- Home

- »

- Animal Health

- »

-

U.S. Veterinary Artificial Insemination Market Size Report, 2030GVR Report cover

![U.S. Veterinary Artificial Insemination Market Size, Share & Trends Report]()

U.S. Veterinary Artificial Insemination Market (2025 - 2030) Size, Share & Trends Analysis Report By Solutions (Equipment & Consumables, Semen, Services), By Animal Type, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-566-2

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

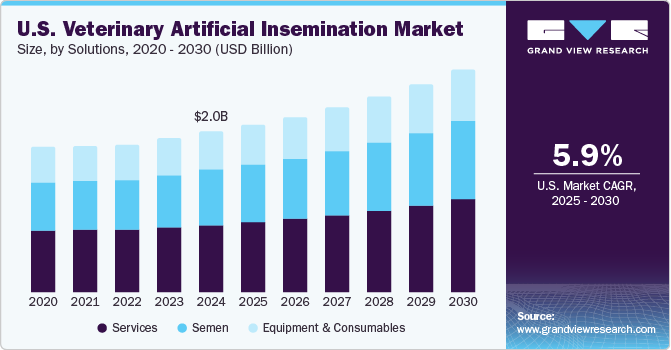

The U.S. veterinary artificial insemination market size was estimated at USD 2.00 billion in 2024 and is projected to grow at a CAGR of 5.9% from 2025 to 2030. The market is largely driven by the rising demand for high-yield dairy production (e.g., Holstein cows bred for superior milk output), advancements in cryopreservation technologies, and increased focus on genetic improvement and disease resistance in livestock. Government-backed research further supports innovation and adoption. For instance, in August 2024, At University Park, Pennsylvania, researchers from Penn State's College of Agricultural Sciences received a $650,000 grant from the USDA's National Institute of Food and Agriculture to study cattle reproduction, particularly focusing on the genetic mechanisms behind testis development and sperm production. This research could significantly enhance the efficiency and reliability of AI in the cattle industry.

AI and cryopreservation have revolutionized livestock breeding, particularly in the dairy industry. According to the USDA, Artificial insemination (AI) has been utilized for over two centuries to produce offspring from genetically superior males. Advances in cryopreservation have made semen storage and transportation more practical, expanding AI's accessibility among livestock producers. Similar progress in embryo freezing has enabled the international trade of high-quality genetics. Bull semen, in particular, freezes and stores well, making AI especially effective in the dairy industry, where over 60% of cows in the U.S. are bred this way.

In contrast, AI use in beef cattle remains under 5% due to the extensive nature of range-based management. The advancements in cryopreservation have significantly boosted AI use in the U.S. dairy sector, making it a cost-effective and reliable breeding method. However, limited application in beef cattle and other species restricts full market growth. Ongoing research supported by NIFA aims to broaden the usability of AI across species, which could unlock substantial future market potential and enhance genetic improvement efforts industry-wide.

The expansion of mobile veterinary artificial insemination (AI) service stations significantly enhances the U.S. veterinary AI market by improving accessibility and efficiency, particularly in rural and underserved regions. These mobile units deliver essential services directly to farms, including semen delivery, nitrogen supply for cryopreservation, and on-site breeding assistance. This approach reduces the need for animal transport and minimizes stress, thereby improving reproductive outcomes. For instance, in Idaho-a leading dairy-producing state-mobile AI services have become integral to herd management, contributing to the state's high milk and cheese production levels. The convenience and effectiveness of these mobile services are driving increased adoption of AI technologies across the livestock industry.

Evolution of Veterinary Artificial Insemination In The U.S. Over Time

Time Period

Milestone/Advancement

Description & Impact

Early 1900s

Introduction of AI

Initial experiments in AI began in U.S. livestock, primarily in universities.

1937

First AI Cooperative (New Jersey)

Marked the beginning of organized AI use in dairy cattle.

1940s-1950s

Cryopreservation with Liquid Nitrogen

Revolutionized semen storage and global distribution.

1960s-1970s

National AI Infrastructure & Genetic Selection

AI adoption spread nationally; genetic traits like milk yield became a selection focus.

1980s

Computerized Recordkeeping & AI Scheduling

Improved reproductive management and herd tracking.

1990s

Sexed Semen Technology Development

Enabled control over calf gender, increasing female offspring for dairy.

2000s

Mobile AI Services & On-Farm Breeding Support

Brought AI directly to remote farms, reduced reliance on traditional veterinary clinics.

2010s

Genomic Selection & Precision Breeding

Allowed accurate prediction of genetic potential; improved sire selection.

2020s-Present

AI Integration with Digital Tools & Expansion to More Species

Use of apps, AI robots, and genomic tools; increasing AI use in beef, goats, and swine.

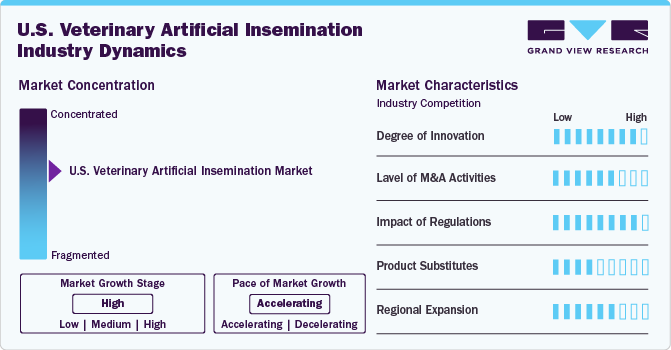

Market Concentration & Characteristics

The U.S. veterinary artificial insemination market is moderately concentrated, with major players like Genex, Select Sires, ABS Global, and STgenetics dominating the landscape. These companies control a significant share of the AI semen supply, genetic services, and on-farm support. Smaller regional providers exist but face challenges competing on technology, distribution, and genetic resources. This concentration drives high service quality but limits price competition.

The U.S. veterinary artificial insemination (AI) market is experiencing significant innovation, driven by advancements in reproductive technologies and strategic industry collaborations. Companies like IMV Technologies have introduced tools such as BovIntel, an ultrasound software that enhances fertility assessment in cattle, improving pregnancy rates and herd management efficiency. Additionally, Genus plc has developed sexed semen solutions that allow for gender-specific genetic improvements in livestock populations. Strategic partnerships, such as the collaboration between Cogent and AB Europe, have introduced sexed semen services in sheep breeding, enabling better control over offspring gender. These innovations are enhancing breeding efficiency, genetic selection, and overall productivity in the livestock industry.

Within the market, a moderate level of mergers and acquisitions activity exists, indicative of ongoing consolidation and strategic partnerships among industry players. For example, in January 2025, IMV Technologies acquired Conception Ro-Main Inc., a Quebec-based leader in AI-driven swine production technology, to strengthen its farm animal division. The deal, expected to close in Q1 2025, will bring Ro-Main's advanced IoT and AI solutions into IMV’s global portfolio, supporting innovation in sustainable pig farming.

Regulations significantly influence the U.S. veterinary artificial insemination (AI) market by ensuring safety, promoting ethical practices, and fostering technological advancements. The FDA's approval of cloning techniques and the use of semen from genetically engineered animals has expanded breeding options, enhancing genetic diversity and productivity in livestock. Additionally, USDA's National Organic Program enforces standards that impact AI practices, such as restrictions on induced molting and confinement, affecting breeding methods in organic livestock. These regulations safeguard animal welfare and public health and drive innovation and efficiency in AI technologies, thereby supporting the growth and competitiveness of the U.S. veterinary AI market.

In the U.S. veterinary artificial insemination (AI) market, natural service (NS) remains a viable alternative to AI, particularly in beef cattle operations. NS involves using bulls for mating, offering simplicity and lower upfront costs, making it appealing for producers with limited resources or those in extensive grazing systems. However, AI provides advantages in genetic improvement, disease control, and herd management efficiency. Economic analyses indicate that AI can be more cost-effective than NS, especially when considering factors like genetic merit premiums and reduced bull maintenance costs. For instance, a study found that AI was less expensive than using bulls 60% of the time, with net expenses of $67.80 per cow per year for AI compared to $100.49 for NS.

Regional expansion in the U.S. veterinary artificial insemination (AI) market is driven by increasing demand for advanced reproductive technologies in livestock management. For instance, specialized mobile AI services in Idaho support the state's dairy industry by delivering bull semen and breeding supplies directly to rural dairies, enhancing breeding efficiency and herd health. Similarly, Oklahoma State University's CVM Ranch is a research hub for equine and cattle reproductive health, advancing AI and embryo transfer techniques. These regional initiatives contribute to the broader adoption and optimization of AI practices across various states, reflecting a growing trend toward localized, specialized services in the veterinary AI sector.

Solutions Insights

The services segment dominated the market with a share of 41.87% in 2024. These include AI service execution, reproduction management, semen evaluation & analysis, genetic consultations, and training & education. The semen segment, on the other hand, is anticipated to grow the fastest at a rate of 6.98% in the coming years.

The normal semen segment accounted for the largest revenue share in 2024, while sexed semen is projected to grow at the fastest CAGR during the forecast period. The need to boost livestock productivity to meet the rising demand for animal protein, the economic benefits of selectively breeding high-yielding dairy and beef cattle, and technological advancements such as sexed semen that allow producers to predetermine offspring gender for more efficient herd management. For example, sexed semen now holds over 60% of the market share because it enables dairy farmers to reliably produce more female calves, which are essential for milk production, thereby increasing economic returns and supporting herd expansion. Additionally, leading companies like STgenetics have developed sex-sorted semen with up to 93% female purity, further driving adoption among U.S. producers seeking to maximize productivity and profitability. This surge is supported by favorable government policies, growing awareness of AI technologies, and the need to reduce disease transmission through controlled breeding.

Distribution Channel Insights

The private segment accounted for the largest revenue share of the market in 2024 and is also projected to grow the fastest over the forecast period. This dominance is attributed to the private sector's ability to offer specialized, efficient, and technologically advanced AI services personalized to the specific needs of breeders and livestock owners. Private companies provide services such as fertility testing, genetic counseling, semen collection, and regulatory compliance, making them more appealing to clients seeking precise genetic traits and improved reproductive outcomes. In contrast, public sector contributions are more limited and often focus on broader, government-sponsored programs.

The public distribution channel in the U.S. veterinary artificial insemination (AI) market, while smaller than the private sector, is experiencing steady growth due to increased government involvement in animal breeding programs and rural development initiatives. Public institutions such as the USDA, land-grant universities (e.g., Oklahoma State University, Penn State), and cooperative extension services support AI through research, education, and subsidized breeding programs, especially in underserved or remote areas. This channel plays a critical role in enhancing accessibility to AI technologies for small and medium-scale producers, promoting genetic improvement and livestock productivity.

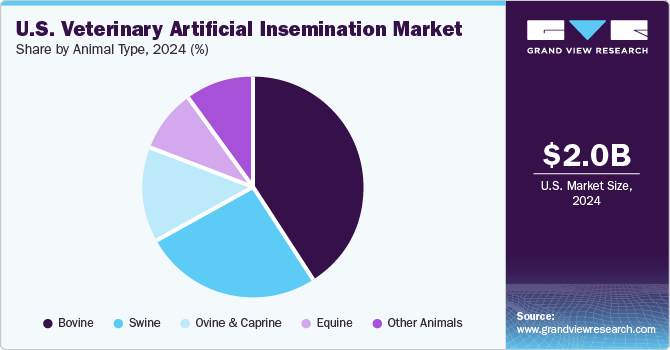

Animal Type Insights

In 2024, the bovine segment dominates the U.S. veterinary artificial insemination (AI) market due to the large-scale use of AI in the dairy and beef cattle industries, which is essential for improving productivity and genetic quality. More than 60% of dairy cows in the U.S. are bred using AI, facilitating the selection of superior genetics for milk production, disease resistance, and overall herd health. Companies like Select Sires and Genus PLC provide advanced semen and breeding services that enhance these traits. The widespread adoption of AI in cattle farming, particularly in large-scale operations, ensures higher genetic potential and greater herd management efficiency, making the bovine segment the largest within the market.

The swine segment is estimated to grow the fastest at a CAGR of 7.4%. This growth is driven by rising pork consumption, advancements in reproductive technologies, and the adoption of precision breeding techniques. Companies like Shipley Swine Genetics and Semen Cardona S.L. are leading the way by offering high-quality semen and comprehensive breeding programs, enhancing genetic traits such as meat quality and disease resistance. Additionally, the integration of automation and AI-powered analytics in breeding operations is improving efficiency and reducing costs, making AI more accessible to producers. These factors collectively contribute to the rapid expansion of the swine AI segment in the U.S. market.

Key U.S. Veterinary Artificial Insemination Company Insights

The U.S. veterinary artificial insemination (AI) market is characterized by moderate concentration, with a few key players holding significant market shares. Major companies such as Genus PLC, URUS Group, CRV, SEMEX, IMV Technologies, and Select Sires Inc. dominate the market, using extensive distribution networks, advanced reproductive technologies, and comprehensive service offerings. These companies focus on expanding manufacturing facilities, investing in R&D, and integrating operations across the value chain to maintain competitive effectiveness and meet increasing demand.

Key U.S. Veterinary Artificial Insemination Companies:

- Genus

- URUS Group LP

- CRV

- SEMEX

- IMV Technologies

- Select Sires Inc.

- Swine Genetics International

- Shipley Swine Genetics

- Stallion AI Services Ltd

- STgenetics

Recent Developments

-

In January 2025, IMV Technologies announced that Conception Ro-Main Inc., a Canadian leader in high-tech swine production solutions, will join its Farm Animal business. The acquisition, expected to close in Q1 2025, will strengthen IMV’s global portfolio with Ro-Main’s AI-powered technologies and IoT solutions, enhancing innovation in sustainable pig farming.

-

In February 2024, HKScan Sweden partnered with PIC to develop its Hampshire pig breed by gaining access to PIC’s expertise and cutting-edge technology.

-

In January 2023, BullWise- a breeding organization in Ireland and CRV partnered to distribute CRV genetic solutions in Ireland & Northern Ireland, offering farmers access to quality semen from top bulls. With this, BullWIse became a key distributor for CRV in the region.

U.S. Veterinary Artificial Insemination Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.08 billion

Revenue forecast in 2030

USD 2.77 billion

Growth rate

CAGR of 5.9% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solutions, animal type, distribution channel

Key companies profiled

Genus; URUS Group LP; CRV; SEMEX; IMV Technologies; Select Sires Inc.; Swine Genetics International; Shipley Swine Genetics; Stallion AI Services Ltd; STgenetics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Veterinary Artificial Insemination Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. veterinary artificial insemination market report based on solutions, animal type, and distribution channel:

-

Solutions Outlook (Revenue, USD Million, 2018 - 2030)

-

Equipment & Consumables

-

Semen

-

Normal

-

Sexed

-

Services

-

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Bovine

-

Swine

-

Ovine & Caprine

-

Equine

-

Other Animals

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Private

-

Public

-

Frequently Asked Questions About This Report

b. The U.S. veterinary artificial insemination market size was estimated at USD 2.0 billion in 2024 and is expected to reach USD 2.08 billion in 2025.

b. The U.S. veterinary artificial insemination market is expected to grow at a compound annual growth rate of 5.89% from 2025 to 2030 to reach USD 2.77 billion by 2030.

b. In 2024, the bovine segment dominates the U.S. veterinary artificial insemination (AI) market due to the large-scale use of AI in the dairy and beef cattle industries, which is essential for improving productivity and genetic quality. More than 60% of dairy cows in the U.S. are bred using AI, facilitating the selection of superior genetics for milk production, disease resistance, and overall herd health. Companies like Select Sires and Genus PLC provide advanced semen and breeding services that enhance these traits.

b. Some key players operating in the U.S. veterinary artificial insemination market include Genus, URUS Group LP, CRV, SEMEX, IMV Technologies, Select Sires Inc., Swine Genetics International, Shipley Swine Genetics, Stallion AI Services Ltd, STgenetics

b. Key factors driving the U.S. veterinary artificial insemination market include rising demand for high-yield dairy production (e.g., Holstein cows bred for superior milk output), advancements in cryopreservation technologies, and increased focus on genetic improvement and disease resistance in livestock. Government-backed research further supports innovation and adoption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.