet Owners Survey conducted by the American Pet Products Association estimates that 63.4 million households in the U.S. own a dog and the total number of dogs owned by the U.S. is 89.7 million. The rising number of dog ownership is anticipated to drive the market in the U.S. over the forecast period.

The cats segment is expected to witness a CAGR of 7.0% from 2021 to 2028. According to the American Pet Products Association’s 2019-2020 National Pet Owners Survey, 42.7 million cats are owned by U.S. households. Moreover, the lower carbon footprint of cats over dogs is a favorable factor that encourages people toward cat adoption. Based on a 2009 study, the resources needed to feed a dog over the course of its life create the same eco-footprint as that of a Land Cruiser. This scenario has shed light on the environment-friendly aspects of adopting a cat over a dog. These aforementioned factors are anticipated to drive the overall market for surgical pet collars in the U.S.

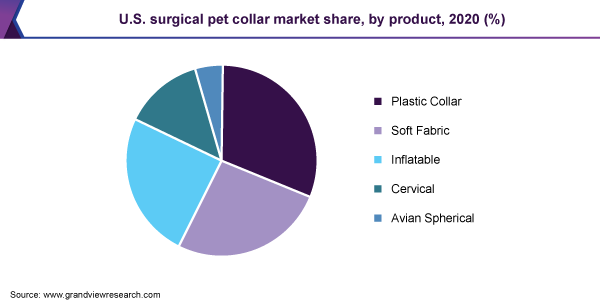

Product Insights

The plastic collar segment dominated the market and accounted for the largest revenue share of over 31.0% in 2020. This product segment is projected to witness a CAGR of 6.5% over the forecast period. This type of surgical collar for pet animals is made using low-density polyethylene and is very firm, thereby successfully restricting the pet from reaching, licking, or scratching the infected area. The surgical collar has cotton padding and is secured around the neck with Velcro on the neckline or can be directly attached to the regular collar. Some of these also have a padded outer rim to prevent chaffing. These factors are expected to drive segment growth in the coming years.

The inflatable pet collar segment is projected to witness a maximum CAGR of 8.0% from 2021 to 2028. Inflatable surgical collars have gained immense popularity as they do not hinder the peripheral vision of the pet while also being extremely comfortable. Most conical surgical collars tend to make eating and drinking difficult and are not user-friendly. However, the inflatable surgical collars are designed in a way that is similar to neck pillows for humans. As these surgical collars can be deflated, stored, washed, the product can be used multiple times. The protective inflatable surgical collar for dogs has gained immense popularity among dog owners in the U.S.

Key Companies & Market Share Insights

The market is fragmented in nature due to the presence of a large number of regional players and a few international players. Some of the key players in the market are KONG Company, Remedy+Recovery, KVP International Inc., and Lomir Biomedical Inc. These players hold a significant market share, have diverse product portfolios, and a strong market presence in the U.S. The market for surgical pet collars also comprises small-scale players, who offer a selected range of surgical pet collars, targeting a specific group of people as per their requirements and needs.

Companies in this market are increasingly focusing on strategic initiatives, such as product developments and constant research and development to meet the ever-changing needs of pet owners. For instance, in 2020, Acorn Pet Products LLC launched its dual patent calming recovery collar lines that feature calming attributes with recovery attributes. The products are infused with essential oils like Lavender, Nepeta Cataria, and Valerian. These products keep the pets calm and help them recover quickly post-surgery. Some of the prominent players in the U.S. surgical pet collar market include:

-

KONG Company

-

Acorn Pet Products LLC

-

Remedy+Recovery

-

ZenPet

-

All Four Paws

-

Campbell Pet Company

-

Trimline Inc.

-

KVP International, Inc.

-

Génia USA Inc.

-

Lomir Biomedical Inc.

U.S. Surgical Pet Collar Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 139.3 million

Revenue forecast in 2028

USD 219.0 million

Growth rate

CAGR of 7.2% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Product, end-use

Country scope

U.S.

Key companies profiled

KONG Company; Acorn Pet Products LLC; Remedy+Recovery; ZenPet; All Four Paws; Campbell Pet Company; Trimline Inc.; KVP International, Inc.; Génia USA Inc.; Lomir Biomedical Inc.

Customization scope

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of the customization

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the U.S. surgical pet collar market report on the basis of product and end use.

-

Product Outlook (Revenue, USD Million, 2016 - 2028)

-

Plastic Collar

-

Soft Fabric

-

Inflatable

-

Cervical

-

Avian Spherical

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2028)

-

Dogs

-

Cats

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. surgical pet collar market size was estimated at USD 126.0 million in 2020 and is expected to reach USD 139.3 million in 2021.

b. The U.S. surgical pet collar market is expected to grow at a compound annual growth rate of 7.2% from 2021 to 2028 to reach USD 219.0 million by 2028.

b. The plastic collar segment dominated the U.S. surgical pet collar market and accounted for the largest revenue share of over 31.0% in 2020.

b. Some key players operating in the U.S. surgical pet collar market include KONG Company; Acorn Pet Products LLC; Remedy+Recovery; ZenPet; All Four Paws; Campbell Pet Company; Trimline Inc.; KVP International, Inc.; Génia USA Inc.; and Lomir Biomedical Inc.

b. Key factors that are driving the market growth include the growing prevalence of diseases, including the diseases that cause wounding or need surgery, among pet animals is majorly driving the U.S. surgical pet collar market.

b. The dogs segment dominated the U.S. surgical pet collar market and accounted for the largest revenue share of over 61.0% in 2020.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.