- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Synthetic Resin Market Size, Industry Report, 2033GVR Report cover

![U.S. Synthetic Resin Market Size, Share & Trends Report]()

U.S. Synthetic Resin Market (2025 - 2033) Size, Share & Trends Analysis Report By Form (Solid, Liquid, Emulsion, Dispersion), By Product Type (Thermosetting Resin, Thermoplastic Resin), By Application, By End Use, By Region And Segment Forecasts

- Report ID: GVR-4-68040-618-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Synthetic Resin Market Summary

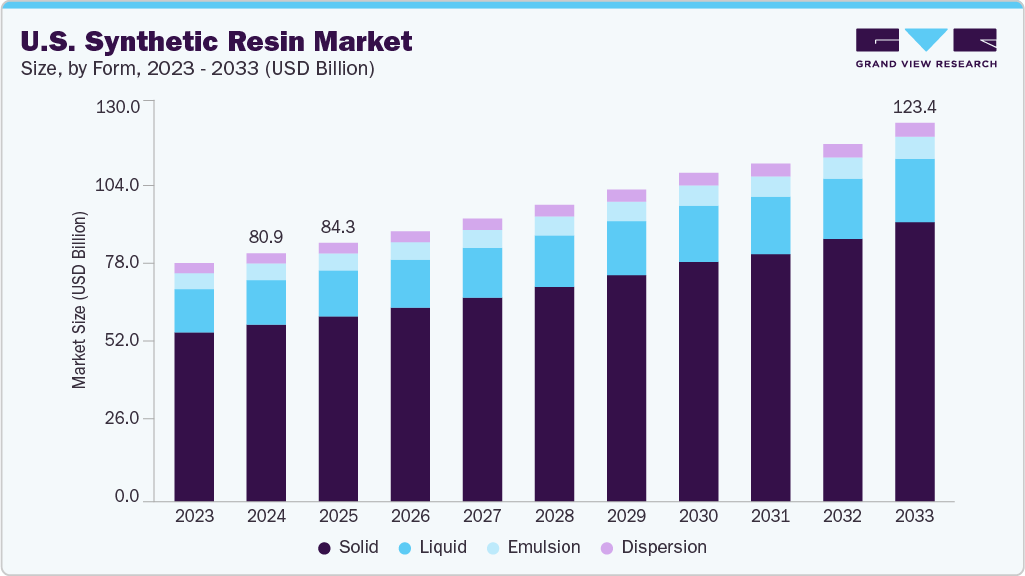

The U.S. synthetic resin market size was estimated at USD 80.88 billion in 2024 and is projected to reach USD 123.39 billion by 2033, growing at a CAGR of 4.88% from 2025 to 2033. Rising demand from the electronics industry for resins with superior thermal stability and electrical insulation is boosting market growth.

Key Market Trends & Insights

- By form, the solid segment is expected to grow at a considerable CAGR of 5.28% from 2025 to 2033 in terms of revenue.

- By product type, the thermosetting resin segment is expected to grow at a considerable revenue CAGR of 5.41% from 2025 to 2033.

- By application, the packaging segment is expected to grow at a considerable CAGR of 5.82% from 2025 to 2033 in terms of revenue.

- By end use, the transportation segment is expected to grow at a considerable CAGR of 6.26% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 80.88 Billion

- 2033 Projected Market Size: USD 123.39 Billion

- CAGR (2025 - 2033): 4.88%

These high-performance materials are essential for manufacturing smaller, more reliable devices, driving resin consumption. In the U.S. Synthetic Resin Market, a prevailing trend is the accelerated shift towards bio-based and sustainable resin formulations. Fueled by heightened environmental consciousness among consumers and corporations, manufacturers are expanding R&D efforts to develop resins derived from renewable sources such as plant oils and agricultural waste. These bio-based alternatives not only align with corporate sustainability goals but also respond to evolving regulations aimed at reducing the carbon footprint of petrochemical products.

Technological advancements in polymer chemistry are enabling performance parity with traditional petrochemical resins, thereby facilitating market adoption across key end-use industries such as packaging and automotive. As a result, market players are increasingly positioning sustainability as a core competitive differentiator, reshaping product portfolios and supply chain strategies to prioritize eco-friendly solutions.

Drivers, Opportunities & Restraints

A primary driver underpinning the U.S. Synthetic Resin Market is the robust demand from the packaging and automotive sectors for lightweight, high-performance materials. In packaging, synthetic resins such as polyethylene and polypropylene cater to the need for cost-effective, durable, and hygienic solutions, particularly in food and beverage applications where safety and shelf-life extension are critical.

An emerging opportunity within the U.S. Synthetic Resin Market lies in advancing circular economy initiatives through enhanced resin recycling and the integration of post-consumer recycled (PCR) content. Growing investment in recycling infrastructure, supported by both public funding and private sustainability commitments, is enabling higher-quality recycled resins that can be reintroduced into products without significant performance compromise. This development not only addresses regulatory pressures related to plastic waste but also opens new revenue streams for resin manufacturers through the supply of PCR-based materials to packaging, construction, and consumer goods industries.

One significant restraint confronting the U.S. Synthetic Resin Market is the inherent volatility of petrochemical feedstock prices, which directly impacts production economics and supply chain stability. Synthetic resins predominantly rely on crude oil and natural gas derivatives, exposing manufacturers to unpredictable cost fluctuations driven by geopolitical tensions, supply disruptions, and global energy market dynamics. These price instabilities can erode profit margins, particularly for smaller producers lacking the scale to absorb cost shocks.

Market Concentration & Characteristics

The market growth stage of the U.S. Synthetic Resin Market is medium, and the pace is accelerating. The market exhibits market fragmentation, with key players dominating the industry landscape. Major companies like Dow Inc., DuPont de Nemours, Inc., Westlake Chemical Corporation, Hexion Inc., Huntsman Corporation, Ashland Global Holdings Inc., Ingevity, AOC, LLC, Reichhold LLC, and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and end uses to meet evolving industry demands.

Amid growing environmental scrutiny, bio-based polymers such as polylactic acid (PLA) and plant-derived epoxy resins are increasingly replacing traditional petroleum-derived resins in select applications. These renewable alternatives, sourced from agricultural byproducts like starches and lignin, offer comparable mechanical properties while minimizing lifecycle carbon emissions. For instance, bio-based epoxy formulations derived from glycerin byproducts of biodiesel production have gained traction in coatings and adhesives due to their performance parity and regulatory appeal.

Stringent EPA mandates, such as the April 2025 NESHAP revisions for Synthetic Organic Chemical Manufacturing, have forced resin manufacturers to invest heavily in volatile organic compound (VOC) control technologies and continuous emissions monitoring systems (CEMS) to meet tighter hazardous air pollutant limits.

Form Insights & Trends

Solid form dominated the U.S. synthetic resin market with a revenue share of 71.28% in 2024, due to the rising adoption of powder coating and pelletized resin formats, which offer streamlined handling and uniform dosing across manufacturing lines. These solid resins facilitate reduced solvent usage and lower VOC emissions, aligning with stringent U.S. environmental regulations and corporate sustainability targets.

The liquid form segment is anticipated to grow at a significant CAGR of 4.03% through the forecast period. This is driven by escalating requirements for advanced UV-curable and waterborne resin technologies in coatings and adhesives. Liquid epoxies and acrylic-based liquid resins offer superior wetting characteristics and rapid cure profiles—attributes essential for high-throughput industrial painting lines and electronics encapsulation.

Product Type Insights & Trends

Thermosetting resins dominated the U.S. synthetic resin market with a revenue share of 77.00% in 2024. This is attributable to the surging need for durable, heat-resistant materials in aerospace and high-performance automotive composites.

Unsaturated polyester and phenolic resins, for instance, deliver exceptional mechanical integrity and thermal stability—qualities indispensable for structural components exposed to elevated temperatures and mechanical stresses. As Original Equipment Manufacturers (OEMs) in the aviation industry pursue weight reduction without sacrificing safety, thermosetting formulations optimized for resin transfer molding (RTM) and prepreg processes have become strategic enablers of lightweight composite parts.

The thermoplastic resins segment is anticipated to grow at a CAGR of 2.90% over the forecast period. Polypropylene and polyamide grades exhibit high tensile strength coupled with favorable melt flow indices, making them ideal for injection-molded structural parts and bumper fascias. Electric vehicle (EV) OEMs, in particular, are evaluating high-performance thermoplastics to optimize battery housings and interior trim, balancing structural requirements with weight constraints.

Application Insights & Trends

Packaging led the U.S. synthetic resin market with a revenue share of 42.60% in 2024. Synthetic resins are increasingly driven by the explosion of e-commerce and shifting consumer preferences toward sustainable, lightweight materials.

Polyethylene terephthalate (PET) and high-barrier multilayer films are in high demand to extend shelf life and maintain product integrity during long-distance shipping. Major CPG players are mandating PCR (post-consumer recycled) content in rigid and flexible packaging, prompting resin producers to enhance their recycling streams and develop upcycled resin grades.

The printing inks segment is expected to expand at a substantial CAGR of 5.63% through the forecast period, driven by the rapid transition to UV-curable and water-based ink technologies, as digital printing platforms replace legacy flexographic and gravure systems. UV-curable resins deliver near-instant cure speeds and reduced energy consumption, critical for fast-turnaround label and flexible packaging operations.

End Use Insights & Trends

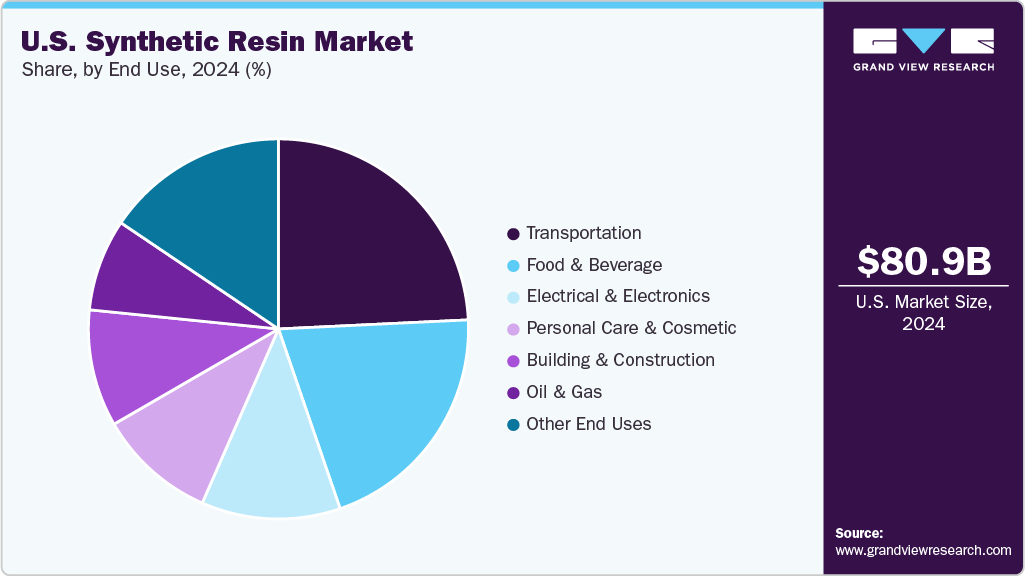

Transportation dominated the U.S. synthetic resin market with a revenue share of 24.24% in 2024. The adoption of synthetic resins is underpinned by OEMs’ pursuit of lighter, more fuel-efficient vehicles and stringent crash-safety standards.

Glass fiber-reinforced thermosetting composites and high-modulus thermoplastics provide significant weight savings compared to steel, without compromising structural performance. Resins with reinforced fiber matrices are now routinely used in interior panels, under-the-hood components, and exterior body parts to meet CAFE (Corporate Average Fuel Economy) targets set by the NHTSA.

The food & beverage segment is projected to witness a substantial CAGR of 5.13% over the forecast period. The segment’s drive toward resilient, food-grade resin applications stems from consumer demand for safer, more sustainable packaging that extends shelf life and ensures product integrity. High-barrier polyethylene and polypropylene films, often co-extruded with EVA or functionalized ethylene vinyl alcohol (EVOH), provide critical oxygen and moisture barriers for perishable goods.

Key U.S. Synthetic Resin Company Insights

The U.S. synthetic resin market is highly competitive, with several key players dominating the landscape. Major companies include Dow Inc., DuPont de Nemours, Inc., Westlake Chemical Corporation, Hexion Inc., Huntsman Corporation, Ashland Global Holdings Inc., Ingevity, AOC, LLC, and Reichhold LLC. The U.S. Synthetic Resin Market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key U.S. Synthetic Resins Companies:

- Dow Inc.

- DuPont de Nemours, Inc.

- Westlake Chemical Corporation

- Hexion Inc.

- Huntsman Corporation

- Ashland Global Holdings Inc.

- Ingevity

- AOC, LLC

- Reichhold LLC

Recent Developments

-

In February 2025, Abu Dhabi National Oil Company (ADNOC) and Austrian energy firm OMV announced plans to merge their plastics businesses and acquire Canadian plastic producer Nova Chemicals in a deal valued at over USD 30 billion. The merger aimed to consolidate their polyolefin operations by integrating Borealis, Borouge, and Nova Chemicals, enhancing resource allocation, technology access, and market competitiveness.

-

In March 2025, Westlake Corporation announced that its Westlake Epoxy division launched the EpoVIVE portfolio, a new line of epoxy phenolic resins and curing agents designed with sustainability in mind. The portfolio targets diverse industries such as adhesives, aerospace, automotive, construction, composites, electronics, marine, and protective coatings.

U.S. Synthetic Resin Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 84.29 billion

Revenue forecast in 2033

USD 123.39 billion

Growth rate

CAGR of 4.88% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion, volume in million tons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Form, product type, application, end use, region

Key companies profiled

Dow Inc.; DuPont de Nemours, Inc.; Westlake Chemical Corporation; Hexion Inc.; Huntsman Corporation; Ashland Global Holdings Inc.; Ingevity; AOC, LLC; Reichhold LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Synthetic Resin Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. synthetic resin market report based on form, product type, application, and end use:

-

Form Outlook (Volume, Million Tons; Revenue, USD Billion, 2021 - 2033)

-

Solid

-

Liquid

-

Emulsion

-

Dispersion

-

-

Product Type Outlook (Volume, Million Tons; Revenue, USD Billion, 2021 - 2033)

-

Thermosetting Resin

-

Epoxy Resins

-

Phenolic Resins

-

Polyurethane Resins

-

Polyester Resins

-

Other Thermosetting Resin

-

-

Thermoplastic Resin

-

Polyethylene

-

Polypropylene

-

Polyvinyl Chloride

-

Polycarbonate

-

Polyethylene Terephthalate

-

Nylon

-

Other Thermoplastic Resin

-

-

-

Application Outlook (Volume, Million Tons; Revenue, USD Billion, 2021 - 2033)

-

Packaging

-

Printing Inks

-

Pipes & Hoses

-

Sheets & Films

-

Paints & Coatings

-

Adhesives & Sealants

-

Electronic Fabrications

-

Transportation Components

-

Other Applications

-

-

End Use Outlook (Volume, Million Tons; Revenue, USD Billion, 2021 - 2033)

-

Transportation

-

Food & Beverage

-

Personal Care & Cosmetic

-

Building & Construction

-

Oil & Gas

-

Electrical & Electronics

-

Other End Uses

-

Frequently Asked Questions About This Report

b. The global U.S. synthetic resin market size was estimated at USD 80.88 billion in 2024 and is expected to reach USD 84.29 billion in 2025.

b. The global U.S. synthetic resin market is expected to grow at a compound annual growth rate of 4.88% from 2025 to 2033 to reach USD 123.39 billion by 2033.

b. Transportation dominated the U.S. synthetic resins market across the end use segmentation in terms of revenue, accounting for a market share of 24.24% in 2024. The adoption of synthetic resins is underpinned by OEMs’ pursuit of lighter, more fuel-efficient vehicles and stringent crash-safety standards.

b. Some key players operating in the U.S. Synthetic Resin market include Dow Inc., DuPont de Nemours, Inc., Westlake Chemical Corporation, Hexion Inc., Huntsman Corporation, Ashland Global Holdings Inc., Ingevity, AOC, LLC, and Reichhold LLC.

b. Rising demand from the electronics industry for resins with superior thermal stability and electrical insulation is boosting market growth. These high-performance materials are essential for manufacturing smaller, more reliable devices, driving resin consumption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.