- Home

- »

- Advanced Interior Materials

- »

-

U.S. Textile Processing Machinery Market Size Report, 2030GVR Report cover

![U.S. Textile Processing Machinery Market Size, Share & Trends Report]()

U.S. Textile Processing Machinery Market (2024 - 2030) Size, Share & Trends Analysis Report By Process (Bleaching/Dyeing Machines, Washing Machine, Ironing Machines & Presses, Drying Machines), And Segment Forecasts

- Report ID: GVR-4-68040-169-6

- Number of Report Pages: 134

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

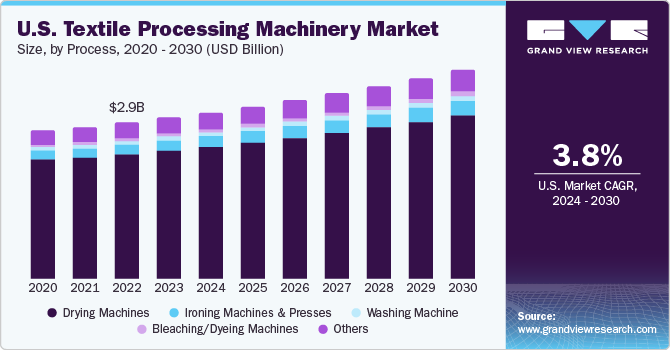

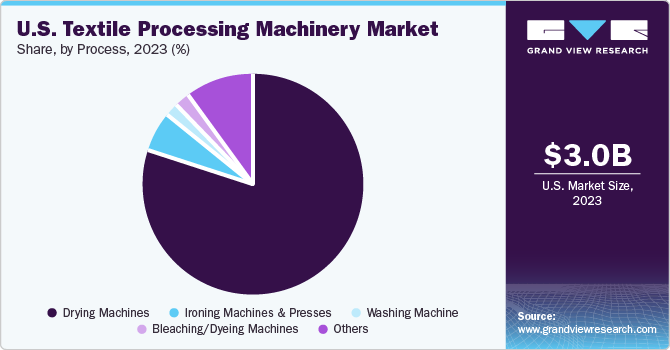

The U.S. textile processing machinery market size was estimated at USD 3.03 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 3.8% from 2024 to 2030. The growing textile industry in the U.S. is an important factor driving the industry growth. In 2022, the market growth in the U.S. has remained optimistic and witnessed steady growth. In addition, the prospect for the textile industry is likely to remain optimistic in the U.S. due to the e-commerce boom & fast fashion trends. Moreover, the introduction of advanced technologies, such as the Industrial Internet of Things (IIoT), and digital dyeing, are reducing the waste being generated during the textile manufacturing process.

The expansion of the parent market and technological advancement are driving the U.S. market growth. Several advancements in washing machines, drying machines, dyeing machines, and ironing machines over the past few years have resulted in augmented efficiency for attaining sustainability. Hence, with the incorporation of automation-based textile processing machines to improve process control, reduce waste, and improve facility efficiency, the demand for textile processing machinery is expected to increase. High demand for textile processing machinery to ensure product safety and quality has resulted in increased investments from manufacturers of textile processing machinery.

The majority of these companies are enhancing their production operations through automation to meet rising consumer demands. Moreover, manufacturers are focusing on sustainable production with minimal wastage and maximum hygiene. Due to these factors, the product demand is anticipated to increase in coming years. The U.S. is a leading manufacturer of textiles, yarns, textile raw materials, fabrics, home furnishing, apparel, etc. It is also a key producer and exporter of raw cotton, as well as a top importer of raw textiles in the world. According to the National Council of Textile Organizations (NCTO), from 2011 to 2020, the textile industry in the U.S. invested USD 20.2 billion in the deployment of innovative equipment and the establishment of plants.

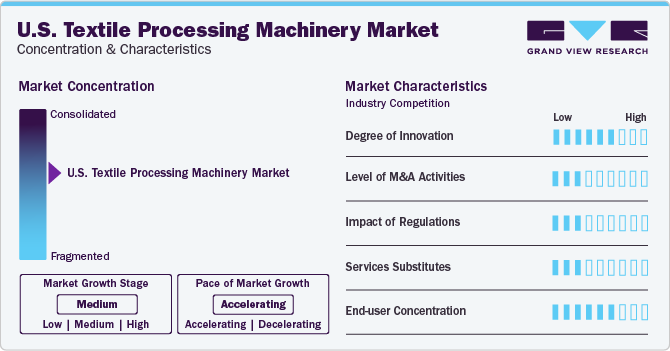

In addition, new facilities have been opened in the U.S., to carry out large-scale textile production, which also offer recycling services. All these factors imply the market growth in the U.S. The industry is characterized by the presence of numerous small- and large-scale manufacturers, resulting in a high level of competition at both global and regional levels. This has a moderate effect on the bargaining power of buyers as product pricing is based on global demand. Furthermore, the competitive nature of this market is expected to contribute to its growth.

Market Concentration & Characteristics

The market growth stage is medium, and the pace of its growth is accelerating. Manufacturers adopt several strategies, including expansions, acquisitions, joint ventures, and mergers, to enhance their market penetration and cater to the changing technological demands of the textile industry.

Key players also engage in R&D and new product development activities by partnering with other players to offer the latest technologies and introduce machinery that caters to the requirements of different end-use industries. In addition, a higher level of market specialization can be observed due to the involvement of capital-intensive infrastructures, such as heavy machinery to manufacture the textile processing machinery.

The degree of innovation factor is expected to remain significantly important in this market. Manufacturers are increasingly prioritizing sustainability by opting for eco-friendly materials and processes for the development of these machines. By embracing sustainable materials, manufacturers not only contribute to environmental conservation but also improve their brand positioning and market penetration rate.

Process Insights

The drying machines segment dominated the industry and accounted for a revenue share of 79.6% in 2023. Dryers are equipped with motorized centering and tensioning devices for specific conveyors. Heating methods, burner, and chamber are some of the key points manufacturers consider while buying a drying machine. Key manufacturers of drying machines are G.A. BRAUN, Inc., Continental Girbau, B&C Technologies, Pellerin Milnor Corporation, and CLMTexfinity. Drying machines are used to efficiently remove moisture from the fabric, thereby accelerating textile production. Due to these machines, manufacturers can ensure controlled and consistent drying, which ultimately reduces the process time and improves the drying process quality. These factors drive the segment growth.

The ironing machines & presses segment is expected to register the fastest CAGR from 2024 to 2030. These machines provide a uniform fabric finish during the last stage of manufacturing, thereby improving the product quality. In addition, ironing and pressing machines are utilized for ironing out seams, folding edges, and raising the pile during textile manufacturing. In the textile manufacturing facility, a semi-finished garment is shaped by an ironing and pressing machine, which first makes the fabric fibers highly elastic before deforming and setting them. This is accomplished by applying pressure, heat, and moisture to the fabric. Due to these process characteristics, and to improve the surface finish of the manufactured textiles, the demand for ironing machines & presses is expected to increase.

Key Companies & Market Share Insights

Some of the key players operating in the market include G.A. Braun Inc., Wolfe Dye & Bleach Works, Inc. Leonard Automatics, Pellerin Milnor Corporation, Alliance Laundry System LLC.

-

G.A. Braun, Inc. is headquartered in New York, U.S. It has been present in the market for the last 77 years and provides a full range of ironing, feeding, drying, washing, and folding equipment. The company also provides material handling products and safety equipment solutions. Hence it developed an extensive product mix offering solutions for different processes. The company has been focusing on sustainability and uses its remanufacturing technique, where it scrapes the equipment down to its basic steel and rebuilds it to ensure that the equipment performs with the same reliability as it was first built. Due to these sustainability measures and a larger market presence, the company is considered a mature player in the market

-

Wolfe Dye & Bleach Works, Inc. was established in 1902 and is headquartered in Pennsylvania, U.S. In the textile commission dyeing and finishing sector, the company’s technology has been at the forefront of innovation. In addition, the company has highly skilled human resources working in the field of design and development of textile processing machines. The company specializes in tailored dyeing, finishing, and bleaching solutions

Continental Girbau, B&C Technologies, Lapauw USA, LLC, Kusters Calico, and CLMTexfinity are some of the emerging market participants in the U.S. textile processing machinery market.

-

CLMTexfinity was established in 2001 and is headquartered in Arendonk, Belgium. The company has development/production centers in Belgium and China, while it has local sales centers in 25 countries of the world. CLMTexfinity has a 130,000-building area with 200,000 square meters of total floor space. Till 2022, the company provided more than 20,000 industrial laundry appliances and more than 200 sets of advanced testing equipment. The company has been trying to develop the market in the U.S. by catering to the unique needs of textile manufacturers. The company also focuses on customer relationship management (CRM) through various tailor-made education programs for technicians, which helps textile manufacturers in better understanding its products

-

Lapauw USA, LLC was established in 2014 and is headquartered in Warwick, the U.S. It adopted the market differentiation strategy, where it focuses on providing solutions in washing, ironing, and garments. In addition, to penetrate the market, it implemented service digitalization and intensive product training initiatives to ensure the supplied machines work properly. Due to these reasons, the company is considered an emerging

Key U.S. Textile Processing Machinery Companies:

- G. A. Braun, Inc.

- Continental Girbau

- B&C Technologies

- Wolfe Dye & Bleach Works, Inc.

- Leonard Automatics

- Pellerin Milnor Corporation

- Alliance Laundry Systems LLC

- Lapauw USA, LLC

- Kusters Calico

- CLMTexfinity

Recent Developments

-

In August 2022, HX Series was unveiled on-site by B&C Technologies. The HX Series has straightforward controls and is easy to operate. This HX series commercial washer is designed to cater to the needs of commercial laundry and is anticipated to improve the company’s market share

-

In August 2022, Alliance Laundry Systems LLC showcased its laundry systems booth at the 2022 Clean Show. The company showcased its laundry systems and technologies, as well as value-added laundry services. These newly launched laundry systems are expected to improve the company’s offering in the market

-

In July 2021, G.A. Braun, Inc. launched an innovation platform in the industrial sector. The new business model is expected to transform its current industrial laundry business

U.S. Textile Processing Machinery Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.13 billion

Revenue forecast in 2030

USD 3.92 billion

Growth rate

CAGR of 3.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Process

Country scope

U.S.

Key companies profiled

G. A. Braun, Inc.; Continental Girbau; B&C Technologies; Wolfe Dye & Bleach Works Inc.; Leonard Automatics; Pellerin Milnor Corporation; Alliance Laundry Systems LLC; Lapauw USA, LLC; Kusters Calico; CLMTexfinity

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Textile Processing Machinery Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. textile processing machinery market report based on process:

-

Process Outlook (Revenue, USD Billion, 2018 - 2030)

-

Washing Machine

-

Bleaching/Dyeing Machines

-

Drying Machines

-

Ironing Machines and Presses

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. textile processing machinery market size was estimated at USD 3.03 billion in 2023 and.is expected to reach USD 3.13 billion in 2024.

b. The U.S. textile processing machinery market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.8% from 2024 to 2030 and reach USD 3.92 billion by 2030.

b. Drying machines segment accounted for the largest market revenue share of 79.6% in 2023, owing to their ability to remove the moisture from the fabric, thereby accelerating the textile production.

b. Some of the key players operating in the U.S. textile processing machinery are, Benninger AG (Jakob Muller AG), Camozzi Group S.p.A., Mayer & Cie, Morgan Tecnica, Murata Machinery Ltd., OC Oerlikon Management AG, Rieter, Santex Rimar group, Saurer Intelligent Technology AG, Toyota Industries Corporation

b. The rising textile industry, growing technological advancements, ability of processing machines to reduce waste being generated, greater process control are the key factors driving the U.S. textile processing machinery market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.