- Home

- »

- Animal Health

- »

-

U.S. Veterinary Eye Care Services Market Size Report, 2033GVR Report cover

![U.S. Veterinary Eye Care Services Market Size, Share & Trends Report]()

U.S. Veterinary Eye Care Services Market (2025 - 2033) Size, Share & Trends Analysis Report By Animal, By Service (Consultation, Diagnosis, Treatment), By Indication, By Service Provider, And Segment Forecasts

- Report ID: GVR-4-68040-765-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Veterinary Eye Care Services Market Summary

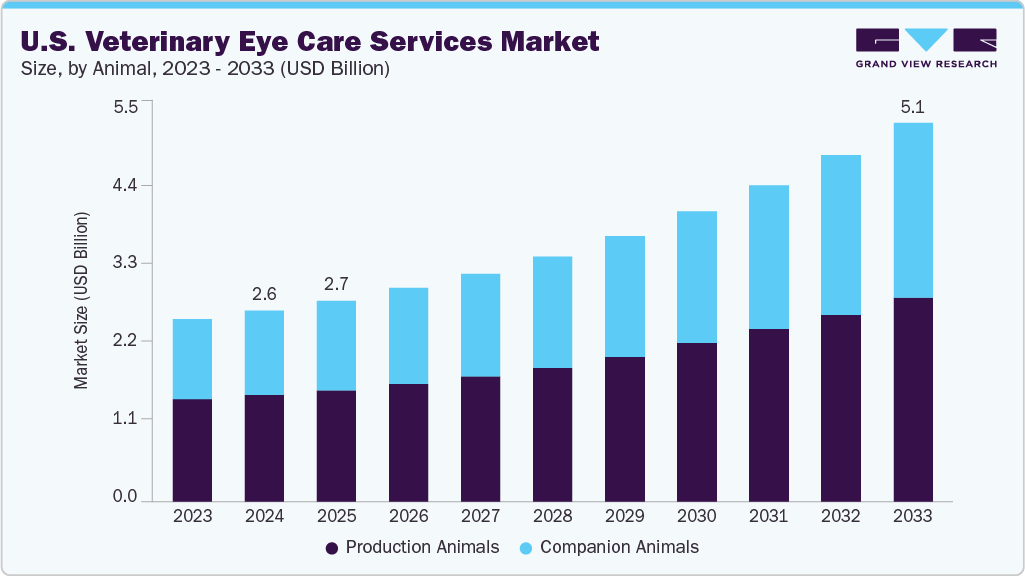

The U.S. veterinary eye care services market size was estimated at USD 2.59 billion in 2024 and is projected to reach USD 5.12 billion by 2033, growing at a CAGR of 8.23% from 2025 to 2033. The market is propelled by rising pet ownership and humanization of pets, increasing incidence of eye disorders in pets, and the growth of pet insurance and financial support for specialized care.

Key Market Trends & Insights

- By animal, the production animals segment led the market with the largest revenue share of 55.68% in 2024

- By service, the treatment segment accounted for the largest market revenue share in 2024.

- By indication, the uveitis segment accounted for the largest market revenue share in 2024.

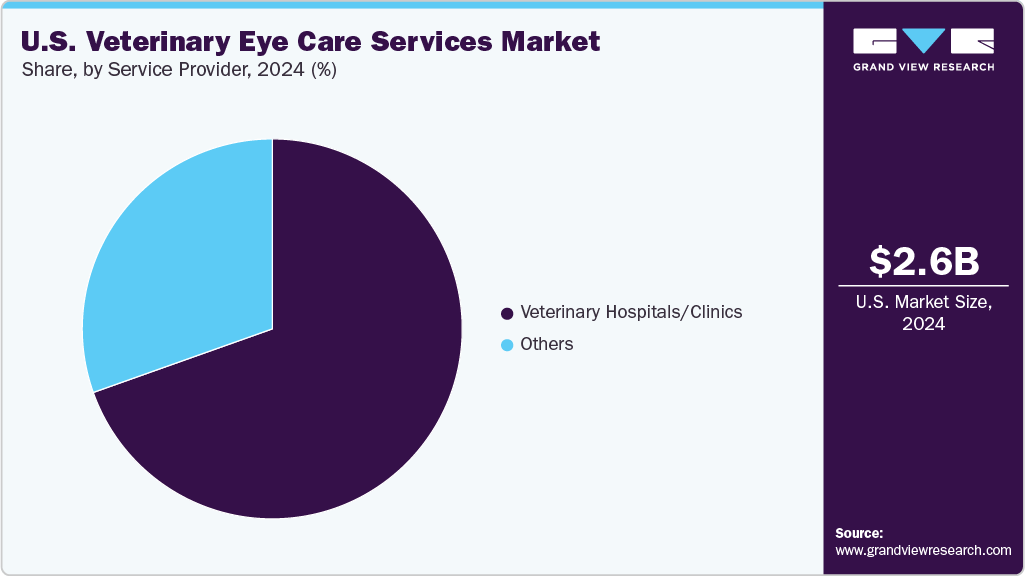

- By service provider, the veterinary hospitals/clinics segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.59 Billion

- 2033 Projected Market Size: USD 5.12 Billion

- CAGR (2025-2033): 8.23%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The growing number of pets in the U.S. increases demand for specialized healthcare services, including ophthalmology. According to the American Veterinary Medical Association report of 2024, the total number of U.S. households owning dogs is 59.8 million, and that of cats is 42.2 million. As more households adopt dogs and cats, veterinarians encounter a higher incidence of eye-related conditions such as cataracts, glaucoma, and retinal diseases. This surge in cases directly drives the need for advanced diagnostic and treatment facilities. Hence, veterinary clinics and specialty centers are expanding ophthalmology services, investing in equipment like slit lamps, tonometers, and surgical lasers.

Furthermore, the prevalence of ocular diseases in pets, including glaucoma, cataracts, and retinal degeneration, has risen due to aging pet populations and genetic predispositions in certain breeds. Cataracts and lenticular sclerosis are among the most common ocular conditions in dogs, particularly as they age. According to a report of Cornell University College of Veterinary Medicine, approximately 75-80% of diabetic dogs develop cataracts within the first year of diagnosis. It progresses rapidly and frequently leads to severe lens-induced uveitis, which can cause secondary glaucoma.

Similarly, according to the VCA animal hospitals report, age-related eye disorders are also prevalent, in which 50% of dogs above 9 years develop cataracts or lenticular sclerosis, with the incidence rising to nearly 100% in dogs above 13 years. Higher disease incidence creates a direct need for diagnostic, surgical, and treatment services, increasing patient volume for veterinary eye care providers. These rising incidences of ocular diseases compel clinics to expand ophthalmology services, adopt advanced treatment technologies, and train specialized staff.

The increasing adoption of pet insurance in the U.S. enables owners to afford specialized veterinary services, including ophthalmology. The financial effect of maintaining a pet's eye health is reflected in the average cost of medical treatment for eye disorders, which is estimated to be USD 260 for cats and approximately USD 300 for dogs per veterinarian visit. For chronic eye problems, policies frequently cover ongoing treatments, surgery, and diagnostics. Pet owners are more inclined to seek prompt, advanced eye care for their animals, which increases patient volume and lowers budgetary obstacles.

In addition, it motivates veterinary hospitals to hire specialists, upgrade their ophthalmology departments, and make investments in innovative machinery. The availability of insurance coverage directly supports the uptake of complex eye procedures, fueling revenue growth and accelerating the overall expansion of the U.S. veterinary eye care services industry.

U.S. Pet Ownership Statistics

Statistic

Dogs

Cats

Percentage of U.S. households owning

45.5

32.1

Total number of U.S. households owning

59.8M

42.2M

Average number per pet-owning household

1.5 M

1.8 M

Total number in the U.S.

89.7M

73.8M

Average spending on veterinary care per household per year

USD 580

USD 433

Source: American Veterinary Medical Association, AVMA.

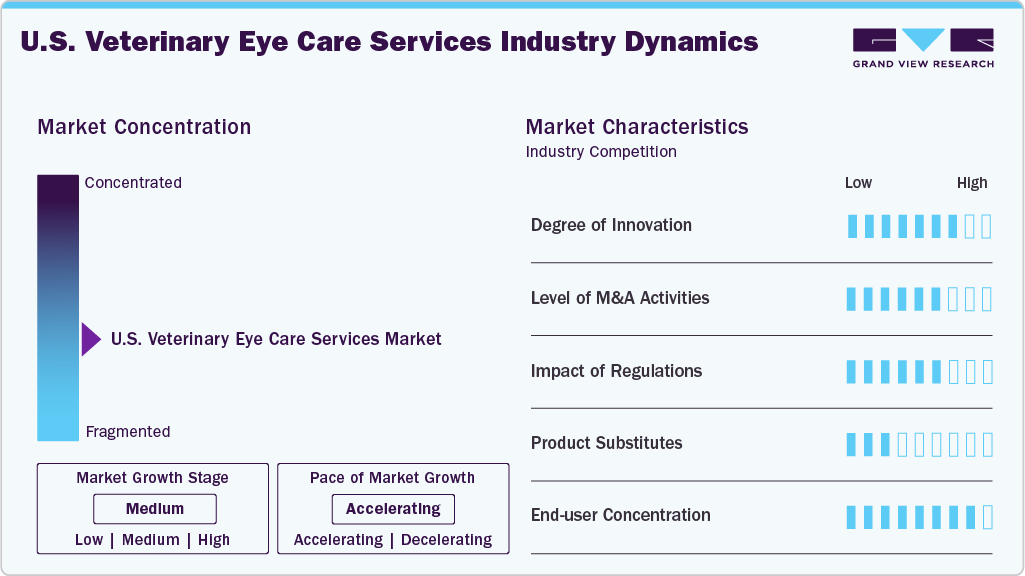

Market Concentration & Characteristics

The U.S. veterinary eye care services industry shows moderate concentration, and the pace is accelerating, dominated by specialty hospitals, academic veterinary centers, and multi-location providers like VCA and BluePearl. While independent ophthalmology practices remain significant, consolidation and corporate investments are steadily reshaping the landscape, enhancing service capacity, technology adoption, and referral networks across the country.

The implementation of advanced imaging methods, laser-based treatments, and AI-powered diagnostic tools that enhance accuracy and clinical results is contributing to the rapid growth of veterinary ophthalmology in the US. Ophthalmology is also seeing an increase in tele-ophthalmology, which increases access to specialized care and minimally invasive surgical techniques. So as to facilitate these healthcare advancements and promote efficiency, companies are additionally making investments in digital infrastructure.

For example, in January 2025, Petvisor launched Petvisor Hub, a centralized, AI-powered platform that integrates marketing, phone systems, appointment scheduling, and communication. This enables networks of veterinary medical centers to enhance client engagement, streamline workflows, while offering reliable and higher-quality treatment.

The market is steadily transforming through mergers and acquisitions, led by consolidators like Mars’ BluePearl and NVA expanding specialty care networks. Such activity improves access to capital, technology, and professional expertise, enabling growth in ophthalmology services. Independent practices face rising acquisition interest, fueling market consolidation and creating larger, multi-specialty veterinary service providers nationwide.

Regulatory frameworks in the U.S., such as FDA oversight of veterinary ophthalmic drugs and state-level veterinary practice acts, directly affect eye care services. Prescription guidelines, controlled drug usage, and facility standards ensure quality and safety. Compliance increases operational costs but enhances trust, positioning regulatory adherence as a key driver of sustainable growth in ophthalmology services.

Substitutes for veterinary eye care services are limited, as general veterinarians often lack the specialized tools and expertise for advanced ophthalmology. Over-the-counter eye drops or online advice may appeal to cost-conscious owners, but they cannot replace accurate diagnosis or surgical intervention. Hence, substitutes remain weak, reinforcing the value of specialist-led eye care.

End users of veterinary eye care in the U.S. are primarily companion animal owners, with dogs representing the largest share of companion animals due to a higher incidence of ocular disorders. Cats and equine patients form smaller but important segments. Concentration is rising among urban and insured pet owners, who demonstrate stronger demand for specialty and preventive ophthalmic services.

Animal Insights

The production animals segment led the market with the largest revenue share of 55.68% in 2024, owing to the economic importance of livestock health and productivity. Eye conditions such as infectious bovine keratoconjunctivitis (pinkeye) in cattle, ocular squamous cell carcinoma, and other vision-related disorders can significantly reduce weight gain, milk yield, and overall animal performance. Early detection and treatment of these conditions are critical to minimizing economic losses for farmers. Veterinary ophthalmology services play a vital role in ensuring herd health, preventing disease spread, and improving welfare standards.

The companion animals segment is anticipated to grow at the fastest CAGR over the forecast period, driven by rising pet ownership, increasing awareness of ocular health, and the humanization of pets. The prevalence of cataracts, glaucoma, and retinal problems in dogs and cats increases the demand for expert ophthalmic care. Treatments are becoming more affordable due to developments in surgery, diagnostics, and pet insurance. In addition, pet owners are prioritizing advanced eye care due to urbanization and increased disposable income, which is driving the industry's rapid growth and opening up new prospects for veterinary ophthalmology professionals.

Service Insights

The treatment segment accounted for the largest market revenue share in 2024, reflecting the high demand for managing complex ocular conditions in pets and livestock. Common issues such as cataracts, glaucoma, corneal ulcers, and ocular tumors often require advanced interventions, including surgery, laser therapy, or long-term medical management. These procedures are expensive, contributing significantly to market revenues. Rising pet insurance adoption and the willingness of owners to invest in quality care further support this trend. Growing technological advancements improve outcomes, hence treatment services continue to dominate, reinforcing their role as the primary revenue driver in veterinary ophthalmology.

The consultation segment is anticipated to grow at the fastest CAGR during the forecast period, owing to the necessity for early detection of eye disorders and growing knowledge of preventative pet healthcare. Before deciding on advanced therapies, pet owners are increasingly seeking professional guidance for illnesses, including cataracts, glaucoma, and uveitis. Consultations with veterinary ophthalmologists are becoming more convenient and frequent due to the expansion of telehealth and referral networks. Proactive care supported by better clinical outcomes establishes consultations as a vital and fastest-growing segment in veterinary ophthalmology.

Indication Insights

The uveitis segment accounted for the largest market revenue share in 2024, largely due to its prevalence and complex management needs. According to the American College of Veterinary Ophthalmologists, immune-mediated uveitis is the most common cause in dogs and cats, accounting for nearly 75% of cases. This condition often requires ongoing diagnostics, specialized treatments, and long-term follow-up, driving substantial clinical demand and revenue. If untreated, uveitis can lead to glaucoma, cataracts, or even blindness, prompting pet owners to seek immediate and continuous care. Its chronic and recurrent nature firmly positions uveitis as the top revenue contributor in ophthalmology.

The conjunctivitis segment is anticipated to grow at the fastest CAGR over the forecast period, propelled by its high incidence in both dogs and cats and the increasing demand for timely treatment. It is caused by infections, allergies, or environmental irritants, and conjunctivitis leads to frequent veterinary visits and repeat consultations, fueling revenue growth. Rising awareness among pet owners about early diagnosis and treatment, combined with the availability of advanced diagnostic tools, is accelerating demand for professional eye care.

Service Provider Insights

The veterinary hospitals and clinics segment accounted for the largest market revenue share in 2024, as they serve as the primary centers for diagnosis, treatment, and ongoing management of ocular disorders. They are equipped with advanced diagnostic tools and surgical facilities, and handle a wide spectrum of cases, from routine eye infections to complex conditions like cataracts and glaucoma. Their accessibility, professional expertise, and established referral networks attract a high volume of patients. Moreover, the integration of specialty ophthalmology services within multi-specialty hospitals further boosts revenue as trusted providers of comprehensive pet care, hospitals, and clinics dominate this market.

The other service segment, comprising academic and research institutions along with animal welfare organizations, is anticipated to grow at the second-fastest CAGR during the forecast period. Through clinical research, innovation, specialized training, and referral services for complex situations, academic institutions are essential to the advancement of ophthalmology. Meanwhile, animal welfare groups help by providing inexpensive or subsidized eye care procedures, especially for animals that have been rescued or placed in shelters.

Key U.S. Veterinary Eye Care Services Company Insights

The U.S. veterinary eye care services industry is transformed by leading players such as VCA Animal Hospitals, BluePearl Specialty + Emergency Pet Hospital, Veterinary Eye Institute, and university veterinary teaching hospitals. These providers dominate through advanced ophthalmic expertise, strong referral networks, and expanding specialty services, capturing significant market share nationwide.

For instance, in May 2024, Cornell’s SAVY symposium highlighted emerging AI projects, showcasing potential advancements. AI is rapidly transforming veterinary care, with applications in diagnostic imaging, medical record management, and automated procedures. This integration is set to improve diagnostic accuracy, operational efficiency, and overall market growth in the veterinary sector.

Key U.S. Veterinary Eye Care Services Companies:

- The Animal Medical Center (AMC)

- VCA Animal Hospitals

- The Eye Vet

- Veterinary Eye Institute (VEI)

- Veterinary Vision

- Colorado State University

- Cornell University College of Veterinary Medicine

- BluePearl Holdings LLC

- Veterinary Eye Clinic

- The Animal Eye Institute

Recent Developments

-

In March 2025, MedVet opens a new 24/7 emergency hospital in Frisco, Texas, providing around-the-clock specialty and emergency care, in collaboration with nearby MedVet locations and Veterinary Eye Institute. Strengthening local access to expert veterinary services.

-

In June 2024, the American Association of Equine Practitioners (AAEP) launched XP Experiential, a hands-on wet labs series for equine veterinarians, debuting with ophthalmology training in Ocala, Florida. This series enhances clinical skills and offers RACE-accredited continuing education.

-

In April 2024,ACVO, sponsored by Epicur Pharma, launched the annual National Service Animal Eye Exam Event, offering free board-certified ophthalmology screenings to service and working animals across multiple countries.

U.S. Veterinary Eye Care Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.72 billion

Revenue forecast in 2033

USD 5.12 billion

Growth rate

CAGR of 8.23% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal, service, indication, service provider

Country scope

U.S.

Key companies profiled

The Animal Medical Center (AMC); VCA Animal Hospitals; The Eye Vet; Veterinary Eye Institute (VEI); Veterinary Vision; Colorado State University; Cornell University College of Veterinary Medicine; BluePearl Holdings LLC; Veterinary Eye Clinic; The Animal Eye Institute

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Veterinary Eye Care Services Market Report Segmentation

This report forecasts revenue growth in the U.S. and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. Veterinary eye care services market report based on animal, service, indication, and service provider:

-

Animal Outlook (Revenue, USD Million, 2021 - 2033)

-

Companion Animals

-

Dogs

-

Cats

-

Horses

-

Others

-

-

Production Animals

-

Cattle

-

Poultry

-

Swine

-

Others

-

-

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Consultation

-

Diagnosis

-

In-Vitro Diagnosis

-

In-Vivo Diagnosis

-

-

Treatment

-

Surgery

-

Corneal

-

Cataract

-

Eyelid

-

Other Surgeries

-

-

Others

-

-

-

Indication Outlook (Revenue, USD Million, 2021 - 2033)

-

Eyelid Abnormalities

-

Cataract

-

Glaucoma

-

Retinal Complications

-

Uveitis

-

Conjunctivitis

-

Corneal Complications

-

Other Indications

-

-

Service Provider Outlook (Revenue, USD Million, 2021 - 2033)

-

Veterinary Hospitals/Clinics

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. veterinary eye care services market size was estimated at USD 2.59 billion in 2024 and is expected to reach USD 2.72 billion in 2025.

b. The U.S. veterinary eye care services market is expected to grow at a compound annual growth rate of 8.23% from 2025 to 2033 to reach USD 5.12 billion by 2033.

b. Production Animals dominated the U.S. veterinary eye care services market with a share of 55.68% in 2024. This is owing to the economic importance of livestock health and productivity. Eye conditions such as infectious bovine keratoconjunctivitis (pinkeye) in cattle, ocular squamous cell carcinoma, and other vision-related disorders can significantly reduce weight gain, milk yield, and overall animal performance.

b. Some key players operating in the U.S. veterinary eye care services market include The Animal Medical Center (AMC), VCA Animal Hospitals, The Eye Vet, Veterinary Eye Institute (VEI), Veterinary Vision, Colorado State University, Cornell University College of Veterinary Medicine, BluePearl Holdings LLC, Veterinary Eye Clinic, and The Animal Eye Institute

b. Key factors that are driving the market growth include rising pet ownership and humanization of pets, increasing incidence of eye disorders in pets and growth of pet insurance and financial support for specialized care.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.