- Home

- »

- Medical Devices

- »

-

U.S. Topical Cyanoacrylates Market Size, Industry Report, 2033GVR Report cover

![U.S. Topical Cyanoacrylates Market Size, Share & Trends Report]()

U.S. Topical Cyanoacrylates Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (2-Octyl Cyanoacrylate, n-Butyl-cyanoacrylate), By Application (General Surgery, Plastic Aesthetic Procedures), By End Use (Hospitals, Home Care Settings), And Segment Forecasts

- Report ID: GVR-4-68040-641-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Topical Cyanoacrylates Market Trends

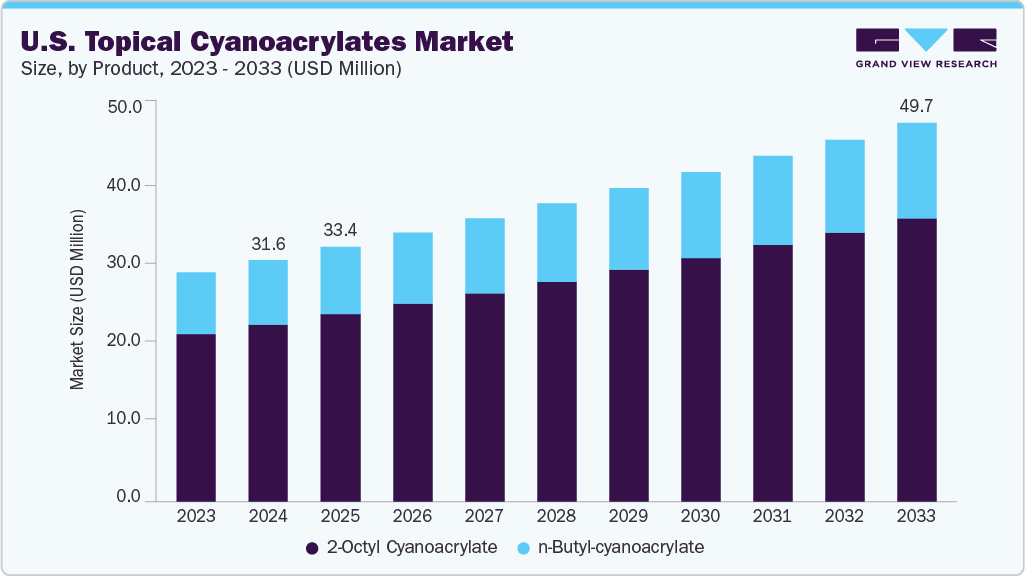

The U.S. topical cyanoacrylates market size was estimated at USD 31.65 million in 2024 and is expected to grow at a CAGR of 5.10% from 2025 to 2033. The market growth is attributed to the increasing demand for fast-acting, non-invasive wound closure solutions in both clinical and home care settings. These adhesives are widely used as an alternative to sutures and staples for closing surgical incisions, lacerations, and minor cuts, offering advantages such as reduced procedure time, minimal scarring, and lower infection risk. Growth is further supported by the rising number of surgical procedures, trauma cases, and sports injuries, alongside an aging population that requires more chronic wound care.

There is a growing demand for non-invasive wound closure methods, especially in outpatient clinics and emergency care settings. Topical cyanoacrylate adhesives are becoming a preferred option due to their quick application, ability to minimize scarring, and lower risk of infection compared to traditional sutures or staples. These benefits make them an attractive solution for patients and healthcare providers seeking efficient and safe alternatives for wound management.

The increasing volume of surgical procedures-ranging from cosmetic to trauma-related interventions-is driving demand for fast, reliable wound closure solutions. Topical cyanoacrylate adhesives offer a convenient and effective alternative to traditional sutures and staples, supporting quicker recovery times and enhancing patient comfort. Their ease of use aligns well with the shift toward outpatient care, where efficiency and reduced procedural complexity are key priorities.

Category

Procedure

2023

2022

% Change

Breast

Breast augmentation (implant placement for primary/revisions)

304,181

298,568

2%

Breast implant removals (augmentation patients only)

41,115

37,679

9%

Breast lift (mastopexy)

153,600

143,364

7%

Breast reduction (aesthetic patients only)

76,031

71,364

7%

Breast reduction in males (gynecomastia surgery)

25,888

24,517

6%

Body

Buttock augmentation with fat grafting (Brazilian butt lift)

29,383

28,638

3%

Buttock implants

1,234

1,164

6%

Buttock lift

7,748

7,338

6%

Labiaplasty

10,631

10,433

2%

Liposuction

347,782

325,669

7%

Lower body lift

10,947

10,445

5%

Thigh lift

9,600

9,421

2%

Tummy tuck (abdominoplasty)

170,110

161,948

5%

Upper arm lift (brachioplasty)

23,058

21,429

8%

Face

Buccal fat pad removal

4,866

4,543

7%

Cheek implant (malar augmentation)

8,825

8,238

7%

Chin augmentation (mentoplasty)

5,484

5,403

1%

Ear surgery (otoplasty)

4,817

4,713

2%

Eyelid surgery (blepharoplasty)

120,747

115,261

5%

Facelift (rhytidectomy)

78,482

72,668

8%

Facial fat grafting

34,216

33,877

1%

Forehead lift

13,518

13,318

2%

Liposuction (submental)

23,667

22,285

6%

Neck lift

22,007

21,575

2%

Nose reshaping (rhinoplasty)

47,307

44,503

6%

Total

All Procedures Combined

1,575,244

1,498,361

5%

Source: American Society of Plastic Surgeons

Topical cyanoacrylate adhesives are increasingly favored for their ability to reduce pain, minimize scarring, and support faster healing, which improves patient comfort and satisfaction-especially in visible areas or pediatric care. At the same time, strong regulatory support, including approvals from the U.S. FDA, ensures the safety and effectiveness of these products. This combination of patient-friendly benefits and official endorsements is helping boost adoption and drive market growth.

Recent innovations in cyanoacrylate formulations have led to better bonding strength, flexibility, and biocompatibility, making topical adhesives safer and more effective for various medical uses. For instance, in February 2024, Henkel launched two new medical-grade cyanoacrylate adhesives-Loctite 4011S and Loctite 4061S. These next-generation adhesives are free from CMR (Carcinogenic, Mutagenic, or Reproductively hazardous) substances and offer improved strength, even after heat exposure. They are designed to match the performance of existing products, Loctite 4011 and 4061, making it easier for manufacturers to validate and adopt them in current medical applications.

“Henkel is committed to medical quality systems and good manufacturing practices as a pioneer for sustainable solutions,” said Philipp Loosen, Vice President and Head of Industrials EIMEA and Global Key Accounts Medical at Henkel. “The launch of these new, next generation instant adhesive are formulated to meet the highest safety standards, addressing the need for safe and effective medical device assemblies, and demonstrating our longstanding commitment to the medical industry.”

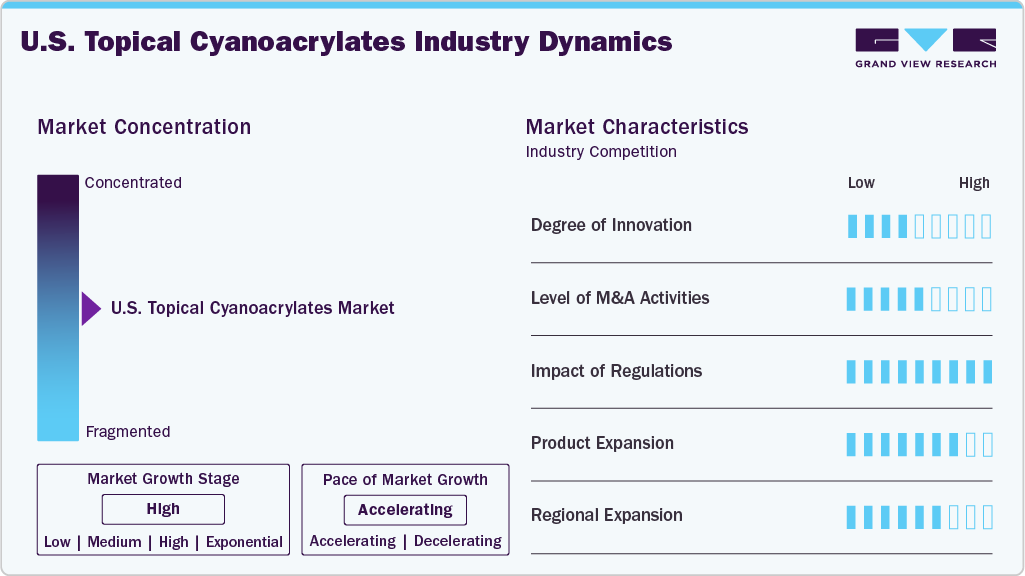

Market Concentration & Characteristics

The U.S. topical cyanoacrylates market is witnessing high innovation, particularly in terms of safer, stronger, and more biocompatible adhesive formulations. Recent advancements focus on eliminating harmful ingredients such as CMR (carcinogenic, mutagenic, or reproductive toxicants) while improving bonding strength and thermal stability. Companies are developing next-generation medical-grade adhesives tailored for a broader range of clinical applications-from surgical wound closure to emergency trauma care and pediatric procedures. Innovations also include faster-setting adhesives, improved applicator designs for ease of use, and enhanced moisture resistance, making these products more versatile in outpatient and field-care settings.

Regulation plays a pivotal role in shaping the U.S. topical cyanoacrylate market by setting strict standards for safety, biocompatibility, and sterility under FDA oversight. Products are regulated as medical devices and must undergo either 510(k) clearance or Premarket Approval (PMA), depending on their classification. New synthetic and antimicrobial adhesives like cyanoacrylates often require clinical data to support advanced claims. Regulatory requirements also mandate thorough testing of physical properties-such as viscosity, setting time, and polymerization heat-to ensure product performance aligns with labeled indications. Additionally, adhesives must comply with ISO 10993 biocompatibility standards and demonstrate resistance to sterilization processes. While demanding, these regulations promote innovation by raising safety and performance benchmarks. Consequently, regulatory approval enhances healthcare provider and patient trust, enabling broader adoption and supporting the market's growth trajectory.

M&A activity in the U.S. topical cyanoacrylate market has steadily risen as companies reposition themselves for growth in the medical adhesive space. A notable example is H.B. Fuller’s recent acquisitions, including ND Industries Inc. and medical adhesive specialists like GEM S.r.l. and Medifill Ltd., which significantly strengthen its portfolio in medical-grade cyanoacrylates. These strategic moves reflect a broader industry trend where manufacturers are consolidating expertise and production capabilities to serve better expanding healthcare and regulatory demands. As competition increases and innovation accelerates, M&A plays a central role in shaping the competitive landscape, enabling companies to access new technologies, enter higher-growth segments, and enhance global distribution.

Several product substitutes exist in the U.S. topical cyanoacrylate market that compete based on clinical needs and wound characteristics. Traditional sutures and surgical staples are widely used for deeper or high-tension wounds, offering strong mechanical closure but often requiring removal and potentially causing more scarring. Adhesive strips, such as Steri-Strips, serve as non-invasive alternatives for minor wounds, providing ease of use and reduced discomfort. Fibrin sealants and polyethylene glycol-based adhesives are also used in specific surgical contexts, especially where biocompatibility and internal use are crucial. While cyanoacrylates offer benefits like faster application, reduced infection risk, and better cosmetic outcomes, these substitutes play a vital role in wound management depending on wound depth, location, and patient factors.

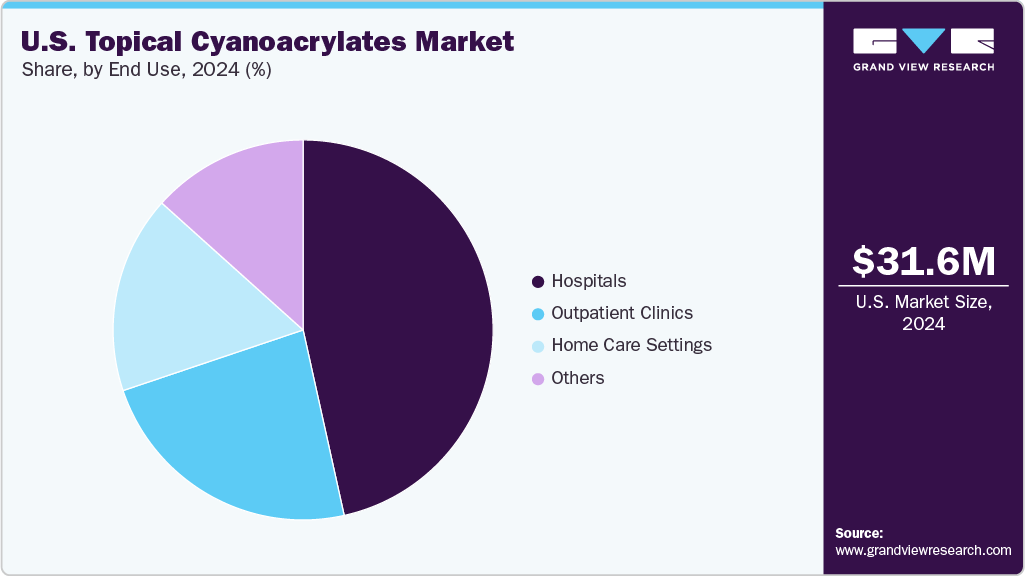

In the U.S., hospitals and surgical centers dominate as the primary end users of topical cyanoacrylate adhesives due to their extensive need for advanced, efficient wound closure in diverse procedures, from emergency trauma to elective surgeries. Outpatient clinics, including urgent care and dermatology offices, form a rapidly growing secondary segment, driven by their demand for minimally invasive, patient-friendly options that facilitate quick recovery and reduce infection risk. Home care and consumer use contribute a smaller yet emerging share, supported mainly by newer formulations that are safe and easy for self-application. This end-user mix reflects a healthcare landscape shifting toward convenience, cost-efficiency, and improved cosmetic outcomes, with cyanoacrylate adhesives uniquely positioned to serve all care settings.

Product Insights

2-Octyl Cyanoacrylate led the market and accounted for more than 73.36% share in 2024 and is expected to witness the fastest growth over the forecast period.The market dominance is attributable to its superior clinical performance, safety profile, and broad acceptance in surgical and wound care applications. Compared to n-butyl cyanoacrylate, 2-octyl offers enhanced flexibility, stronger wound closure, and reduced skin irritation, making it ideal for use on dynamic body areas and in sensitive patient populations, including children. It also provides longer-lasting adhesion and better cosmetic outcomes, such as minimal scarring, which aligns with the growing demand for minimally invasive and aesthetically favorable wound closure solutions. Backed by FDA approvals and widely adopted branded formulations, 2-octyl cyanoacrylate has become the preferred choice in hospital and outpatient settings.

Application Insights

General surgery led the market and accounted for more than 32.15% share in 2024. This dominance is attributed to the high frequency and diversity of procedures requiring efficient, sterile wound closure. Surgeries such as appendectomies, hernia repairs, biopsies, and trauma interventions are routinely performed in both inpatient and outpatient settings, creating a consistent demand for reliable closure methods. Topical cyanoacrylate adhesives are favored in general surgery because they reduce closure time, minimize infection risk, and eliminate the need for suture removal, improving patient outcomes and surgical efficiency. Their use aligns well with fast-paced operating environments and protocols emphasizing reduced hospital stays and faster recovery, reinforcing their widespread adoption in general surgical practices.

Plastic surgery and aesthetic procedures are anticipated to witness the fastest growth over the forecast period. As more individuals opt for minimally invasive cosmetic enhancements-such as facial rejuvenation, scar revision, and elective body contouring-there is a growing need for closure methods that deliver minimal scarring and rapid recovery. Topical cyanoacrylate adhesives meet this demand by offering precision, strong yet flexible bonding, and excellent cosmetic results. Additionally, outpatient and ambulatory surgery centers increasingly adopt these adhesives to improve clinic efficiency and patient satisfaction. Coupled with rising consumer expectations for quick healing and aesthetic outcomes, these trends are propelling accelerated adoption of cyanoacrylate technologies in plastic and aesthetic surgery settings.

End Use Insights

Hospitals led the market and accounted for a revenue share of 46.53% in 2024 and are expected to witness the fastest growth over the forecast period. This dominance is driven by the high volume and complexity of procedures performed in hospital settings, ranging from trauma surgeries and general operations to cardiovascular and orthopedic interventions. In these fast-paced environments, topical cyanoacrylate adhesives are favored for their ability to significantly reduce operating time, lower infection rates, and provide robust, skin-friendly wound closure.

Hospitals also benefit from immediate product availability, direct supply chains, and dedicated clinical teams trained in advanced closure techniques. Additionally, ongoing investments in surgical infrastructure and a strong push for patient-centered care support the continued adoption of cyanoacrylate sealants, making hospitals the central hub for innovation and usage in this market.

Key U.S. Topical Cyanoacrylates Company Insights

Some key companies include Ethicon, Inc. (Johnson & Johnson); 3M; B. Braun SE; Chemence Medical, Inc.; H.B. Fuller Medical Adhesive Technologies, LLC; GluStitch, Inc.; Medline Industries; Advanced Medical Solutions; Cardinal Health; Meyer Haake, among others. They provide a broad range of advanced injector solutions through their strong distribution and supply channels across the world. Leading companies are involved in new product launches, strategic collaborations, mergers & acquisitions, and regional expansions to gain the maximum revenue share in the industry. Mergers & acquisitions help companies expand their businesses and market presence.

Key U.S. Topical Cyanoacrylates Companies:

- Ethicon, Inc. (Johnson & Johnson)

- 3M

- B. Braun SE

- Chemence Medical, Inc.

- H.B. Fuller Medical Adhesive Technologies, LLC

- GluStitch, Inc.

- Medline Industries

- Advanced Medical Solutions

- Cardinal Health

- Meyer Haake

Recent Developments

-

In December 2024, H.B. Fuller Company (NYSE: FUL), a global pure-play adhesives leader, announced that it has signed agreements to acquire two prominent medical adhesive technology firms: GEM S.r.l. and Medifill Ltd.

-

In February 2024, Henkel launched two next-generation medical-grade instant adhesives based on cyanoacrylates, featuring enhanced safety and performance. These new formulations are free from CMR (Carcinogenic, Mutagenic, or Reproductively hazardous) substances and are engineered to provide increased strength both during and after heat cycling. Loctite 4011S and Loctite 4061S are designed to align with the specifications of Loctite 4011 and 4061, facilitating easier validation for existing medical applications.

-

In July 2023, H.B. Fuller Company has announced the acquisition of Adhezion Biomedical, a privately owned U.S.-based medical adhesives firm. Adhezion serves customers in over 40 countries and holds more than 35 global certifications along with 105 patents.

U.S. Topical Cyanoacrylates Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 33.40 million

Revenue forecast in 2033

USD 49.72 million

Growth rate

CAGR of 5.10% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use

Country scope

U.S.

Key companies profiled

Ethicon, Inc. (Johnson & Johnson); 3M; B. Braun SE; Chemence Medical, Inc.; H.B. Fuller Medical Adhesive Technologies, LLC; GluStitch, Inc.; Medline Industries; Advanced Medical Solutions; Cardinal Health; Meyer Haake

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Topical Cyanoacrylates Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. topical cyanoacrylates market report based on product, application, and end use:

-

Product Outlook (Revenue USD Million, 2021 - 2033)

-

2-Octyl Cyanoacrylate

-

n-Butyl-cyanoacrylate

-

-

Application Outlook (Revenue USD Million, 2021 - 2033)

-

General Surgery

-

Plastic Surgery and Aesthetic Procedures

-

Orthopedic

-

Pediatric

-

Gynecology

-

Dental Surgery

-

Others

-

-

End Use Outlook (Revenue USD Million, 2021 - 2033)

-

Hospitals

-

Outpatient Clinics

-

Home Care Settings

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. topical cyanoacrylates market size was estimated at USD 31.65 million in 2024 and is expected to reach USD 33.40 million in 2025.

b. The U.S. topical cyanoacrylates market is expected to grow at a compound annual growth rate of 5.10% from 2025 to 2033 to reach USD 49.72 billion by 2033.

b. 2-Octyl cyanoacrylate dominated the U.S. topical cyanoacrylates market with a share of 28.9% in 2024. This is attributable to its superior clinical performance, safety profile, and broad acceptance in surgical and wound care applications.

b. Some key players operating in the U.S. topical cyanoacrylates market include Ethicon, Inc. (Johnson & Johnson); 3M; B. Braun SE; Chemence Medical, Inc.; H.B. Fuller Medical Adhesive Technologies, LLC; GluStitch, Inc.; Medline Industries; Advanced Medical Solutions; Cardinal Health; Meyer Haake

b. Key factors that are driving the market growth include the increasing demand for fast-acting, non-invasive wound closure solutions in both clinical and home care settings, and increasing surgical procedures.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.