- Home

- »

- Pharmaceuticals

- »

-

U.S. Ultomiris Drug Market Size, Share, Industry Report 2033GVR Report cover

![U.S. Ultomiris Drug Market Size, Share & Trends Report]()

U.S. Ultomiris Drug Market (2025 - 2033) Size, Share & Trends Analysis Report By Indication (Paroxysmal Nocturnal Hemoglobinuria (PNH), Atypical Hemolytic Uremic Syndrome (aHUS)), By End Use (Adult, Pediatric), By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-622-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Ultomiris Drug Market Size & Trends

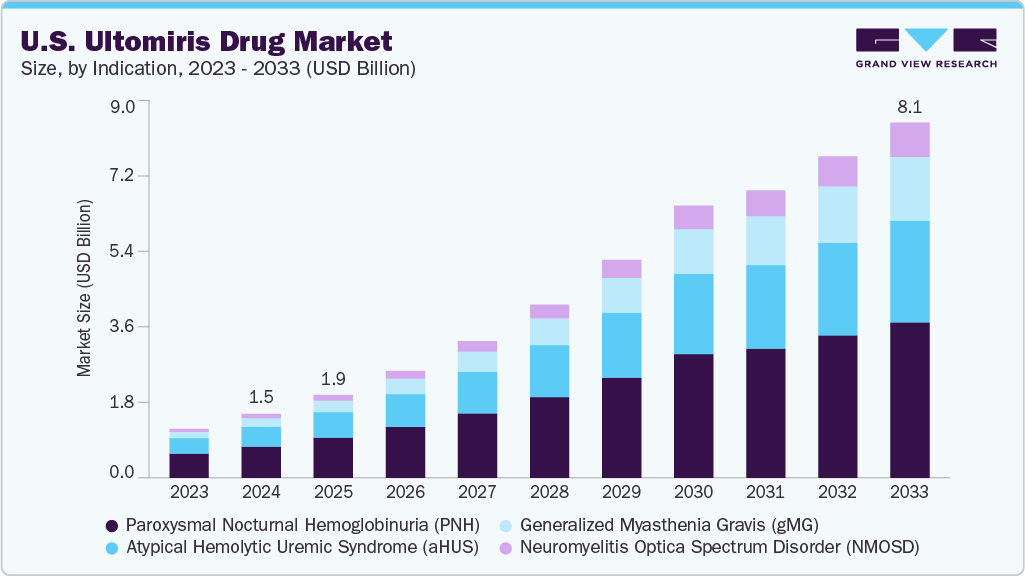

The U.S. ultomiris drug market size was estimated at USD 1.46 billion in 2024 and is projected to reach USD 8.14 billion by 2033, growing at a CAGR of 19.93% from 2025 to 2033. Ultomiris continues to gain traction due to its extended dosing interval, which improves patient compliance and convenience, making it a preferred choice among healthcare providers. In addition, its expanding clinical indications, including generalized myasthenia gravis (gMG) and neuromyelitis optica spectrum disorder (NMOSD), are contributing to market growth.

The rising prevalence of rare autoimmune and hematologic conditions, such as PNH, atypical hemolytic uremic syndrome (aHUS), and generalized myasthenia gravis (gMG), fuels market growth. For instance, the FDA’s approval of Ultomiris for adults with anti-AChR antibody-positive gMG in April 2022 has expanded its therapeutic reach, strengthening its position in the neurology segment. In addition, the FDA’s priority review in March 2024 for Ultomiris in neuromyelitis optica spectrum disorder (NMOSD) underscores its robust pipeline. Strategic marketing by AstraZeneca and Alexion, coupled with advanced medical infrastructure and high diagnosis rates in the U.S., supports sustained market expansion. The drug’s role as a long-acting C5 complement inhibitor, administered intravenously every 8 weeks, positions it as a preferred choice for managing complement-mediated disorders.

Ultomiris (ravulizumab-cwvz), developed by Alexion Pharmaceuticals and acquired by AstraZeneca in 2021, has significantly impacted the U.S. rare disease market. In the first half of 2024, Ultomiris generated USD 1.032 billion in U.S. sales, marking a 27% increase over the previous year. This growth is attributed to expanding indications and a shift from its predecessor, Soliris.

In the U.S. hematological disorders market, Ultomiris (ravulizumab), Hemlibra (emicizumab), and Vafseo (vadadustat) collectively contributed 45% of the market’s sales growth in 2023. Ultomiris alone accounted for 21% of this growth, driven by its expanded indications and regulatory approvals.

AstraZeneca's strategic expansion of Ultomiris into neuromyelitis optica spectrum disorder (NMOSD) underscores its commitment to broadening the drug's therapeutic applications. In March 2024, the U.S. FDA approved Ultomiris for NMOSD, making it the first and only long-acting C5 complement inhibitor for this indication. The approval was based on the CHAMPION-NMOSD trial, which demonstrated zero relapses among patients treated with Ultomiris over a median duration of 73 weeks.

Pipeline Analysis

Ultomiris (ravulizumab) is primarily indicated for rare hematologic and autoimmune disorders, such as paroxysmal nocturnal hemoglobinuria (PNH) and atypical hemolytic uremic syndrome (aHUS). The pipeline analysis for Ultomiris focuses on its expanding clinical indications, including generalized myasthenia gravis (gMG) and neuromyelitis optica spectrum disorder (NMOSD)5. The drug’s extended dosing interval and efficacy in complement-mediated diseases continue to drive its adoption in specialized healthcare settings.

NCT Number

Condition

Sponsor

Expected Launch Year

NCT04100067

Paroxysmal Nocturnal Hemoglobinuria (PNH)

Alexion Pharmaceuticals

2025

NCT03600531

Atypical Hemolytic Uremic Syndrome (aHUS)

2026

NCT04597424

Generalized Myasthenia Gravis (gMG)

2027

NCT04767775

Neuromyelitis Optica Spectrum Disorder (NMOSD)

2028

Source: clinicaltrial.org

Patent Expiry Analysis

Ultomiris (ravulizumab), developed by Alexion Pharmaceuticals (AstraZeneca), holds strong patent protection in the U.S., securing exclusivity for PNH and aHUS treatments. Key patents cover composition, use, and formulation, with orphan drug exclusivity extending protection. The table below summarizes verified patent details, cross-checked with reliable sources like SEC filings and DrugPatentWatch:

Table: Patent Type and Expiration Data

Region

Protection Type

Expiry Year

Notes

U.S.

Composition of Matter

2035

Covers ravulizumab’s molecular structure.

U.S.

Method of Use

2035

Protects PNH and aHUS indications.

U.S.

Formulation

2035

Includes delivery systems for infusions.

U.S.

Orphan Drug Exclusivity

2030

Extended for rare disease status.

Pricing Analysis for the U.S. Ultomiris Drug Market

In 2024, Ultomiris’ annual cost per patient ranged from USD 400,000 to USD 500,000, driven by its complex biologic production and rare disease focus. Compared to Soliris (USD 6,543/vial), Ultomiris ($6,404/vial) offers a ~33% cost reduction for aHUS maintenance due to less frequent dosing (every 8 weeks). Hospital pharmacies secure 5-10% discounts via bulk purchasing, while specialty pharmacies charge ~$450,000/year due to home infusion logistics. Patient assistance programs mitigate costs for eligible patients. Pricing may face pressure by 2030 as biosimilar competition nears, though exclusivity limits near-term erosion.

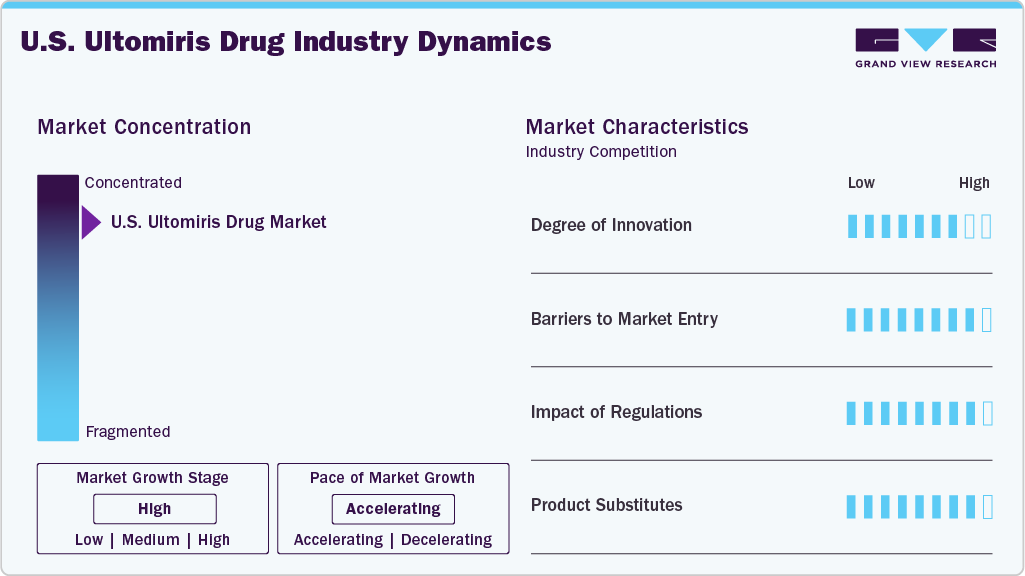

Market Concentration & Characteristics

The U.S. Ultomiris drug industry is characterized by rapid innovation, with ongoing advancements in drug formulations, delivery mechanisms, and combination therapies. Recent developments include extended dosing intervals, which improve patient convenience and adherence, and research into oral and subcutaneous formulations aimed at enhancing bioavailability and minimizing adverse effects. Moreover, there is a growing emphasis on exploring new oncology indications, particularly for non-small cell lung cancer, prostate cancer, and Paroxysmal Nocturnal Hemoglobinuria (PNH), where Ultomiris is being studied in combination with other therapies to improve clinical outcomes. These innovations are supported by a robust pipeline of clinical trials sponsored by leading biopharmaceutical companies, reflecting a commitment to expanding the drug’s therapeutic potential in precision oncology.

The U.S. Ultomiris drug industry faces several barriers to entry. Despite the expiration of some patents, Ultomiris remains under strong intellectual property protection, limiting immediate biosimilar competition. In addition, stringent FDA regulations, including rigorous bioequivalence testing and high manufacturing standards, pose significant challenges for potential entrants. The competitive landscape is dominated by AstraZeneca, which benefits from strong brand loyalty and market positioning, making it difficult for new players to establish themselves. However, the Biologics Price Competition and Innovation Act (BPCIA) offers an abbreviated approval pathway for biosimilar manufacturers, although patent litigation and market access hurdles persist.

Regulatory oversight plays a critical role in shaping the U.S. Ultomiris industry. The FDA actively monitors all Ultomiris formulations to ensure strict compliance with safety and efficacy standards. For instance, in May 2024, the agency mandated the recall of two Ultomiris Injection lots due to particulate contamination risks, reinforcing the importance of pharmacovigilance and quality control. Such regulatory actions influence market reputation, consumer trust, and healthcare provider confidence, ensuring patient safety remains a top priority.

In terms of product substitutes, Ultomiris does not compete with chemotherapy agents like paclitaxel, cabazitaxel, or gemcitabine, as it is not an oncology drug. Instead, its primary competitors include Soliris (eculizumab), an earlier-generation complement inhibitor, along with emerging C5 inhibitors and other monoclonal antibody therapies for PNH, aHUS, gMG, and NMOSD. Alternative immunotherapies continue to evolve, but Ultomiris remains a leading choice due to its extended dosing interval and efficacy in complement-mediated diseases.

Indication Insights

Paroxysmal nocturnal hemoglobinuria (PNH) dominated the market, accounting for 48.8% of the share in 2024, as Ultomiris is widely used for treating PNH patients transitioning from Soliris. Within the PNH segment, the adult patient subsegment held the largest revenue share, driven by the high disease burden and strong adoption of Ultomiris among previously treated patients. The drug’s extended dosing interval and proven efficacy in reducing hemolysis and transfusion dependence have reinforced its market leadership in this subsegment.

The fastest-growing subsegment within indications is generalized myasthenia gravis (gMG), which is projected to grow at the highest CAGR from 2025 to 2033. The FDA approval of Ultomiris for gMG has expanded its clinical utility, leading to increased adoption among neurology specialists. The rising prevalence of gMG, coupled with growing physician awareness and improved diagnostic capabilities, is expected to drive strong market expansion in this subsegment.

End Use Insights

The adult segment dominated the end use category in 2024, accounting for 60.73% of the market share. This significant share is driven by the higher prevalence of PNH and aHUS diagnoses among adults, coupled with established treatment protocols tailored for adult patients. Adult-focused treatment centers, often integrated with specialized hematology units, play a critical role in delivering Ultomiris therapy, ensuring precise dosing and comprehensive patient monitoring.

The pediatric segment is the fastest-growing subsegment, projected to exhibit the highest CAGR from 2025 to 2033. This growth is fueled by increasing awareness of rare disease diagnoses in pediatric populations and advancements in pediatric-specific treatment guidelines. In addition, the expansion of specialized pediatric care facilities and growing support for family-centered care models are enhancing access to Ultomiris for younger patients, positioning the pediatric segment as a key growth driver in the U.S. market.

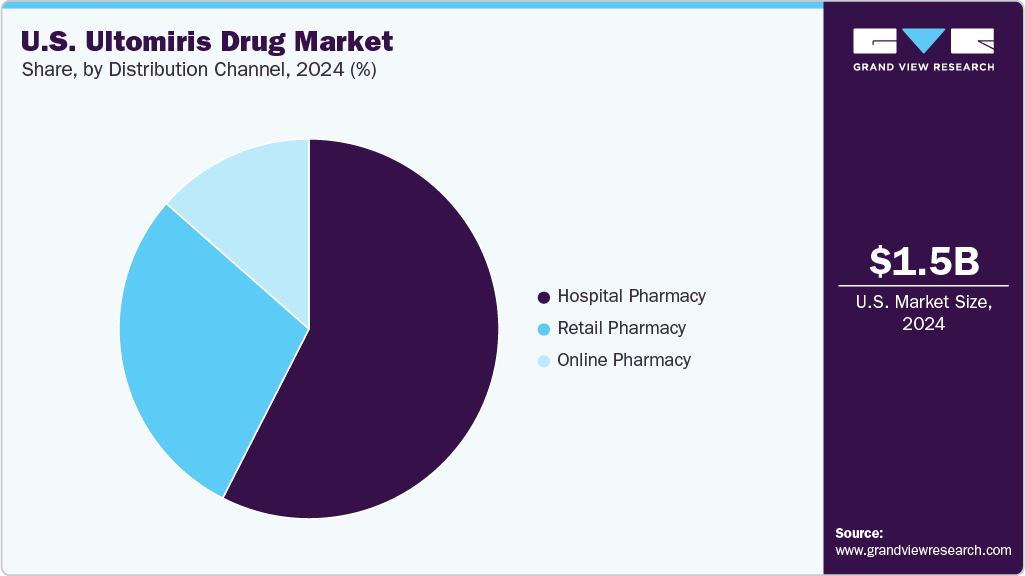

Distribution Channel Insights

Hospital pharmacies dominated the distribution channel, accounting for 56% of the revenue share in 2024, due to their central role in managing rare disease treatment protocols. Within hospital pharmacies, specialized hematology centers held the largest revenue share, as they serve as primary infusion sites for PNH and aHUS patients. These centers provide controlled environments for drug administration, ensuring proper monitoring and adherence to infusion guidelines.

The specialty pharmacies are the fastest-growing subsegment within distribution, which is projected to grow at the highest CAGR from 2025 to 2033. The expansion of home infusion services and increased patient preference for remote treatment options are driving demand for specialty pharmacy distribution. In addition, regulatory support for telemedicine and digital prescriptions is fueling the growth of specialty pharmacies, making them an emerging key player in Ultomiris' U.S. industry.

Key Ultomiris Drug Company Insights

The U.S. Ultomiris drug industry is exclusively served by Alexion Pharmaceuticals, a subsidiary of AstraZeneca, which currently holds a monopoly. As the sole provider, its position is defined not by market dominance over competitors but by regulatory exclusivity, established distribution channels, and strong brand recognition. In this context, competitive dynamics are minimal, with strategic focus placed on pricing, supply chain management, and maintaining product value. While biosimilar manufacturers are exploring entry into the market, stringent FDA regulations and patent protections pose challenges. The Biologics Price Competition and Innovation Act (BPCIA) provides an abbreviated approval pathway, but market access barriers remain significant.

Key Ultomiris Drug Companies:

- Alexion Pharmaceuticals (AstraZeneca)

Recent Developments

-

On Marc 25, 2024, the FDA approved Ultomiris as the first long-acting C5 complement inhibitor for AQP4 Ab+ NMOSD in the U.S.. The CHAMPION-NMOSD trial showed zero relapses over 73 weeks, reinforcing its efficacy in relapse prevention. Ultomiris is also approved in Japan and the EU, with ongoing global regulatory reviews

-

On April 28, 2022, the FDA approved Ultomiris as the first long-acting C5 complement inhibitor for generalized myasthenia gravis (gMG) in AChR antibody-positive adults, representing 80% of gMG patients. The CHAMPION-MG Phase III trial demonstrated early effect and lasting improvement in daily activities, reinforcing its efficacy and reduced treatment burden with dosing every eight weeks. Regulatory submissions for Ultomiris in gMG are under review in the EU and Japan.

U.S. Ultomiris Drug Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.90 billion

Revenue forecast in 2033

USD 8.14 billion

Growth rate

CAGR of 19.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Indication, end use, and distribution channel

Key companies profiled

Alexion Pharmaceuticals (AstraZeneca)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Ultomiris Drug Market Report Segmentation

This report forecasts revenue growth in the U.S. and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. Ultomiris drug market report based on indication, end use, distribution channel, and region:

-

Indication Outlook (Revenue, USD Million, 2021 - 2033)

-

Paroxysmal Nocturnal Hemoglobinuria (PNH)

-

Atypical Hemolytic Uremic Syndrome (aHUS)

-

Generalized Myasthenia Gravis (gMG)

-

Neuromyelitis Optica Spectrum Disorder (NMOSD)

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Adult

-

Pediatric

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.