- Home

- »

- Animal Health

- »

-

U.S. Veterinary Medicine Market Size, Industry Report, 2033GVR Report cover

![U.S. Veterinary Medicine Market Size, Share & Trends Report]()

U.S. Veterinary Medicine Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Biologics, Pharmaceuticals, Medicated Feed Additives), By Animal Type (Production, Companion), By Route Of Administration, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-197-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Veterinary Medicine Market Trends

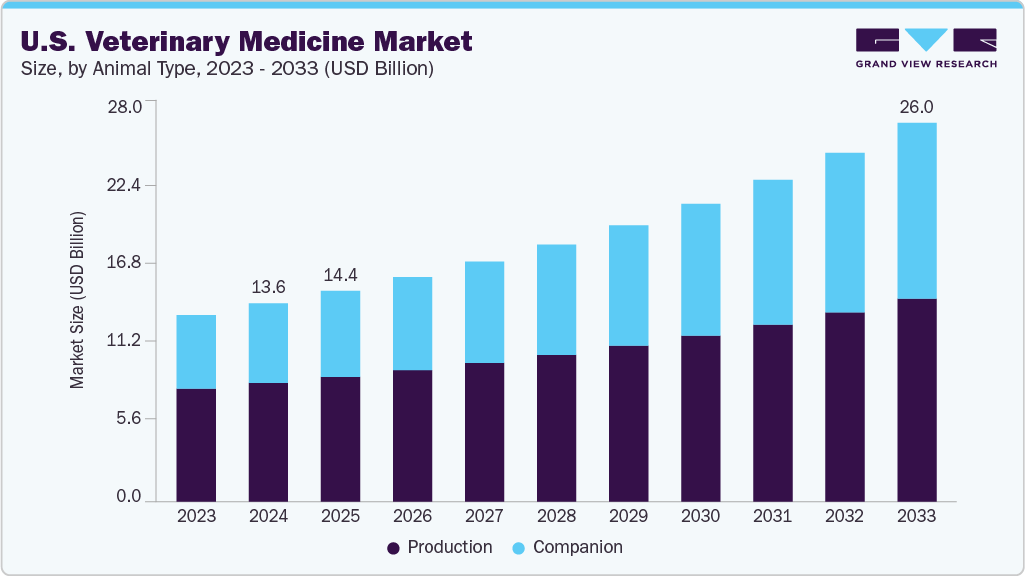

The U.S. veterinary medicine market size was estimated at USD 13.61 billion in 2024 and is projected to reach USD 26.00 billion by 2033, growing at a CAGR of 7.6% from 2025 to 2033. The market growth is largely influenced by the rising global demand for animal protein, which increases the need for healthier livestock and efficient disease management. The growing incidence of animal diseases further amplifies the demand for effective diagnostic and treatment solutions. In addition, frequent product launches and innovations are enhancing the availability of advanced veterinary solutions, while continuous advancements in veterinary medicine are improving accuracy and outcomes in animal healthcare.

The market is continuously evolving due to research into novel product development, business expansion efforts, and strategic alliances to introduce innovative technologies. These efforts are reshaping market demand and practices. For instance, in February 2025, Align Capital Partners' pet health platform, Custom Veterinary Services (CVS), acquired Green Mountain Animal (GMA) to create a unified pet health products company called CompletePet. This merger is expected to offer a range of custom-formulated pet medicated feed additives and health products, with GMA's Vermont facility continuing to support innovation and supply chain capabilities.

Moreover, the growing trend of pet humanization has led pet owners to increasingly prioritize their pets’ health and well-being, driving a willingness to spend significantly more on their care. People are spending more on veterinary care and pet-related products, including premium food, medications, preventive checkups, vaccinations, surgeries, and even advanced treatments. According to the American Pet Products Association, U.S. spending on pets rose from $90.5 billion in 2018 to around $150.6 billion in 2024, an increase of 66%. Between 2018 and 2020, spending grew steadily by 14.5%, but the COVID-19 pandemic accelerated the trend, with a 45.4% jump from 2020 to 2024, largely due to more people adopting pets.

In addition, the FDA approval and subsequent U.S. launch of Zenrelia in September 2024 are playing a pivotal role in driving the growth of the veterinary medicine market by broadening the availability of advanced therapies for widespread yet difficult-to-manage conditions such as allergic and atopic dermatitis in dogs. Skin disorders are among the most frequent reasons for veterinary visits, and introduction of more effective therapy creates strong demand from both veterinarians and pet owners seeking better outcomes. Zenrelia works better than existing drugs such as Apoquel, which not only makes more veterinarians and pet owners choose it but also raises the standard for new treatments, encouraging more research and development in targeted therapies and precision medicine.

Market Concentration & Characteristics

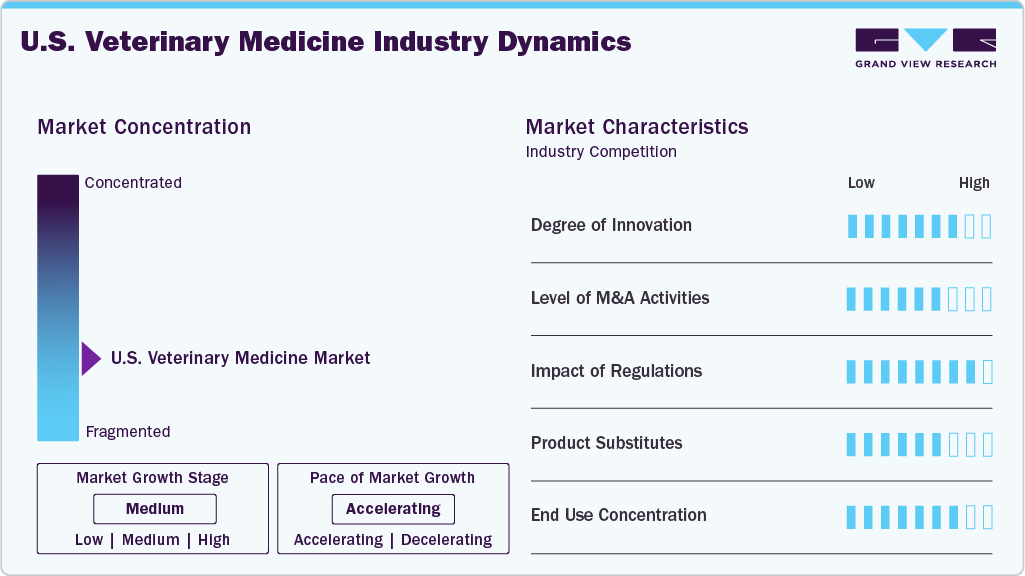

The U.S. veterinary medicine market is moderately concentrated, with its competitive dynamics largely defined by the strong presence of major players including Zoetis, Boehringer Ingelheim International GmbH, Merck, Virbac, and others. These companies maintain a leading position through broad product portfolios, sustained R&D investments, and strategic initiatives designed to drive market expansion.

The U.S. veterinary medicine market demonstrates a high degree of innovation, with technologies such as AI playing an increasingly transformative role in veterinary pharmacology. By making drug development more efficient and supporting customized treatment options, these technologies help create a broader range of effective medications. As a result, the use of veterinary drugs is expected to grow, since more targeted treatments and better outcomes meet the increasing expectations of both pet owners and veterinarians.

Mergers and acquisitions in the U.S. veterinary medicine market remain moderate to high. For example, in November 2024, Phibro Animal Health Corporation acquired Zoetis’ entire medicated feed additive portfolio, which spans more than 80 countries and includes over 37 product lines.

Regulations play a major role in the U.S. veterinary medicine market, affecting how products are developed and brought to market. Agencies like the FDA and USDA enforce strict approval processes to make sure veterinary drugs, vaccines, and feed additives are safe, effective, and high quality. While these rules can make it harder and more expensive to launch new products, they also give veterinarians and pet owners confidence that their treatments are reliable and safe.

In the U.S. veterinary market, substitute products have a moderate to strong influence. These include options such as nutraceuticals, herbal remedies, preventive care measures, compounded medications, and non-drug treatments such as physiotherapy or laser therapy. While they don’t fully replace traditional medicines, they are often used alongside them or as more cost-effective solutions, particularly for managing chronic conditions and maintaining overall pet wellness.

End user concentration in the market is relatively high, as demand is primarily driven by a few key groups, companion animal owners, livestock producers, and veterinary hospitals or clinics. Pet owners are increasingly treating their animals like family and are willing to spend more on advanced treatments, which is driving demand in the companion animal sector. At the same time, livestock farmers focus on keeping their herds healthy and productive, creating strong demand for preventive medicines, vaccines, and feed additives.

Product Insights

Pharmaceuticals segment dominated the U.S. veterinary medicine market with a revenue share of 67.43% in 2024. The growth is attributed to the rising number of animal diseases and the proactive efforts of leading companies, especially through new product development and regulatory approvals. For Instance, in October 2024, the FDA approved Elanco Animal Health’s Credelio Quattro, a once-monthly chewable for dogs eight weeks and older. Unlike traditional treatments that usually target only one or two parasites, this product protects against six major parasites—fleas, ticks, roundworms, hookworms, tapeworms, and heartworm. By combining all these protections in a single chew, Credelio Quattro makes it easier for pet owners to keep their pets protected while giving veterinarians a more complete and effective treatment option. Such products show a trend in the market toward multipurpose, efficient, and safe solutions that improve animal health, supporting long-term growth.

The biologics segment represents the fastest-growing segment in the U.S. veterinary medicine market. The growth of the segment is being fueled by accelerated approval processes and reduced development timelines for veterinary biologics, enabling faster market entry of new products. In addition, the increasing number of product launches further supports this expansion. For instance, in August 2024, Virbac introduced Canigen Bb, an injectable vaccine that helps protect dogs against Bordetella bronchiseptica. Unlike intranasal live vaccines, this option is especially useful for dogs around people with weakened immune systems.

Animal Type Insights

Production animals dominated the U.S. veterinary medicine market with a largest revenue share of 59.92% in 2024. This growth is being fueled by the widespread use of medications in livestock, the increasing focus on preventing and controlling diseases, and more intensive farming practices. As the population grows, the demand for animal products like meat, milk, and dairy keeps rising, putting pressure on farmers to produce more. This, in turn, heightens the reliance on veterinary medicines to safeguard animal health and maintain productivity.

The companion animals segment is anticipated to grow at the fastest CAGR over the forecast period. The growth of this segment is being driven by more people owning pets, increased spending on pet healthcare, and the wider availability of medicines designed specifically for pets. For example, in May 2023, Zoetis’ Librela (bedinvetmab injection) became the first monoclonal antibody approved in the U.S. to treat osteoarthritis pain in dogs.

Route of Administration Insights

The injectable segment dominated the market with the largest revenue share of 45.18% in 2024. Injectable medications are often preferred because they act quickly, allow accurate dosing, and are absorbed more effectively than oral medicines. They are commonly used for critical care, vaccinations, and long-lasting treatments. Used in both pets and livestock, injectables are important for preventing and controlling infections, managing pain, and delivering advanced therapies like vaccines and monoclonal antibodies. Their reliability and effectiveness help improve treatment results and make it easier for veterinarians and pet owners to follow through with care.

The other segment is projected to grow at the fastest CAGR over the forecast period. Alternative methods, such as inhalation, nasal sprays, and skin patches, are becoming more popular because they offer targeted treatments that are easier on animals and simpler for owners to use. For instance, nasal vaccines can trigger a quick immune response without needles, while skin patches provide a steady release of medication for long-term conditions. These options are especially useful when standard injections are not ideal, such as for young pets, stressed animals, or those with weakened immune systems. Their growing use in advanced therapies underscores their contribution to market growth by diversifying treatment options and improving overall healthcare outcomes.

Distribution Channel Insights

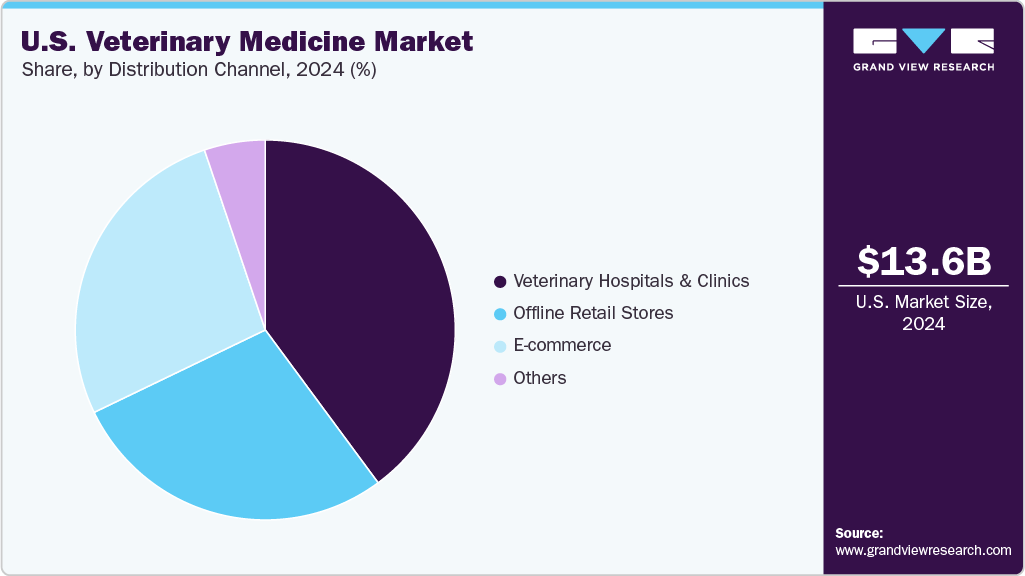

The veterinary hospitals & clinics led the U.S. veterinary medicine market with the largest revenue share of 39.88% in 2024. Veterinary hospitals and clinics play a crucial role in driving market growth as they serve as the primary point of access for animal healthcare services, ranging from routine checkups and vaccinations to advanced diagnostics, surgeries, and specialized treatments. Their ability to provide comprehensive care fosters higher demand for veterinary medicines, vaccines, and therapeutic products. Moreover, the growing number of veterinary facilities, coupled with increased pet ownership and awareness of animal health, is expanding the volume of treatments administered through these channels. As trusted intermediaries between manufacturers and pet owners or livestock producers, hospitals and clinics significantly influence product adoption and utilization, thereby fueling the overall expansion of the veterinary medicine market.

E-commerce is anticipated to grow at the fastest CAGR over the forecast period. Online platforms make buying pet health products easier and more convenient. They offer competitive prices, home delivery, subscription options for regular treatments, and the ability to compare products easily. Telemedicine and online vet consultations have made this even more effective, since prescriptions can now be filled directly through e-commerce sites. With more people using the internet, preferring doorstep services, and manufacturers partnering with online retailers, e-commerce is changing how products reach pet owners and helping the market grow faster.

Country Insight

The veterinary medicine market in the U.S. is steadily growing, driven by advances in veterinary care, an increase in chronic diseases among pets, and the actions of major companies such as Zoetis, Boehringer Ingelheim, and Dechra. These companies are expanding the market through acquisitions and by introducing new treatments designed specifically for pets. For instance, Zoetis, Elanco, and Boehringer Ingelheim offer a range of therapies for canine osteoarthritis. Medications like Galliprant (grapiprant) and Librela (bedinvetmab) help manage pain from osteoarthritis, while Adequan Canine (polysulfated glycosaminoglycan) supports joint health and slows cartilage breakdown. Together, these developments are helping the market continue to grow.

Key U.S. Veterinary Medicine Company Insights

The U.S. veterinary medicine market is fragmented. The market includes both well-known global companies and smaller regional players. These companies offer a wide range of veterinary medicines for various animals and medical needs. To stay competitive and grow, they are focusing on strategies like investing in research and development, merging with or acquiring other companies, expanding into new regions, and forming partnerships or collaborations.

Key U.S. Veterinary Medicine Companies:

- Zoetis Inc.

- Boehringer Ingelheim International Gmbh

- Merck & Co., Inc.

- Elanco

- Dechra Pharmaceuticals PLC

- Ceva Santé Animale

- Phibro Animal Health Corporation

- Virbac

- Bimeda Corporate

- Biogénesis Bagó

Recent Developments

-

In October 2024, Elanco received FDA approval for Credelio Quattro (lotilaner, moxidectin, praziquantel, and pyrantel chewable tablets), the first canine oral parasiticide to protect against six parasites, including fleas, ticks, heartworms, and intestinal worms.

-

In September 2024, Elanco received FDA approval for Zenrelia (ilunocitinib), a once-daily oral JAK inhibitor for managing pruritus and atopic dermatitis in dogs.

-

In July 2024, the FDA approved a three-year expiration date for Clevor (ropinirole ophthalmic solution), extending it by 12 months. Clevor, the first FDA-approved emesis inducer for dogs, is easy to administer ocularly, offering a less stressful process for pets and veterinarians

-

In February 2024, BluePearl, a part of Mars Veterinary Health, launched a new hospital in Monroeville, PA, offering specialty and emergency veterinary care starting March 4, with expanded services including surgery, urgent care, internal medicine, dentistry, and 24/7 emergency services.

U.S. Veterinary Medicine Market Report Scope

Report Attribute

Details

Market size in 2025

USD 14.46 billion

Revenue forecast in 2033

USD 26.00 billion

Growth rate

CAGR of 7.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, animal type, route of administration, distribution channel

Key companies profiled

Zoetis Inc.; Boehringer Ingelheim International Gmbh; Merck & Co., Inc.; Elanco; Dechra Pharmaceuticals PLC; Ceva Santé Animale; Phibro Animal Health Corporation; Virbac; Bimeda Corporate; Biogénesis Bagó

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Veterinary Medicine Market Report Segmentation

This report forecasts revenue growth provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. veterinary medicine market report based on product, animal type, route of administration, distribution channel:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Biologics

-

Vaccines

-

Modified/ Attenuated Live

-

Inactivated (Killed)

-

Other Vaccines

-

-

Other Biologics

-

-

Pharmaceuticals

-

Parasiticides

-

Anti-infectives

-

Anti-inflammatory

-

Analgesics

-

Others

-

-

Medicated Feed Additives

-

Others

-

-

Animal Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Production Animals

-

Poultry

-

Pigs

-

Cattle

-

Sheep & Goats

-

Others

-

-

Companion Animals

-

Dogs

-

Cats

-

Horses

-

Others

-

-

-

Route of Administration Outlook (Revenue, USD Million, 2021 - 2033)

-

Oral

-

Injectable

-

Topical

-

Other Routes

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Veterinary Hospitals & Clinics

-

E-commerce

-

Offline Retail Stores

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. veterinary medicine market size was estimated at USD 13.61 billion in 2024 and is expected to reach USD 14.46 billion in 2025.

b. The U.S. veterinary medicine market is expected to grow at a compound annual growth rate (CAGR) of 7.61% from 2025 to 2033 to reach USD 26.0 billion by 2033.

b. In terms of share pharmaceuticals dominated the product segment with the largest market share of 67.43% in 2024. This high share is attributable to rising investments in research and development activities to introduce new and improved veterinary medicines by pharmaceutical companies, technological advancements and a shift towards preventive care.

b. Some key players operating in the U.S. veterinary medicine market include Zoetis Inc.; Boehringer Ingelheim International Gmbh; Merck & Co., Inc.; Elanco; Dechra Pharmaceuticals PLC; Ceva Santé Animale; Phibro Animal Health Corporation; Virbac; Bimeda Corporate; Biogénesis Bagó

b. Key factors that are driving the market growth include rising incidences of zoonotic diseases, increased livestock population, growing focus on preventive care, advancements in pet medicine and increasing pet ownership.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.