- Home

- »

- Clinical Diagnostics

- »

-

U.S. Thyroid Cancer Diagnostics Market Size Report, 2033GVR Report cover

![U.S. Thyroid Cancer Diagnostics Market Size, Share & Trends Report]()

U.S. Thyroid Cancer Diagnostics Market (2025 - 2033) Size, Share & Trends Analysis Report By Cancer (Papillary Carcinoma, Follicular Carcinoma), By Technique (Imaging, Biopsy), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-728-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

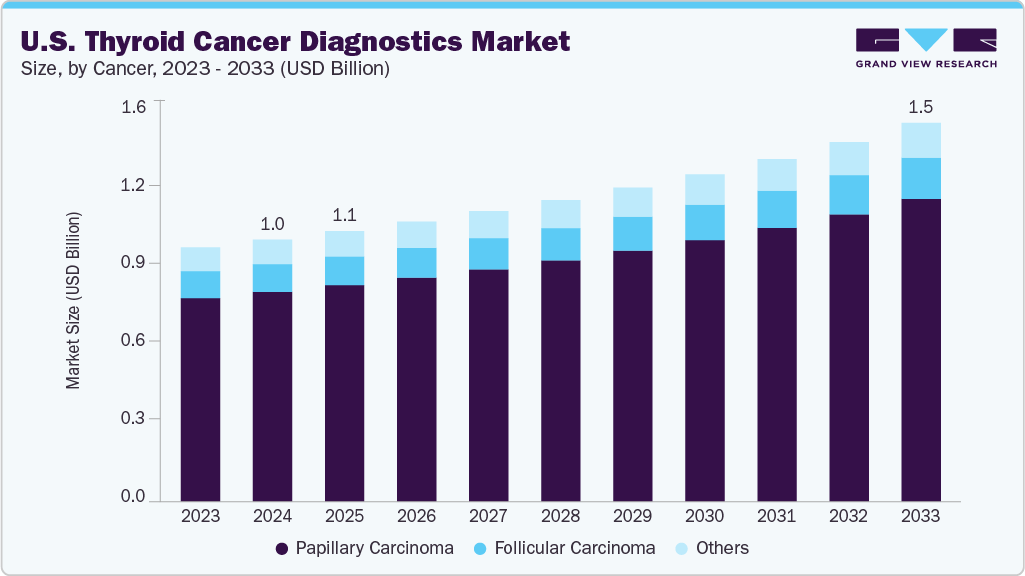

The U.S. thyroid cancer diagnostics market size was estimated at USD 1.02 billion in 2024 and is projected to reach USD 1.48 billion by 2033, growing at a CAGR of around 4.30% from 2025 to 2033. Thyroid cancer diagnostics in the U.S. are rapidly evolving, with 2025 estimates projecting 44,020 new cases and 2,290 deaths. The disease is more common in women, often diagnosed at a younger age, and less prevalent among Black populations. While incidence rose for decades due to overdiagnosis from imaging, stricter criteria have reduced rates by 2% annually since 2014. Advances in genomics, AI-driven imaging, and molecular testing now enable precision medicine, reduce overtreatment, and improve outcomes for aggressive subtypes.

Thyroid cancer diagnostics in the United States are evolving rapidly, shaped by changing incidence trends, risk factors, and advances in molecular tools. In 2025, the American Cancer Society projects about 44,020 new cases (12,670 in men and 31,350 in women) and 2,290 deaths, with diagnosis typically occurring at a younger age (average 51 years). The disease is nearly three times more common in women than in men and is about 40-50% less common among Black populations compared to other groups. Over the past four decades, incidence rose dramatically, largely due to widespread use of sensitive imaging tests that detected small, localized tumors with excellent survival rates-many of which represented overdiagnosis. Since 2014, stricter diagnostic criteria have helped reduce overdiagnosis, leading to a 2% annual decline in incidence, while mortality has remained stable since 2009.

Key etiological insights have emerged alongside these trends. Historically, childhood radiation exposure was the only modifiable risk factor; however, obesity has now been recognized as a major contributor, though its biological mechanisms are not fully understood. Research is also examining the role of endocrine-disrupting chemicals and thyroid dysfunction in disease development. Importantly, genetic and molecular profiling has identified critical mutations-such as BRAFV600E, RAS, RET, and NTRK-that are both prognostic and predictive, offering targets for precision therapies. These discoveries have not only improved disease understanding but have also reshaped diagnostics by integrating molecular assays and next-generation sequencing into biopsy evaluation, allowing better differentiation between benign and malignant nodules.

The diagnostic paradigm has shifted significantly from reliance on ultrasound and fine-needle aspiration toward more sophisticated molecular diagnostics, liquid biopsy, and AI-driven imaging tools that reduce indeterminate results and unnecessary surgeries. A landmark development has been the reclassification of certain low-risk tumors, such as noninvasive follicular thyroid neoplasm with papillary-like nuclear features (NIFTP), which has reduced overtreatment and spared many patients from thyroidectomies and lifelong hormone replacement therapy. At the same time, aggressive subtypes-particularly those driven by BRAFV600E mutations-remain challenging due to reduced radioactive iodine uptake and early recurrence. Innovative research is now focused on drug pretreatment strategies to restore iodine sensitivity, promising more effective therapies for high-risk patients. Collectively, these advances illustrate a transformative era in U.S. thyroid cancer diagnostics-marked by precision medicine, reduced overtreatment, and improved alignment of diagnosis and treatment with individual patient profiles.

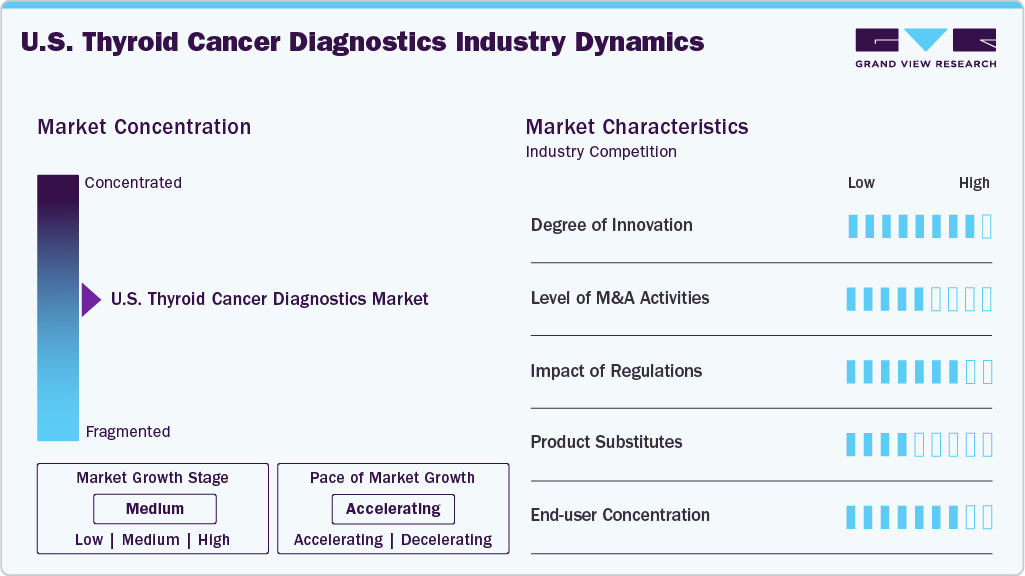

Market Concentration & Characteristics

Thyroid cancer diagnostics demonstrate a high degree of innovation, moving from traditional imaging and fine-needle aspiration toward advanced molecular assays, NGS panels, liquid biopsies, and AI-powered imaging. These technologies improve diagnostic accuracy, reduce unnecessary surgeries, and enable precision treatment decisions. Molecular profiling of mutations such as BRAFV600E, RET, and NTRK is transforming care by linking diagnostics directly with targeted therapy options, ushering in a new era of personalized oncology.

M&A activities in thyroid cancer diagnostics focus on acquiring companies with molecular, genomic, and AI-based capabilities. Large IVD players pursue firms offering NGS panels, mutation-specific assays, and liquid biopsy tools to strengthen oncology portfolios. Startups with AI-driven ultrasound or risk-stratification platforms are attractive targets, while strategic collaborations help global firms integrate companion diagnostics and expand distribution. These activities consolidate market presence, accelerate innovation, and enhance access to personalized diagnostic solutions worldwide.

Regulation significantly shapes thyroid cancer diagnostics, with agencies like the FDA and EMA requiring rigorous validation for sensitivity, accuracy, and reproducibility. Companion diagnostic approvals have accelerated precision medicine, particularly for RET and NTRK mutation-targeted therapies. However, evolving policies around laboratory-developed tests (LDTs) and reimbursement frameworks can increase costs and delay adoption. Harmonized global standards and clearer reimbursement guidelines are expected to improve innovation uptake, ensuring broader patient access to advanced diagnostic solutions.

Product expansion in thyroid cancer diagnostics is centered on broadening portfolios beyond ultrasound and FNA toward advanced molecular assays, mutation panels, and liquid biopsies. Companies are developing companion diagnostics linked to targeted therapies while integrating AI-based imaging and digital pathology tools. These expanded offerings deliver more accurate, non-invasive, and personalized results, reduce overtreatment, and strengthen competitive advantage, ultimately enabling end-to-end solutions that address both indolent and aggressive thyroid cancer subtypes.

Regional expansion strategies emphasize entry into fast-growing markets such as Asia-Pacific, Latin America, and the Middle East, where rising incidence and evolving healthcare infrastructure create opportunities. Global leaders partner with local labs, hospitals, and distributors to navigate regulatory approvals and reimbursement frameworks. Collaborations with regional authorities help align diagnostics with local guidelines. These initiatives expand access, improve early detection, and support precision oncology adoption, driving global standardization of thyroid cancer diagnostic practices.

Cancer Insights

Papillary carcinoma led the market and accounted for the largest revenue share of 80.03% in 2024, primarily driven by its high prevalence, accounting for majority of the thyroid cancer cases. In addition, increased awareness, improved screening programs, and advancements in imaging and molecular diagnostic techniques have enabled earlier and more accurate detection. Furthermore, environmental factors, lifestyle changes, and a younger average age at diagnosis also contribute to rising case numbers, driving demand for effective diagnostic solutions and supporting market expansion for this cancer.

Follicular carcinoma diagnostics is expected to grow at a CAGR of 4.61% over the forecast period, owing to its status as the second most common thyroid cancer, with a higher malignancy potential compared to papillary carcinoma. Furthermore, rapid invasion into surrounding tissues and a lower cure rate with increasing age highlight the need for precise and early detection. Moreover, increased susceptibility among females, greater focus on early diagnosis, and advancements in diagnostic technologies further fuel market growth for follicular carcinoma in the thyroid cancer diagnostics segment.

Technique Insights

Imaging technique dominated the market in 2024 with the largest revenue share of 36.92%. This growth is attributed to its critical role in the early detection and evaluation of thyroid nodules and tumors. Furthermore, advanced imaging modalities such as ultrasound, CT, MRI, and PET scans provide non-invasive, highly accurate, and rapid results, improving diagnostic confidence. Moreover, the integration of artificial intelligence and enhanced imaging resolution further supports precise tumor localization and monitoring, making imaging an indispensable tool in thyroid cancer diagnosis and management.

Biopsy technique is expected to grow at a significant CAGR of 4.43% over the forecast period, owing to its essential function in confirming thyroid cancer diagnosis at the cellular level. In addition, the increasing adoption of molecular and genetic analysis through biopsy samples enables more personalized and targeted treatment strategies. Furthermore, advances in next-generation sequencing and biomarker analysis have improved diagnostic accuracy, supporting individualized care. The demand for minimally invasive, reliable, and definitive diagnostic techniques continues to drive the expansion of biopsy in the market.

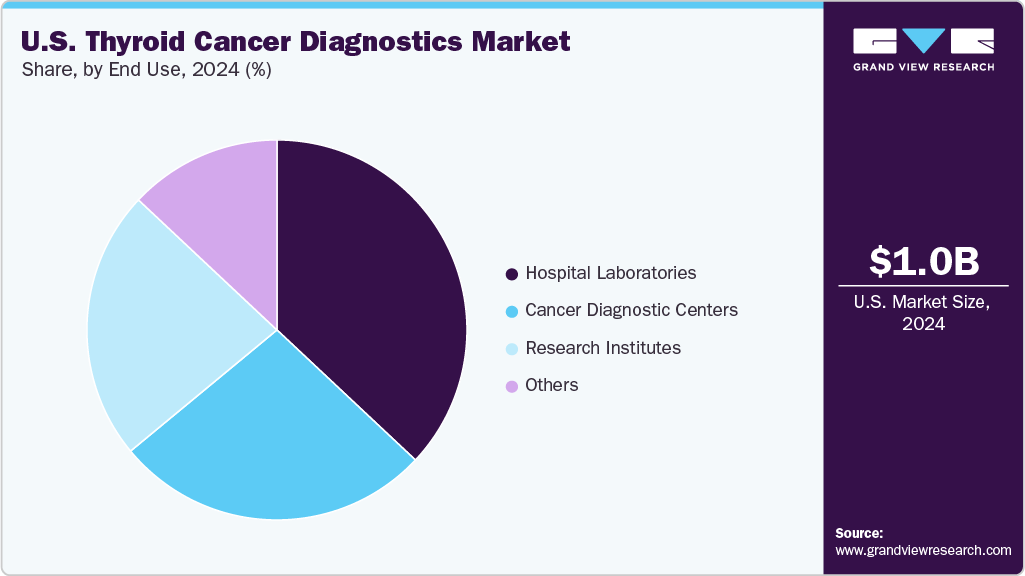

End Use Insights

Hospital laboratories held the dominant position in the market and accounted for the largest revenue share of 37.44% in 2024, driven by increasing patient inflow for cancer diagnosis, rising awareness of thyroid disorders, and expanding healthcare infrastructure, especially in developing regions. In addition, hospitals are often the primary point of care, providing comprehensive diagnostic services, advanced technologies, and specialized personnel. Furthermore, investments in modern equipment and integration of molecular and genetic testing capabilities further enhance the accuracy and efficiency of thyroid cancer diagnostics in hospital settings, supporting continued market expansion.

Research institutes are expected to grow at a CAGR of 5.34% from 2025 to 2033, due to increased funding for cancer research and a strong focus on innovation. These institutes play a pivotal role in developing and validating new diagnostic technologies, such as advanced molecular assays and genetic profiling. Furthermore, collaborative efforts with academic and industry partners, access to grant funding, and participation in clinical trials drive breakthroughs in early detection and personalized medicine, positioning research institutes as key contributors to market advancement.

Key U.S. Thyroid Cancer Diagnostics Company Insights

Key players in the thyroid cancer diagnostics market in the U.S. include F.Hoffmann-La Roche Ltd., Thermo Fisher Scientific, Inc., Siemens Healthcare GmbH, and others. These companies implement strategies such as investing in research and development, introducing advanced diagnostic technologies, expanding product portfolios, forming collaborations and partnerships, and focusing on regulatory approvals. These approaches help enhance diagnostic accuracy, broaden market reach, and address evolving patient and healthcare provider needs.

-

Siemens Healthcare GmbH offers a comprehensive portfolio of laboratory assays and automated immunoassay systems designed to detect, diagnose, and monitor thyroid disorders, including thyroid cancer. The company manufactures and supplies advanced diagnostic solutions that are used to assess thyroid function, monitor differentiated thyroid cancer, and support clinical decision-making. Siemens operates primarily in the laboratory diagnostics and medical imaging segments.

-

Bio-Rad Laboratories, Inc. develops and markets a wide range of molecular testing kits, reagents, and automated systems that enable the detection and analysis of thyroid cancer biomarkers. Bio-Rad operates in the clinical diagnostics segment, providing tools for genetic, protein, and cellular analysis. It supports both routine diagnostic testing and advanced research in thyroid cancer and related endocrine disorders.

Key U.S. Thyroid Cancer Diagnostics Companies:

- Abbott

- F.Hoffmann-La Roche Ltd.

- Thermo Fisher Scientific, Inc.

- Siemens Healthcare GmbH

- Bio-Rad Laboratories, Inc

- GE HealthCare

- Hologic, Inc.

- Koninklijke Philips N.V.

- Toshiba Corporation

- Agilent Technologies, Inc.

- Illumina, Inc.

Recent Developments

-

In October 2024, GE HealthCare took a leading role in Thera4Care, an initiative to revolutionize cancer care through theranostics. This personalized approach integrates imaging diagnostics and targeted therapeutics, using molecular imaging to visualize tumors and deliver radioactive drugs.

-

In August 2024, Illumina's TruSight Oncology (TSO) Comprehensive test secured FDA approval, marking a milestone as the pan-cancer companion diagnostic claims and the first distributable comprehensive genomic profiling IVD kit.

-

In May 2020, Veracyte launched the “More About You” campaign, a patient-focused digital initiative aimed at raising awareness about thyroid cancer diagnostics and empowering individuals with thyroid nodules to actively engage in discussions with their physicians. The campaign, supported by the dedicated website AskForAfirma.com, provides educational resources on thyroid nodule evaluation, biopsy outcomes, and molecular testing options. By highlighting the value of Afirma genomic testing-which has already helped over 160,000 patients avoid unnecessary surgeries-Veracyte positions itself as a leader in patient-centric diagnostics. The initiative leverages online platforms, social media, and physician outreach to address low patient awareness around indeterminate fine-needle aspiration results, while promoting advanced genomic solutions that reduce invasive procedures and ensure personalized care.

-

In May 2020, NeoGenomics partnered with Bayer to launch a Sponsored Testing Program offering free RNA-based NTRK fusion testing for eligible colorectal and thyroid cancer patients. The initiative targets metastatic colorectal cancer (MSI-H/dMMR) and radioactive iodine refractory differentiated thyroid carcinoma (RAIR DTC) cases, providing NGS fusion profiling and TrK IHC testing at no cost, fully covered by Bayer. This collaboration enhances patient access to actionable genomic insights, accelerates treatment decisions, and strengthens NeoGenomics’ positioning in precision oncology diagnostics.

U.S. Thyroid Cancer Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.06 billion

Revenue forecast in 2033

USD 1.48 billion

Growth rate

CAGR of 4.30% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Cancer, technique, end use

Key companies profiled

Abbott; F.Hoffmann-La Roche Ltd.; Thermo Fisher Scientific, Inc.; Siemens Healthcare GmbH; Bio-Rad Laboratories, Inc; GE HealthCare; Hologic, Inc.; Koninklijke Philips N.V.; Toshiba Corporation; Agilent Technologies, Inc.; Illumina, Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Thyroid Cancer Diagnostics Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. thyroid cancer diagnostics market report based on cancer, technique, end use, and region:

-

Cancer Outlook (Revenue, USD Million, 2021 - 2033)

-

Papillary carcinoma

-

Follicular carcinoma

-

Others

-

-

Technique Outlook (Revenue, USD Million, 2021 - 2033)

-

Blood Test

-

Imaging

-

Biopsy

-

Others

-

-

End Use Indication Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospital Laboratories

-

Cancer Diagnostic Centers

-

Research Institutes

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. thyroid cancer diagnostics market size was estimated at USD 1.02 billion in 2024 and is expected to reach USD 1.06 billion in 2025.

b. The U.S. thyroid cancer diagnostics market is expected to grow at a compound annual growth rate of 4.30% from 2025 to 2033 to reach USD 1.48 billion by 2033.

b. Papillary carcinoma dominated the thyroid cancer diagnostics market with a share of 80.03% in 2024. This is attributable due to this condition recording one of the highest cure rates among all cancer types, with a five-year survival rate of nearly 98%.

b. Some key players operating in the thyroid cancer diagnostics market include Abbott; F. Hoffmann-La Roche Ltd.; Thermo Fisher Scientific, Inc.; Siemens Healthcare GmbH; Bio-Rad Laboratories, Inc; General Electric; Koninklijke Philips N.V.; Toshiba Corporation; Agilent Technologies, Inc.; and Illumina, Inc.

b. Thyroid cancer diagnostics in the U.S. are rapidly evolving, with 2025 estimates projecting 44,020 new cases and 2,290 deaths. The disease is more common in women, often diagnosed at a younger age, and less prevalent among Black populations. While incidence rose for decades due to overdiagnosis from imaging, stricter criteria have reduced rates by 2% annually since 2014. Advances in genomics, AI-driven imaging, and molecular testing now enable precision medicine, reduce overtreatment, and improve outcomes for aggressive subtypes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.