- Home

- »

- Advanced Interior Materials

- »

-

U.S. Test & Measurement Equipment Market Report, 2030GVR Report cover

![U.S. Test & Measurement Equipment Market Size, Share & Trends Report]()

U.S. Test & Measurement Equipment Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (General Purpose Test Equipment, Mechanical Test Equipment), By Service, By End Use And Segment Forecasts

- Report ID: GVR-4-68040-613-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

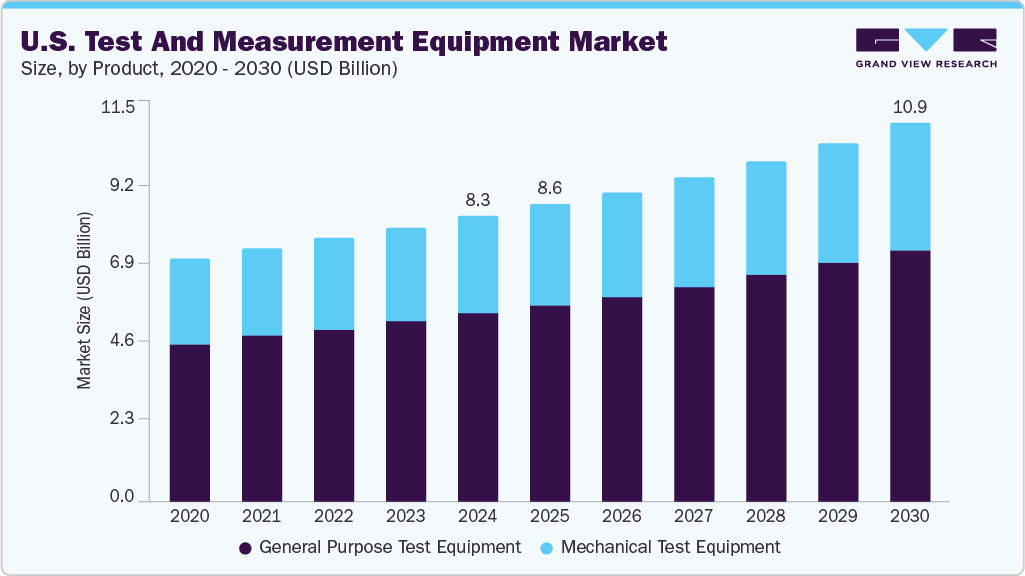

The U.S. test and measurement equipment market size was valued at USD 8.27 billion in 2024 and is projected to grow at a CAGR of 5.0% from 2025 to 2030. This growth can be attributed to the critical role of equipment in various industries. The market growth is driven by the increasing complexity of electronic devices and systems across the automotive, telecommunications, and aerospace industries. The rise of emerging technologies like IoT, 5G, and AI demands precise testing for performance and compliance. Additionally, increasing focus on quality assurance and predictive maintenance drives demand for advanced test and measurement solutions.

The U.S. test and measurement equipment industry is experiencing significant growth, driven by several key trends and opportunities, including the rapid deployment of 5G infrastructure across the U.S., driving the demand for test and measurement equipment. As 5G networks introduce complexities, there is a pressing need for advanced testing tools to ensure optimal network performance. Instruments such as oscilloscopes, signal generators, and network analyzers are essential for validating the functionality of 5G systems. For instance, digital oscilloscopes are employed to measure 5G signals, utilizing Analog-to-Digital Converters (ADC) to scale waveforms, which is crucial for understanding component and signal issues.

Government initiatives and policy frameworks in the equipment industry have also emerged as significant market drivers. Recent federal efforts aim to revitalize domestic semiconductor manufacturing, which directly impacts the demand for high-precision testing instruments. By providing substantial financial incentives and research grants, the U.S. government is encouraging the expansion of advanced manufacturing facilities that require rigorous quality control and compliance testing.

Product Insights

On the basis of product, the market is segmented into general-purpose test equipment and mechanical test equipment. The general-purpose test equipment segment dominated the market in 2024. This growth highlights a crucial shift in the electronics and manufacturing sectors toward greater precision, reliability, and compliance. General-purpose test equipment enhances product development and quality assurance by enabling accurate measurement and diagnostics across critical parameters. It significantly enhances operational workflows by ensuring that devices meet industry standards and function optimally in real-world conditions.

Oscilloscopes in the general-purpose test equipment segment held the largest revenue share of 27.6% in 2024 in the U.S. test and measurement equipment industry. This is primarily driven by its critical role in analyzing and visualizing electronic signals across various sectors. The growing complexity of electronic systems, especially with the rise of high-speed technologies like 5G, requires oscilloscopes that can measure accurately and handle high frequencies. The signal generators subsegment is expected to grow at the fastest CAGR of 7.2% over the forecast years. This growth is attributed to the extensive utilization of signal generators in designing, testing, and troubleshooting modern high-speed communication systems and their critical role in ensuring the performance and reliability of electronic components in various applications.

Machine vision inspection led the mechanical test equipment segment in the U.S. test and measurement equipment industry in 2024. Machine vision systems are widely used for quality control, defect detection, and component verification across automotive, electronics, pharmaceuticals, and food processing industries. Integrating AI and deep learning technologies into machine vision inspection equipment has expanded its capabilities, making it a necessary tool for high-precision production environments.

Machine condition monitoring is projected to be the fastest-growing sub-segment from 2025 to 2030. The rising emphasis on predictive maintenance and asset reliability in manufacturing, energy, aerospace, and transportation drives this growth. By continuously tracking parameters like vibration, temperature, and acoustic emissions, condition monitoring systems help identify potential equipment failures before they occur, reducing unplanned downtime and maintenance costs.

Service Insights

Calibration services held the largest share of the U.S. test and measurement equipment market in 2024. As industries such as aerospace, defense, automotive, and healthcare continue to adopt advanced testing equipment, the need for precise and reliable calibration has become increasingly critical. Regular calibration helps maintain equipment performance, meet industry standards, and avoid costly measurement errors. The growing regulatory emphasis on quality assurance and the rising complexity of electronic systems have further reinforced the demand for professional calibration services.

Repair and after-sales services are expected to grow at the fastest CAGR from 2025 to 2030. Minimizing downtime and extending equipment lifespan have become top priorities for industries that rely on high-precision instruments. This drives demand for timely maintenance, repair, and technical support.

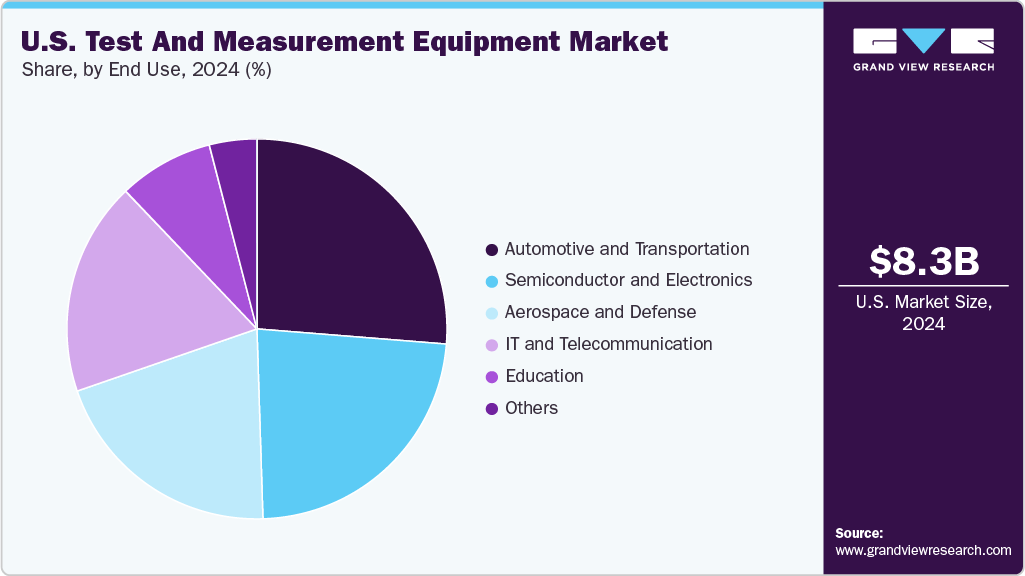

End Use Insights

The automotive and transportation segment dominated the U.S. test and measurement equipment market in 2024. This dominance is attributed to the rising integration of advanced electronics, safety systems, and autonomous technologies in modern vehicles. From powertrain testing to Advanced Driver Assistance Systems (ADAS) validation, high-precision testing equipment is essential at every stage of automotive design and production.

IT and telecommunication are expected to emerge as the fastest-growing segment over the forecast period, driven by the rapid rollout of 5G infrastructure, expansion of fiber-optic networks, and increasing demand for high-speed data transmission. With telecom providers investing heavily in network performance and reliability, there is a significant surge in the need for advanced test equipment like signal analyzers, spectrum analyzers, and protocol testers.

Key U.S. Test And Measurement Equipment Company Insights

Some key test and measurement equipment companies include Keysight Technologies, Fortive, National Instruments Corp., and AMETEK, Inc.

-

Keysight Technologies is recognized for enabling faster and more reliable product development through advanced design, emulation, and testing solutions. The company helps businesses push engineering boundaries and deliver superior product experiences by leveraging deep measurement expertise and collaborative innovation.

-

Fortive delivers essential technologies for connected workflow solutions across various high-impact fields. With a portfolio of brands like Tektronix and Fluke, it operates in strategic segments such as Intelligent Operating Solutions, Precision Technologies, and Advanced Healthcare Solutions.

Key U.S. Test And Measurement Equipment Companies:

- Keysight Technologies

- Fortive

- National Instruments Corp.

- Teledyne Technologies Incorporated.

- VIAVI Solutions Inc.

- Particle Measuring Systems

- AMETEK, Inc.

- Astronics Corporation

- Crystal Instruments Corporation

- DS Instruments

Recent Developments

-

In January 2025, Keysight Technologies introduced the Chiplet PHY Designer 2025, an advanced software solution for high-speed digital chiplet design, tailored for data center and AI applications.

-

In May 2025, AMETEK announced its agreement to acquire FARO Technologies, a 3D measurement and imaging solutions leader, in a deal valued at approximately USD 920 million.

U.S. Test And Measurement Equipment Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 10.96 billion

Growth Rate

CAGR of 5.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, service, end use

Key companies profiled

Keysight Technologies; Fortive; National Instruments Corp.; Teledyne Technologies Incorporated.; VIAVI Solutions Inc.; Particle Measuring Systems; AMETEK, Inc.; Astronics Corporation; Crystal Instruments Corporation; DS Instruments

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Test And Measurement Equipment Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. test and measurement equipment market report based on product, service, end use.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

General Purpose Test Equipment

-

Oscilloscopes

-

Signal Generators

-

Multimeters

-

Logic Analyzers

-

Spectrum Analyzers

-

Bit Error Rate Test (BERT)

-

Network Analyzers

-

Others

-

-

Mechanical Test Equipment

-

Non-Destructive Test Equipment

-

Machine Vision Inspection

-

Machine Condition Monitoring

-

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Calibration Services

-

Repair Services/After-Sales Services

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive and Transportation

-

Aerospace and Defense

-

IT and Telecommunication

-

Education

-

Semiconductor and Electronics

-

Others

-

Frequently Asked Questions About This Report

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.